Trends in the Grocery Market in Asia:

Consumer Behavior and Strategic Approaches

2024/06/07

Between April 19 and May 1, 2024, a consumer trend survey was conducted across four countries: Singapore, Indonesia, India, and Malaysia. This survey targeted general consumers aged 15 to 59, delving into their purchasing behaviors concerning groceries, daily necessities, clothing, entertainment products, and general imported goods. In all the surveyed countries, overall consumption is expected to increase over the next year, indicating a positive trend towards spending.

Based on the results of this survey, this article provides an in-depth analysis of market trends in each country, focusing on expenditure on groceries, purchasing behaviors, and important factors that consumers consider. It also offers insights valuable for business strategies.

General Findings

Analyzing the consumer trends in each country revealed the following key characteristics:

-

Priority of Expenditure: The highest percentage of respondents across the four countries (an average of 74%) indicated that groceries were the category they spent the most on in the past year. Although the percentage of respondents who predicted groceries to be the category they would spend the most on in the next year was slightly lower at 68%, groceries still held a high priority.

-

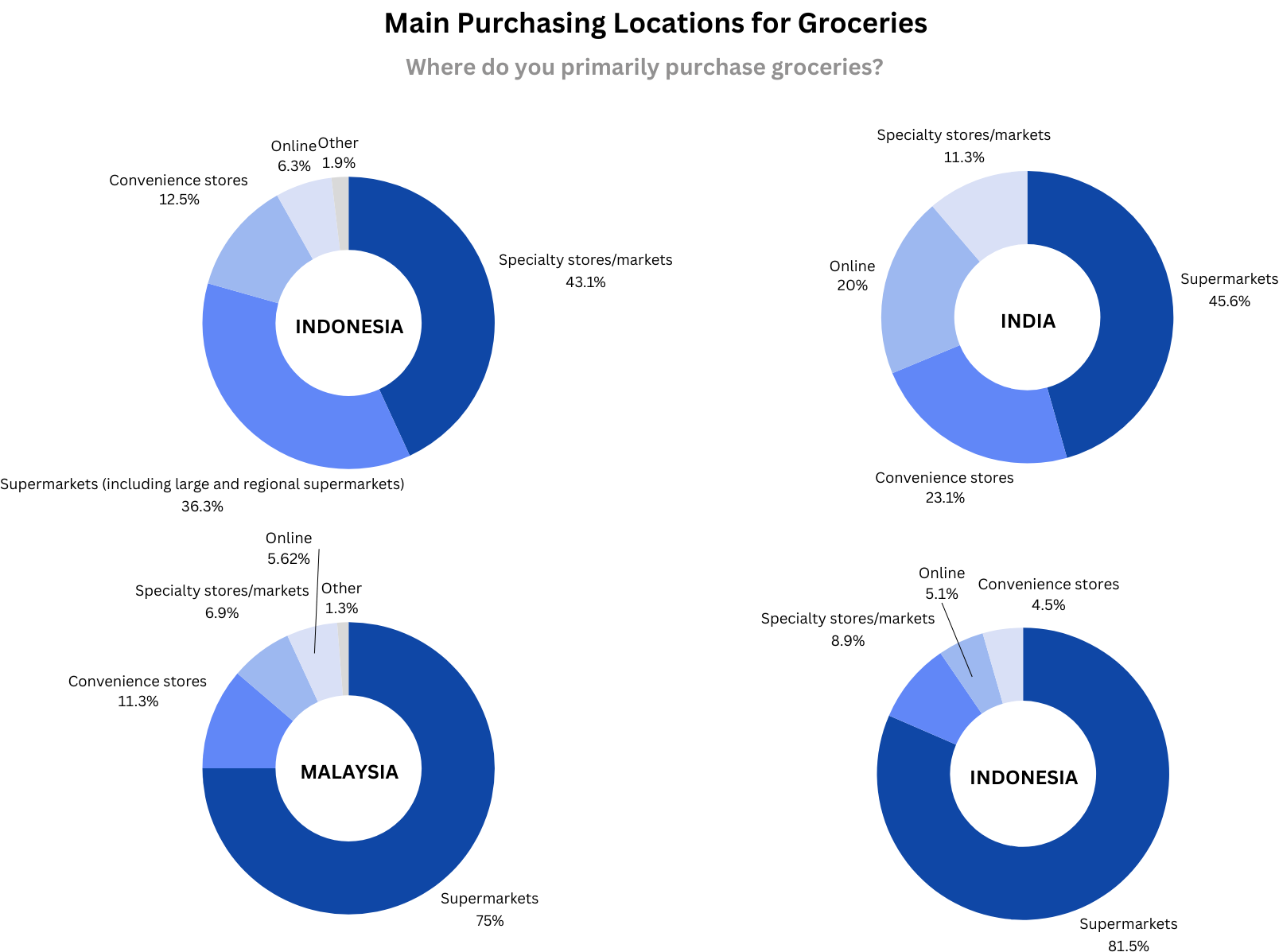

Diverse Purchase Channels: While supermarkets remain the main purchasing location for groceries in most countries, a notable number of consumers also buy through other channels, suggesting a further diversification of purchase channels in the future.

-

Importance of Freshness and Ingredients: The freshness of products is a crucial factor for choosing groceries across all countries. There is also a strong emphasis on ingredients and safety, indicating that consumers are making choices based on quality and health considerations.

Characteristics by Country

Most Frequently Purchased Groceries:

- Indonesia: "Grains" are purchased most frequently, followed by "meat" and "vegetables," reflecting the entrenched rice culture. "Seafood" is also frequently purchased.

- India: "Vegetables" are the most frequently purchased, followed by "meat" and "seafood." "Dairy products" also show high purchase frequency, highlighting their importance in the diet.

- Malaysia: "Meat" is the most frequently purchased, followed by "vegetables" and "seafood." "Grains" and "beverages" are also bought relatively frequently, showing a balanced consumption pattern.

- Singapore: "Meat" is the most frequently purchased, followed by "vegetables" and "grains," reflecting the influence of rice culture, with "seafood" also frequently purchased.

These results highlight differences in purchasing frequencies based on each country's food culture and consumption habits, indicating the need for market-specific strategies.

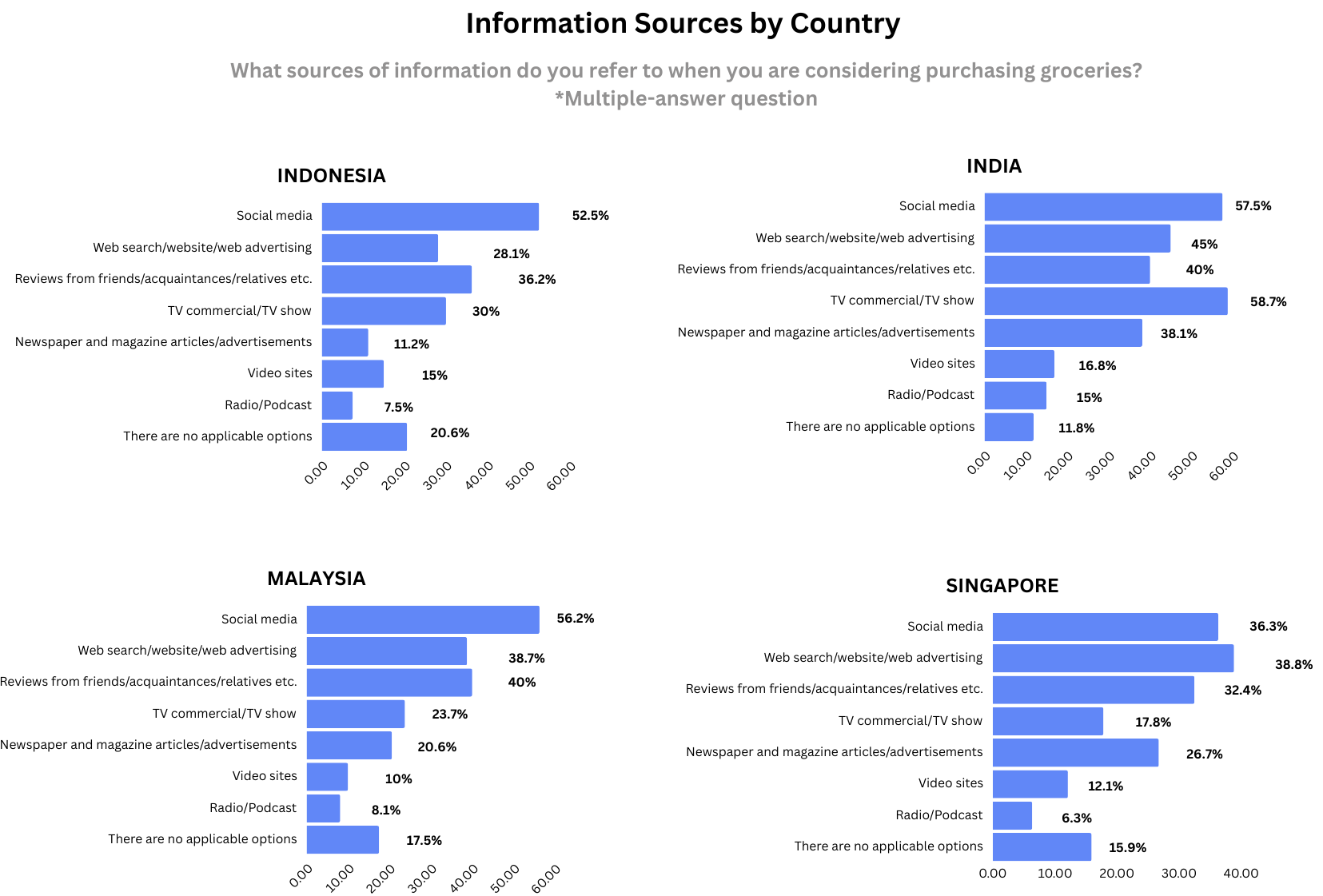

Sources of Information: While "social media" is a common source of information for purchases overall, "TV commercial/TV show" are more influential in India, and "web search/website/web advertising" are more influential in Singapore. Digital sources play a significant role in consumer decision-making across all countries.

Factors Considered Important:

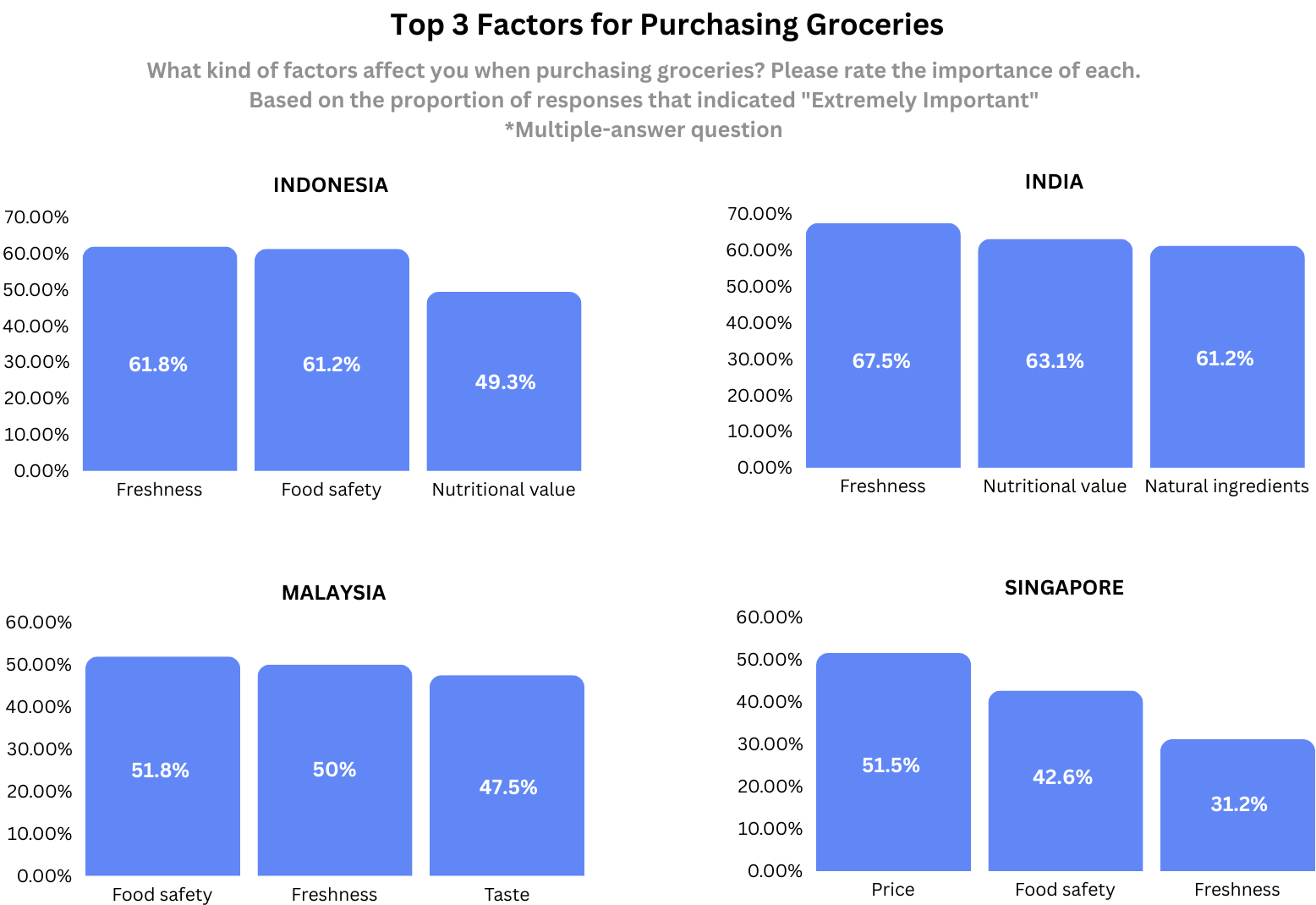

- Indonesia and India: There is a high emphasis on "natural ingredients" and "nutritional value," with a preference for health-conscious and naturally-derived products.

- Malaysia and Singapore: "Food safety" is also a significant concern, with greater attention to economic factors and basic food quality.

Purchase Channels: "Supermarkets" are the primary channels for purchasing groceries in most countries. However, in Indonesia, "specialty markets (butchers, fish markets, vegetable shops, farmers' markets)" account for 43%, surpassing "supermarkets". In India, "convenience stores" (23%) and "online purchases" (20%) are also significant. Consumers use different purchase channels depending on the country and product category.

Brand Loyalty: There is a strong tendency to purchase specific brands, with 72% of respondents in India and 58% in Singapore indicating they "mostly purchase specific brands." This tendency is more than 10 points higher than in Malaysia (45%) and Indonesia (42%), showing a stronger preference for food brands.

Strategic Insights from Market Data

Considering these characteristics, here are some strategic insights for the grocery industry:

-

Maintaining Price Competitiveness: To meet consumer needs for reasonable pricing, it is important to understand the appropriate price for the target country and demographic and offer high-cost-performance products. With the rise of online shopping making price comparisons easier, balancing price and quality becomes even more critical.

-

Ensuring Food Safety: Given the strong emphasis on safety and quality, providing the necessary information during promotions is crucial. Providing evidence of product safety and quality (e.g., third-party certifications, ingredient analysis results) in advertisements and promotions can reassure consumers. Strengthening digital channels for information provision can also facilitate consumer access.

-

Strengthening Collaboration Across Diverse Channels: While supermarkets are the main purchase channels, it is necessary to adopt strategies that suit each channel. For example, convenience stores can offer ready-to-eat or small-package products for convenience-focused consumers, and specialty stores can provide high-quality or specialized products to emphasize reliability.

-

Emphasizing Local Ingredients and Freshness: Understanding the evaluation points of target consumers (e.g., freshness, locally sourced ingredients, health orientation) based on the region and demographic and tailoring marketing strategies accordingly is crucial.

Conclusion: The Role and Value of Marketing Research

This survey shows a number of differing approaches to groceries and consumer expectations across countries. Strategies tailored to these insights are key to success in each region.

For companies looking to strengthen their business in domestic and international markets, leveraging marketing research to understand consumer behavior patterns and preferences in detail is essential for strategic decision-making. Understanding how their products and services are received in the local market through research and designing and executing effective approaches based on data can enhance competitive advantage and achieve sustainable growth. Strengthen your market position and realize sustainable growth through marketing research.

Survey Theme: Consumer Trends in Asia

Survey Areas: Singapore, India, Malaysia, Indonesia

Survey Targets: Men and women aged 15-59, a total of 640 people (160 by each country)

Survey Date: April 19 - May 1, 2024

Methodology: Internet survey (closed survey)

This survey was conducted using our "Quick Survey"

|

Our Quick Survey service is fast, affordable, and easy to use. Perfect for businesses in APAC, it quickly finds survey participants and gathers data, making it ideal for simple data collection. Obtain authentic consumer feedback promptly and make swift, data-driven decisions to capitalize on business opportunities. |

Related Articles

Learn why consumers are shifting to online shopping and how price, safety, and quality drive their choices.

Understand the strong brand loyalty in certain regions, the importance of online shopping, and the balance between following trends and personal style.

Discover the factors driving positive perceptions of products from major exporting countries and how quality and price influence purchasing decisions.