Unlocking Growth: The Strategic Value of U&A Studies for FMCG Brands in Southeast Asia

2025/05/13

Image credit: www.artSEAn.com

In the highly competitive, Fast-Moving Consumer Goods (FMCG) landscape, success in Southeast Asian markets critically depends on understanding local consumer behaviour. With a population of 700 million spread across culturally diverse countries, the region offers immense growth potential—but only for brands that recognise and adapt to local preferences. Usage and Attitude (U&A) studies have emerged as essential strategic tools that provide the deep insights needed to operate effectively in these complex markets.

Southeast Asia's economic trajectory makes it particularly attractive for FMCG expansion. By 2030, the region's workforce is forecast to grow by 24 million, coinciding with rising incomes and an expanding middle class. This demographic shift signals accelerated regional consumption growth in the next decade. So, it is crucial for companies to understand how consumers use products or services.

Understanding Regional Consumer Preferences

Southeast Asia is one of the most culturally and economically diverse regions in the world—making standardised global strategies insufficient and often ineffective. Insights from GMO Research & AI's studies highlight the differences in consumer priorities across key markets, underlining the clear need for localised approaches. For example, in Singapore, consumer decisions are typically quality driven, with premium products and global brands in favour. In contrast, Indonesian and Thai shoppers are value-oriented and strongly prefer discounts, promotions, and affordability. Meanwhile, in Malaysia, purchasing behaviour is influenced by brand trust and reputation, often preferring established names or international brands.

These differences are not surface-level—they reflect distinct cultural, economic, and social contexts. As such, even globally recognised FMCG brands can face significant setbacks if they fail to understand and adapt to these nuances.

The Business Impact of U&A Research: Indonesia and Thailand Case Studies

Successful brands conduct thorough U&A research to uncover what drives consumer decision-making in each market. From price sensitivity to brand perception and cultural values, these insights form the foundation of effective market entry and long-term growth strategies.

In short, local knowledge isn't optional—it's essential. Brands that invest in understanding Southeast Asian consumers at a granular level are best positioned to scale, resonate, and thrive in the region.

-

Providing an overview of the significance of U&A surveys, practical tips for leveraging survey results, and a free questionnaire template, download our exclusive

-

"Usage and Attitude Survey : Tips and Free Template"

Indonesia: Navigating the Instant Noodle Market

Indonesia is the second-largest consumer market of instant noodles globally, with significant export potential. U&A studies provide crucial insights into this complex market, shaped by:

Diverse regional taste preferences significantly influence consumer choices. Evolving urban lifestyles are reshaping consumption patterns across the country. Cultural influences like the Korean Wave impact product preferences, especially among younger demographics. Increasing health consciousness is driving demand for better-for-you alternatives in traditional food categories.

And, specifically for Indonesia's halal market, U&A research reveals how the growing middle class drives consumption shifts toward protein-rich, premium halal-certified products, including processed snacks and functional beverages. Moreover, Indonesian brands possess unique advantages when expanding internationally, particularly their expertise in halal products and a cultural affinity with Muslim markets across the ASEAN region and beyond.

Thailand's Health and Wellness Revolution

Thailand's FMCG sector is transforming, driven by a surge in consumer health consciousness and national policies to boost the wellness economy. This shift, amplified by the pandemic, presents considerable international opportunities for brands that can strategically align with evolving local needs:

Nuanced health priorities exist across different consumer segments, requiring targeted product development. The importance of botanical ingredients and natural products cannot be overstated in this health-conscious market. Understanding how to leverage Asian wellness traditions provides brands with a competitive advantage. Specific health concerns driving purchasing decisions vary by demographic, necessitating segment-specific approaches.

Thai brands with expertise in botanical ingredients and natural products have demonstrated high export success rates, highlighting the value of cultural authenticity that can be revealed through thorough U&A research.

Data-Driven Success Through U&A Studies

FMCG brands investing in consumer understanding through U&A studies gain significant competitive advantage by improving their products and services and even optimising their marketing strategies. By understanding the cultural, behavioural, and economic factors shaping local consumption patterns, brands can develop focused strategies that drive sustainable growth in Southeast Asian markets.

Whether you're an Indonesian brand looking to expand, a Thai company targeting global markets, or an international brand seeking market entry into Southeast Asia, U&A consumer research provides the bedrock for success. GMO Research & AI offers access to over 65 million survey respondents across 14 APAC regions which is applicable for U&A studies. Feel free to contact us for more details and download our exclusive "Usage and Attitude Survey: Tips and Free Template" to start!

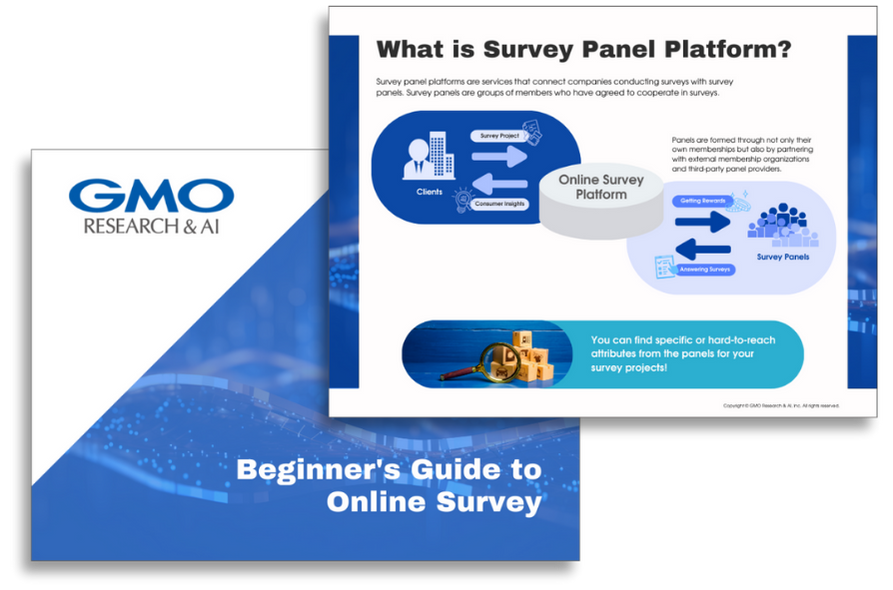

Beginner's Guide to Successful Online Survey

|

Using online surveys is a quick and cost-effective way to understand your target consumer and build right strategies. |