2024 Gaming Insights:

Emerging Markets and Player Trends

2024/07/30

The Asian gaming market, projected to reach $14.74 billion in 2022 and $14.99 billion by 2031, is garnering global attention for its scale and growth potential. However, the gaming markets within Asia are diverse, with each country and region exhibiting unique trends and adoption rates, necessitating tailored approaches.

Against this backdrop, GMO Research & AI conducted a survey from June 24 to June 30, 2024, targeting general consumers in emerging gaming markets such as Vietnam, Thailand, and Singapore.

In this first part, we will analyze gaming habits and trends using data from 291 players who reported playing mobile games, AR games, esports, or NFT games within the past six months.

What Are the Realities of Non-Gamers? Click here for Part 2!

Key Findings

- Approximately 10% of players engage in AR games.

- Around 40% of mobile game players play almost daily.

- The primary purpose of gaming is "stress relief."

- Players tend to play during "relaxation time at home" or "before bedtime," regardless of weekdays or weekends.

- Factors such as "enjoyment of the game" and "quality of graphics and music" are key criteria for choosing a game.

Game Player Trend

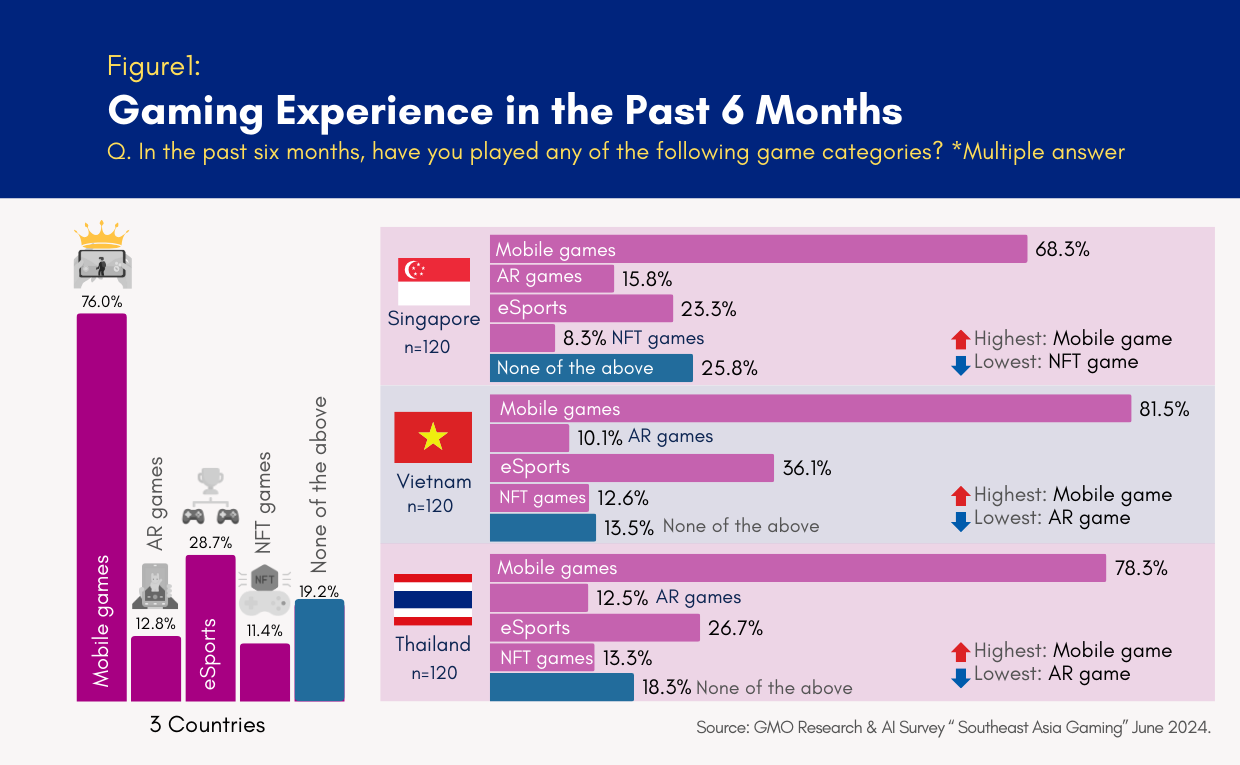

Approximately 10% of Players Engage in AR Games

In the past six months of gaming experience by category, mobile games emerged as the most commonly played (average across three countries: 74.9%). In contrast, AR games had the lowest engagement rate in two of the three countries, excluding Singapore, with an average of 11.3%.

On the other hand, Singapore recorded the highest percentage of respondents selecting 'None of the above.' Understanding the behavior and preferences of potential customer segments, such as non-gamers, is crucial for expanding the user base. For more insights into non-gamers, please refer here.

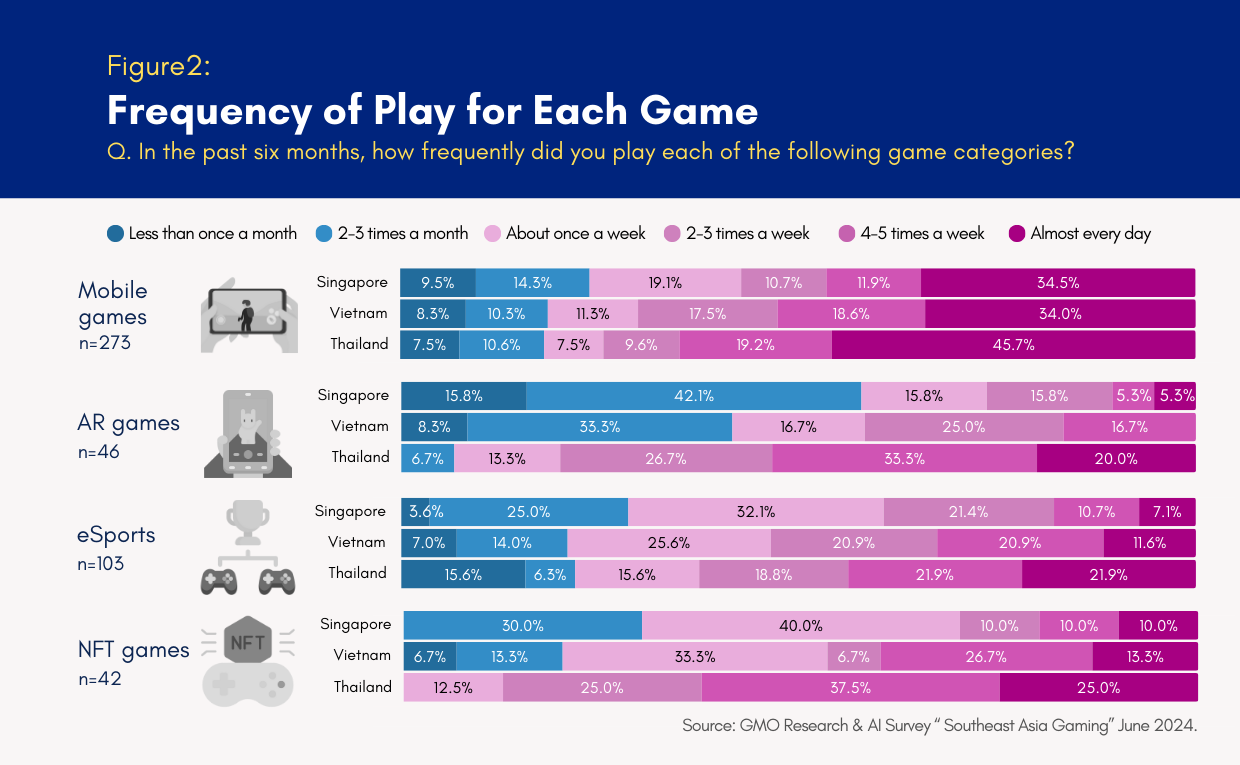

Around 40% of Mobile Game Players Play Almost Every Day

Regarding gaming frequency over the past six months, mobile games had the highest proportion of almost-daily players in all surveyed countries (average across three countries: 38%). The next highest was NFT games, with 17% playing almost every day (three-country average).

In contrast, AR games showed a tendency for low-frequency play ("Less than once a month" or "2-3 times a month"), a trend that was particularly notable in Singapore and Vietnam.

Among the three countries, Thailand had the highest proportion of players engaging in high-frequency gaming ("About once a week," "2-3 times a week," "4-5 times a week," or "Almost every day") across all game categories, reflecting a particularly active gaming culture regardless of the category.

The Main Purpose of Gaming is "To Relieve Stress"

Across three countries, the main purpose of gaming was "To relieve stress" (three-country average: 19.6%), followed by "To have fun" (18.6%) and "To relax" (14.6%).

In Thailand, an additional notable purpose was "To enjoy interesting stories or characters," with a response rate approximately 5 points higher than in the other two countries, highlighting the relatively higher importance of game content and characters in this market.

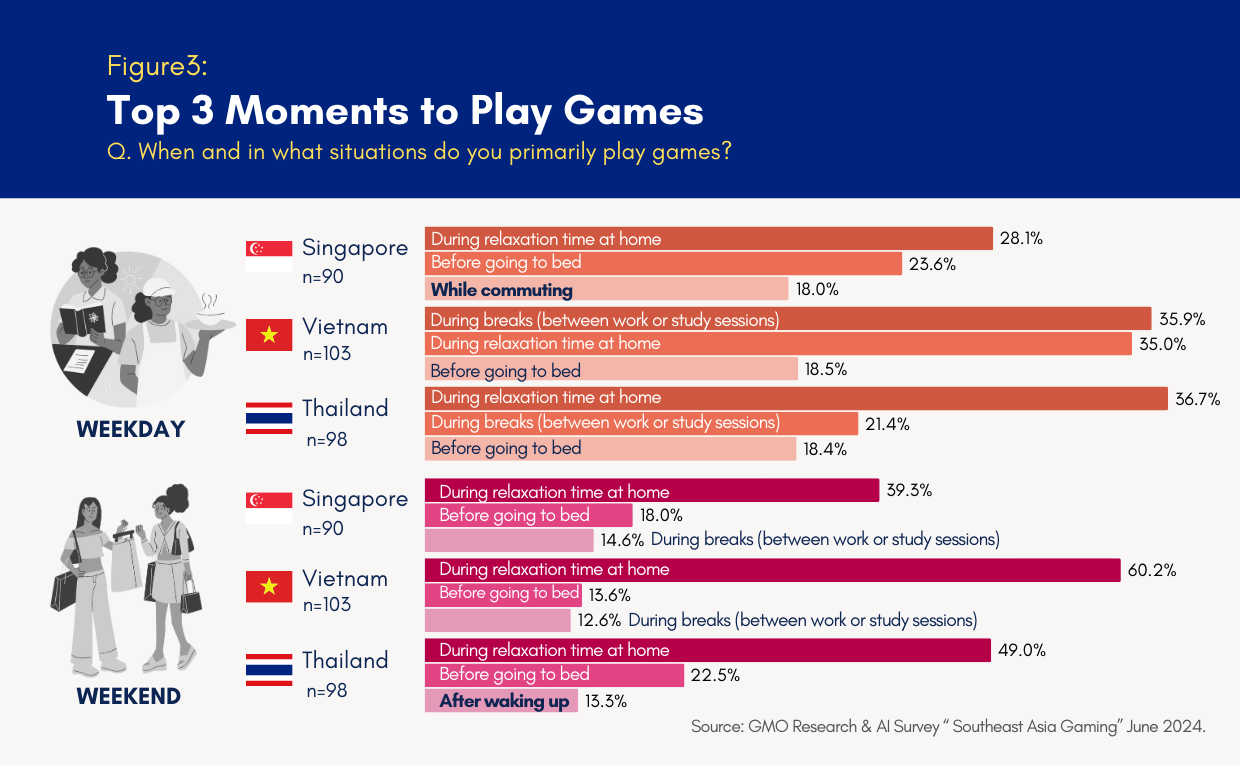

Gaming During "Relaxation Time at Home" or "Before Bed" is Common, Regardless of Weekdays or Weekends

Across three countries, gaming most frequently occurred during "relaxation time at home" or "before going to bed," regardless of whether it was a weekday or weekend.

On weekdays, Vietnam and Thailand also showed a high proportion of gaming "during breaks (between work or study sessions)," with Vietnam even surpassing "relaxation time at home." This indicates that gaming is commonly used as a break from work or study in these countries. In Singapore, however, a notably higher percentage (18%) reported gaming "while commuting," suggesting that gaming during transit is more common, likely influenced by differences in commuting habits and environments.

On weekends, while the proportions shifted, the trends remained consistent, with "during relaxation time at home" and "before going to bed" being the top occasions for gaming. Additionally, Thailand stood out with a notable percentage of respondents reporting gaming "after waking up," reflecting subtle differences in gaming habits and routines across countries. These findings suggest that gaming habits are shaped by local lifestyles and time-use preferences.

"Gameplay Enjoyment" and "Graphics & Music Quality" Are Key Factors When They Choose Games

About the factors they prioritize when choosing games, respondents across three countries consistently highlighted "Gameplay enjoyment (fun and novelty of gameplay)" (three-country average: 30.8%) and "Quality of graphics and music (graphics quality, game music, and sound effects)" (three-country average: 20.3%) as key considerations. Notably, Thailand showed the highest emphasis on "Gameplay enjoyment," with 40.1% of respondents prioritizing this factor.

Additional preferences varied by country: in Singapore, "Recommendations or reviews (reviews from friends, family, or online sources)" ranked highly, while in Thailand and Vietnam, "Preferred genre" was a significant consideration. These findings suggest that while there are shared priorities in how players choose games, the importance of specific factors varies by country.

Strategies for Capturing the Asian Game Player

Based on the trends revealed in the survey, the following strategies are considered effective for engaging existing game players:

- Enhancing Creativity: With "quality of graphics and music" being a significant factor in game selection, improving the creative aspects of games, including visuals and audio, will be essential to attracting players.

- Timing-Specific Marketing Strategies: Leverage the unique gaming habits of each country to tailor marketing efforts. For instance, promote games that are suitable for commuting in Singapore, while focusing on games that can be enjoyed during work or study breaks in Thailand and Vietnam.

These strategies align with player preferences and behaviors, enabling targeted engagement and stronger connections with Asian gamers.

Effective Approach with Marketing Research

This article focuses on game players in Singapore, Thailand, and Vietnam, highlighting trends in their gaming habits. Marketing research is an indispensable tool for deeply understanding user needs and behavior patterns, enabling the development of effective business strategies.

Harness the power of marketing research to strengthen your competitive edge in the global market. Consult with GMO Research & AI to develop strategic approaches based on insightful data. Let’s work together to achieve your business success.

In the upcoming second part, we will provide insights into changes in non-gamers’ gaming behavior and how they spend their leisure time.

Survey Theme: Southeast Asia Gaming Survey

Survey Regions: Singapore, Thailand, Vietnam

Survey Participants: 360 men and women aged 15-49 (120 by each country)

Survey Period: June 24, 2024 - June 30, 2024

Survey Method: Internet survey (closed survey)

Explore the Gaming Landscape of 2024: Insightful Infographic

|

Get a glimpse into the evolving gaming habits in Asia! |

Related Contents

2024 Gaming Insights:

Emerging Markets and Non-Player Trends

Learn about non-gamers' leisure activities, factors influencing game play, and strategies to boost engagement in Singapore, Thailand, and Vietnam.

READ MORE

Trends in the Entertainment Products Market in Asia

See what is the key when they purchase the entertainment products, and how to leverage these insights for strategic advantage.