Fast Food Brand Study in Singapore: McDonald’s Leads Across the Board, Burger King Excels in Loyalty, Shake Shack Faces Satisfaction Challenge

2025/06/25

This report was conducted by GMO Research & AI and Z.com Engagement Lab, analyzes consumer perceptions of major fast food brands in Singapore across several key metrics: Awareness, Favorability, Consideration, Prioritization (among those considering), Usage, Repurchase (among users), and Net Promoter Score (NPS). The findings offer insights into each brand’s position in the competitive landscape and areas for strategic improvement.

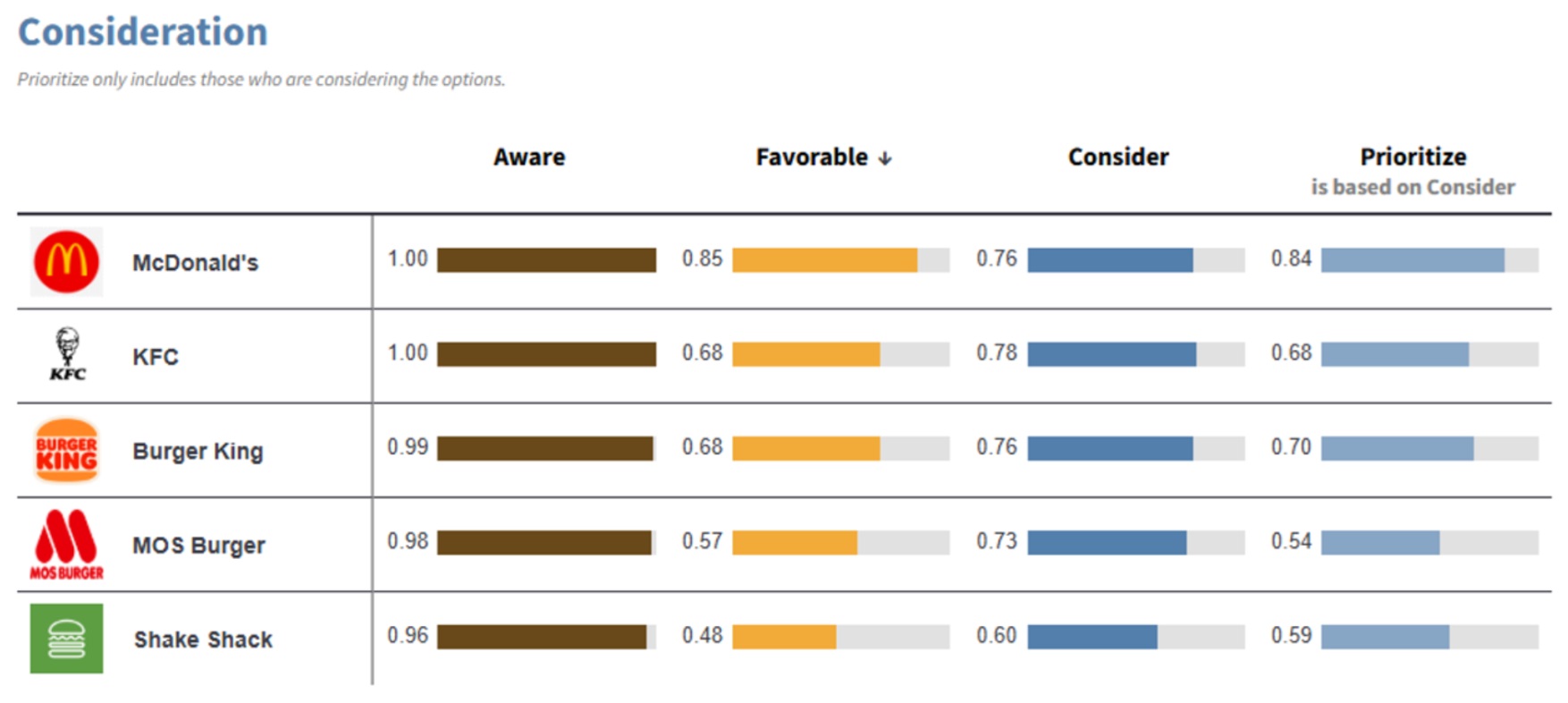

Consideration Stage: McDonald’s Has Strong Pull, KFC Slightly Higher in Consideration

Both McDonald’s and KFC boast 100% awareness. McDonald’s also enjoys a favorability rating of 85%, a consideration rate of 76%, and a very high prioritization rate of 84%, indicating that it is often the top choice when consumers think about fast food.

Interestingly, KFC edges out slightly in consideration (78%), but its lower favorability score of 68% leads to a lower prioritization of 68%.

Burger King and MOS Burger both have strong awareness (99% and 98%, respectively), but Burger King outperforms in favorability (68% vs. 57%), consideration (76% vs. 73%), and prioritization (70% vs. 54%), indicating stronger purchase intent among those considering it.

Shake Shack, despite 96% awareness, lags behind with just 48% favorability, 60% consideration, and 59% prioritization — highlighting a brand with visibility but weaker appeal.

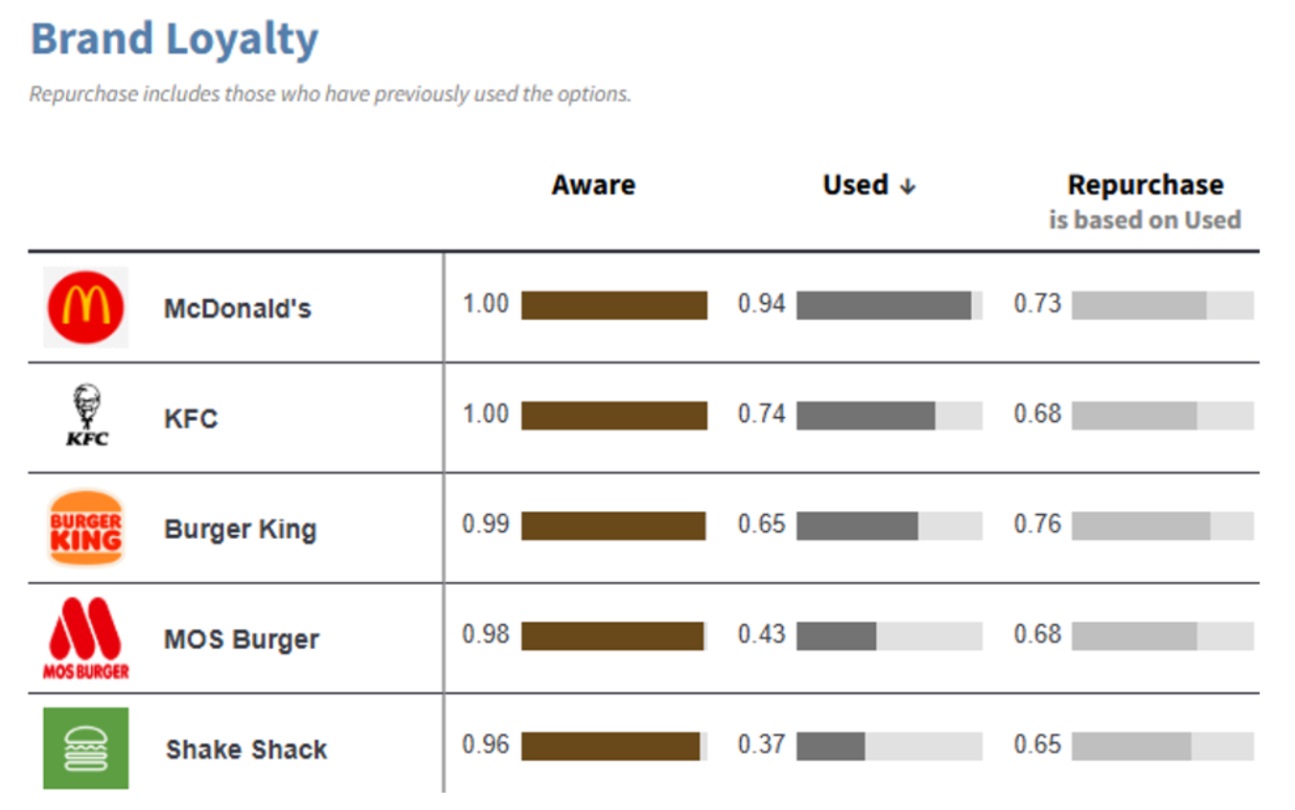

Usage & Repurchase: Burger King Converts Well, MOS & Shake Shack Face Conversion Challenges

In terms of actual behavior, McDonald’s leads again with 94% having purchased, and 73% of them repurchasing, showing a loyal and well-established customer base.

Surprisingly, Burger King stands out with the highest repurchase rate at 76%, despite a lower usage rate (65%), meaning that once tried, the brand delivers satisfaction and builds loyalty.

On the flip side, MOS Burger and Shake Shack have high awareness (98% and 96%) but low usage (43% and 37%), indicating difficulty in converting awareness into trial. While their repurchase rates are moderate (MOS 68%, Shake Shack 65%), the small base limits impact. These brands would benefit from campaigns to boost trial rates.

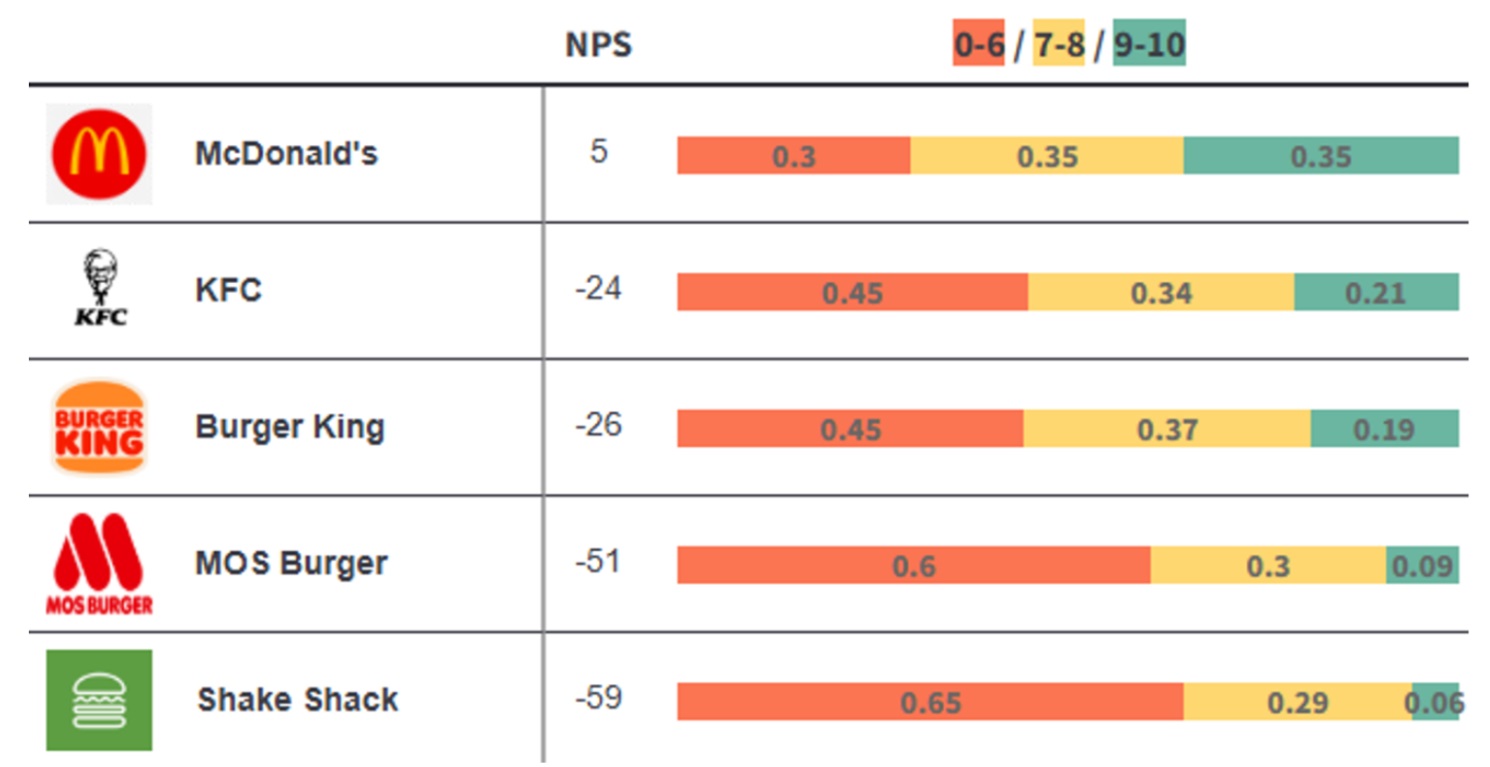

NPS: McDonald’s the Only Positive Score, Shake Shack Scores Lowest

Looking at Net Promoter Score (NPS), McDonald’s is the only brand with a positive score (+5), with 35% promoters (rating 9–10) and another 35% in the neutral range (7–8), reflecting overall satisfaction and advocacy.

KFC (-24) and Burger King (-26) have slightly better NPS distributions with about 20% promoters, but also suffer from high detractor rates (score 0–6).

MOS Burger (-51) and Shake Shack (-59) show the lowest NPS. With 60%–65% of users giving low scores, and only 9% and 6% promoters, these brands face significant perception challenges and must address satisfaction urgently.

Strategic Takeaways

- 1. McDonald’s remains the category leader, performing strongly across all metrics. Continued focus on consistent service and brand experience will help maintain this position.

- 2. Burger King has the highest repurchase loyalty. The brand should invest in first-trial promotions to increase user base and capitalize on strong retention.

- 3. KFC shows strong consideration but weaker prioritization and loyalty. Unique menu offerings or promotions may help differentiate and deepen brand preference.

- 4. MOS Burger and Shake Shack face high awareness but low usage and low advocacy, pointing to an urgent need to refine their value proposition, pricing, and customer experience to improve conversion and satisfaction.

GMO Research & AI and Z.com Engagement Lab will continue to monitor Singaporean consumers’ dining habits toward fast food restaurants and regularly update the data to track market trends and changes in consumer needs.

Survey Specifications

-

Research by|Z. com Engagement Lab powered by GMO Research & AI

Survey Date|2025-04-09 to 2025-04-15

Methodology|Online survey

Target Group|Singapore internet users aged 16-60

Sample Size|325

Editor|Z.com Engagement Lab / ShareParty Insights

Review by|Tatt Chen

* Contents in this report were drafted with input from generative.ai