Brand Research: A Marketing Research Solution for Branding (Part 3 – Analysis Methods)

2024/11/29

Brand Research: A Marketing Research Solution for Branding

(Part 3 – Analysis Methods)

Brand research is a powerful tool for brands to understand consumer behavior, strengthen their branding efforts, and boost brand awareness, and it creates more powerful insights for subsequent branding strategies when conducted in combination with data analysis methods.

In the previous articles, three types of brand research and five ways for implementation were explained in detail. The following section will be about various methods and key points of analysis, which upgrades your brand research to another level.

Brand Research: A Marketing Research Solution for Branding (Part 1 – Types)

Brand Research: A Marketing Research Solution for Branding (Part 2 – Survey Methods)

Brand Research Analysis Methods

Consumer Behavior Models (AIDMA/AISAS/5A) for Market Understanding

Using consumer behavior models identifies which consumer segments should be the focus of the research in relation to a company’s challenges. Consumer behavior models range from traditional models like AIDMA and AISAS to newer models like 5A.

AIDMA / AISAS

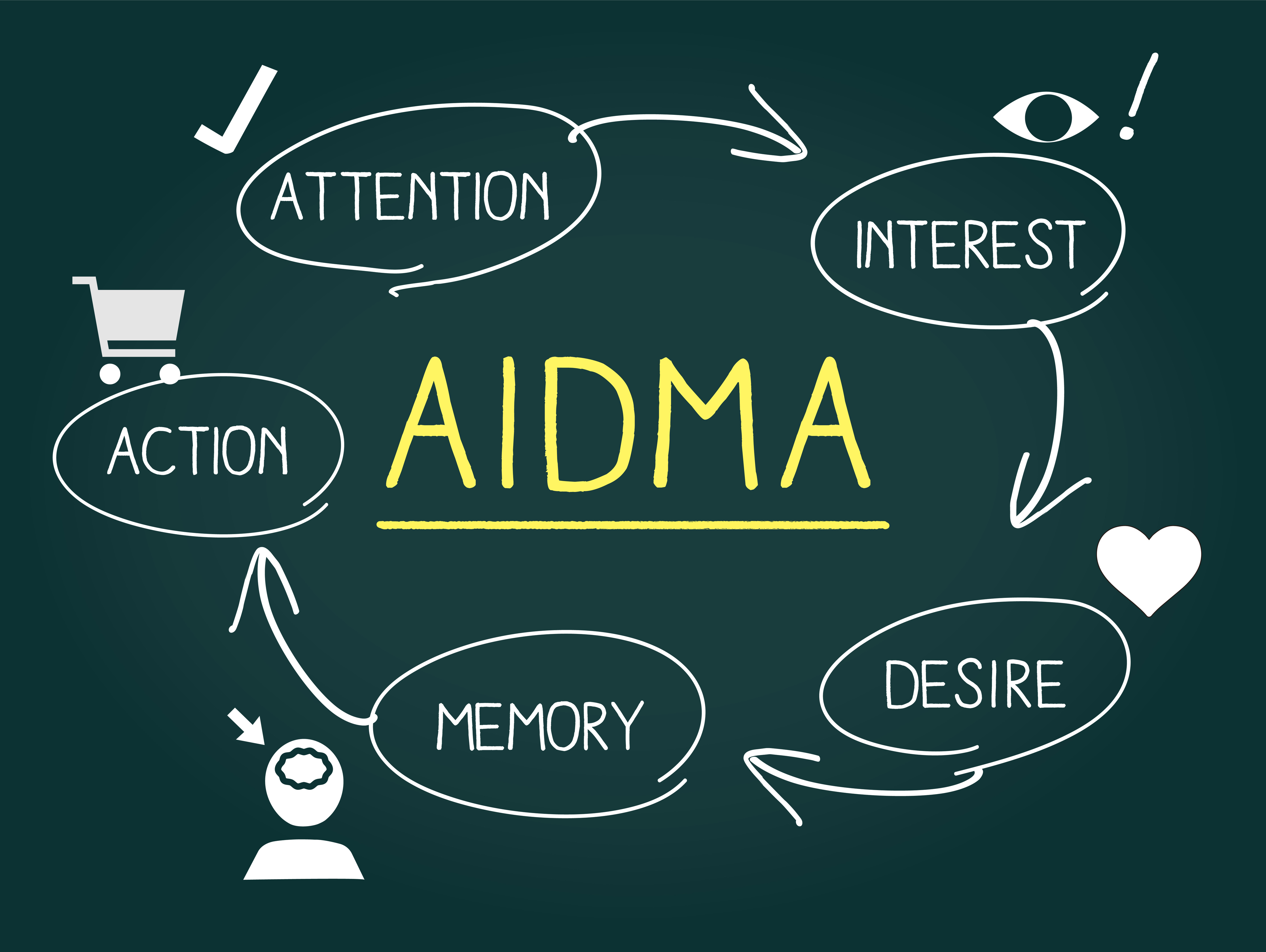

AIDMA is a framework that explains the consumer purchase decision process in five stages: Attention, Interest, Desire, Memory, and Action. This model identifies which stage has issues when evaluating the results of marketing strategies, which is useful in applying the appropriate approaches based on the consumer's stage.

When the result of a brand research shows that consumers are familiar with the brand but fail to recall it during the purchase decision (Memory stage), efforts could be directed toward reinforcing brand messaging or increasing brand visibility at the point of sale.

AISAS, on the other hand, is a customer behavior model adapted to the internet age. Like AIDMA, it divides the purchase decision process into five stages, but assumes the use of the internet: Attention, Interest, Search, Action (Purchase), and Share.

If the response of the survey reveals that consumers frequently search for a brand but rarely share their experiences post-purchase, it may indicate the need to encourage more user-generated content or online reviews, helping to boost brand credibility and awareness.

AIDMA vs AISAS: Key Differences in Customer Journey Models

5A Model

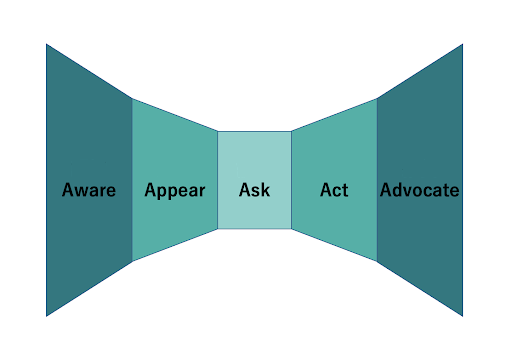

The 5A model is a customer behavior model that assumes users are more actively involved in sharing and spreading information online compared to traditional models. It breaks the process down into five stages: Aware, Appeal, Ask, Act, and Advocate.

Unlike traditional models such as AIDMA and AISAS, where the number of people decreases at each stage from awareness to action, the 5A model is performed in a bowtie shape. In the age of connected consumers through the internet, a customer's recommendation can drive the purchasing behavior of others. In some cases, customers purchase based on the recommendations of others and they did not search by themselves. This is the reason why it is important to understand how individuals who are aware of the brand will recommend it to others.

If brand research shows a high number of "Aware" consumers but few "Advocates," it may indicate a need to strengthen post-purchase engagement, such as improving customer service, encouraging reviews, or fostering loyalty programs.

5W3H Framework for Consumer Understanding

To better understand consumers, using the 5W3H framework is effective. Organizing information based on eight key points helps clarify the current situation, issues, and goals.

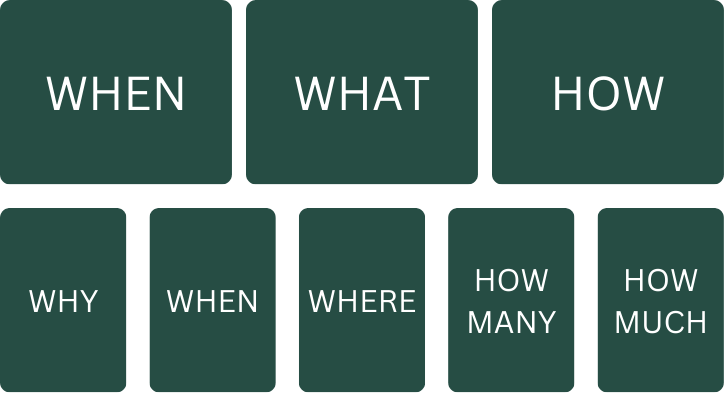

Main Framework (2W1H): Who, What, How

Sub Framework (3W2H): Why, When, Where, How many, How much

Applying the 5W3H framework to form clear hypotheses about consumer behavior before conducting research. For example, using "Who" and "What" can define target demographics and preferences, while "Why" can uncover motivations for brand loyalty or dissatisfaction.

Five Analysis Frameworks

Below are five main analysis frameworks that are commonly used for analyzing the result of brand research:

1. PEST Analysis

PEST analysis is a framework used to understand and predict the impact of external environments. It breaks down the external environment into four factors: Politics, Economy, Society, and Technology.

There are two types of external environments surrounding a company: Microenvironment and Macroenvironment. PEST analysis is suitable for analyzing the macroenvironment, which is difficult to control.

Microenvironment:

Refers to the market and competitors surrounding the company. It involves analyzing market prospects, customer behavior, and competitor trends.

Macroenvironment:

Refers to environmental factors such as politics, economy, society, and technology. It includes analyzing demographics, technological innovations, and changes in trends.

By using PEST analysis, businesses can predict upcoming societal changes and utilize this information for developing business and marketing strategies.

Technological innovations (Technology) might shift how consumers engage with a brand online, while societal changes (Society) could affect brand perception and messaging strategies.

2. 3C Analysis

3C analysis is a method that divides the business environment into three components: Customer, Competitor, and Company.

By analyzing each of the three indicators, 3C analysis helps to find the Key Success Factors (KSF) and identify the direction of marketing strategies for business success. It is primarily used when developing marketing strategies or adjusting business direction.

Understanding customer needs (Customer) can guide brand messaging, while analyzing competitor strategies (Competitor) can reveal market gaps. Insights from the company’s capabilities (Company) help align branding efforts with core strengths.

3.SWOT Analysis

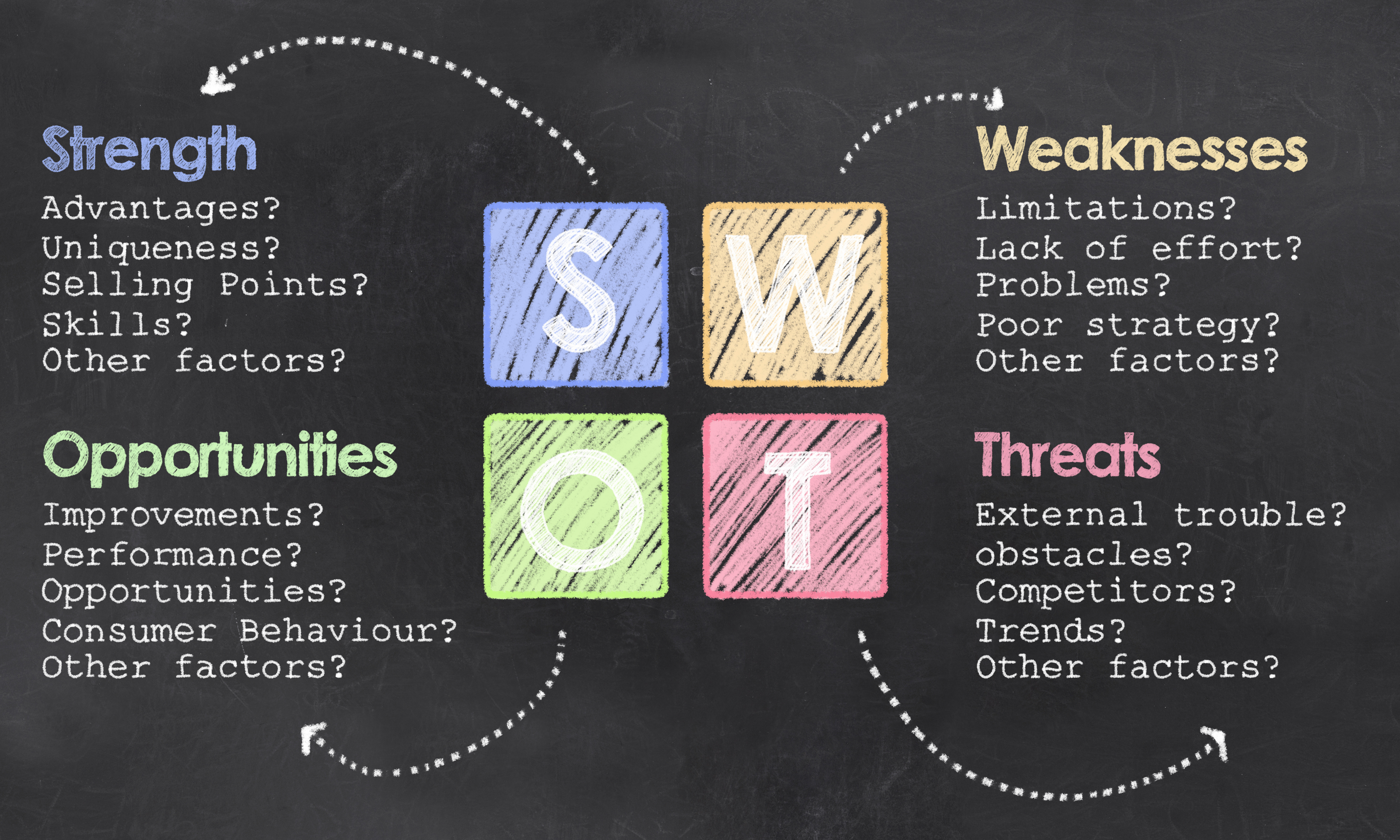

SWOT analysis is a framework for analyzing the market environment surrounding a company’s products or services. It separates the market environment into external factors (which the company cannot control) and internal factors (which the company can influence), analyzing both positive and negative aspects.

Internal Factors:

・ Strength (Positive) (e.g. brand reputation)

・ Weakness (Negative)

External Factors:・ Opportunity (Positive) (e.g.emerging market trends)

・ Threat (Negative) (e.g., new competitors)

SWOT analysis is often used in the early stages of developing branding strategies to assess the market environment.

4. Funnel Analysis

Funnel analysis visualizes the flow of users' changing awareness from recognizing a service to purchasing or signing up, using a funnel (narrowing process) model.

Consumer’s Stages: Awareness > Interest > Consideration > Purchase

For example, if research shows high awareness but a significant drop-off at the consideration stage, it might indicate the need for more persuasive messaging or clearer value propositions.

Businesses can measure the dropout rate at each consumer’s stage and define their target persona (the typical user of the product or service) clearly.

5. Correspondence Analysis

Correspondence analysis is a type of multivariate analysis used to map the relationships between two variables based on cross-tabulation data.

It is useful when there are too many survey categories, making it difficult to summarize cross-tabulation results, or when results need to be visually represented in a way other than graphs.

Here are some marketing situations where correspondence analysis is effective:

・ Understanding the product or brand image based on attributes such as age and gender

・ Creating a positioning map of the brand image of competitors and your company

・ Grasping the actual characteristics and needs of the target audience

Easy Start Option for Your Brand Research

Companies can understand their position in the market and grasp the image that customers have of their products and services through brand research. By utilizing the survey results in marketing strategies, companies can implement more objective and effective improvements.

“Quick Survey” of GMO research & AI could be a fast, affordable, and easy-to-use service to help level up your business's branding activities. Our consumer network in the Asia-Pacific covers up to 16 regions, where you can pinpoint your ideal audience. Please feel free to check out the service details and contact us through the link below!

*Clicking this link will redirect you to the Z.com Engagement Lab website.