Exploring Business Opportunities in Indonesia: Consumer Trends Uncovered by Online Survey

2025/04/23

Given its linguistic and cultural diversity and the sheer size of its islands, Indonesia can be a challenging market to enter. Indonesia is, after all, the world’s fourth most populous country. But, as an archipelago, the disparities between rural and local areas can make it difficult to learn information about what the market is like.

Still, through looking at the trends, one can get an accurate view of the Indonesian market. This is vital for those seeking to enter this exciting, growing, and dynamic market. It may be important to understand the specific market dynamics of Indonesia, then.

What Do Indonesian Customers Want?

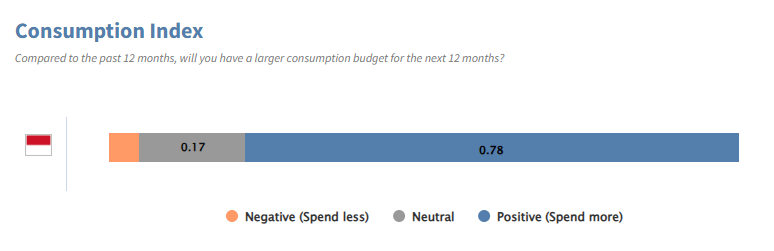

What makes the Indonesian market one exciting to get into? For one, Indonesia is one marked by strong enthusiasm about the future. An online survey targeting internet users aged 16-60, conducted by GMO Research & AI in July 2024 with over 1100 respondents, reveals that consumer sentiment in Indonesia is markedly positive. Around 80% of consumers have a positive outlook on future spending. This means that Indonesian customers generally hope to spend in the future and are optimistic about being able to afford to spend.

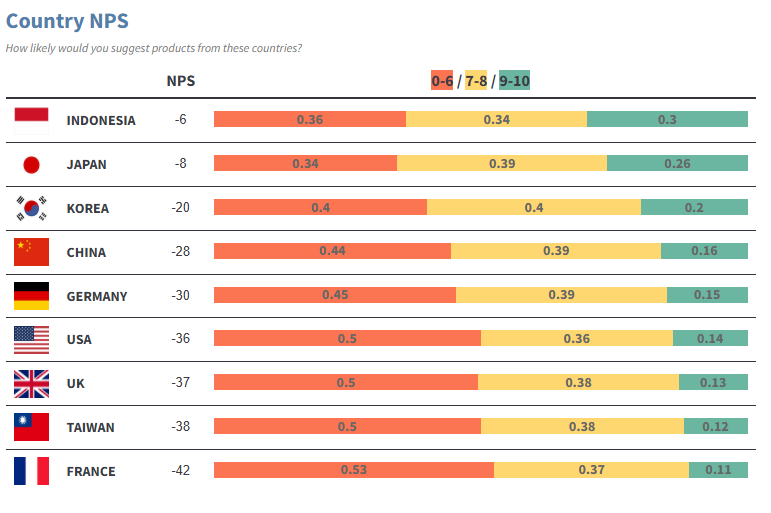

As for the impressions of products from various countries, respondents are most likely to recommend domestic products, followed by those from Japan and Korea.

*Remarks: 9-10 stands for willing to recommend, 7-8 is neutral and 0-6 means not willing to recommend.

The Essential Goods Market: Positive Sentiment with a Higher Preference for Domestic Products

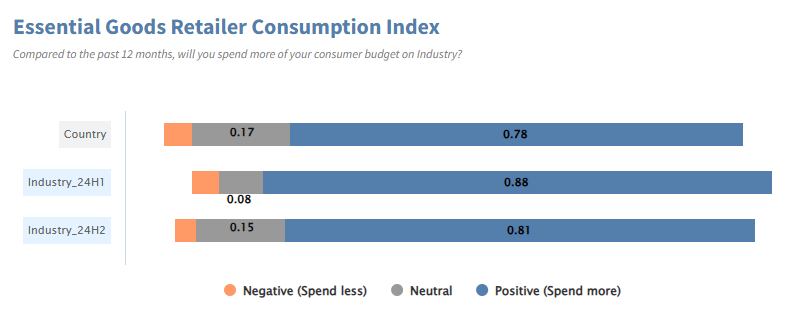

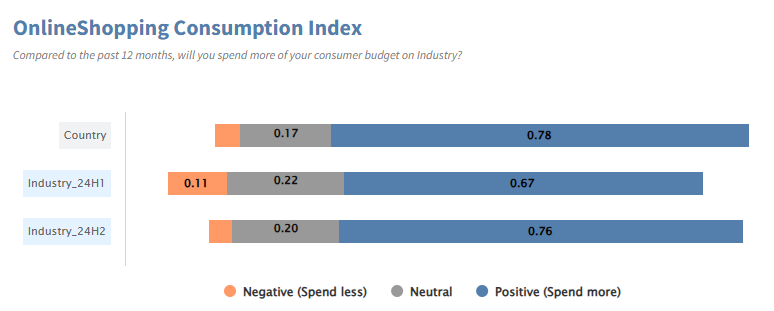

A similar trend is observed for the essential goods industry, which refers to daily products that people use on a day-to-day basis. In 2024, approximately 80% of respondent consumers had a positive outlook on purchasing essential necessities.

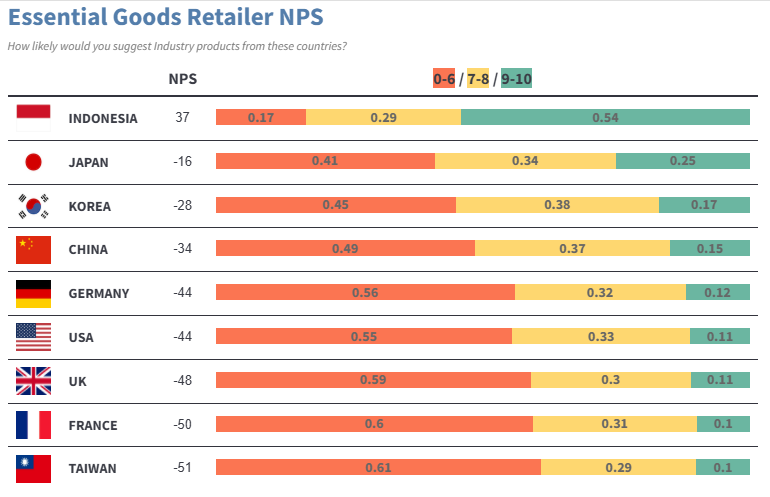

When compared with overseas products, the satisfaction level for domestic products is the highest, with the percentage of respondents who strongly recommend them (scoring 9–10) being 20–40 points higher than those for products from other countries. This suggests that consumers have an overwhelmingly positive perception of everyday domestic products. With a Muslim majority population, Halal certification could be a value-add for many domestic brands.

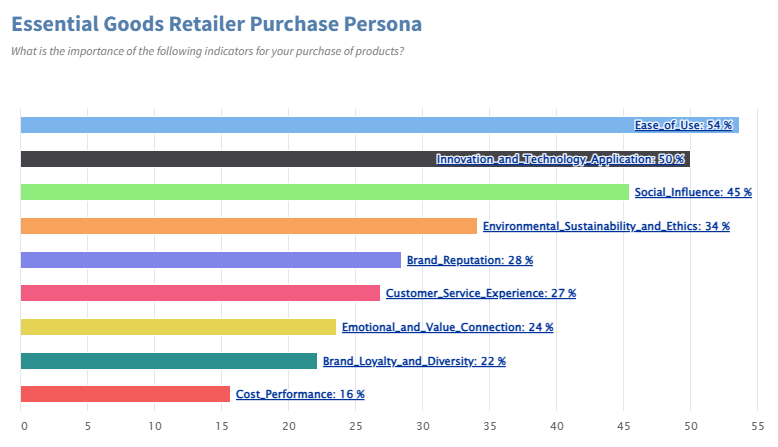

The most important factor in purchasing essential goods was “ease of use,” with 54% of respondents emphasizing its importance. A possible reason behind this could be urbanization increasing the numbers of consumers who are seeking a balance between work and family. However, “innovation and technology application” is also significant, with 50% considering them key factors.

Online Shopping: Willing to Spend More and Value "Ease of Use"

Such dynamics also apply to online shopping. In 2024, approximately 70% of respondents consumers had a positive attitude on online shopping consumption. The use of apps with wide-ranging functionalities ranging from online shopping to food delivery and transportation, such as Grab, has made life more convenient.

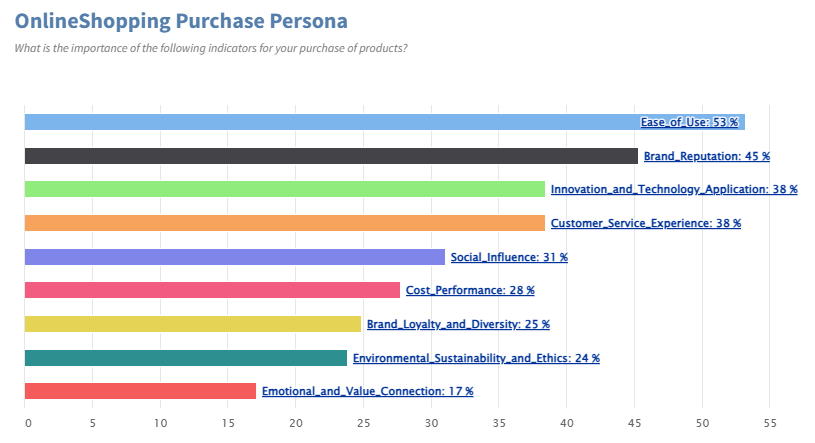

Regarding the key factors to purchasing, 53% prioritized “ease of use.” This is backed up by the reality on the ground. Logistical convenience is prioritized in Indonesia because it is an archipelago, in which the gaps between rural and urban areas are harder to navigate.

At the same time, 45% prioritized “brand reputation.” 38% preferred “Innovation and Technology Application” and “Customer Service Experience.” People are afraid of potential online fraud and scams. This is likely why brand reputation is important to Indonesians, as this indicates the reliability and safety of a product or service.

Consumer Surveys as a Way to Understand the Indonesian Market

Although it is known that strong potentials are recognized in the Indonesian market, not enough is known about consumer engagement or retention, when it comes to products and services. As is true more generally, to enter the Indonesian market, one also needs to be aware of the competitors and their product and service offerings, so as to establish one’s own niche in the market.

Consumer surveys, then, can play a key role in clarifying this–making it easier for businesses to enter the Indonesian market. One can, in this way, identify the areas one needs to improve and drive up consumer retention, while coming to a better understanding of usage patterns for your product or service. The following are examples of online survey applications.

Finding new areas for product improvement

Conducting a survey a few months after a new product launched to gain insights about customer usage helps deepen understanding towards your target's dissatisfaction and requests for improvement, which eventually enhances overall customer satisfaction.

You may ask questions like “Which of the following features of this product do you use most frequently?” or “How satisfied are you with the following features of the product?” to identify most commonly used features and those needing improvement. Concrete feedback on desired improvements could also be collected by adding open-ended questions like “What improvements or additional features would you like to see in the product to enhance your experience?"

Refining marketing and product positioning

Analyzing product usage helps determine if it resonates with the intended audience. Understanding how specific demographics use the product is essential for effective marketing strategies.

For example, cross-tabulate demographic data with behavioral responses to questions like, “How often do you use the product?” or “What best describes your purpose for using the product?” This reveals how each segment uses the product, providing insights for messaging and positioning strategies.

A Usage and Attitude Survey offers essential data to achieve the above objectives.

Download our E-book for a comprehensive explanation and free questionnaire template!

Leveraging Online Survey for your Overseas Business

The tried-and-true method of online surveys proves a way to have it all, then. Online surveys offer a convenient and effective way to gather data from your overseas customer base, which is often harder to reach than local customers. The customizable online survey services provided by GMO Research &AI can assist. 65 million individuals can be surveyed, with research available in 14 APAC markets. Gain insights to refine your products and services, and develop strategies to elevate your business in overseas markets.

Beginner's Guide to Successful Online Survey

|

Using online surveys is a quick and cost-effective way to understand your target consumer and build right strategies. |