Usage of Health and Wellness

Apps in Asia

2020/12/09

High smartphone penetration, coupled with an upsurge in government initiatives in the mobile health (mHealth) technology sector, has led to the rapid growth of the Asia Pacific (APAC) mHealth market. It is estimated that, by 2026, the APAC mHealth market will surpass a valuation of US $99.4 billion. The COVID-19 outbreak has further accelerated this growth, as consumers seek out alternative methods for health monitoring and consultation in an attempt to avoid hospitals and clinics. This has resulted in an increase in the usage of health and wellness apps across the region.

In light of this trend, GMO Research conducted a survey on the adoption and usage of health and wellness apps in five different countries across Asia: Japan, Korea, Indonesia, Malaysia and Thailand. This article highlights key trends and behavioral patterns in different parts of Asia to give you an insight into consumer preferences in this diverse region.

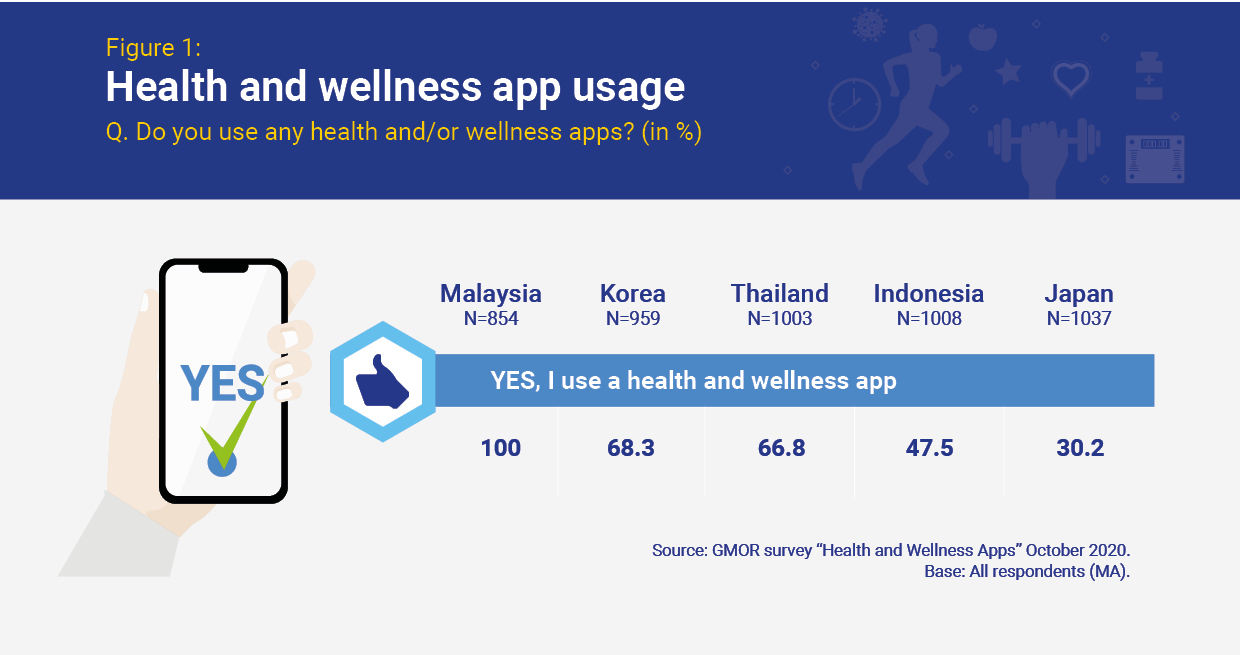

According to the survey, 100% of respondents in Malaysia say they are using some kind of health and wellness app, the highest proportion out of the countries surveyed. This is followed by Korea at 68.3% and Thailand at 66.8%. The lowest usage rate is reported in Japan, where only 30.2% say they are using one or more health and wellness apps.

So what are some of the most popular health and wellness apps in the region?

Asia is a diverse region and so it comes as no surprise that consumer trends differ widely when it comes to the usage of health and wellness apps. Sport and fitness activity tracking apps have proven to be widely popular across the region, coming out on top in Thailand (55.4%) and Korea (53.0%). In Malaysia, COVID-19-related apps are immensely popular, with close to 8 in 10 respondents saying that this is their most used category. COVID-19 apps are also hot favorites among the Japanese (35.5%), outperforming all other categories. For consumers in Indonesia, diet and nutrition apps have emerged on top, with 36.5% reporting that this is their most frequently used category.

As sport and COVID-19 apps gain popularity across the region and continue to grow in terms of user base, let’s not forget that there are other categories that perhaps have yet to be discovered and, as such, hold much potential. Take, for example, medical advice and patient community apps. With the exception of Thailand, this category consistently ranked in the bottom three across the countries surveyed. This might be an opportunity for medical practitioners to look into digital alternatives for their services, if they have not already done so.

Also worth mentioning are menstrual cycle tracking apps, which are widely used among female consumers in Asia. In fact, according to the GMO survey, menstrual tracking apps are used by more than half of the female respondents in Korea.

As shown by the survey, COVID-19 has indeed boosted the usage of health and wellness apps among consumers in Asia. When the respondents were asked which apps they had been using more since the onset of the pandemic, COVID-19-related apps were reported as the category that has seen the largest increase in usage in Japan, Indonesia and Malaysia. In Korea and Thailand, however, sport and fitness activity tracking apps have seen the largest increase in usage.

2020 is drawing to a close, and as we welcome the “new normal” in the new year, health and wellness will continue to remain at the top of our minds. Without a doubt, the burgeoning mHealth market in Asia will continue to flourish as consumers become more health-conscious and continue to seek alternative, non-contact methods of maintaining health and wellness.

*About this survey: This survey was conducted online by GMO Research from October 6th to October 13th on a sample of 4,861 respondents from Japan, Korea, Indonesia, Malaysia and Thailand.