Analyzing Diverse Fashion Trends in Southeast Asia Through Market Segmentation

2025/04/25

The fashion market in Southeast Asia is experiencing diverse trends and consumer purchasing behaviors from 2024 to 2025. A market segmentation analysis is essential for a clearer understanding of these dynamics. This article explores the top-selling fashion trends in Southeast Asia, consumer purchasing tendencies, and the methods and necessary research for practical market segmentation analysis.

Expansion of the Fashion Market in Southeast Asia

According to a report by Statista, total consumer spending on apparel and footwear in Southeast Asia is expected to increase continuously by $15.6 billion (a 30.22% growth) between 2024 and 2029.

As the region experiences economic growth, the fashion market in Southeast Asia is also diversifying, with the following key trends emerging:

- 1. The Rise of Sustainable Fashion

- With increasing environmental awareness, eco-friendly materials and brands prioritizing sustainability in their production processes are gaining popularity.

- 2. Utilization of Digital Platforms

- The rapid increase in online shopping has resulted in more purchases through e-commerce platforms and social media. Live commerce has adapted well to the unique demands of Southeast Asian consumers and is becoming widely adopted.

- 3. Growth of Local Brands

- Designs that incorporate regional culture and traditions are gaining substantial support. For example, Caramel Monster is a brand that has become popular among many women in Singapore. It uses materials suitable for Southeast Asia’s climate while focusing on sustainability and ethical production, offering elegant silhouettes that resonate with consumers.

Consumer Preferences in Fashion Purchases

Consumer purchasing behavior in Southeast Asia exhibits the following trends:

According to a Statista report, by 2025, 91% of apparel market revenue in Southeast Asia is expected to come from non-luxury segments. Affordable fashion remains the preferred choice, with fast-fashion brands being particularly popular.

On the other hand, luxury segment revenues have remained stable over the years, suggesting that many consumers maintain strong brand loyalty to specific high-end labels.

Additionally, as more women enter the workforce, women’s apparel purchases continue to rise annually. Given the young average age of Southeast Asia’s population, sports apparel brands like Nike, Adidas, and Uniqlo are leading the industry. These top-performing brands emphasize eco-friendly products and services, reflecting the growing demand for sustainability among Southeast Asian consumers.

In 2024, key fashion trends in Southeast Asia include sustainable fashion and streetwear. Consumers are increasingly prioritizing online shopping and brand storytelling when making purchasing decisions. Thorough marketing preparation is essential for success in the diverse Southeast Asian market, where cultural backgrounds and lifestyles vary widely. Businesses can implement more effective targeting strategies and optimize their marketing approaches by leveraging market segmentation analysis.

Trend-Savvy vs Trend-Averse

Check out the trend awareness of consumers in Singapore, Malaysia, Indonesia, and India, and the differences in their purchasing behaviors!

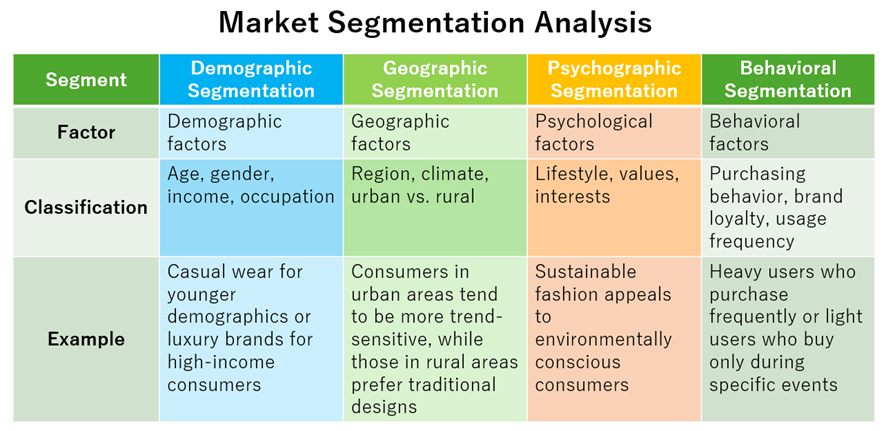

What is Market Segmentation Analysis and STP Analysis

Market segmentation analysis involves breaking down the overall market into detailed segments, focusing on categorization before identifying a target market. It serves as a preliminary step before determining the specific target audience.

A commonly confused concept is STP analysis, which follows market segmentation analysis.

STP analysis (Segmentation, Targeting, and Positioning) goes beyond market segmentation. It involves selecting the target market and defining how to position the brand or product within that market. This process helps formulate a concrete marketing strategy based on the chosen segment.

For example, through market segmentation analysis, a company may identify a segment of 30-year-old women interested in beauty. Using STP analysis, the company can then position itself as a luxury skincare brand targeting 30-year-old women and develop marketing strategies tailored to this audience.

A Practical Approach for Market Segmentation and STP Strategy

To develop and implement effective marketing strategies, a clear understanding of your market is crucial. This section presents a practical, step-by-step approach to connecting market segmentation and STP analysis with a data-driven marketing plan.

Market Segmentation Analysis

1.Data Collection

2.Selection of Segmentation Variables

3.Identification of Segments and Profiling

-

4.Selection of Target Segments

・From the identified segments, strategically select the most valuable ones to target.

-

5.Defining Your Market Position

- ・Define how your product stands out to your target customers by comparing it with competitors and highlighting its unique strengths.

To effectively connect market segmentation analysis to STP analysis, businesses typically follow a structured research flow, ensuring a data-driven and strategic approach to marketing planning.

Data Collection Methods for Market Segmentation Analysis

To conduct an effective market segmentation analysis, businesses must collect and analyze data through multiple methods. These can be categorized into primary data collection, secondary data utilization, and digital data analysis:

1. Primary Data Collection

Surveys

Interviews

・Engage directly with consumers to gain in-depth insight into their motivations, needs, and values.

Observational Research

2. Utilization of Secondary Data

Public Statistical Data

Use government and industry association statistics to analyze overall market trends and segment sizes.

Industry Reports

Referring to market research and consulting company reports on the latest trends and competitor insights.

Academic Papers

Leverage scholarly research for more profound knowledge of specific markets and consumer behaviors.

3. Other Data Collection

Web Analytics

Analyze website and online store visitor data to understand visitor demographics and behavior patterns.

Social Media Analytics

Examine brand mentions, follower demographics, and consumer interests on social media platforms.

Purchase History Data

Analyze customer purchase records to identify repeated purchase trends and product preferences.

By combining these research methods, businesses can accurately segment the market and develop data-driven marketing strategies tailored to each segment's unique characteristics and needs.

The Best Online Survey Methods for Primary Data Collection

With the widespread adoption of smartphones, online surveys are an ideal method for gathering responses from users who purchase apparel. They allow for easy data collection, offering low-cost and fast results. This makes online surveys the most effective approach for initially gathering broad consumer insights.

Additionally, by carefully structuring survey questions, businesses can quickly and cost-effectively conduct detailed segmentation analyses. Since online surveys can be conducted across borders, they are the perfect first step in analyzing the diverse cultural backgrounds of the Southeast Asian market. GMO Research & AI provides solutions for conducting successful online surveys. Our consumer network connects with over 65 million real consumers across 14 markets in the Asia-Pacific region. By identifying the right target audience, businesses can maximize the impact of survey results and gain valuable insights for strategic decision-making.

Beginner's Guide to Successful Online Survey

|

Using online surveys is a quick and cost-effective way to understand your target consumer and build right strategies. |