2024 Trends in Indonesia's Cross-Border

E-Commerce Market

2024/11/15

With e-commerce expanding rapidly across Asia, Indonesia stands out as a promising market with significant growth potential, especially in cross-border e-commerce (CBEC). As Internet penetration increases, e-commerce usage is growing among young people and other age groups in Indonesia, and the market size is projected to reach up to $120 billion by 2025.

A recent survey from October 23 to 28, 2024, collected data from 286 Indonesian consumers aged 15 to 59 to gain insight into this dynamic market. The goal was to uncover key trends among both CBEC users and non-users. The findings reveal CBEC usage, factors consumers value, and barriers to use as perceived by non-users. They also provide valuable insights for companies looking to optimize their business strategies in Indonesia's fast-growing e-commerce environment.

Cross-border E-commerce User Trends

63% of Respondents Use CBEC Platforms

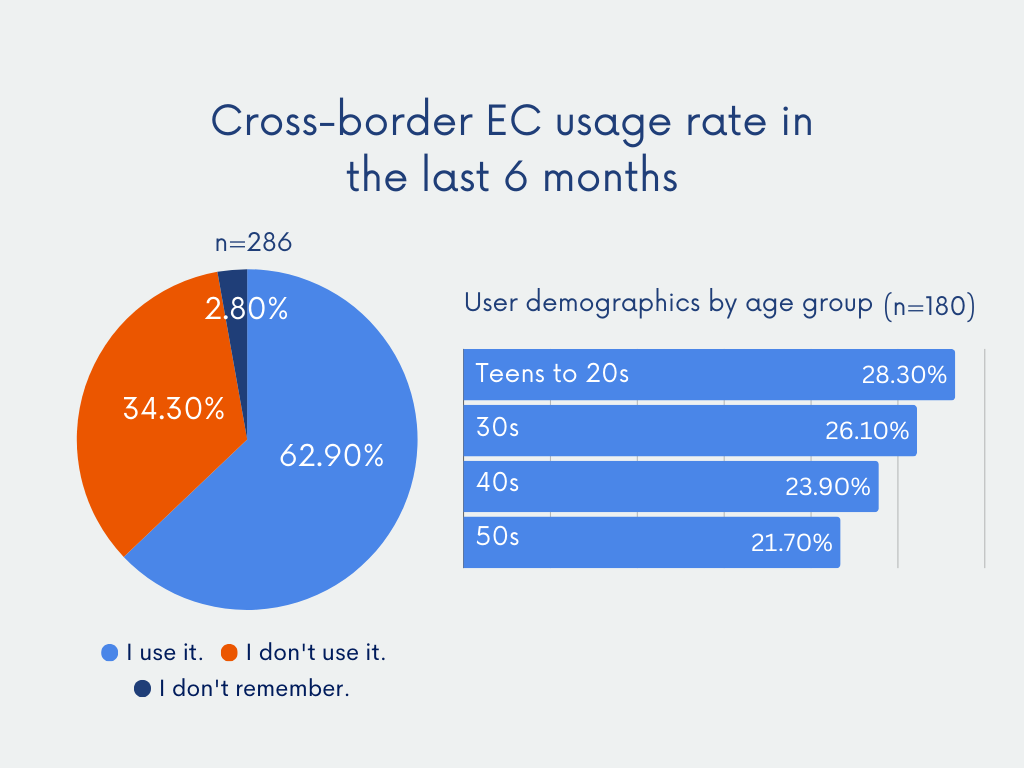

In this survey, 63% of respondents indicated they had used CBEC. By age group, the highest use rate was among young people in their 10s and 20s, at 28%, followed by those in their 30s at 26%, and those in their 40s at 24%. While these results show a trend of younger people using CBEC, they also indicate that other age groups have a certain amount of experience using CBEC.

Fashion Category Leads the Way in CBEC

“Fashion (including clothing and accessories) “ was the most popular product category purchased by users, with 61.7% of all respondents purchasing fashion items. Following this were consumer electronics, such as smartphones and home appliances, at 46.1%, and food and beverages 38.9%, both of which remain popular.

Critical Factors in CBEC: Cost, Quality, and Scarcity

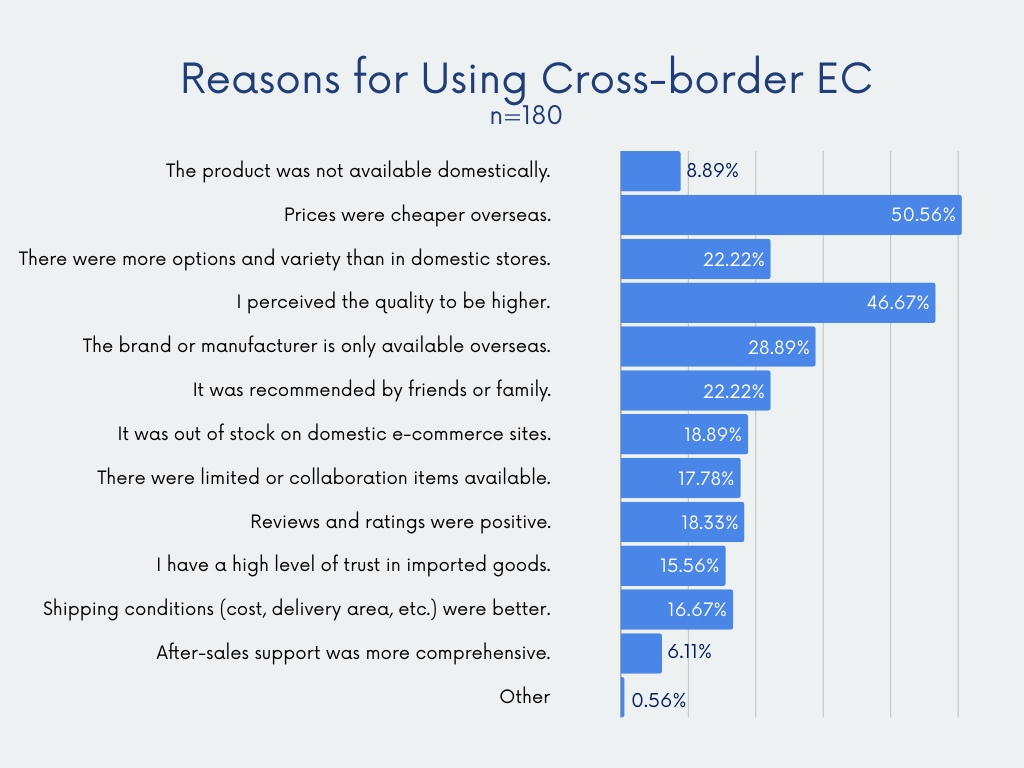

The main reason for choosing CBEC is low price, cited by 50.6% of respondents, with another 46.7% citing quality. Consumers also seek unique products that are available only through CBEC, with brands and products that are not available domestically attracting their interest.

Cross-border E-commerce Non-user Trends

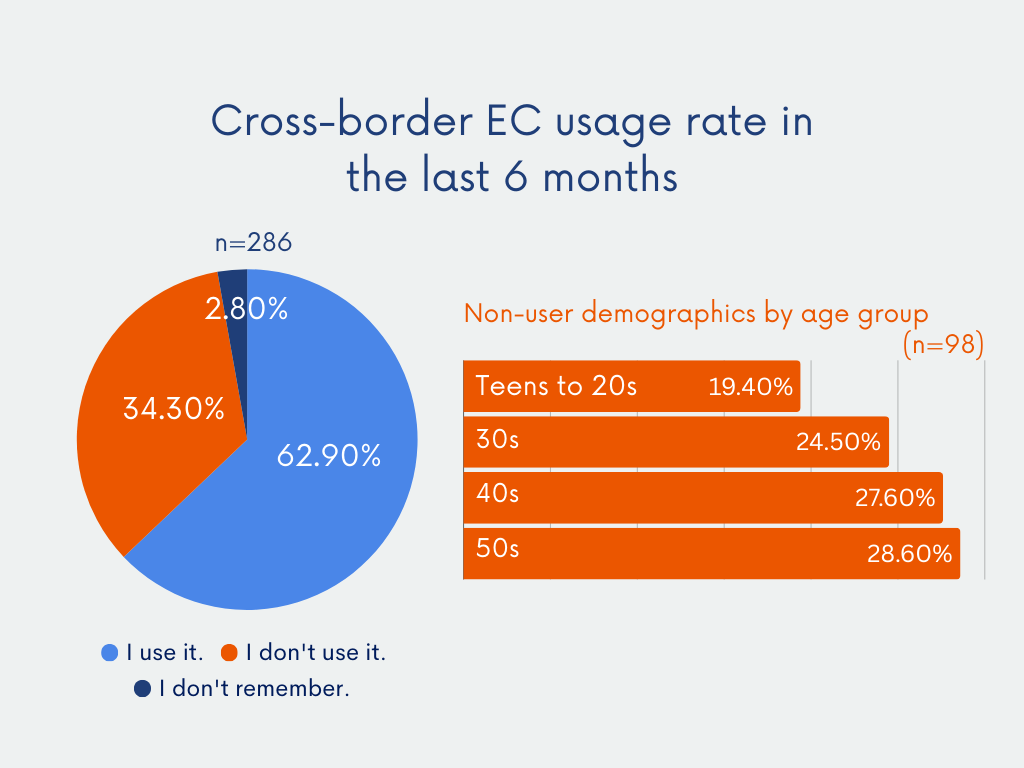

A Significant 34% Lack Experience in CBEC

According to the survey, 34% of all respondents have never used CBEC. Non-users were mainly in the 40+ age group, with 29% in their 50s and 28% in their 40s being particularly non-users.

High Shipping Costs and Quality Concerns Deter CBEC Among 75% of Non-Users

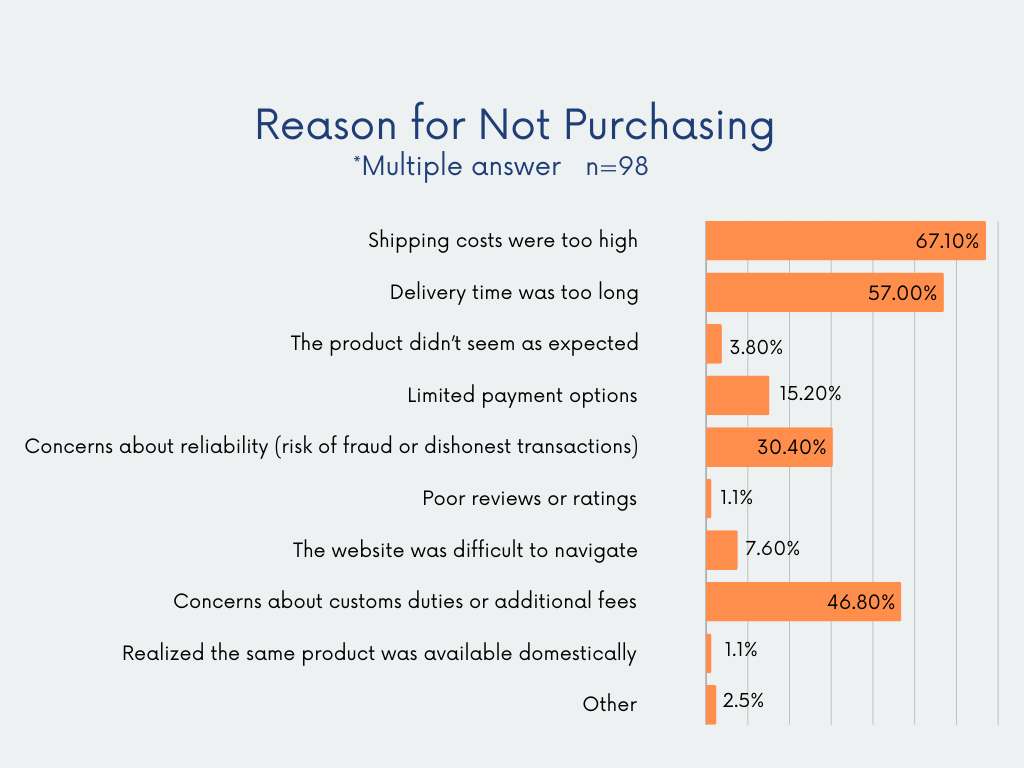

Of the non-users of CBEC, 75% had considered using it. As reasons for not purchasing via CBEC, 67.1% of non-users cited high shipping costs, and 57% cited long delivery times. In addition, 46.8% cited customs duties and additional fees as an issue, indicating that cost concerns associated with international shipping are a significant barrier.

Untapped Demand: Non-users Show Strong Interest in Fashion and Electronics, Mirroring Current User Preferences

Among non-users of CBEC, 67.1% expressed interest in “fashion (clothing, accessories, etc.)”, followed by 51.9% in ”Electronics (smartphones, appliances, etc.) ”and 32.9% in “Cosmetics and beauty products”, regarding categories they considered purchasing. This trend is similar to the categories purchased by actual CBEC users, suggesting a latent need for CBEC among non-users as well.

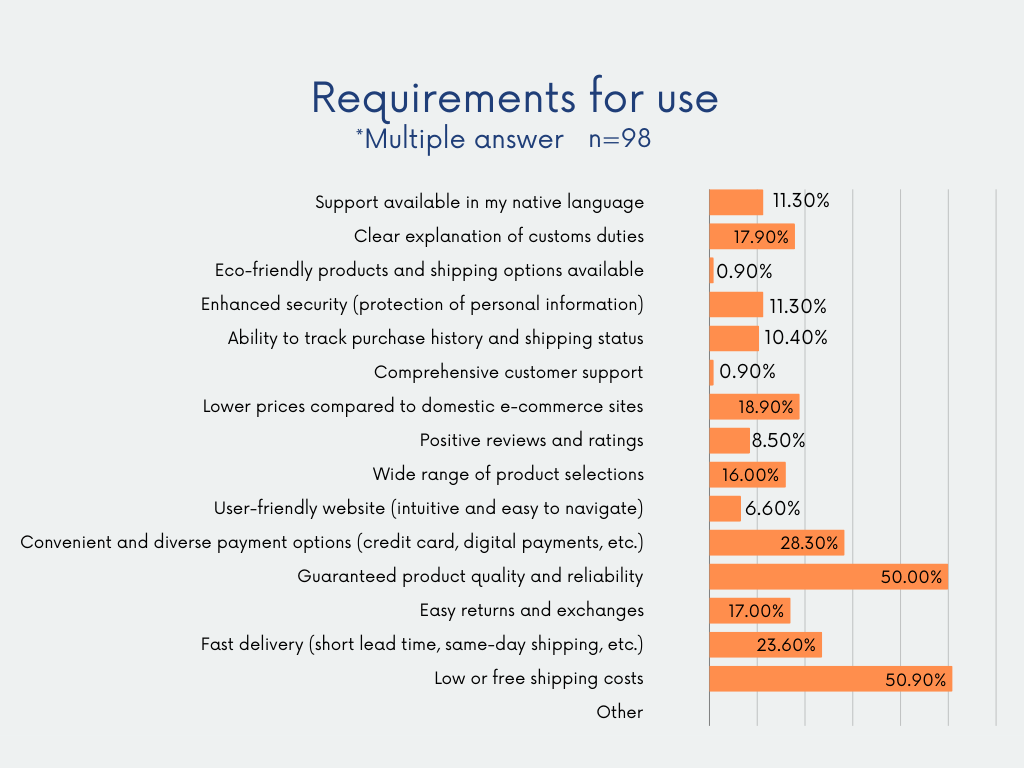

Keys to Boost Consumer Intentions: Shipping Discounts and Reliable Quality

As conditions for non-users to consider using CBEC, 50.9% seek “low or free shipping costs,” and 50% value reliable quality assurance. In addition, 28.3% cited “variety and convenience of payment methods” as a condition, indicating that shipping costs, quality, and payment convenience are vital to attracting non-users.

Strategies to Drive Growth in Cross-border E-commerce

The results of this survey reveal potential growth opportunities for the CBEC market in Indonesia. The following three points are crucial for attracting non-users and improving the engagement of existing users.

1. Cost improvement: Utilize shipping discounts and promotions

This survey revealed that 67.1% of non-users consider high shipping costs an issue. In response to this, offering shipping discounts and first-time free delivery promotions can be expected to increase non-users' intention to try the service.

2. Strengthening quality assurance and improving consumer trust

While 46.7% of users value quality in CBEC, 50% of non-users also demand quality assurance. Building trust through clear quality assurance and review and rating systems can create an environment where consumers feel secure in their purchases and further promote CBEC.

3. Diversifying payment methods and improving convenience

28.3% of non-users expressed willingness to engage in CBEC if provided with diverse and convenient payment options. For example, offering Indonesian digital wallets (such as GoPay and OVO) and deferred payment options, in addition to credit cards, would provide consumers with convenient payment choices and encourage them to make purchases.

The Key to Cross-border EC Growth: Strategies Seen through Consumer Insights

This survey confirmed that while a wide range of age groups uses CBEC, concerns about shipping costs and quality assurance are the main barriers for non-users. Both users and non-users show strong interest in fashion and consumer electronics; thus, improving shipping costs and quality while providing affordable and rare products will enhance their adoption.

Marketing strategies based on these consumer insights effectively increase competitiveness in the CBEC market. To avoid loss of business opportunities and to accurately identify opportunities for sales channel expansion, it is important to understand consumers' actual purchasing conditions and needs correctly and to implement practical approaches in line with consumer trends. Contact GMO Research & AI for your consumer research needs.

Survey Theme: Cross-border E-Commerce Survey

Survey Regions: Indonesia

Survey Participants: 298 men and women aged 15-59

Survey Period: October 23 - 28, 2024

Survey Method: Internet survey (closed survey)

Revealed by Research! Key Points to Keep in Mind When Expanding into Cross-Border E-Commerce

|

The cross-border e-commerce market is experiencing rapid growth, driven by rising global demand, infrastructure improvements, and shifts in consumer buying behavior. Southeast Asia, in particular, is emerging as a prime market, with a high potential for continued expansion. What does it take to succeed in this growing market? Discover essential entry points for companies looking to break into cross-border e-commerce. |

Related Contents

Online Survey is used by many companies to discover and test hypotheses, measure market share, and so on. This paper presents a case study of an e-commerce company.