Reach Your Ideal Audience

|

GMO Research & AI operates an online panel of 65 million individuals across 16 markets in Asia-Pacific with a diverse profile. Find more details of the respondents from the panel book! |

2024/07/30

The Asian gaming market, projected to reach $14.74 billion in 2022 and $14.99 billion by 2031, is recognized as one of the largest markets globally. However, the gaming markets within Asia are diverse, with each country and region exhibiting unique trends and adoption rates, necessitating tailored approaches.

Against this backdrop, GMO Research & AI conducted a survey from June 24 to June 30, 2024, targeting general consumers in emerging gaming markets such as Vietnam, Thailand, and Singapore.

In this second part, we will analyze the interests and perceptions of non-gamers who responded that they had not played mobile games, AR games, eSports, or NFT games in the past six months. This detailed analysis will focus on their attitudes and potential interest in gaming.

In this second part, we will focus on analyzing the interests and perceptions of 69 non-players from various countries—defined as individuals who reported not having played mobile games, AR games, eSports, or NFT games in the past six months (hereafter referred to as "non-players")—as part of our research into these types of games.

What is the Reality of Game Players? Check out part 1!

Key Findings

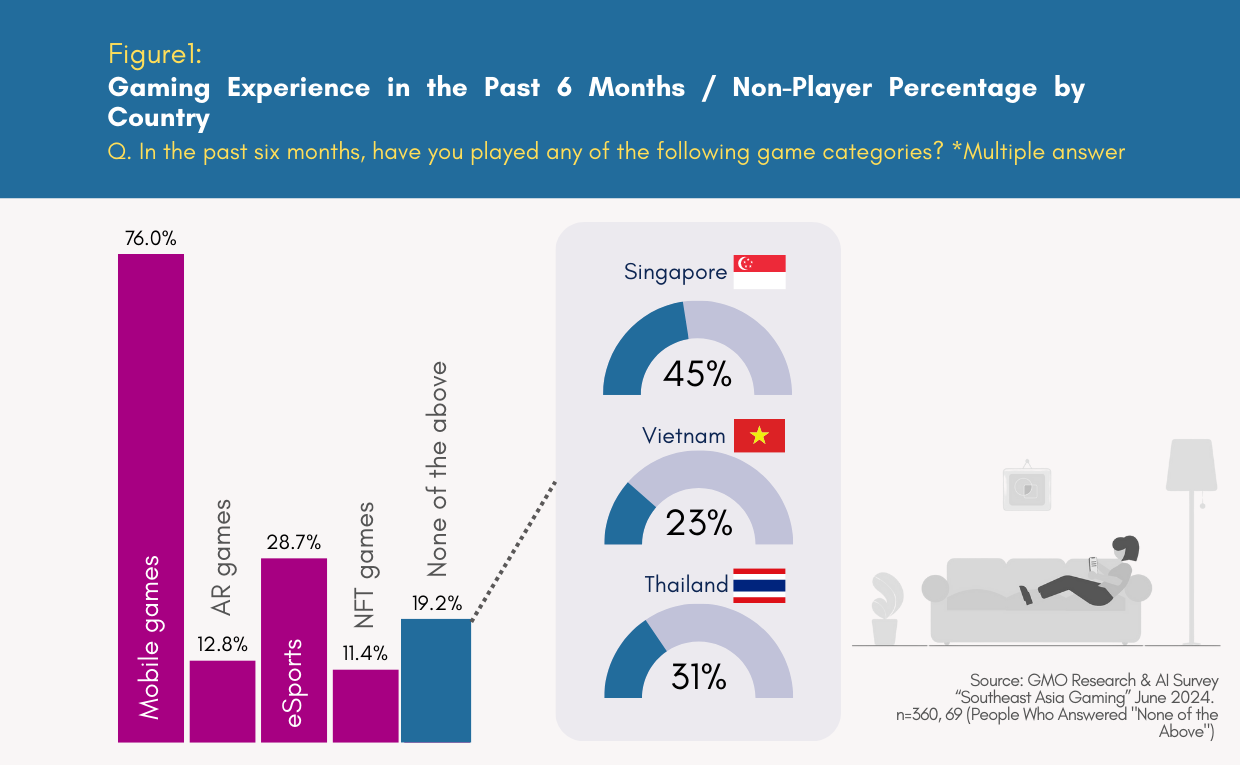

When asked about their experience playing games (mobile games, AR games, eSports, NFT games) in the past six months, 19.2% of respondents overall selected "None of the above." Breaking it down by country, Singapore accounted for 45% of this group.

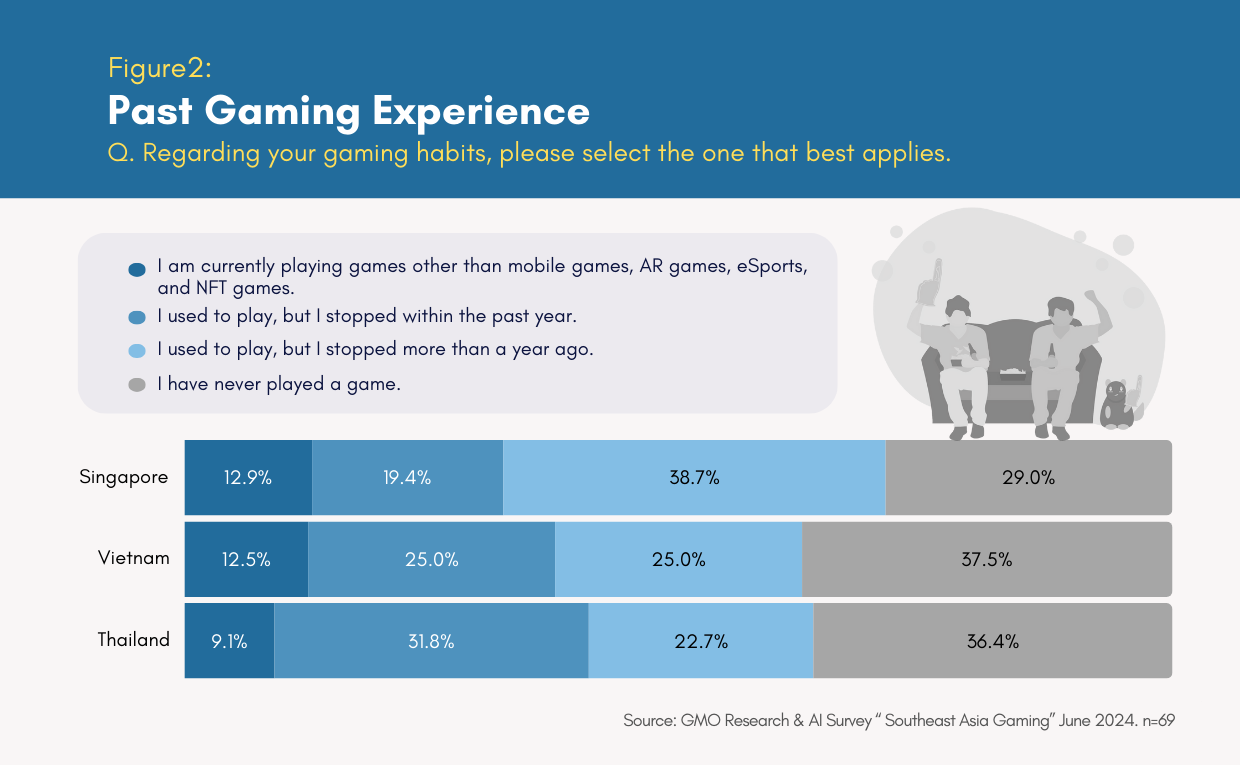

Regarding past gaming experiences, Vietnam and Thailand showed the highest percentage (36.9% on average) of respondents selecting "I have never played a game." In contrast, in Singapore, the most common response was "I used to play, but I stopped more than a year ago," at 38.7%.

This indicates that, while many respondents in Singapore have not played games recently, they do have prior gaming experience and still remember the enjoyment of playing. The proportion of such individuals in Singapore is more than 10 percentage points higher than in the other two countries.

As a result, Singapore stands out as a more promising market compared to Vietnam and Thailand, with a relatively larger group of individuals who may regain interest in gaming through the right approaches and initiatives.

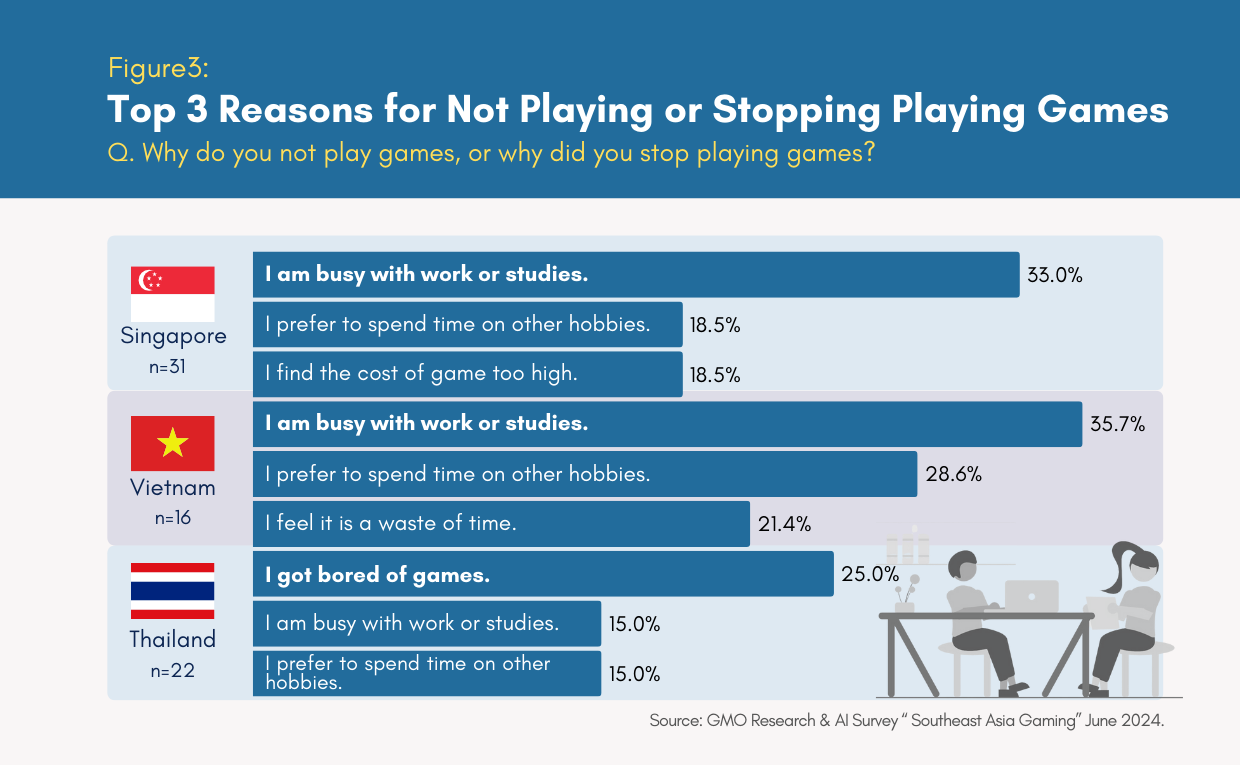

Across all three countries, the reasons for not playing or quitting games showed similar trends, with "I am busy with work or studies" and "I prefer to spend time on other hobbies" ranking relatively high. This indicates that work, studies, and other hobbies are often prioritized over gaming.

However, in Thailand, "I got bored of games" was the top response at 25%, highlighting a significant proportion of players who have lost interest in gaming.

Based on this, offering content in Thailand that minimizes the feeling of wasted time and provides a sense of accomplishment in a short amount of time could be an effective strategy to re-engage these players.

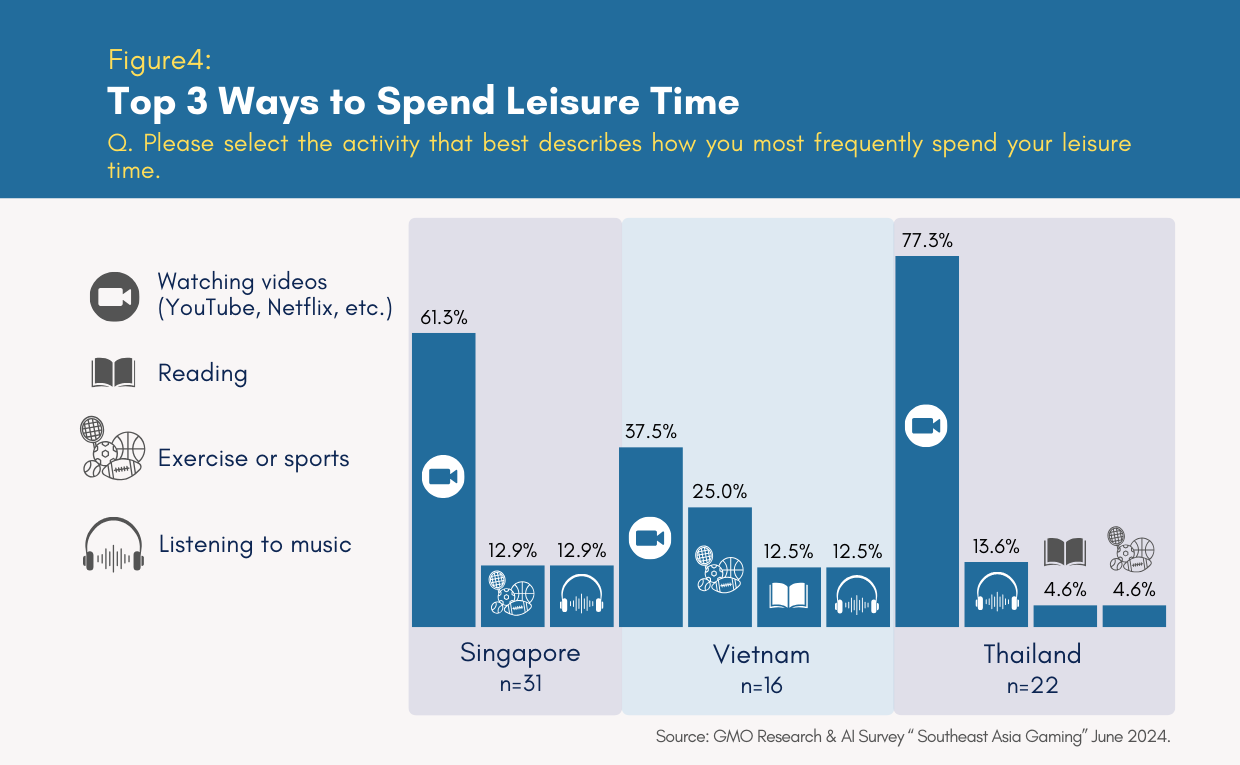

When it comes to how leisure time is spent, "Watching videos (YouTube, Netflix, etc.)" was the most common activity across all three countries, with an average of 58.7%. Thailand stood out with the highest percentage at 77.3%, while Vietnam recorded the lowest at 37.5%.

In Vietnam, "Exercise or sports" accounted for 25%, more than 10 percentage points higher than in the other two countries. This suggests that Vietnamese consumers are more inclined to engage in physical activities as an alternative to video consumption compared to their counterparts in Thailand and Singapore.

The results of this study reveal that among non-players, there is a segment of individuals with prior gaming experience who, with the right approach, may be encouraged to return to gaming. To effectively reach this group, strategies that align with their lifestyle and interests are crucial. Based on this research, GMO Research & AI proposes the following approaches:

This study focused on non-players in the Singapore, Thailand, and Vietnam markets, shedding light on their behaviors and preferences. To expand sales, it is essential for gaming companies to capture the attention of this non-player segment. Achieving this requires a precise understanding of their needs and behavioral patterns, as well as gaining deeper insights through their actual feedback.

GMO Research & AI leverages an extensive panel of survey respondents across 16 Asian countries to deliver fast and accurate research data. Using this data, we can help gaming companies devise strategic approaches that resonate with non-players. For gaming companies considering expansion into the Asian market, please don’t hesitate to consult us. We’re here to support your success.

This report analyzes non-players' responses to ads and provides tailored approaches by country, helping you craft more effective advertising strategies.

Survey Theme: Southeast Asia Gaming Survey

Survey Regions: Singapore, Thailand, Vietnam

Survey Participants: 360 men and women aged 15-49 (120 by each country)

Survey Period: June 24, 2024 - June 30, 2024

Survey Method: Internet survey (closed survey)

Reach Your Ideal Audience

|

GMO Research & AI operates an online panel of 65 million individuals across 16 markets in Asia-Pacific with a diverse profile. Find more details of the respondents from the panel book! |