Thailand Mobile Payment Usage Report: Convenience and Trust Driving High Adoption

2025/09/25

This report, conducted by GMO Research & AI and Z.com Engagement Lab, reveals how mobile payment has become deeply embedded in the daily lives of Thai consumers. Whether shopping, dining, or commuting, paying via smartphone is now a common practice. To better understand user behaviors and attitudes, we analyzed the latest survey data, focusing on adoption rates, motivations, barriers, usage patterns, and potential areas for improvement.

Widespread Usage: Convenience as the Key Driver

In the past 12 months, 90.4% of respondents reported using mobile payment services — a remarkably high penetration rate. The top reasons for adoption include:

● Convenience and speed (68.1%)

● Cashback or reward points (45.0%)

● High security (44.8%) and easy expense tracking (44.4%)

● Promotions and discounts (40.2%)

● Additionally, 25.3% said the pandemic reshaped their payment habits

This indicates that convenience, savings, and security are the three key drivers behind mobile payment adoption in Thailand.

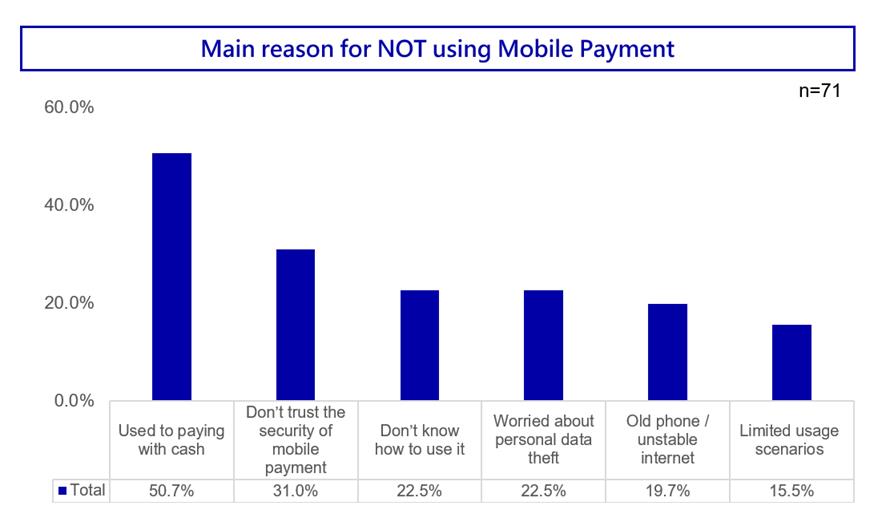

Why Some Still Avoid Mobile Payment: Habit and Trust Issues

Despite its popularity, 9.6% of respondents had not used mobile payment in the past year. Their reasons include:

● Preference for cash (50.7%)

● Lack of trust in security (31.0%)

● Not knowing how to use the service (22.5%)

● Concerns about data theft (22.5%)

● Old phones or unstable internet (19.7%)

● Limited usage scenarios (15.5%)

This shows that traditional habits and security concerns remain major barriers, even in a highly digital environment.

Usage Habits: Strong Dependence on a Single Platform

Among mobile payment users, 51.7% stick to only one platform, while 27.8% have multiple accounts but rely mainly on one. Only 20.5% actively switch between platforms depending on the situation.

This indicates that despite market competition, user loyalty to a “main platform” is relatively strong in Thailand.

Key Factors Driving Platform Switching

When considering switching platforms, the most influential factors are:

● Better user experience (59.5%)

● More secure payment process (49.6%)

● Direct linkage to bank accounts or credit cards (46.9%)

● Acceptance by more merchants (46.5%)

● More promotions or discounts (44.5%)

Clearly, Thai users value not just promotions but also ease of use and security, showing a shift from purely price-driven adoption to a more balanced view of trust and functionality.

Unlocking Potential Users: Incentives, Education, and Trust

For those who haven’t used mobile payment yet, the top factors that could encourage adoption include:

● Clear discounts or cashback (45.1%)

● Guidance on how to use the service (25.4%)

● Stronger security measures (25.4%)

● Government or merchant promotion (14.1%)

However, 19.7% said they would never use mobile payment under any circumstances, highlighting a small but firm resistance group.

Balancing Convenience and Trust for Future Growth

Thailand already enjoys a very high mobile payment adoption rate, but consumer behavior shows that convenience and trust remain the core factors. For platforms, the next stage of growth requires more than discounts — they must focus on user experience, security, and lowering learning barriers to attract new users and build stronger loyalty.

GMO Research &AI and Z.com Engagement Lab will continue to monitor how Thai consumers use mobile payments and provide updated insights into shifting market dynamics.

Survey Specifications

-

Research by|Z. com Engagement Lab powered by GMO Research & AI

Survey Date|2025-08-04 to 2025-08-10

Methodology|Online survey

Target Group|Thailand internet users aged 16-60

Sample Size|736

Editor|Z.com Engagement Lab / ShareParty Insights

Review by|Tatt Chen

* Contents in this report were drafted with input from generative.ai