Asia Leads the Way in Esports Growth

2021/07/01

Photo by Florian Olivo on Unsplash

Asia leads the way in esports growth

Esports, or electronic sports, refers to the competitive world of video gaming, which often takes the form of organised tournaments, participated in by professional gamers and viewed by a large audience. During the COVID-19 outbreak, many sports fans have missed live sporting action, and esports has presented an attractive alternative to traditional live sports. As a result, esports has thrived during the pandemic. The global esports and game-streaming industry is expected to grow from US$2.1 billion in 2021 to US$3.5 billion by 2025, representing a growth of 70% in four years, and much of this phenomenal growth is expected to take place in Asia.

Asia is expected to account for 50% of more than 1 billion esports and game viewers by 2025. It is no wonder, then, that esports is fast approaching mainstream adoption in the region: in fact, it featured at the 2019 Southeast Asian Games as a medal event. In 2022, esports is also expected to be included as a medal event at the Asian Games in Hangzhou. Meanwhile, esports arenas are rapidly popping up across Asia, with capacities in the tens of thousands.

In light of this rapid growth, GMO Research has conducted a survey on gaming and esports to take the pulse of consumer insights and behavioural trends in Asia. The survey was conducted across six countries in the region: China, Malaysia, the Philippines, Taiwan, Thailand, and Vietnam. This article brings you the consumer preferences and spending trends with regards to esports in the region.

Among the countries surveyed, esports proved to be most popular in Vietnam, with up to 75% of respondents having had experience with esports, meaning they had either watched or participated in an esports event, or both. This is followed by China, with 64.4% having had an experience with esports. Next is Thailand at 60.9%, and fourth is the Philippines at 57.8%. Malaysia and Taiwan are the only countries where fewer than half of the respondents reported having had an experience with esports, at 43% and 38.7% respectively.

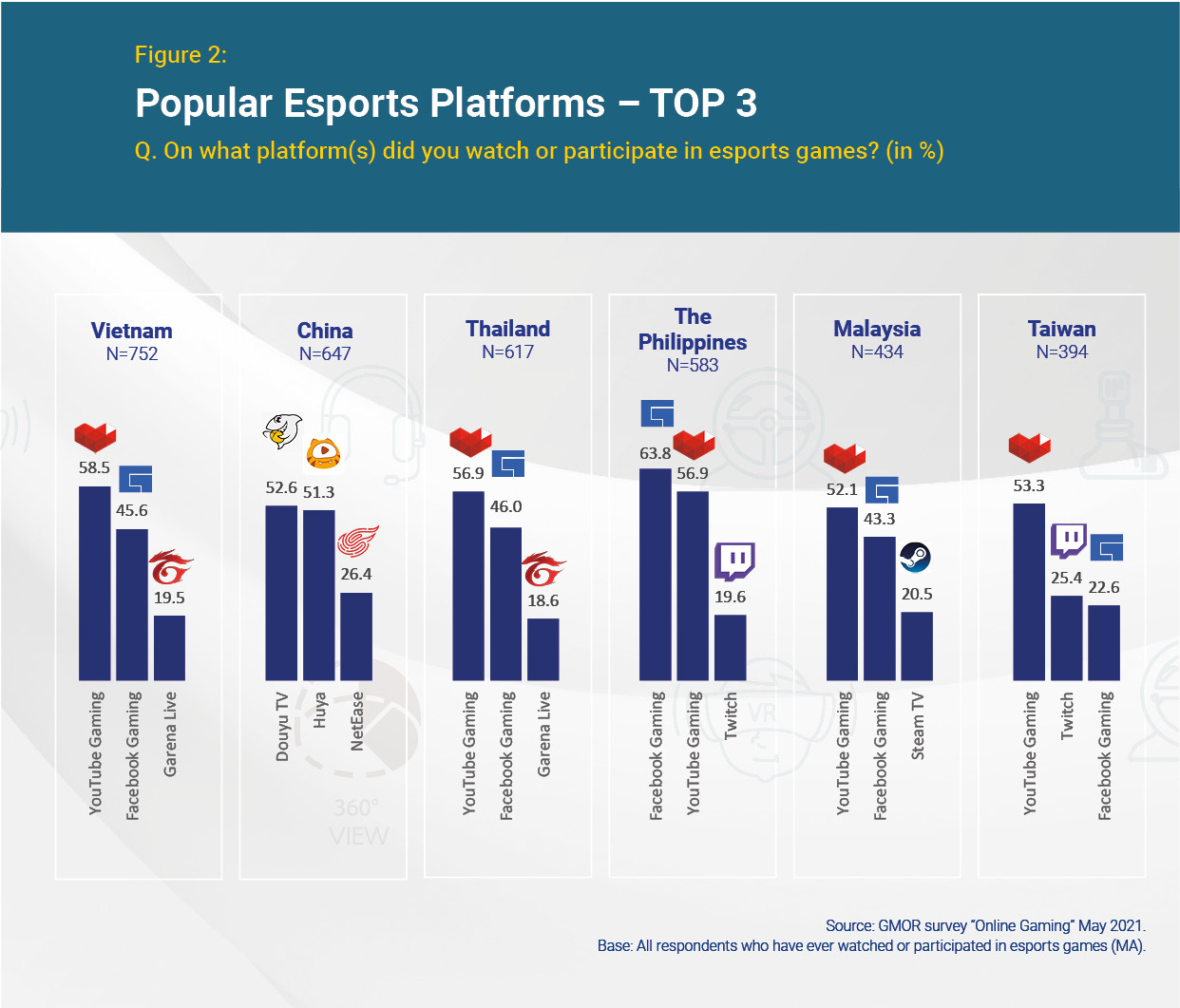

With the exception of China, a few platforms emerged as popular choices across Asia for viewing and/or participating in esports. These platforms include YouTube Gaming, Facebook Gaming, Twitch, and Garena Live. When gamers were asked which platforms they use for viewing or participating in esports, YouTube Gaming emerged as the most popular, coming out top in Vietnam (58%), Thailand (56.9%), Taiwan (53.3%), and Malaysia (52.1%). The next most popular is Facebook Gaming: this is the number one gaming platform in the Philippines, with 63.8% of gamers using it for viewing or participating in esports. Twitch is another platform of choice, coming in second in Taiwan at 25.4%, and third in the Philippines at 19.6%. Garena Live is popular in Thailand and Vietnam (the third most popular in both), with 18.6% and 19.5% of gamers using the platform respectively.

The game-streaming industry in China has taken on a life of its own and is now significantly bigger than that of the US when it comes to users, and innovation. With the largest gaming population in the world, it is no wonder that the rise of esports in China has contributed to a boom in the video game-streaming industry. So who are the top players when it comes to esports platforms in China? According to the GMO survey, the most popular esports platform in China is Douyu TV, with 52.6% of gamers using the platform for viewing or participating in esports. Coming in a close second is Huya at 51.3%, and third is NetEase at 26.4%. As the biggest players, Douyu and Huya dominate the market share with their brand presence and large capital base, thus ensuring that they have the best streamers on board and the clout to organise large-scale esports events.

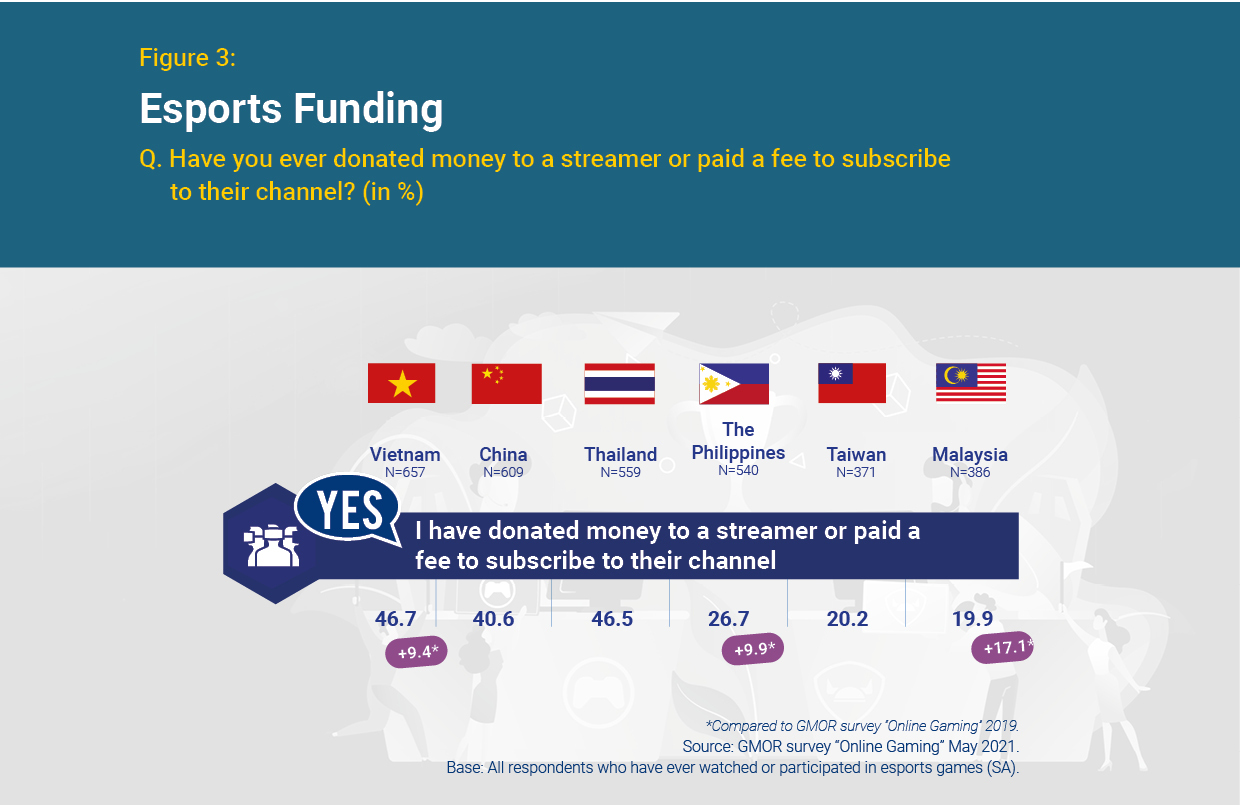

According to the GMO survey, in the past two years, consumer spending in esports has generally increased in terms of both streamer donations and channel subscriptions. The largest increases can be seen in Malaysia (17.1%), the Philippines (9.9%), and Vietnam (9.4%).

The COVID-19 pandemic has further accelerated the meteoric growth of esports in Asia. Bolstered by increasing smartphone proliferation, more sophisticated IT infrastructure, and an expanding middle-class population, the industry will continue to thrive, especially in emerging markets. It is estimated that this year, gamers will make up 30% of the world’s population, bringing games market income to US$189.3 billion, with China and Southeast Asia driving much of the revenue growth.

More game related articles: