GMO Research Travel Survey 2022:

Travel Industry Sees Strong Growth

2022/11/30

In a recent travel survey conducted by GMO Research, results show that with borders opening up again, Asia is beginning to see healthy travel patterns. While the region is still not at pre-pandemic levels, and travellers are still cautious, the interest in overseas travel has significantly increased.

To understand travel patterns and willingness, GMO Research conducted a survey on monitors in ten countries and regions of the ASIA Cloud Panel1, the company's own panel network2.

- Research topic: Consumers' intention to travel internationally

- List of countries surveyed: China, Hong Kong, Japan, South Korea, Singapore, Vietnam, Thailand, Philippines, Indonesia, Malaysia

- Sample: Male/Female, age 20-69: 3,328 people

(China 330, Hong Kong 329, Japan 332, South Korea 346, Singapore 330, Vietnam 338, Thailand 329, Philippines 330, Indonesia 330, Malaysia 334) - Survey period: 29 October–30 October 2022

- Survey method: Online survey (Closed-ended)

1. Respondent’s willingness to inbound tourism

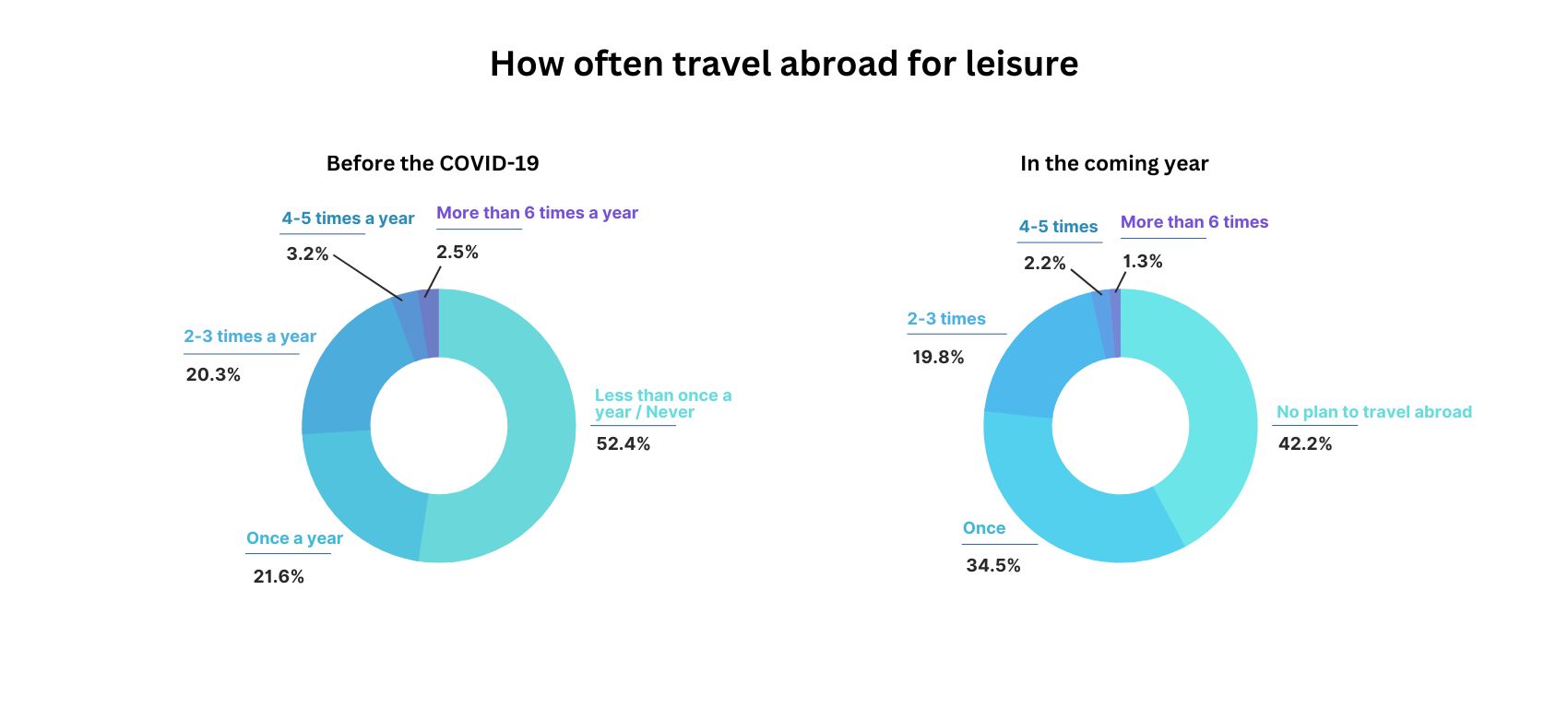

Survey results show that the overall number of respondents who plan to travel abroad “at least once a year” within the next year is 10 points higher than before COVID-19 (Chart 1-1). However, it should be noted that the willingness to travel varies according to country.

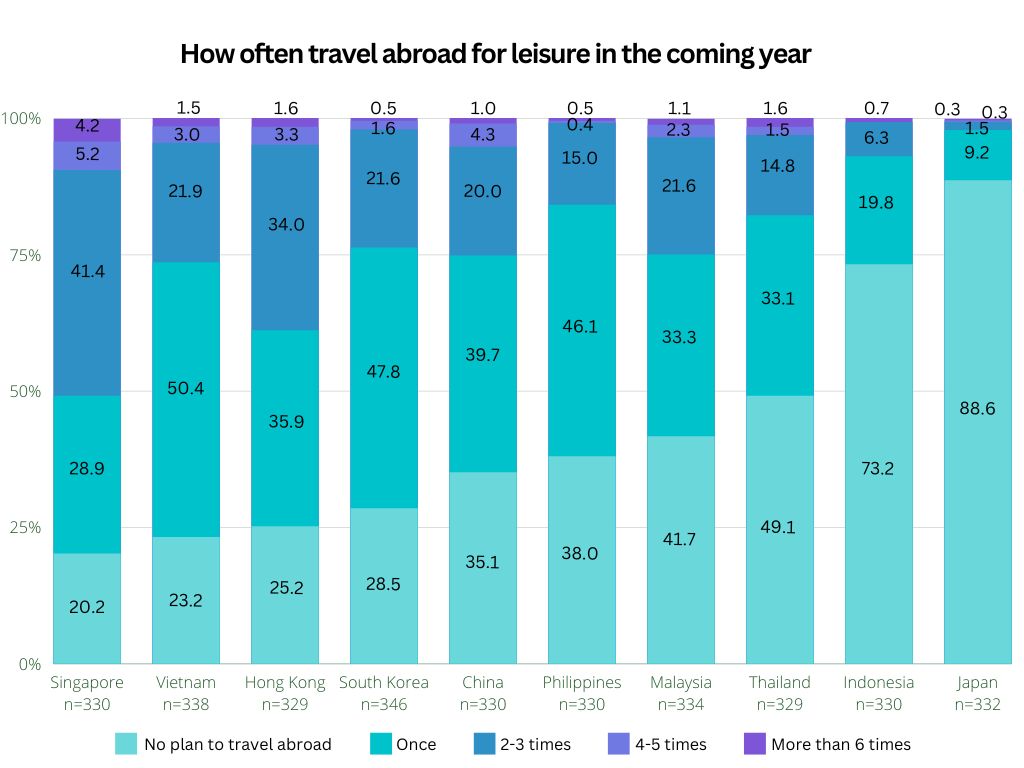

More than half of the respondents in Japan (88.6%) and Indonesia (73.2%) have indicated that they have “no plans to travel abroad” in the next year as they are still cautious about overseas travel and are more focused on having a safe and enjoyable trip (Chart 1-2).

2. Respondent’s travel budgets

(excluding transportation expenses and accommodation)

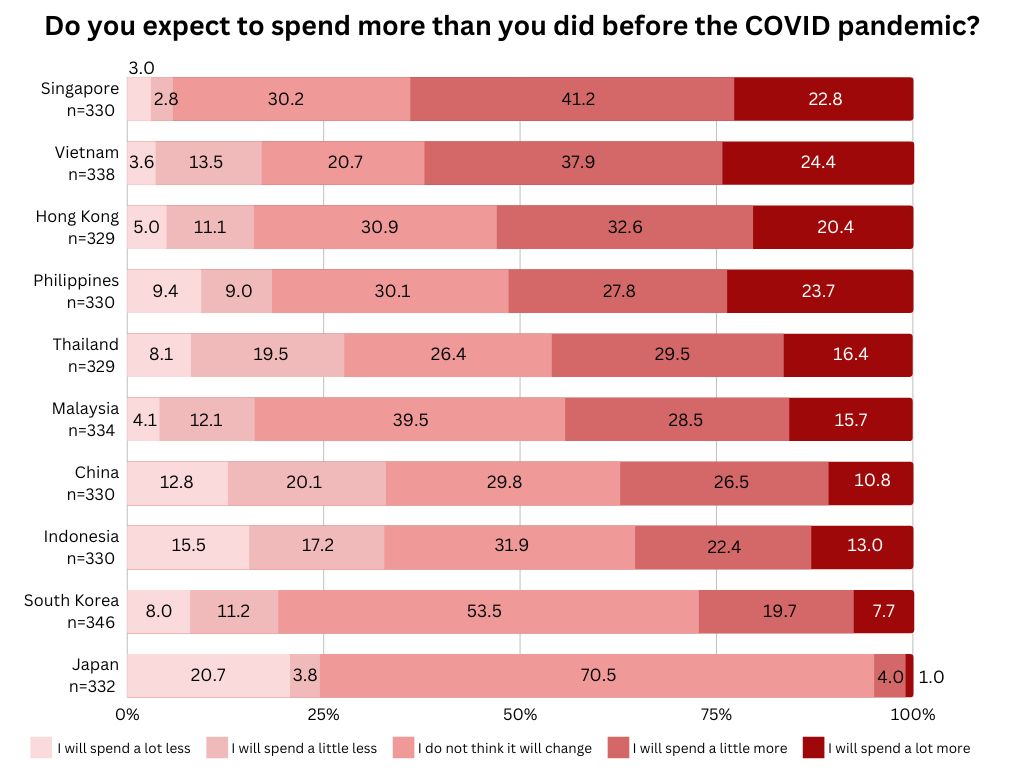

Almost half of the respondents, 42.6%, have indicated that their post-pandemic budgets will increase, while 36.4% have stated that their budget will remain status quo. Similar to the willingness to travel, their responses are divided by countries, with those from Hong Kong (53%), Singapore (64%), the Philippines (51.5%), and Vietnam (62.3%) indicating their plans for an increased travel budget.

In comparison, a large majority from Japan (95%) and South Korea (72.7%) have indicated that they have no plans to spend more and might consider paying a little or a lot less, seemingly due to the depreciation of their currencies (Chart 2).

3. Countries that respondents plan to visit

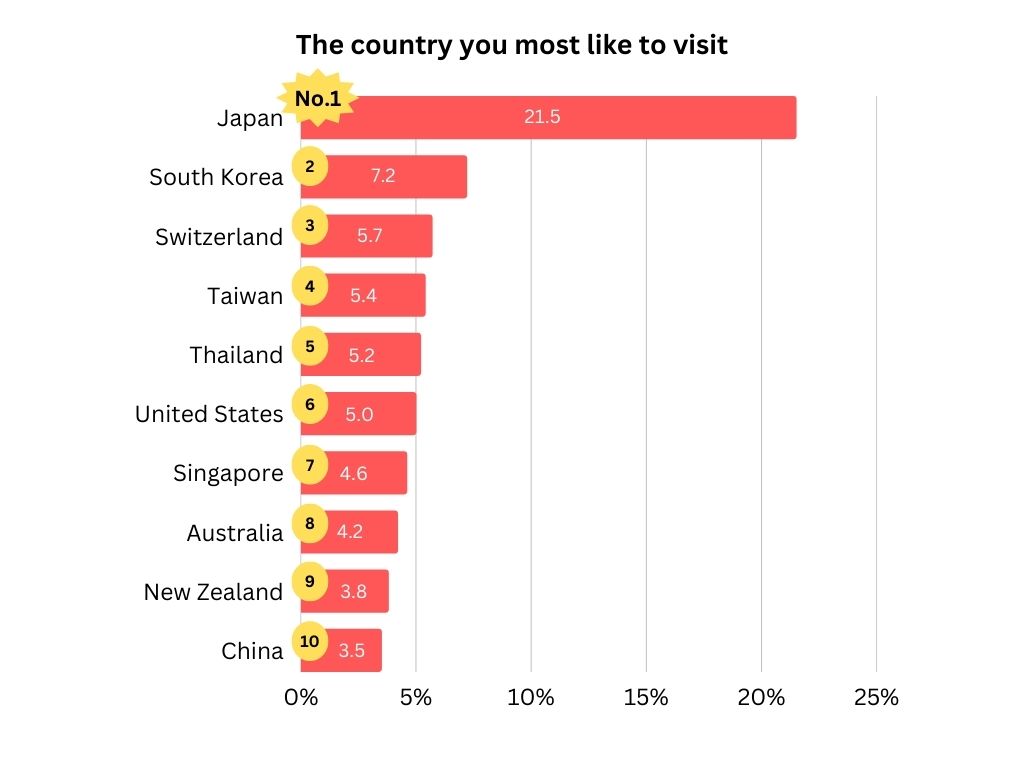

Japan emerged as the number one destination respondents would most like to visit, followed by South Korea in second place (Chart 3). The traditional and local cuisines, unique cultural experiences and tourist attractions are the main push factors for travellers to visit Japan and South Korea.

For Japan, the depreciation of the Japanese Yen is also a motivating factor for respondents to travel to the country with its anime culture.

On the other hand, South Korea’s burgeoning Korean entertainment industry is a contributing factor, as respondents have indicated attending “concerts by BTS and Korean stars” and a love for Korean dramas as strong reasons for wanting to visit South Korea. Similar to Japan, the depreciation of the South Korean Won can also be seen as yet another push factor for respondents to visit the destination, as it becomes more affordable.

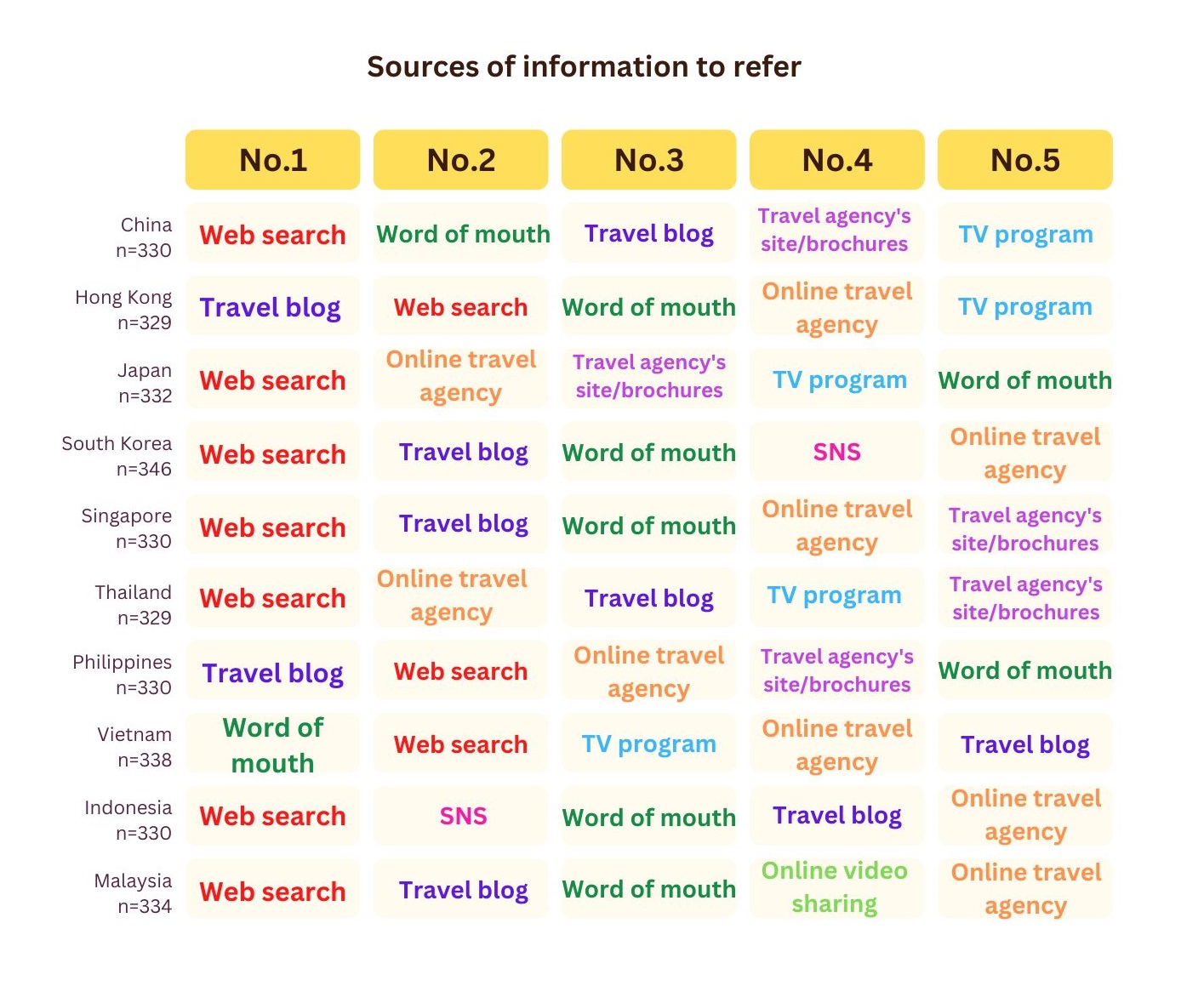

4. Sources of information on international travel

Web searches make for the primary source of international travel planning, with respondents in seven of ten countries indicating that they rely on the internet for their information. Travel blogs and word of mouth from friends/acquaintances/relatives are also amongst the choices for top sources. This highlights the importance of first-hand information for respondents before deciding to travel. In countries such as Indonesia and Vietnam, there is more reliance on social networking services (SNS) and TV programs as a source for receiving travel-related information (Chart 4).

About GMO Research, Inc.

GMO Research Inc. offers an online audience engagement platform that gives access to a multi-country online panel network, the Cloud Panel. The Cloud Panel currently consists of over 52 million3 online consumer panellists across 16 APAC countries, and more than 45 partner countries. Our services range from full service, game research, project management, sample only, qualitative research, and translations, to DIY. We pride ourselves in providing first class service to our clients, leveraging one of the biggest, high-quality proprietary APAC panels. Our clients’ satisfaction is our top priority.

To learn more about GMO Research, visit gmo-research.com.

Contact:

GMO Research, Inc.

Willy Tey - APAC Sales

willy.tey@gmo-research.jp

- ASIA Cloud Panel is a consumer panel that is specialised for the Asian regions in the GMO Research Cloud Panel Internet research services.

- A panel is formed by a collection of monitors (an individual who has agreed to cooperate in a survey).

- As of the end of October, 2022.