2025 Automotive Trends in East Asia: The Growing Impact of EV Demand

2025/04/16

Introduction

The automotive industry in East Asia remains a critical force in the global market. Countries like China, Japan, India, and South Korea contribute over half of the world's passenger car production. Notably, Japan and China are experiencing consistent growth in domestic auto sales. Meanwhile, the region is poised to account for more than 60% of global electric vehicle (EV) sales within the next five years.

GMO Research & AI surveyed 3000 consumers in Japan, China, and South Korea in March 2025, to explore key automotive trends and the evolving EV landscape in East Asia. Survey results revealed a strong preference for domestic manufacturers and notable differences in EV perceptions across the three markets. This article highlights how brand preferences, purchase motivations, and national attitudes toward EVs are shaping the region's dynamic automotive industry.

Survey Specifications

- Survey Date: 18-25 March 2025

Target Group: Driver license holders in Japan, China and Korea aged 20-65

Sample Size: 1000ss per country, with 200ss fixed in the higher income group

Method: Online survey

Top Automotive Brands in East Asia: Insights into the Automotive Industry and Trends

Across the region, the most preferred car brands reflect both national pride and consumer priorities. In Japan, top brands include Toyota, Honda, Daihatsu, Suzuki, and BMW. BYD leads alongside Volkswagen, Toyota, Honda, and BMW in China. South Korean buyers overwhelmingly support Hyundai and Kia, while BMW, Mercedes-Benz, and GM Korea maintain a more minor but notable presence.

Japan: Loyalty to Domestic Brands

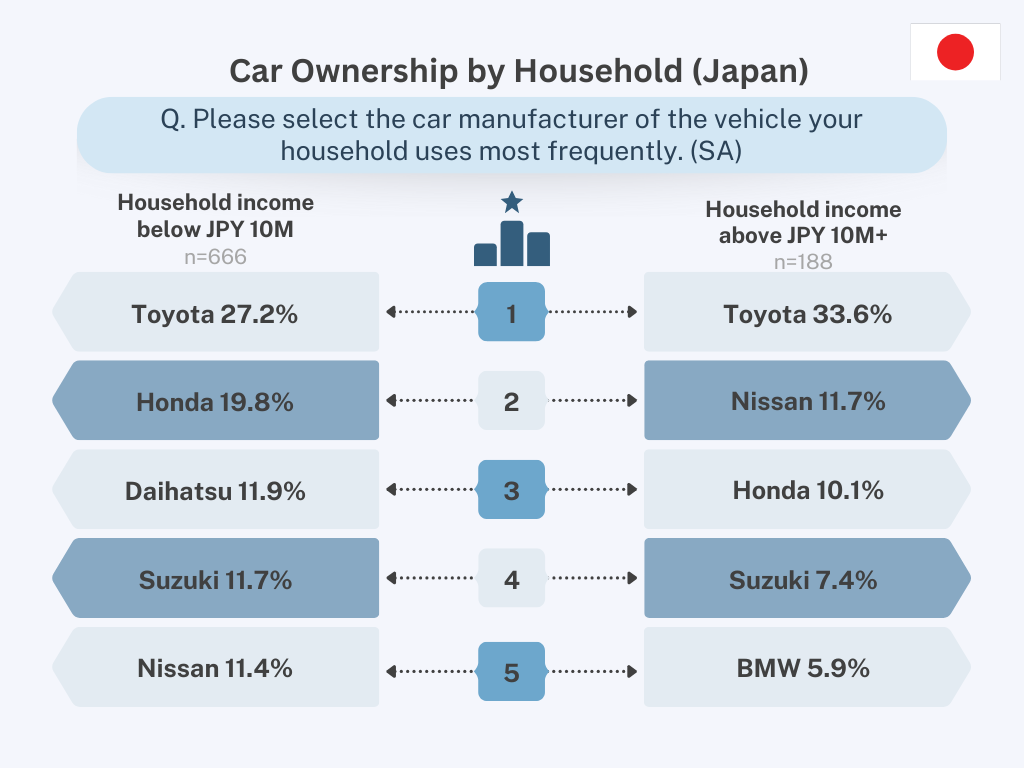

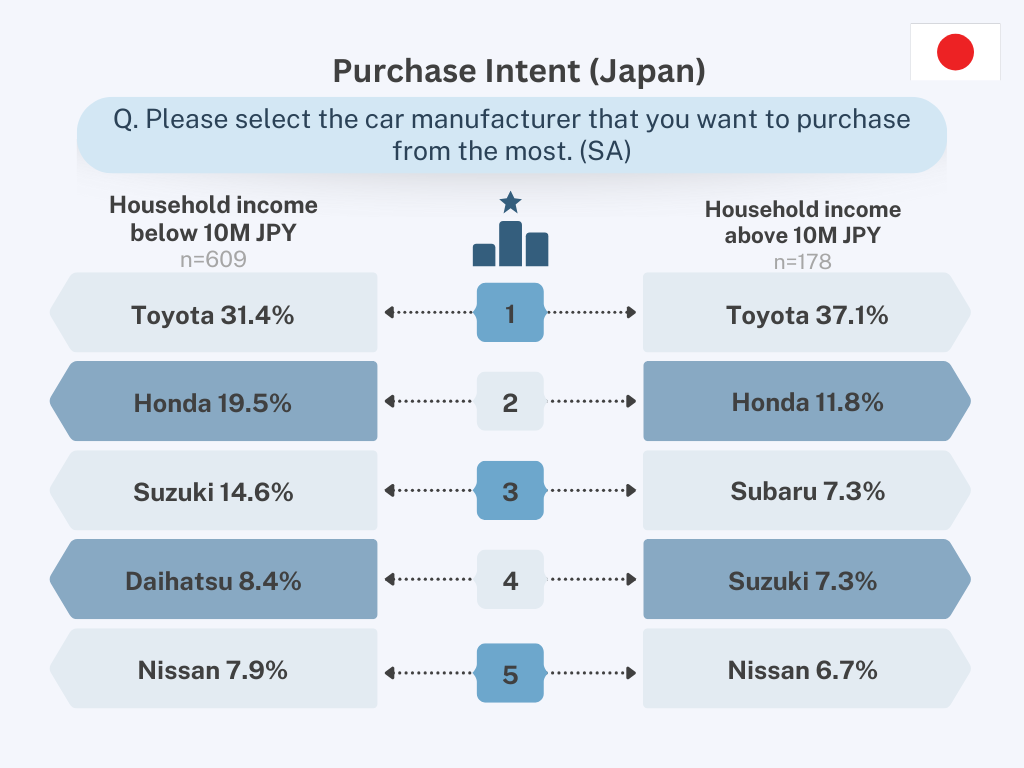

Japanese consumers overwhelmingly favor domestic manufacturers across all income brackets. Toyota ranks first in the mainstream income group, followed by Honda, while Daihatsu, Suzuki, and Nissan are closely grouped in third place. Among high-income earners, BMW stands out as a preferred foreign brand.

*Click on the image to expand

- ・Toyota's dominance is linked to its strong reputation for reliability, extensive dealership network (5,000+ locations), and diverse product offerings.

- ・Daihatsu appeals to budget-conscious buyers, particularly with its small cars.

- ・Despite imported cars representing only 5.2% of Japan's new car sales in 2023, BMW holds the top spot among foreign automakers.

China: Domestic Brands on the Rise

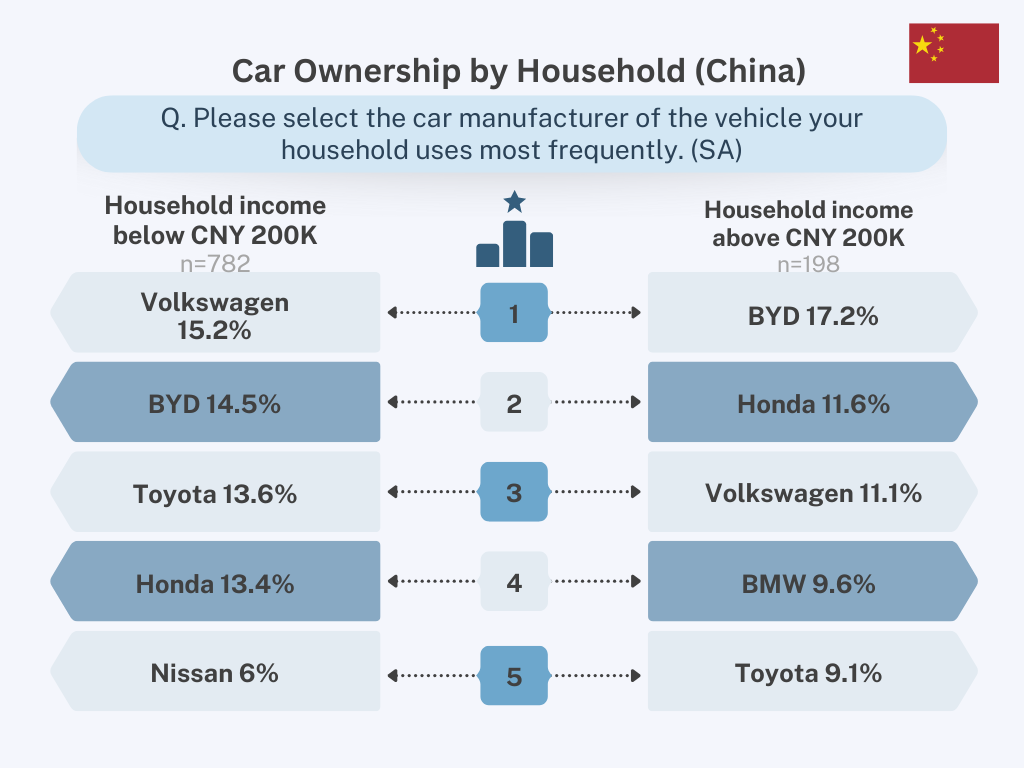

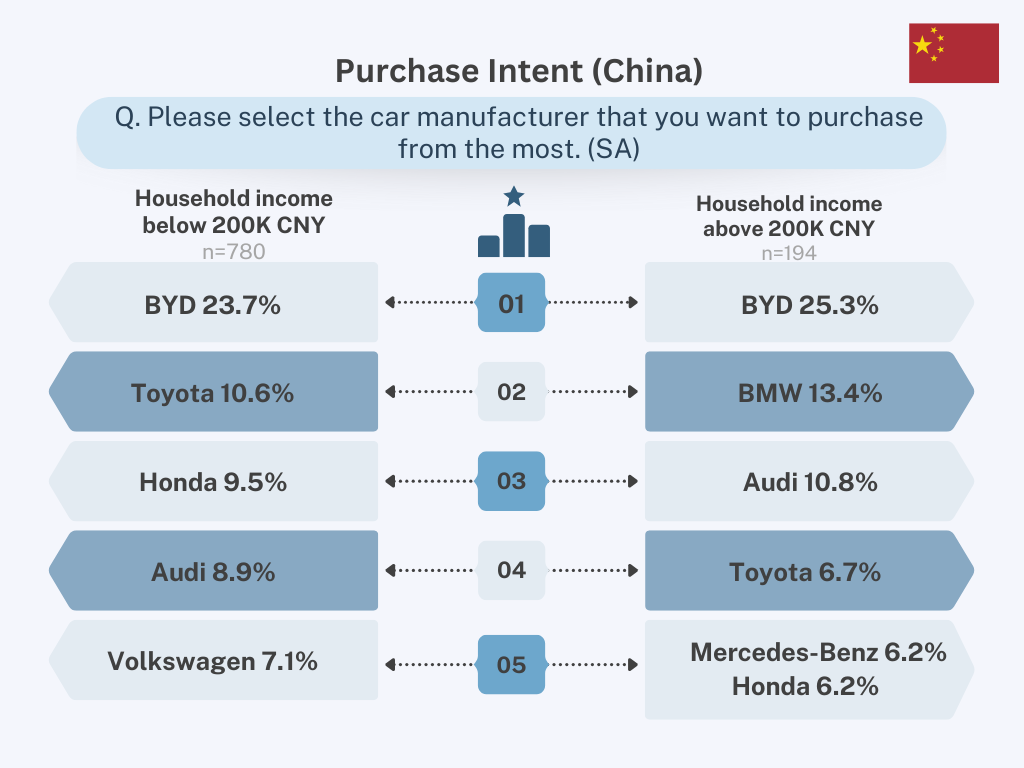

Chinese consumers are shifting towards local players, with BYD, a domestic EV leader, gaining remarkable traction. However, established foreign brands like Volkswagen, Toyota, and Honda remain competitive, especially among middle- to upper-income buyers.

The rise of domestic manufacturers specializing in EVs could be attributed to the surging EV adoption, and EVs now account for nearly half of all new car sales in China. Furthermore, the Chinese government’s goal to eliminate new sales of gas-powered vehicles from 2035 accelerates the growth of local NEV (New Energy Vehicle) brands that continue to erode market share of foreign competitors.

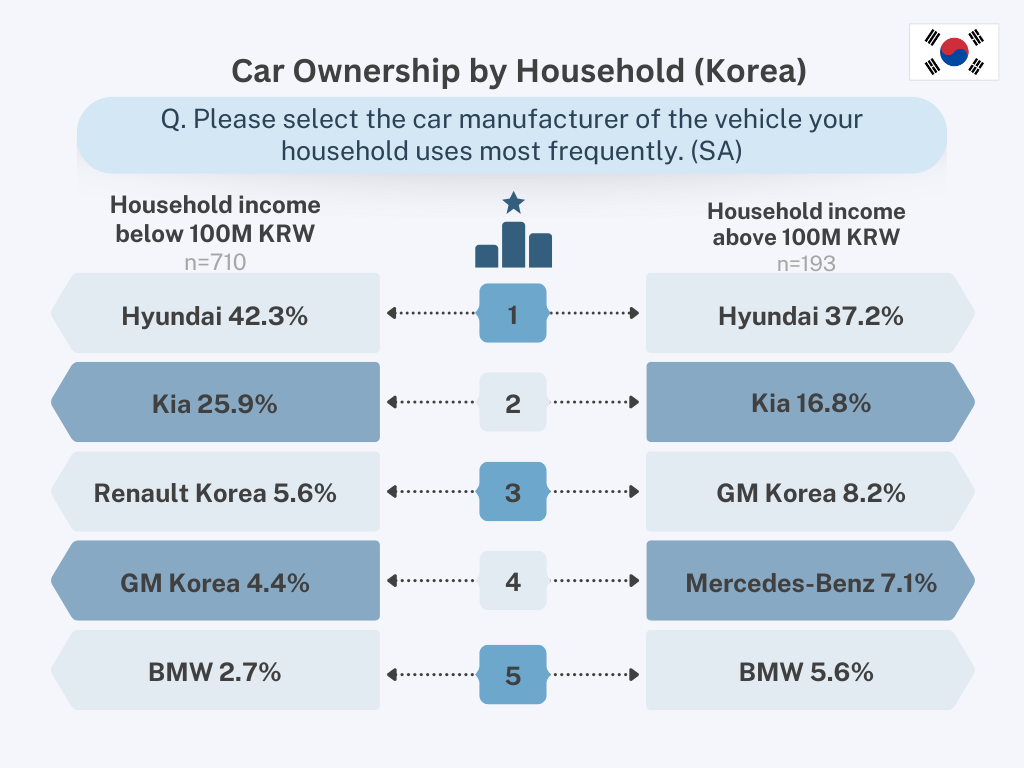

South Korea: Hyundai and Kia Dominate

South Korean consumers show strong allegiance to local automakers, with domestic car brands like Hyundai and Kia making up over 90% of total car sales in 2023. Similar tendency could also be observed in our survey results, where Hyundai and Kia remain clear favorites, regardless of income.

- ・Hyundai's appeal lies in its model diversity, reputation for quality, and affordability.

- ・BMW and Mercedes-Benz, German automotive brands with long-standing presence in South Korea are popular among all income groups, showing a general preference for imported luxury cars in the country.

Automotive Trends: Examining Consumer Priorities and Brand Perceptions Across East Asia

Our survey findings reveal distinct consumer values and perceptions by country. While all respondents appreciate vehicle quality and value, deeper motivations vary across markets. For example, compared to China and South Korea, Japan places greater emphasis on vehicle price; In both China and Korea, factors considered for domestic and international brands differ.

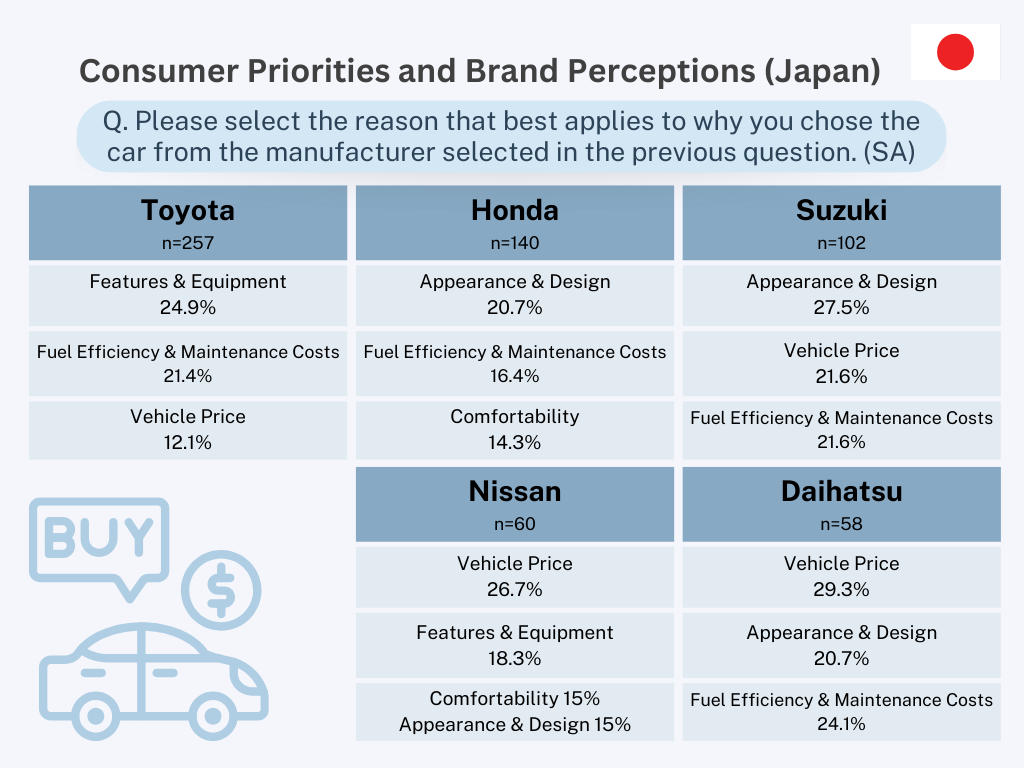

Japan: Affordability and Design Matter Most

Japanese consumers prioritize price, fuel efficiency, and aesthetics. Domestic manufacturers appear to be overwhelmingly popular and reliable at the same time of maintaining a high cost-performance.

Out of 787 respondents with brand preferences:

-

・Toyota led with 257 votes, chosen for its strong features and equipment (24.9%) and fuel efficiency (21.4%).

-

・Daihatsu earned the top affordable brand spot, with 29.3% citing vehicle price as the key reason.

-

・Suzuki attracted buyers with 27.5% appreciating its design and 21.6% for value and efficiency.

-

・Honda was valued for appearance and design (20.7%) and fuel efficiency (16.4%).

-

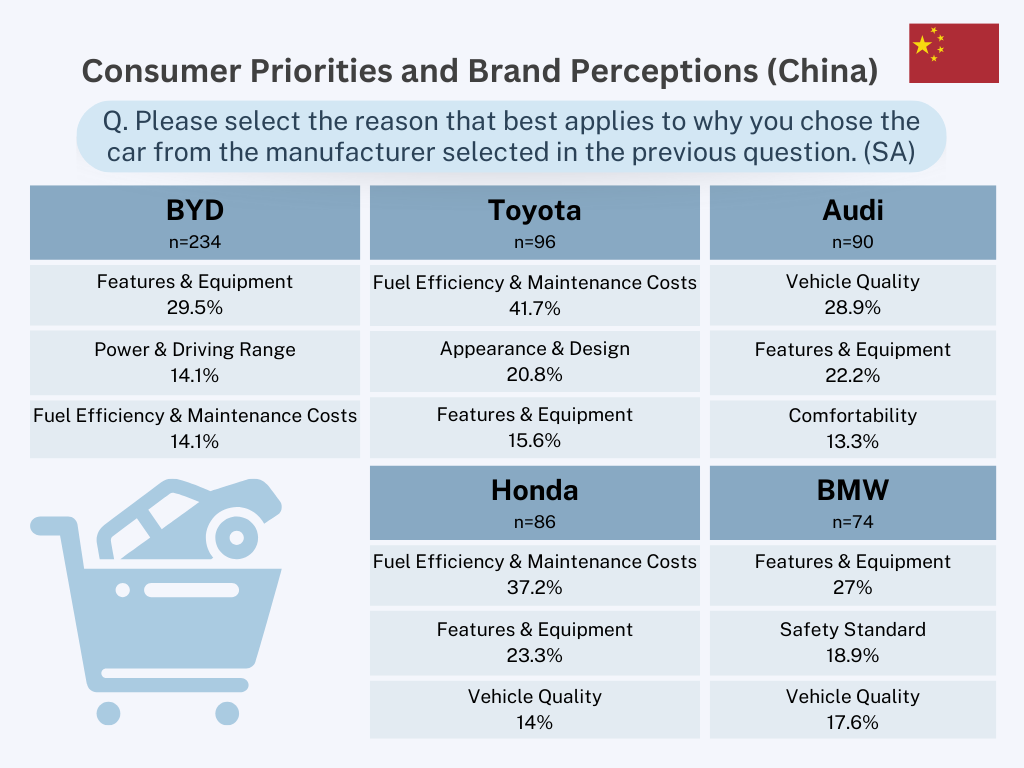

China: Functionality and Performance Drive EV Choices

Consumers focus on advanced features and durability in China's rapidly expanding EV market. While the domestic brand BYD is the most desired option, a greater number of respondents overall prefer foreign cars. Differences in expectations between domestic and global brands could also be identified.

Among 974 respondents:

-

・BYD led with 234 responses. 29.5% emphasized features and equipment, with significant mentions of power/range and efficiency (both 14.1%).

-

・Japanese brands like Toyota and Honda received notable votes for fuel efficiency (41.7% Toyota, 37.2% Honda) and features (15.6% Toyota, 23.3% Honda).

-

・German brands Audi and BMW are praised for quality (28.9% Audi, 17.6% BMW) and design.

-

-

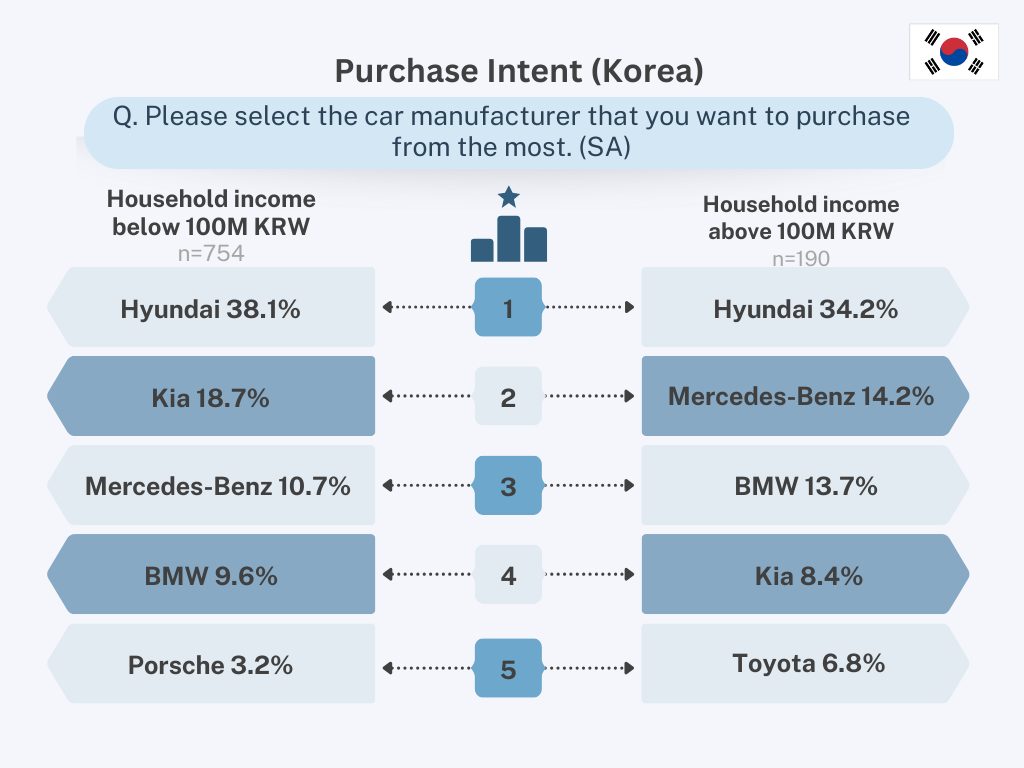

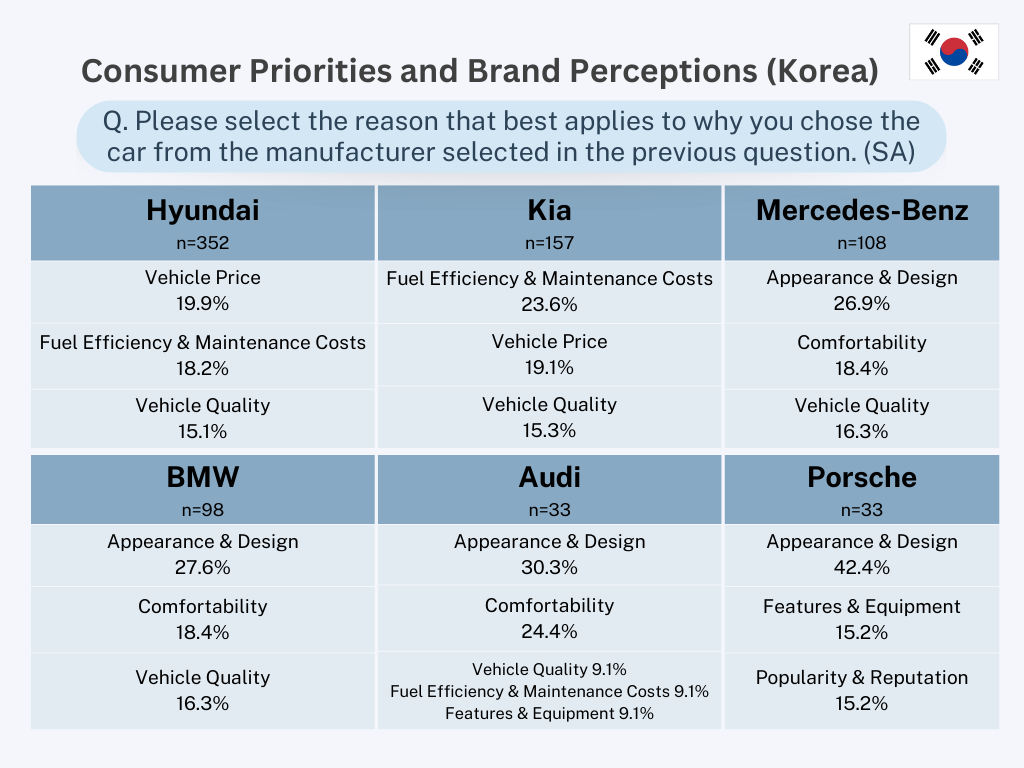

South Korea: Value Meets Prestige

Korean car buyers balance affordability with luxury aspirations. The factors considered for domestic and German manufacturers differ significantly. Vehicle price and fuel efficiency are prioritized for Korean brands, whereas appearance and design is regarded as the most important for German brands. This illustrates a two-tier market: domestic brands dominate the mass market, while foreign brands serve high-end segments.

Among 944 respondents:

-

・Hyundai received 352 selections, chosen for vehicle price (19.9%), fuel efficiency (18.2%), and vehicle quality (15.1%).

-

・Kia followed with similar reasoning: fuel efficiency (23.6%), price (19.1%), and quality (15.3%).

-

・Luxury imports like BMW, Mercedes-Benz, and Audi stood out in design (27.6%, 26.9%, and 30.3%, respectively) and comfort.

-

・Porsche led the styling category, with 42.4% highlighting design as its key advantage.

-

EV Trends Reshaping the Automotive Industry in East Asia

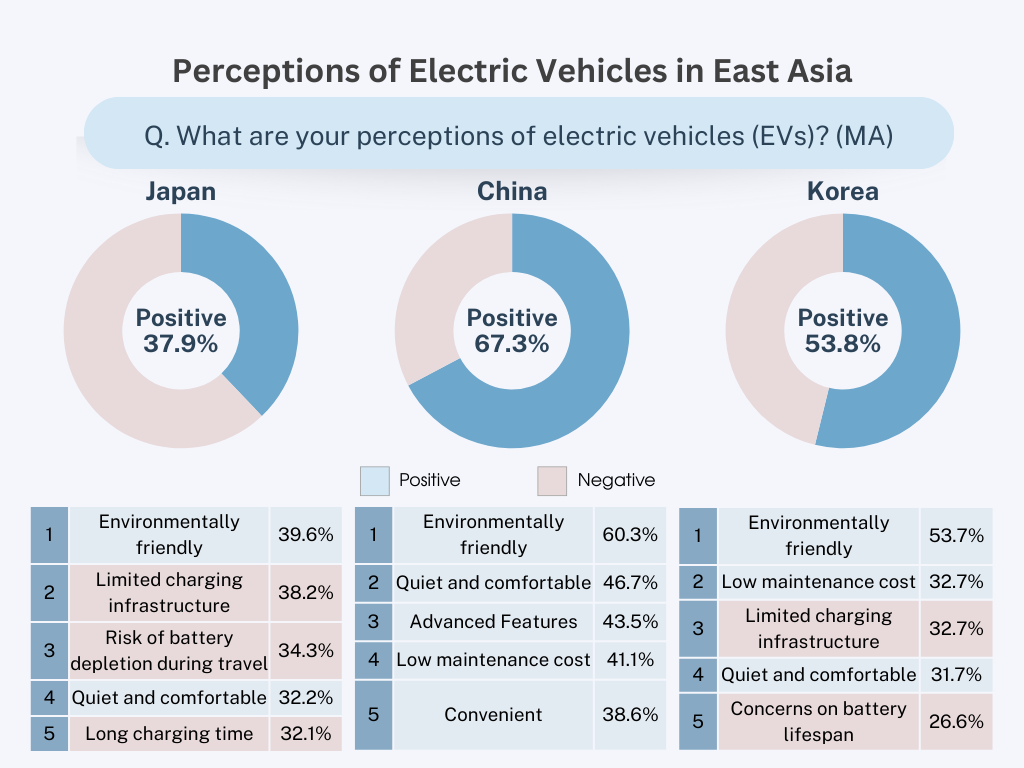

Consumer perceptions and trends of EV are uniquely shaped across East Asia, heavily influenced by infrastructure, government policy, and consumer priorities.

-

・In China, 67.3% of consumers have a favorable view of EVs. Respondents cited environmental friendliness (60.3%), quiet performance (46.7%) and advanced features (43.5%), as key advantages.

-

・In South Korea, 53.8% responded positively. Consumers are cautiously optimistic but remain concerned about battery life and charging station availability.

-

・In Japan, only 37.9% expressed a positive impression, showing the most skepticism toward EVs.

Country-by-Country EV Insights

Japan: EV adoption is sluggish, with the share of EV falling below 2% in 2024—the lowest among developed markets.

While infrastructure gaps and battery are key concerns for the delayed EV adoption, the result of this survey reveals a mismatch between consumer perceptions of EV and the key factors considered for car purchase. Japanese consumers place high value on design and cost performance, yet recognition of these aspects in EVs remains low—with only 3.2% citing 'nice design' and 11.6% noting 'low maintenance cost'."

China: Government incentives and domestic innovation have fueled rapid EV growth, making up 59% of global EV sales in January 2025. Brands like BYD and Geely lead, while foreign automakers expand local EV production.

Respondents view EVs positively in terms of safety standard, features and convenience. However, these factors were less appreciated in Japan and South Korea, implying a generally more favourable sentiment in China. (e.g. For safety standard, China 23.1%, Korea 4%, Japan 3.9%)

South Korea: A fast-growing EV market, supported by Hyundai and Kia's technological strides and government investment in charging networks. Price and performance are key drivers.

Korean respondents' image on EVs’ low maintenance costs aligns with their emphasis on fuel efficiency and low maintenance cost for car purchase. While concerns about charging remain a major issue, government efforts to expand infrastructure could help increase EV adoption.

Conclusion

The automotive industry in East Asia is experiencing pivotal change, shaped by evolving automotive trends and increasing EV demand. While traditional brand loyalties persist, EVs are transforming consumer behavior and reshaping industry dynamics.

GMO Research & AI is ready to support you to explore these regional differences, whether it's China's surge in EV innovation, Japan's emphasis on affordability, or South Korea's dual-market split between value and luxury. Our extensive online panel allows access to 65 million panelists across 16 APAC regions. To explore trends in the automotive industry further or validate hypotheses in specific markets, the right access to regionally targeted automotive audiences can provide a significant advantage. Find out more about our Automotive Panel to support your impactful strategies with deeper, localized insights.

Download our report to discover exclusive insights for navigating or expanding in the East Asian automotive market!

Reach Your Ideal Audience

|

GMO Research & AI operates an online panel of 65 million individuals across 14 markets in Asia-Pacific with a diverse profile. Find more details of the respondents from the panel book! |