Trends in the Apparel Market in Asia:

Consumer Behavior and Strategic Approaches

2024/06/07

Between April 19 and May 1, 2024, a consumer behavior survey was conducted in four countries: Singapore, Indonesia, India, and Malaysia. This survey targeted general consumers aged 15 to 59, delving into their consumption behaviors related to groceries, daily necessities, clothing, entertainment, and imported products in general. Across all countries, overall consumption is expected to increase over the next year, indicating a positive trend towards spending.

This article provides a detailed analysis of the market trends in each country, focusing on expenditures, purchasing behaviors, and the influence of trends on clothing based on the survey results. It also offers insights useful for business strategies.

General Findings

Analyzing the consumer trends in each country revealed the following key characteristics:

-

Priority of Expenditure: Respondents who selected clothing as the category with the highest expenditure in the past year accounted for 11% in India, showing a higher proportion compared to the other three countries, and it is expected to increase to 15% in the coming year. In Singapore, the expenditure on clothing increased from 5% in the past year to 7% in the coming year. On the other hand, in Indonesia and Malaysia, the respondents who chose clothing as the highest expenditure in the past year accounted for 5%, but it is expected to decrease to 3% in the coming year. This suggests a potential decrease in spending on clothing in Indonesia and Malaysia.

-

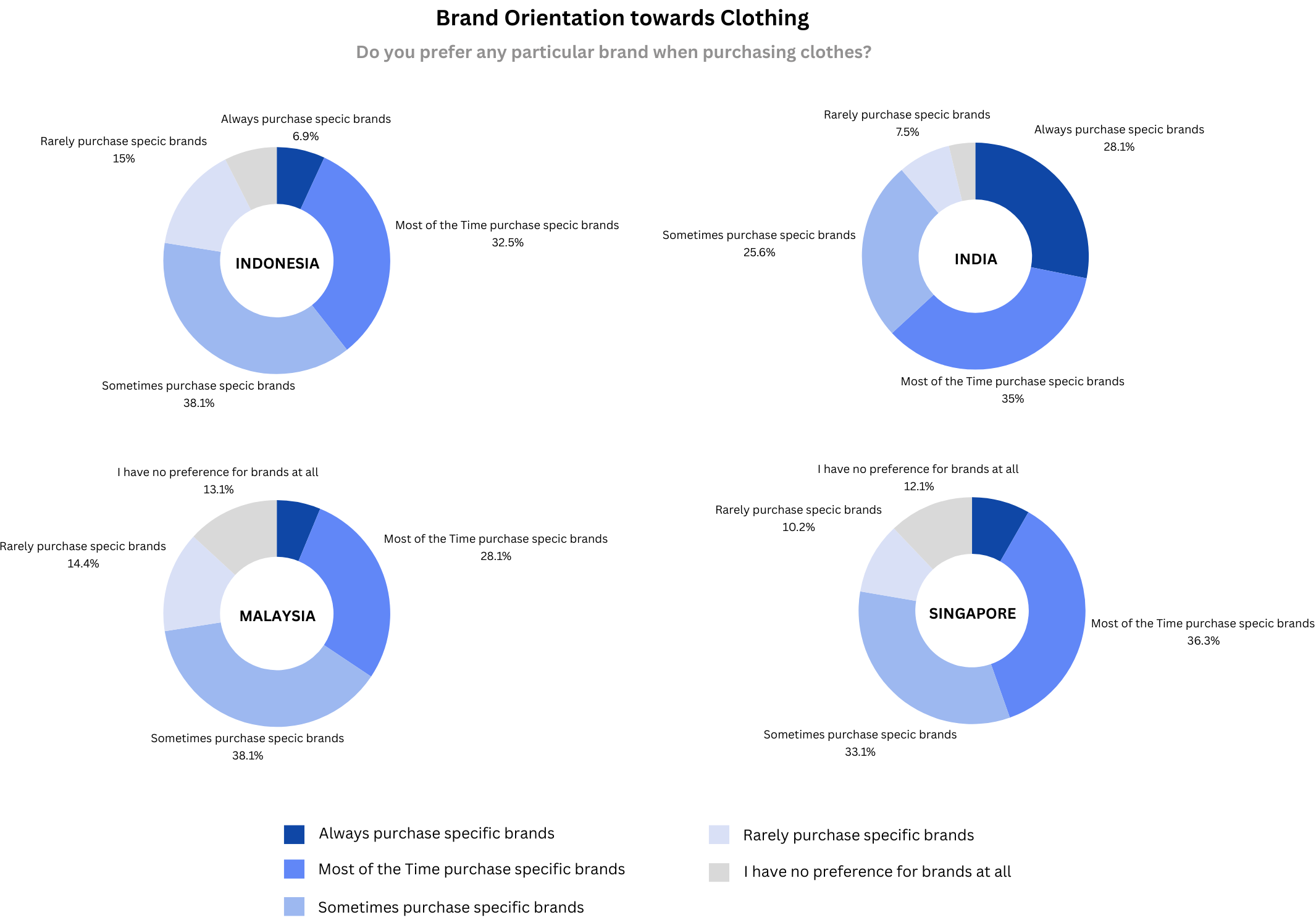

Growth in the Indian Market: In India, 44% of respondents reported purchasing clothing "weekly," "bi-weekly," or "monthly," which is approximately 10 percentage points higher than the other three countries. Additionally, the response "always purchase from specific brands" was 3-4 times higher compared to other countries, indicating strong brand loyalty.

-

Balance of Purchase Channels: "Online shopping" and "shopping malls" are the main purchase channels. Consumers enjoy the convenience of verifying and comparing products through both online and offline channels.

Characteristics by Country

Purchase Frequency: In all countries, "once every 2-3 months" is the most common response for how often respondents purpose clothing. However, in India, the proportion of respondents who purchase clothing "weekly," "bi-weekly," or "monthly" is higher than in the other three countries. This suggests a more active interest in fashion compared to other countries.

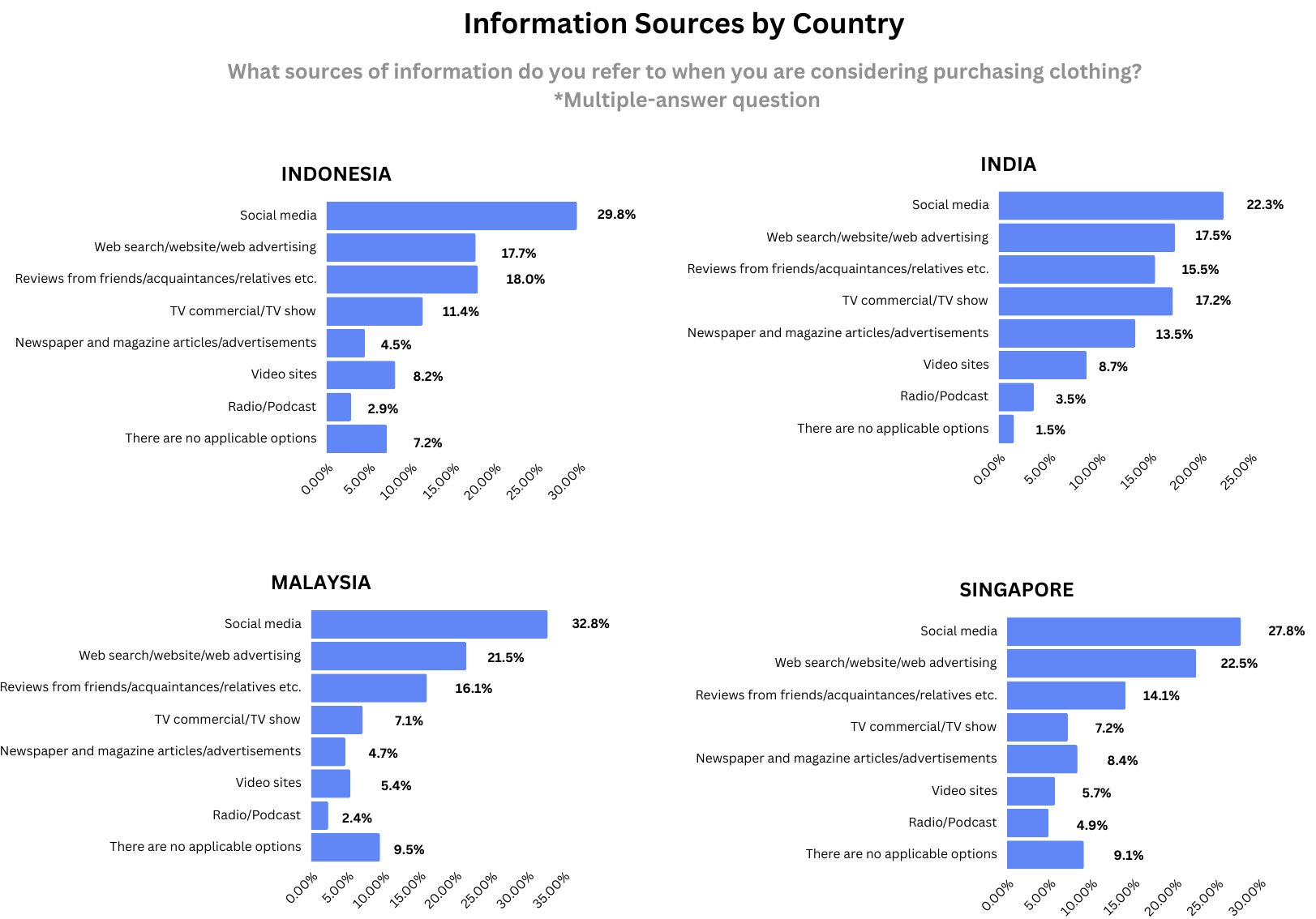

Sources of Information: In all countries, "social media" is the main source of information for clothing purchases. Particularly in Indonesia (29%) and Malaysia (32%), the high usage of social media underscores the importance of digital channels. Additionally, "web search/website/web advertising" are significant information sources in Malaysia (21%) and Singapore (22%).

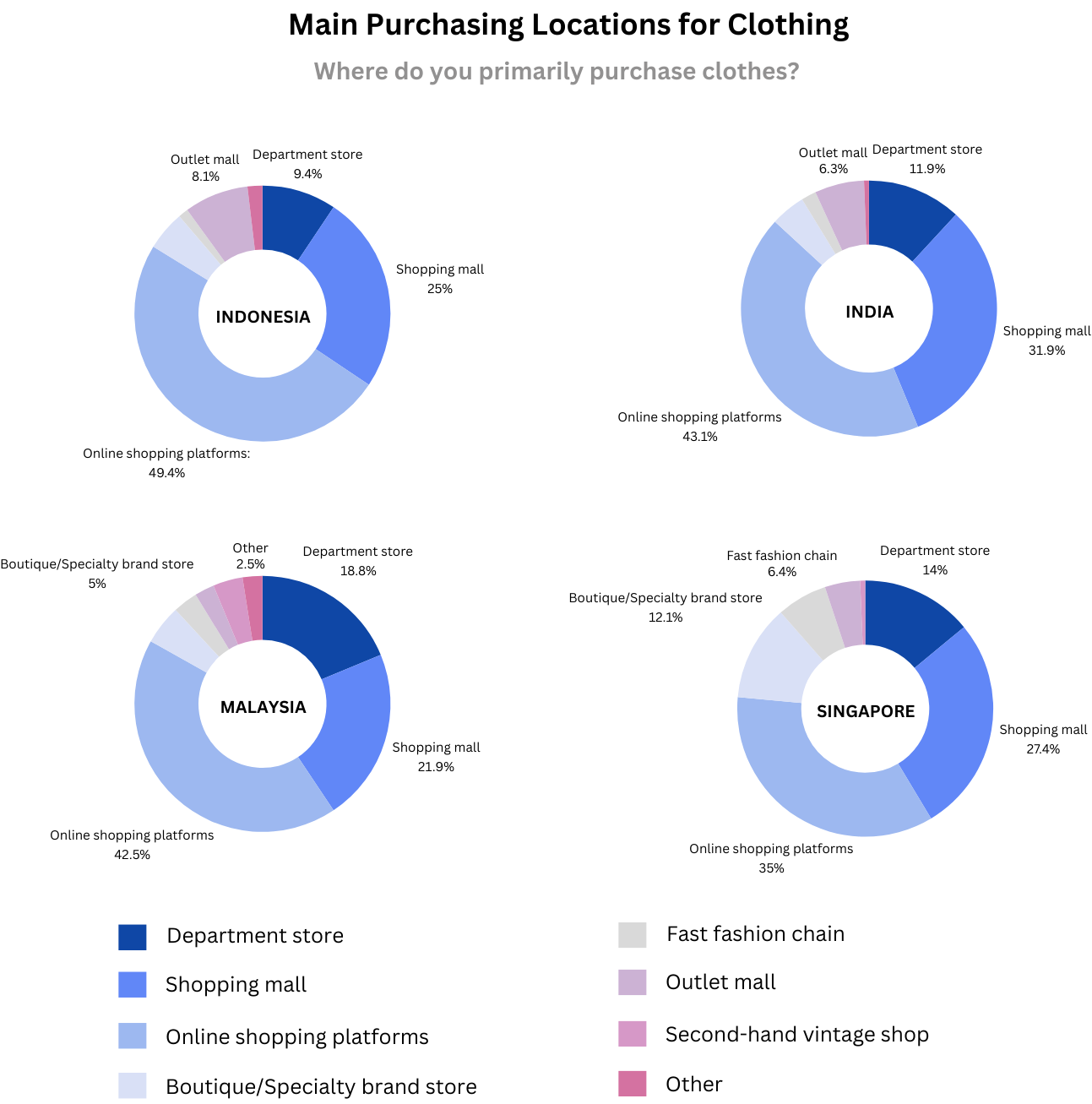

Purchase Channels: "Online shopping platforms" are the highest in all countries (average 42%), followed by "shopping malls" (average 26%). In Singapore, however, the proportion of "online shopping platforms" is slightly lower (35%) compared to other countries, with "boutiques/specialty stores" accounting for twice the proportion of the other three countries (average 6%).

Important Factors: "Price" and "comfort" are the most valued factors in all countries. In Indonesia and India, "quality" is also highly valued. This may be due to the relatively low quality of clothing in the market, leading to a higher demand for sustainable fashion in these countries.

Influence of Trends: The most common response in all countries (average 44%) is "I take inspiration from trends but choose according to my own style." In India, 38% responded "I keep up with trends and always incorporate the latest styles," indicating a proactive attitude towards trends. In contrast, a relatively high proportion of respondents in Malaysia and Singapore have "no interest in trends and choose entirely based on personal preference," suggesting a focus on individual style rather than trends.

Brand Orientation: In India and Singapore, the highest proportion of respondents (35% in India, 36% in Singapore) reported "most of the Time purchase specific brands," indicating strong brand loyalty. In particular, 28% of respondents in India "always purchase specific brands," which is 3-4 times higher than in other countries. In contrast, in Indonesia and Malaysia, the most common response (38% in both countries) was "sometimes purchase specific brands," suggesting relatively low brand loyalty. Additionally, in Malaysia, 27% of respondents reported "rarely purchase specific brands" or "have no preference for brands at all," indicating consumer flexibility and less brand fixation.

Strategic Insights from Market Data

Considering these characteristics, let's consider business strategies in the apparel industry.

-

Importance of an Omnichannel Approach: Since "online shopping platforms" are the most common purchase channel, strengthening online platforms is essential. The high utilization rate of "shopping malls" also suggests that an omnichannel strategy, integrating online and offline channels, would be effective. Providing consumers with a seamless shopping experience could enhance brand loyalty.

-

Ethical Product Development: Product development and marketing should consider "price" and "comfort," and also "quality," which is highly valued in Indonesia and India. Given the rising demand for sustainable fashion, incorporating eco-friendly materials and sustainable production processes can be key points of differentiation.

-

Harmonizing Style and Trends: In India, where there is a proactive attitude towards trends, it is important to quickly provide the latest fashion information. In Malaysia and Singapore, where consumers prioritize their individual style, personalized marketing strategies are effective. Offering product suggestions and coordinating proposals tailored to each consumer's preferences can increase customer satisfaction.

-

Strategies Leveraging Brand Preferences: In India and Singapore, where brand loyalty is strong, it is important to build trust in specific brands. In India, this tendency is particularly strong, so focusing on long-term customer relationships is necessary. In contrast, in Indonesia and Malaysia, where there is relatively low brand loyalty, expanding market share by diversifying brand offerings and enhancing price competitiveness may be effective strategies.

Conclusion: The Role and Value of Marketing Research

This survey has revealed that approaches to apparel and consumer expectations vary by country, and strategies tailored to these differences are key to success in each region.

For companies aiming to strengthen their business in both domestic and international markets, utilizing marketing research to understand consumer behavior patterns and preferences in detail is crucial for strategic decision-making. Understanding how your products and services are received in the local market through research, and designing and implementing effective, data-driven approaches, can enhance competitive advantage and achieve sustainable growth. Strengthen your market position and achieve sustained growth through marketing research.

Survey Theme: Consumer Trends in Asia

Survey Areas: Singapore, India, Malaysia, Indonesia

Survey Targets: Men and women aged 15-59, a total of 640 people (160 by each country)

Survey Date: April 19 - May 1, 2024

Methodology: Internet survey (closed survey)

This survey was conducted using our "Quick Survey"

|

Our Quick Survey service is fast, affordable, and easy to use. Perfect for businesses in APAC, it quickly finds survey participants and gathers data, making it ideal for simple data collection. Obtain authentic consumer feedback promptly and make swift, data-driven decisions to capitalize on business opportunities. |

Related Articles

Learn why consumers are shifting to online shopping and how price, safety, and quality drive their choices.

Discover the factors driving positive perceptions of products from major exporting countries and how quality and price influence purchasing decisions.

Understand how digital content and social media are reshaping entertainment consumption in Singapore, Indonesia, India, and Malaysia.