Exploring the 2024 Trends in Asia's Entertainment Product Market

2024/06/07

Between April 19 and May 1, 2024, a consumer behavior survey was conducted in four countries: Singapore, Indonesia, India, and Malaysia. This survey targeted general consumers aged 15 to 59, delving into their consumption behaviors related to groceries, daily necessities, clothing, and entertainment products. In all countries, overall consumption is expected to increase over the next year, indicating a positive trend towards spending.

This article provides a detailed analysis of the market trends in each country, focusing on expenditures, purchasing behaviors, and the influence of trends on entertainment products* based on the survey results. It also offers insights useful for business strategies.

*This article analyzes consumer spending behavior across the following entertainment product categories: books/e-books, movies/TV dramas, music, games, and live entertainment.

General Findings

Analysis of consumer behavior in each country revealed the following overall characteristics:

-

Priority of Expenditure: The percentage of respondents who selected entertainment products as the category with the highest expenditure in the past year averaged 2.5% across the four countries, the lowest among the categories surveyed. For the coming year, the percentage of respondents expecting to spend the most on entertainment products remains low at an average of 2.8%, though there is a slight increase in the number of respondents in Indonesia and Malaysia. This suggests a modest increase in spending on entertainment products, possibly due to the spread of digital content and economic factors.

-

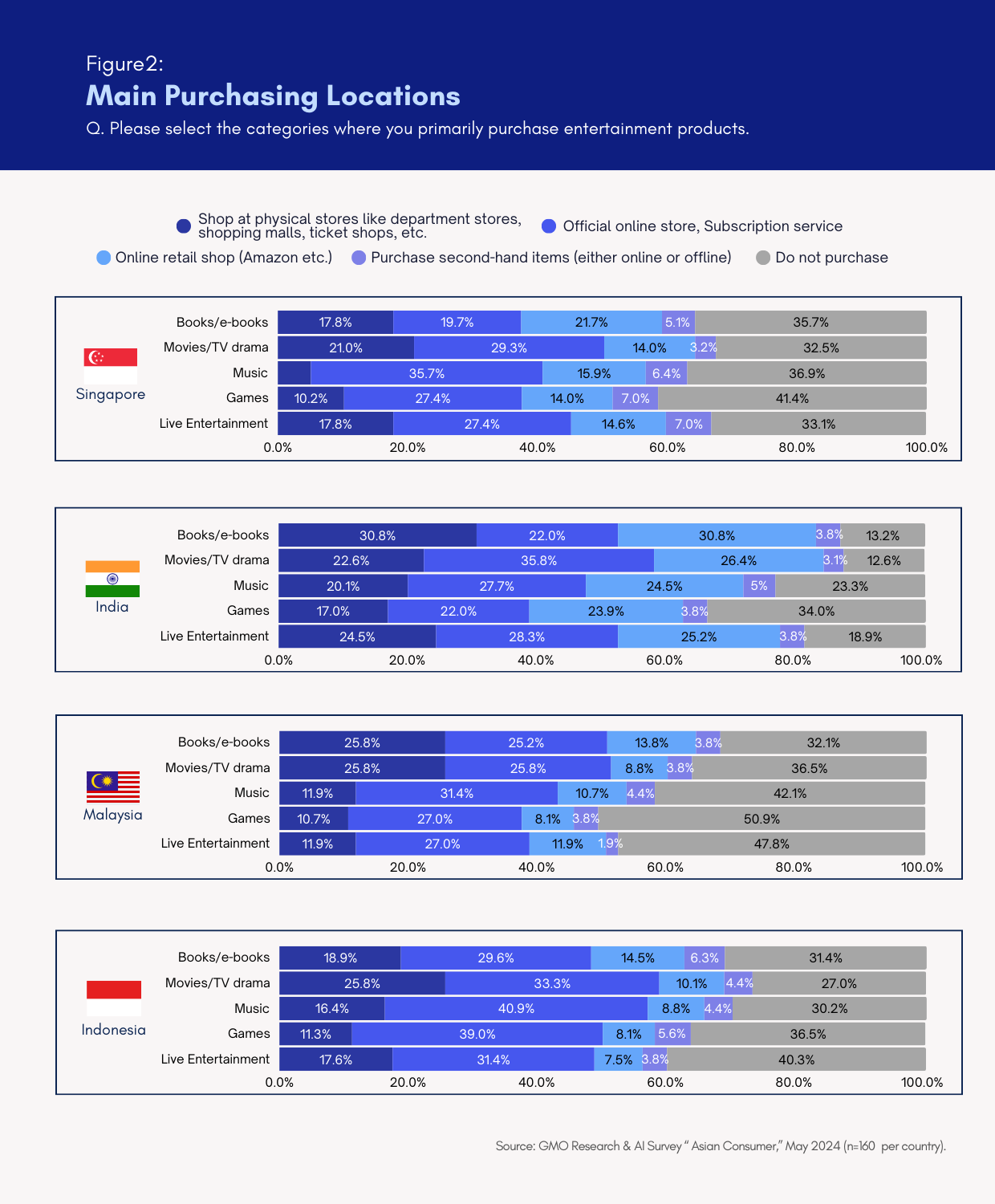

Increasing Demand for Digital Content: Regarding the place of purchase, the percentage for "official online store, subscription service" was high, with this trend being particularly noticeable in some countries. On the other hand, a significant number of respondents indicated "Do not purchase," suggesting a high utilization rate of free or low-cost entertainment content.

-

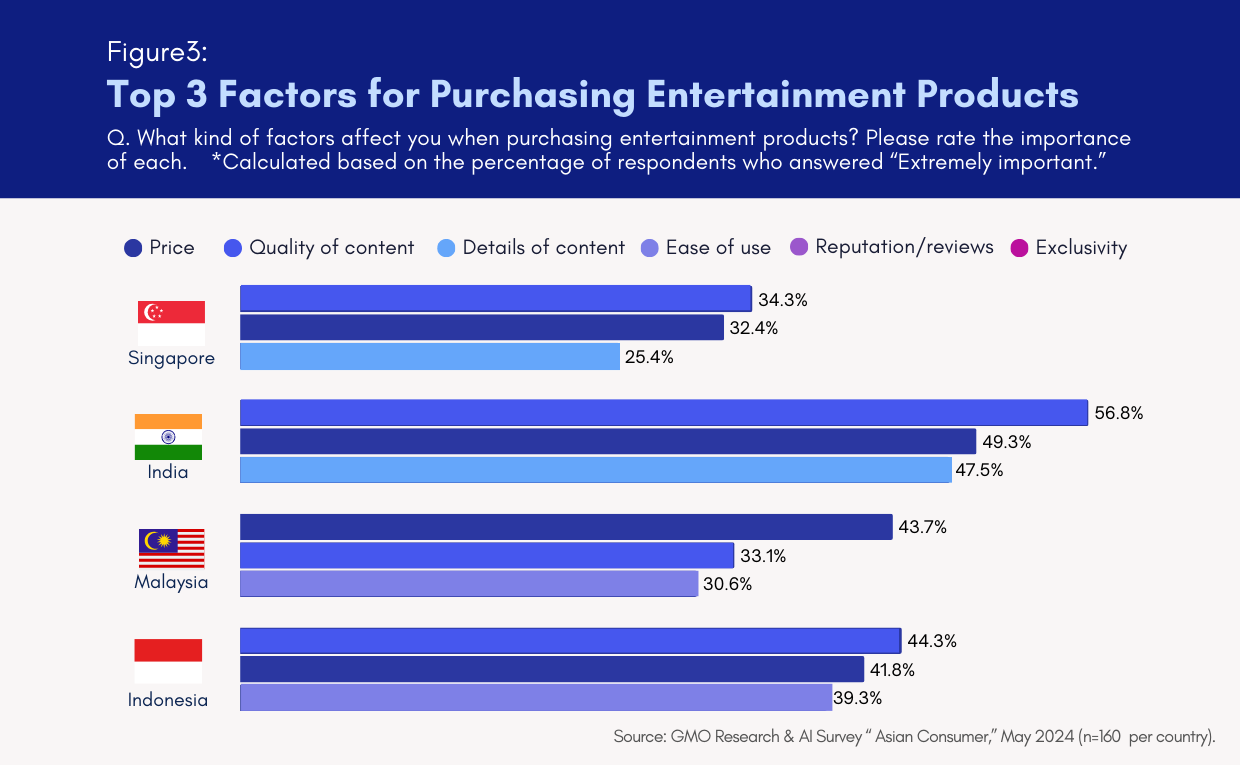

Importance of Price and Content Quality: When choosing entertainment products, consumers consistently emphasized "price" and "quality of content." In some countries, "ease of use" was also important.

-

Social Media as a Key Information Source: "Social media" is widely used as a primary information source. In particular, for movies/TV drama (watching in movie theaters, purchasing DVD/Blu-ray, digital renting), it serves as a major channel for obtaining information about new releases and updates. This indicates that marketing strategies utilizing social media can be highly effective.

Characteristics by Country

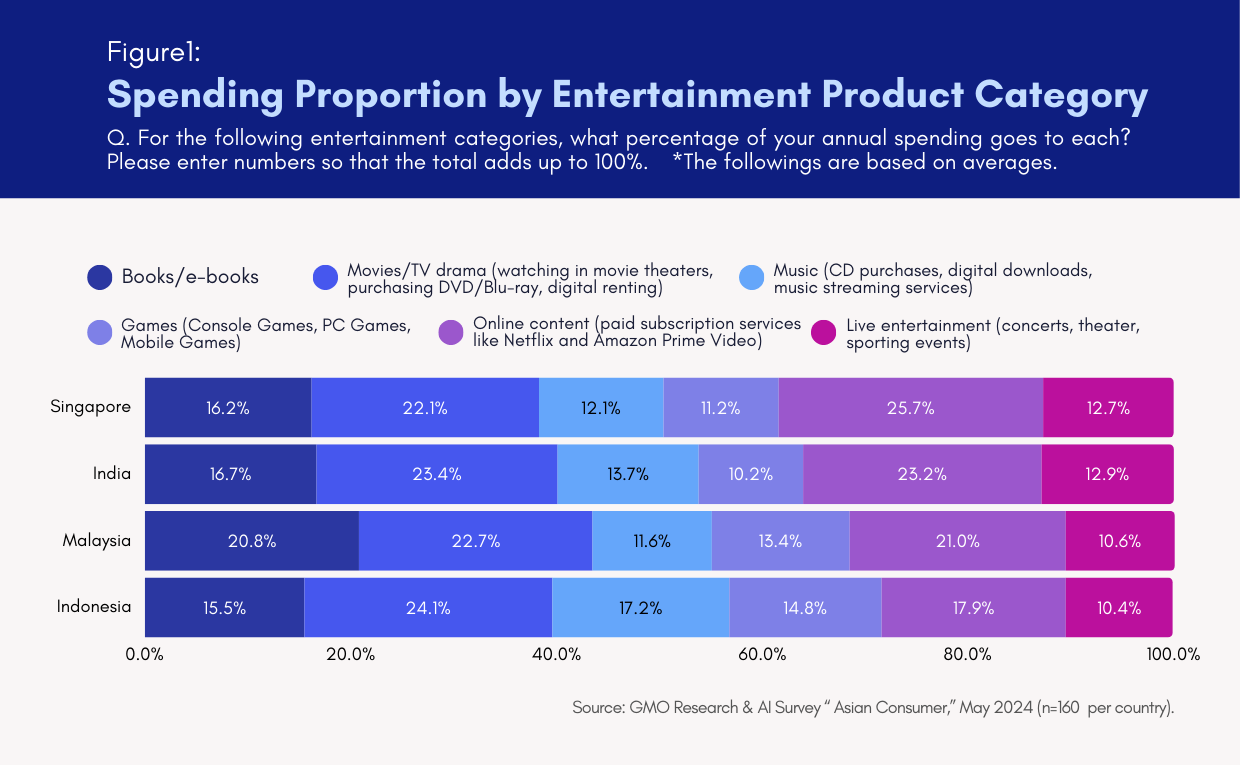

High Expenditure on Entertainment Products: In most countries, "movies/TV drama (watching in movie theaters, purchasing DVD/Blu-ray, digital renting)” account for the highest expenditure. However, in Singapore, "online content (paid subscription services like Netflix and Amazon Prime Video)” shows the highest percentage (25%), surpassing the others. In India, expenditure on "online content (paid subscription services like Netflix and Amazon Prime Video)" is nearly equivalent to that on movies/TV drama, suggesting a relatively strong preference for digital content consumption in both countries.

Purchase Channels: The percentage of "official online store, subscription service" is high, especially in Indonesia. In India, "official online store, subscription service" and "online retail shop (Amazon etc.)" show similar percentages. Meanwhile, in Malaysia and Singapore, the highest percentage of respondents chose "Do not purchase," with this tendency being particularly strong concerning "games (console games, PC games, mobile games).” In Indonesia, the response rates for "official online store, subscription service" and "Do not purchase" are almost equal across various entertainment product categories. This suggests that in Indonesia and India, there is relatively high digital content purchasing, while in Malaysia and Singapore, there is a tendency to use free content.

Important Factors: In all countries, "price" and "quality of content" tend to be the most important factors, a trend particularly prominent in the Indian market. Additionally, in Indonesia and Malaysia, "ease of use" is also relatively important (average of 35% for both countries). This suggests that the user experience significantly influences consumers' purchase decisions in these countries.

Information Sources: As sources of information about new entertainment product releases and updates, "social media" is the most commonly used (approximately 30% across all four countries and entertainment products). The use of “social media” is particularly high for movies/TV drama, accounting for 30% overall. In India, "websites, web searches, online news" are the second most common information sources for movies/TV drama (23%) and online content (26%), followed by “social media.”

Strategic Insights from Market Data

Given these characteristics, let's consider business strategies in the entertainment industry.

-

Strengthening and Diversifying Digital Content: In India and Indonesia, promoting a paid subscription model is effective, and there is a need to enhance content offerings across various genres and languages. In other countries, where free content usage is higher, adopting a freemium model—providing basic content for free while offering premium content for a fee—can be an effective strategy.

-

Providing Value for Money: Since consumers prioritize "price" and "quality of content" when choosing entertainment products, it is crucial to offer high-quality content at a reasonable price that consumers find acceptable. This can enhance consumer satisfaction. In regions where "ease of use" is also important, improving user experience is necessary.

-

Leveraging User-Generated Content (UGC): Encourage consumers to share their experiences by offering incentives, such as discounts or rewards for posts using specific hashtags. This can create organic word-of-mouth effects and increase brand awareness. Additionally, resharing consumer-generated content on official accounts can further strengthen engagement with consumers. Utilizing such UGC strategies can help capture the demand for digital content while deepening relationships with consumers, enhancing brand trust, and raising awareness.

-

Implementing Cross-Media Strategies: In India, where TV advertising remains an effective information source, integrating TV and digital media in a cross-media strategy can reach a broad consumer base. Moreover, employing a marketing strategy that utilizes multiple channels, including social media, websites, and TV advertising, to deliver a consistent brand message is crucial.

Conclusion: The Role and Value of Marketing Research

This survey illustrates differing approaches to entertainment products and consumer expectations across countries. Strategies tailored to these insights are key to success in each region.

For companies looking to strengthen their business in domestic and international markets, leveraging marketing research to understand consumer behavior patterns and preferences in detail is essential for strategic decision-making. Understanding how their products and services are received in the local market through research and designing and executing effective approaches based on data can enhance competitive advantage and achieve sustainable growth. Strengthen your market position and realize sustainable growth through marketing research.

Survey Theme: Consumer Trends in Asia

Survey Areas: Singapore, India, Malaysia, Indonesia

Survey Targets: Men and women aged 15-59, a total of 640 people (160 by each country)

Survey Date: April 19 - May 1, 2024

Methodology: Internet survey (closed survey)

*Clicking this link will redirect you to the Z.com Engagement Lab website.