2024 Insights: Consumer Trends in Asia for Imported Goods

2024/06/07

Between April 19 and May 1, 2024, a consumer behavior survey was conducted in four countries: Singapore, Indonesia, India, and Malaysia. This survey targeted general consumers aged 15 to 59, delving into their consumption behaviors related to groceries, daily necessities, clothing, and entertainment products. In all countries, overall consumption is expected to increase over the next year, indicating a positive trend towards spending.

This article provides a detailed analysis of the market trends in each country, focusing on expenditures, purchasing behaviors, and the influence of trends on entertainment products based on the survey results. It also offers insights useful for business strategies.

General Findings

Analyzing the consumer trends in each country revealed the following key characteristics:

-

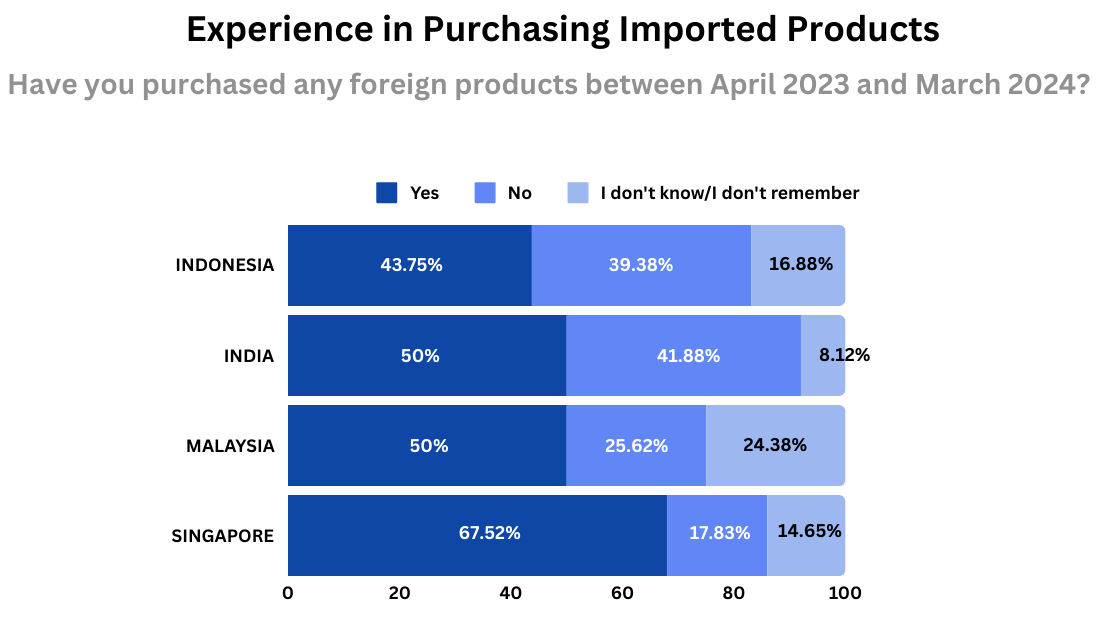

Experience of Purchasing Imported Products: In all countries, around half of the respondents reported having purchased imported products in the past year, with this trend being particularly prominent in Singapore. Conversely, in some countries, a notable number of respondents answered "Don't know/don't remember," suggesting that consumers may not place significant importance on whether a product is imported. Instead, factors such as ”quality/durability, “price”, and “design” play a crucial role in their purchasing decisions. This indicates that if a product is good, there is a chance it will be purchased regardless of its origin.

-

Impressions and Consumption of Major Exporting Countries: The survey revealed that consumers hold relatively positive impressions of major exporting countries, including China, the United States, Germany, the Netherlands, Japan, South Korea, Italy, Belgium, France, and Hong Kong. Particularly, the United States, Germany, Japan, and South Korea are viewed favorably by many, and products exported from these countries are frequently purchased in the four surveyed countries.

-

Key Factors in Purchasing Imported Products: When selecting imported products, consumers consistently prioritize "quality/durability," "price," "brand authenticity," and "safety." This trend is particularly evident in the three countries other than Singapore.

Characteristics by Country

Impressions of Major Exporting Countries: Many consumers have a neutral impression of numerous exporting countries. However, Japan, the United States, and South Korea received a high proportion of responses indicating "very positive impression," "generally positive impression," and "somewhat positive impression."

Background of Positive Impressions of Major Exporting Countries: Respondents who selected "very positive impression," "generally positive impression," and "somewhat positive impression" for each exporting country were asked about the aspects of these countries that led to their favorable impressions. For countries with notably positive perceptions, such as Japan, the United States, Germany, and South Korea, different factors contribute to the positive image.

-

Japan: "Culture and tradition," "domestic products and brands," and "travel experiences" are particularly influential. This can be attributed to the global recognition of Japanese culture and traditions, as well as the trust in high-quality Japanese products.

-

South Korea: "Entertainment (movies, TV dramas, sports)" and "food culture" are significant factors. The strong popularity of K-pop, Korean dramas, and the Korean wave in general is a major influence.

-

United States: Many responses highlighted "national character and image" and "entertainment." The positive impression is linked to the image of freedom, democracy, and being an economic superpower.

-

Germany: "National character and image" and "domestic products and brands" were frequently mentioned. The perception of high technological expertise and famous automobile manufacturers contributes to the positive impression.

Recent purchase experience in the past year: Approximately half of the respondents in the four countries reported having purchased imported products in the past year. Among them, Singapore had the highest percentage at 67%, indicating it is a market with easy access to imported products. On the other hand, Indonesia had the lowest percentage at 43%, showing that domestic products still dominate and there is relatively low dependence on imported goods. Additionally, 24% of respondents in Malaysia answered "Don't know/don't remember," suggesting that consumer memory or awareness is vague. This might imply that imported products are purchased so routinely that they are not specifically noted.

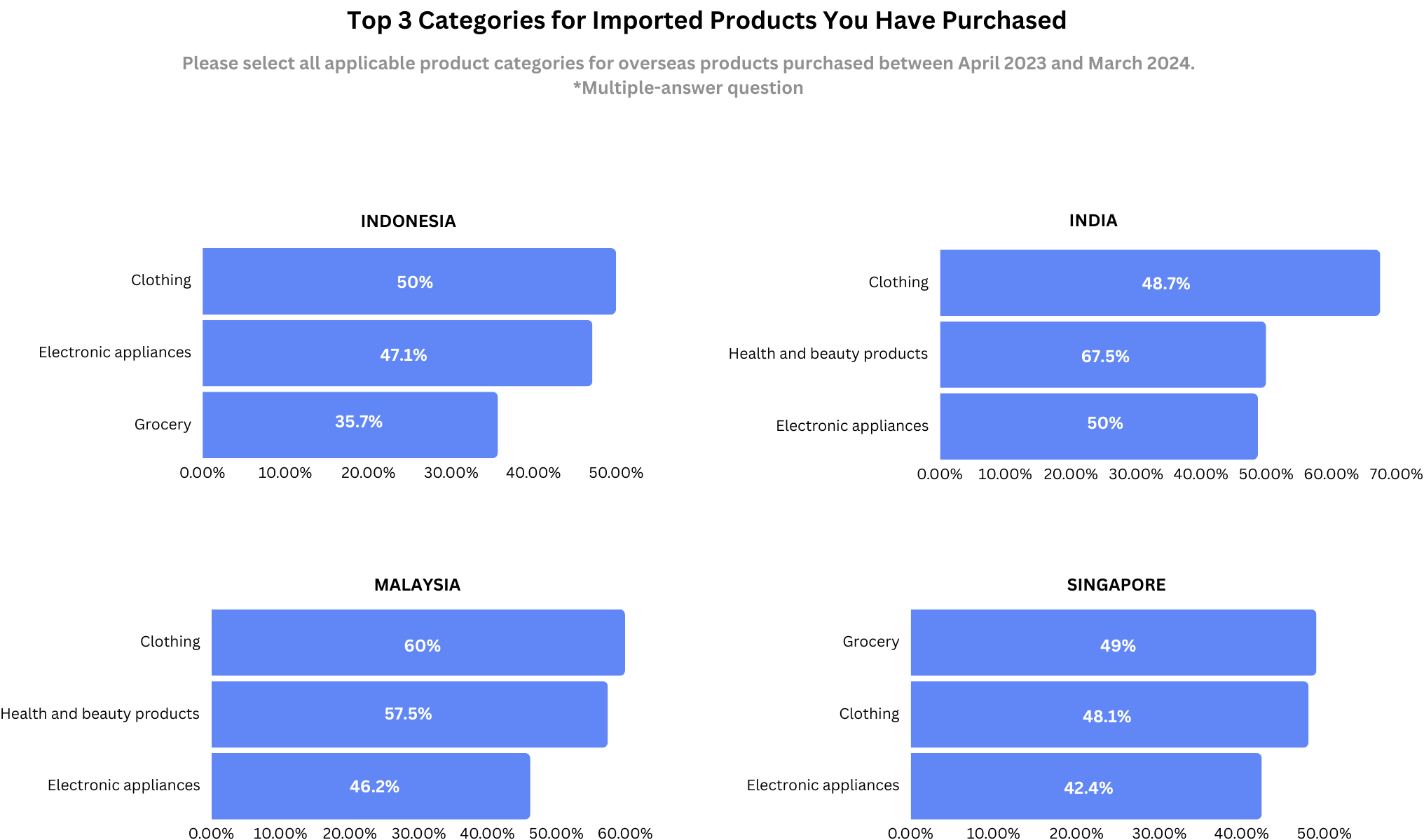

Product Categories with Purchase Experience: Across all four countries, "clothing" and "electronic appliances" were the most commonly purchased categories. In Singapore, however, "grocery" is the most frequently purchased, slightly surpassing "clothing." In India and Malaysia, after”clothing,” "health and beauty products" were also commonly purchased.

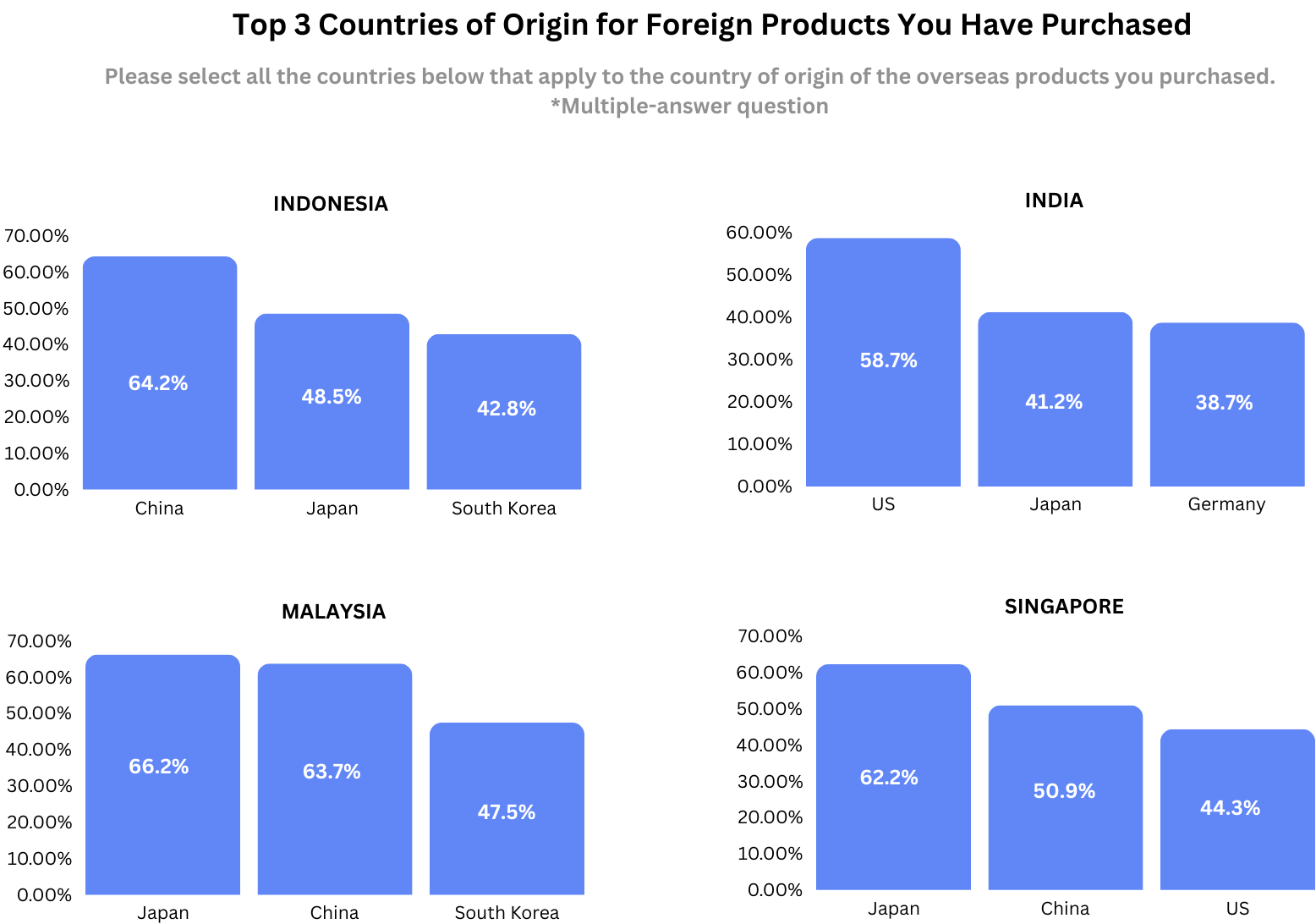

Countries of Origin for Purchased Products: "Japan" ranked high in all four countries. In Indonesia and Malaysia, "China" and "South Korea" also ranked high. In India, the United States was the most frequently mentioned country of origin for imported products.

Key Factors Considered: When purchasing imported products, the factors most emphasized in all countries were "quality/durability," "price," "brand authenticity," and "safety." "Price" was particularly important in India and Malaysia, while "brand authenticity" was highly valued in Indonesia and India. Conversely, in Singapore, only 19% of respondents prioritized "brand authenticity," showing a relatively low emphasis on this factor.

Strategic Insights from Market Data

Given these characteristics, let's consider business strategies for imported products.

-

Enhancing Reliability and Transparency: The survey results indicate that "quality/durability," "price," "brand authenticity," and "safety" are crucial factors for consumers when purchasing imported products. Therefore, it is important to ensure rigorous quality control to maintain high quality, set fair prices, and clearly explain the price breakdown to ensure transparency. Enhancing brand reliability through brand storytelling and corporate social responsibility (CSR) activities is also key. Adhering to safety standards and obtaining necessary certifications will provide consumers with a sense of security. Additionally, offering prompt and courteous customer support can further improve reliability.

-

Implementing Localization Strategies: Adopting localization strategies that cater to local cultures and languages can attract consumer interest in each market. This involves offering a product lineup and promotions tailored to the specific needs of each region.

-

Strengthening Digital Marketing and E-commerce: Companies can enhance their online presence and expand consumer access by leveraging digital marketing. Improving the convenience of purchasing through e-commerce platforms by supporting multiple languages and currencies, providing local delivery options, and implementing consumer data analysis and personalized marketing can significantly enhance consumer convenience.

Conclusion: The Role and Value of Marketing Research

This survey shows differing approaches to imported products and consumer expectations across countries. Strategies tailored to these insights are key to success in each region.

For companies looking to strengthen their business in domestic and international markets, leveraging marketing research to understand consumer behavior patterns and preferences in detail is essential for strategic decision-making. Understanding how their products and services are received in the local market through research and designing and executing effective approaches based on data can enhance competitive advantage and achieve sustainable growth. Strengthen your market position and realize sustainable growth through marketing research.

With global logistics evolving, international products are more accessible than ever, heightening competition in the global market. This trend presents a significant opportunity for businesses looking to expand internationally.

Gain valuable insights into how Asian consumers perceive the value of imported goods!

Discover More

Survey Theme: Consumer Trends in Asia

Survey Areas: Singapore, India, Malaysia, Indonesia

Survey Targets: Men and women aged 15-59, a total of 640 people (160 by each country)

Survey Date: April 19 - May 1, 2024

Methodology: Internet survey (closed survey)

Reach Your Ideal Audience

|

GMO Research & AI operates an online panel of 65 million individuals across 16 markets in Asia-Pacific with a diverse profile. Find more details of the respondents from the panel book! |