Thai Consumers’ Perspective on the Auto Industry: Present Outlook and Future Expectations

2025/05/16

This report is conducted by GMO Research & AI and Z.com Engagement Lab. In the face of a rapidly evolving auto industry, Thai consumers show strong interest and high expectations. According to the latest data from 2025, the majority of respondents in Thailand not only believe the industry is headed in the right direction, but also emphasize the urgent need for innovation and reform. From policymaking to spending behavior and media consumption, these findings indicate that the Thai auto market is at a pivotal moment—a mix of confidence and a call for change. This report explores seven key indicators to provide a picture of consumer sentiment and behavior.

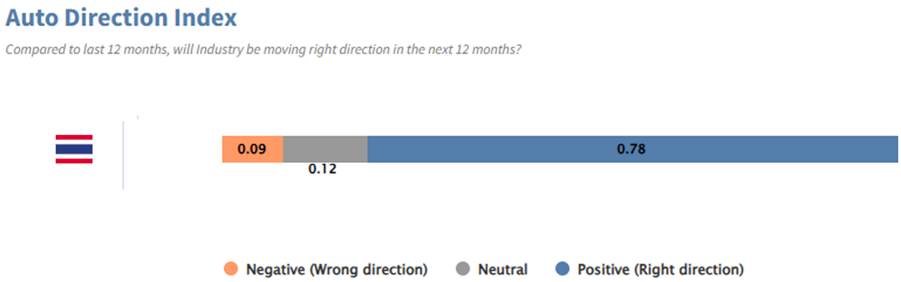

Auto Direction Index: Optimism Prevails

78% of Thai respondents believe the auto industry will move in the right direction over the next 12 months. Only 9% expressed a pessimistic view, signaling strong confidence in growth and innovation.

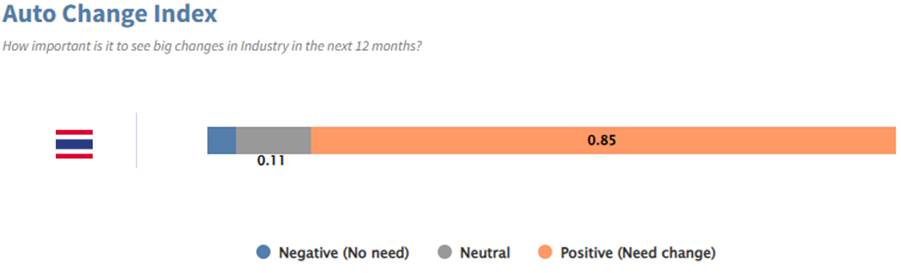

Auto Change Index: Strong Demand for Reform

Despite optimism, 85% of respondents believe that the industry requires major changes. This reflects a strong desire for improvements in innovation, sustainability, and customer experience.

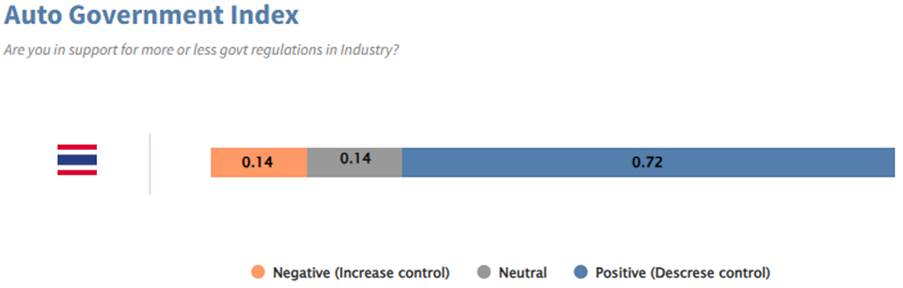

Low Support for Government Intervention: Consumers Favor Market-Driven Development

According to the Auto Government Index, as many as 72% of respondents prefer less government interference in the automotive industry, while only 14% support increased regulation. This indicates that Thai consumers generally favor a more market-driven approach, suggesting that the government should adopt a lighter touch when it comes to policy-making and regulation. Overall, the results reflect a degree of caution toward excessive government control and highlight a strong public expectation for innovation and efficiency within the sector.

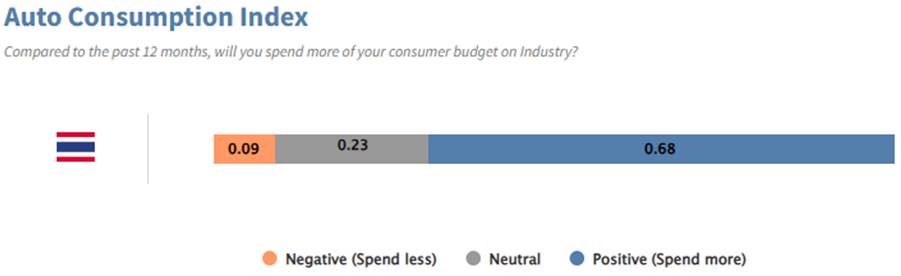

Auto Consumption Index: Rising Spending Intentions

68% of respondents said they are likely to increase their spending on auto-related products and services in the next 12 months, including new vehicles, repairs, accessories, and smart features—showing clear market potential.

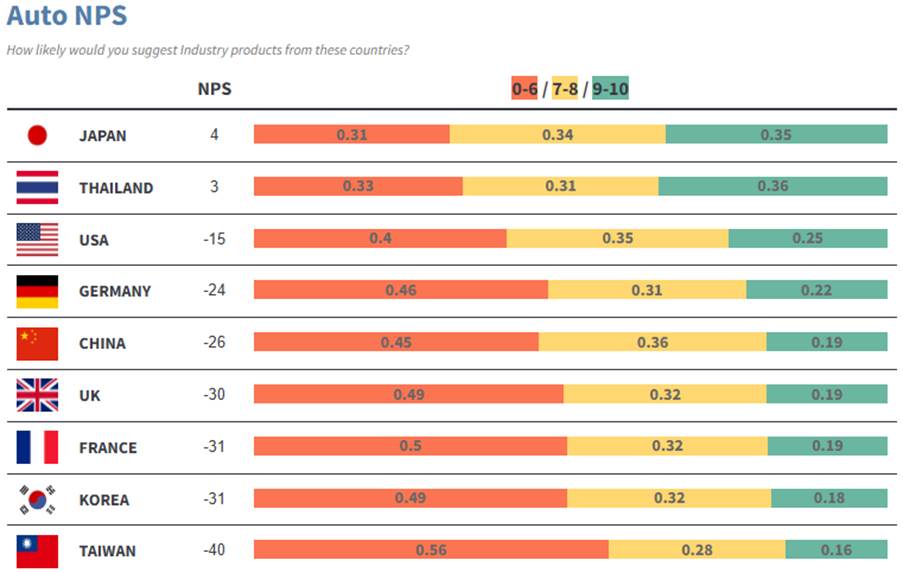

Auto NPS: Japan Leads, Thailand Second

Thailand ranked second in Net Promoter Score (NPS) for recommending auto products, with a score of +3—just behind Japan, and ahead of the USA (-15), China (-26), and Korea (-31). This highlights the strong brand trust in domestic manufacturers.

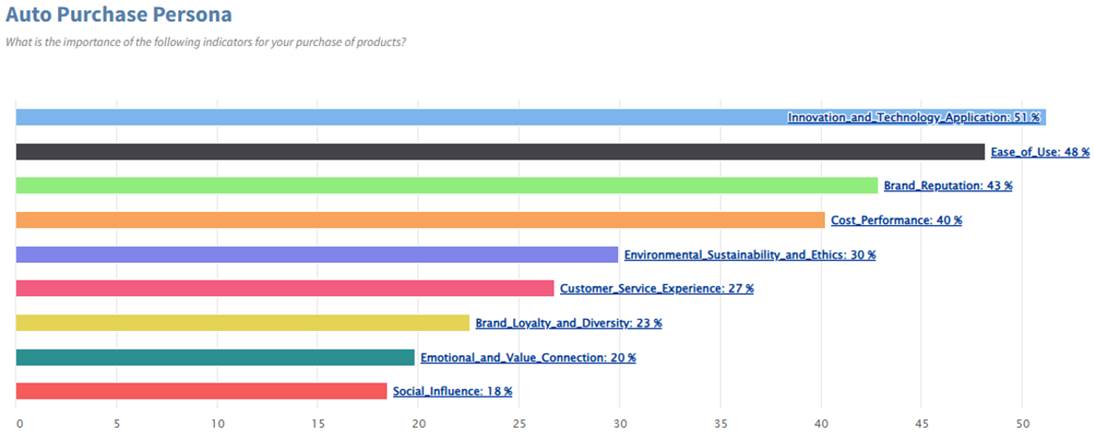

Auto Purchase Persona: Innovation, Ease of Use, and Brand Reputation Lead

The top three factors influencing Thai consumers' vehicle purchases are:

● Innovation and Technology Application (51%)

● Ease of Use (48%)

● Brand Reputation (43%)

This indicates that purchase decisions are no longer driven solely by traditional ‘auto industry’ considerations like price or performance, but by ‘tech industry’ factors like ‘innovation’ much more.

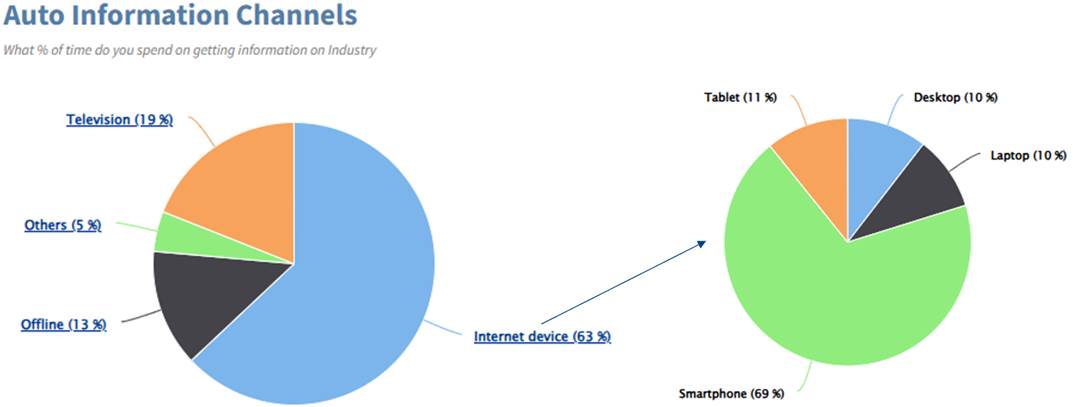

Auto Information Channels: Smartphones Drive Decision-Making

Over 63% of auto-related information searches are conducted through internet devices, with smartphones accounting for 69%. In contrast, traditional media like TV only accounts for 19%, emphasizing the importance of mobile-first content strategies.

Confidence Meets Change: Opportunities and Challenges Ahead

Thai consumers express both strong confidence in and urgent expectations for the future of the auto industry. Brands that embrace innovation, understand user needs, and align with government initiatives will be well positioned to lead in this trust-driven, digitally-influenced market.

GMO Research & AI and Z.com Engagement Lab will continue monitoring Thai consumers’ behaviors and updating insights to track market shifts and evolving demands.

Survey Specifications

-

Research by|GMO Research & AI, Z.com Engagement Lab and ShareParty

Survey Date|2025-3-10 to 2025-03-16

Methodology|Online survey

Target Group|Thailand internet users aged 16-60

Sample Size|973

Editor|TNL Research

Review by|Tatt Chen

* Contents in this report were drafted with input from generative.ai

More Insights into the Asian Automotive Industry

|

Explore how consumers in Japan, China and South Korea perceive both domestic and international car brands in our exclusive and FREE survey report! |