Consumer Insight Report on Indonesia’s Beauty Industry: Optimistic Outlook, Urgent Call for Transformation

2025/08/06

Conducted by GMO Research & AI and Z.com Engagement Lab, this study offers a comprehensive view of the Indonesian beauty market, providing valuable input for brands looking to localize strategies. The research covers future industry direction, the need for change, the role of government, consumer spending outlook, brand preferences, purchase drivers, and information sources.

Consumers are optimistic about the future but dissatisfied with the current state

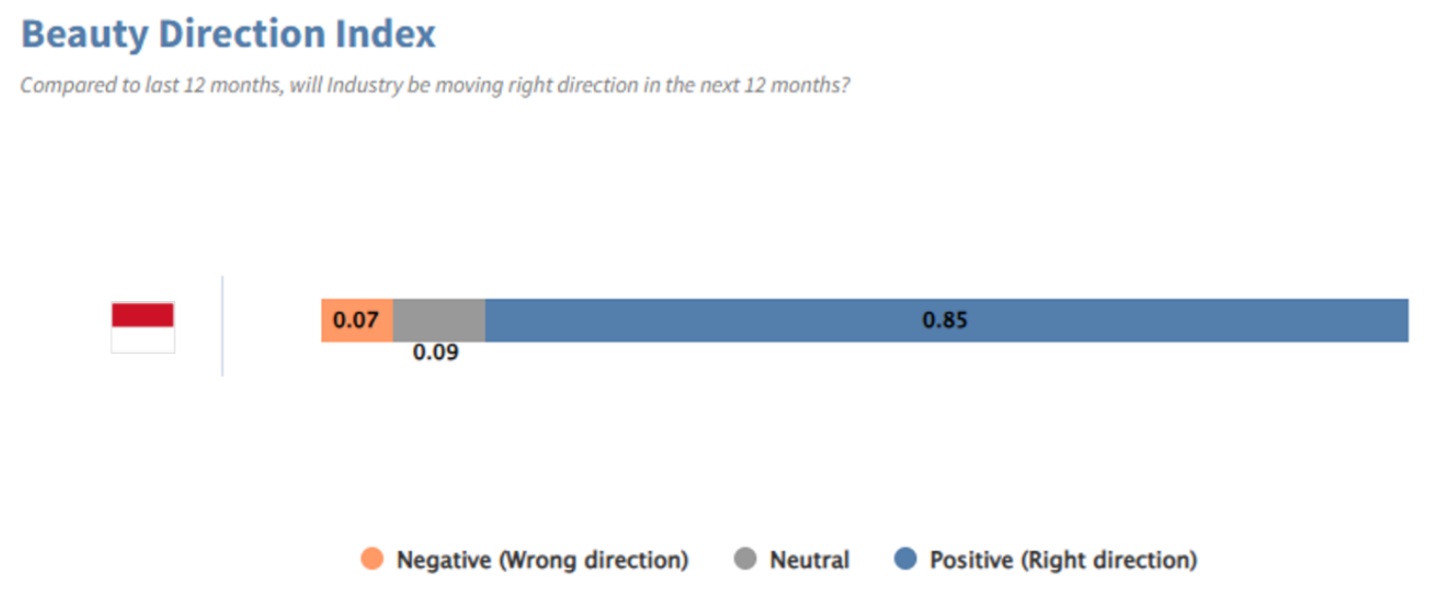

According to the Beauty Direction Index, 85% of Indonesian consumers believe the beauty industry is headed in the right direction over the next 12 months, showing strong confidence in the future.

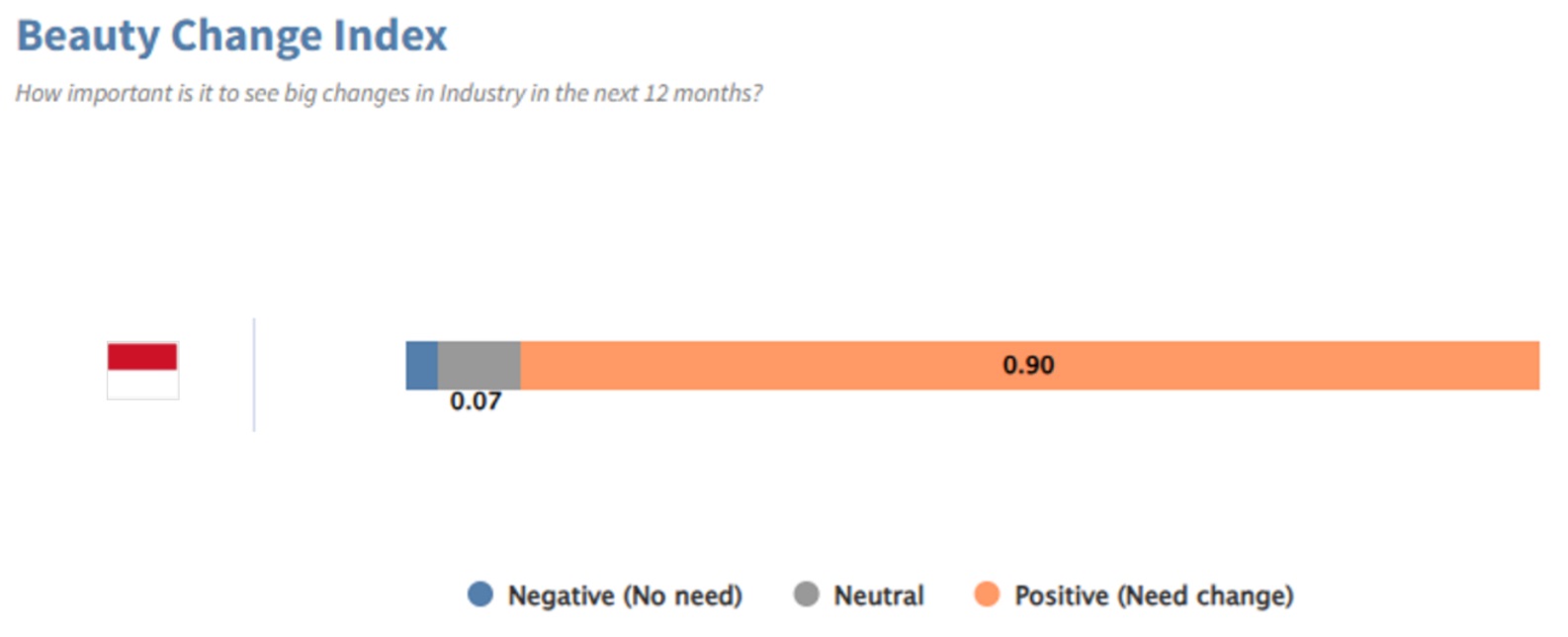

However, the Industry Change Index reveals that 90% believe major changes are needed. This highlights a paradox: while consumers are optimistic about trends, they are still hungry for more innovation from brands.

Majority of consumers prefer “less government intervention”

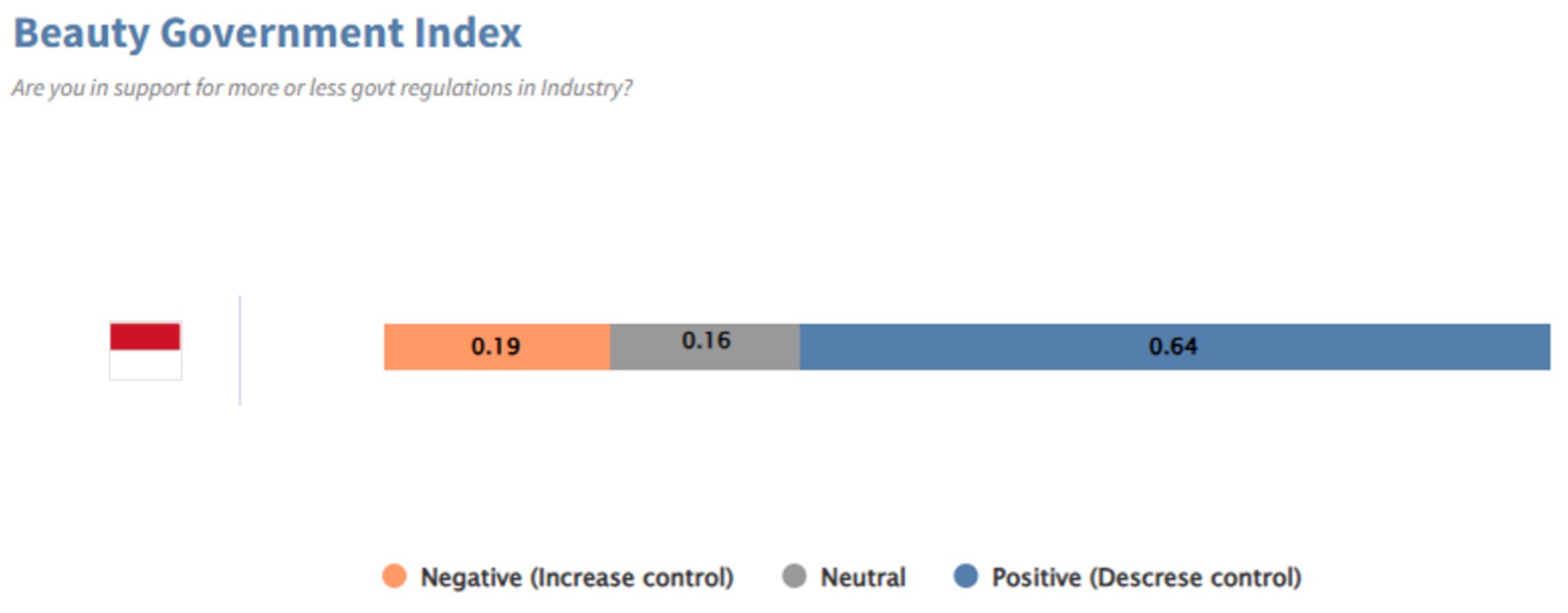

In the Government Control Perception Index, 64% support less government involvement in the beauty sector, with only 19% favoring stricter regulation. This indicates a preference for a more open, innovative, and flexible market environment.

High consumer intent signals strong market growth

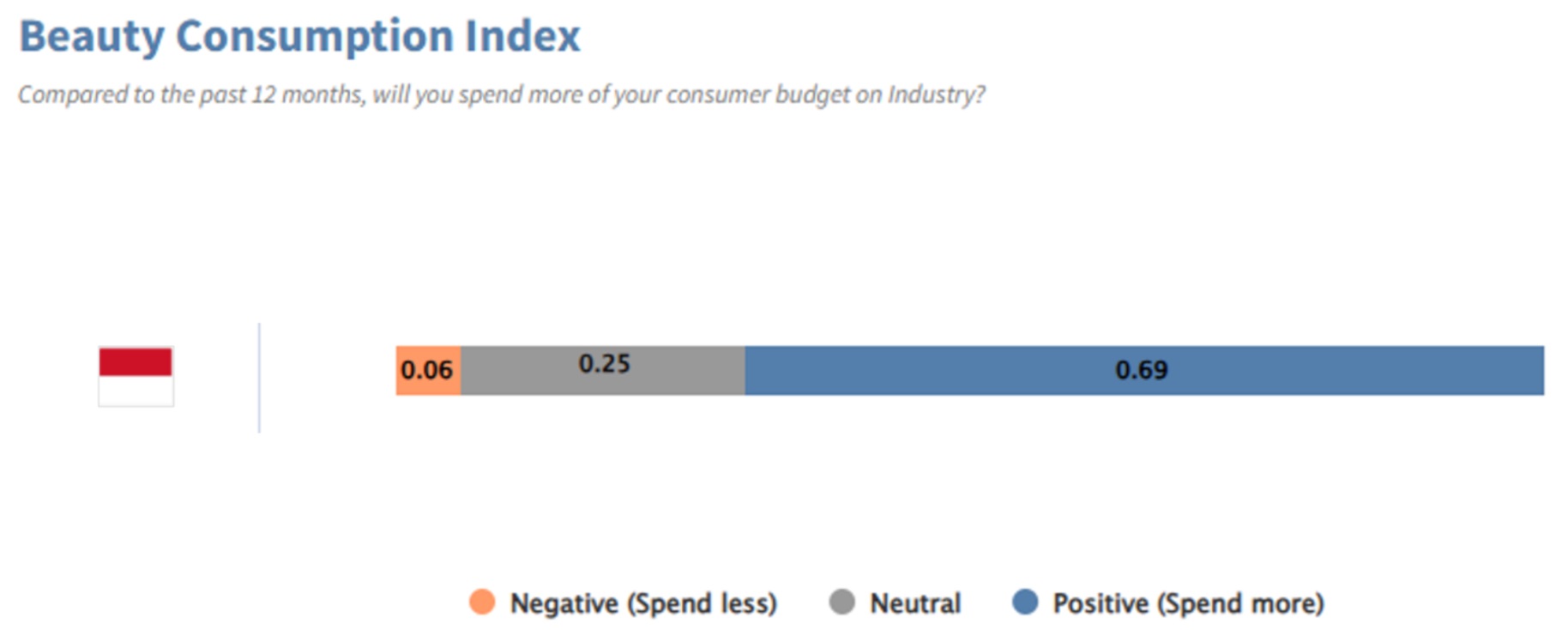

The Consumption Index shows that 69% of consumers expect to increase spending on beauty products in the next year, while only 6% plan to cut back. This reflects strong and rising demand, pointing to a highly promising market.

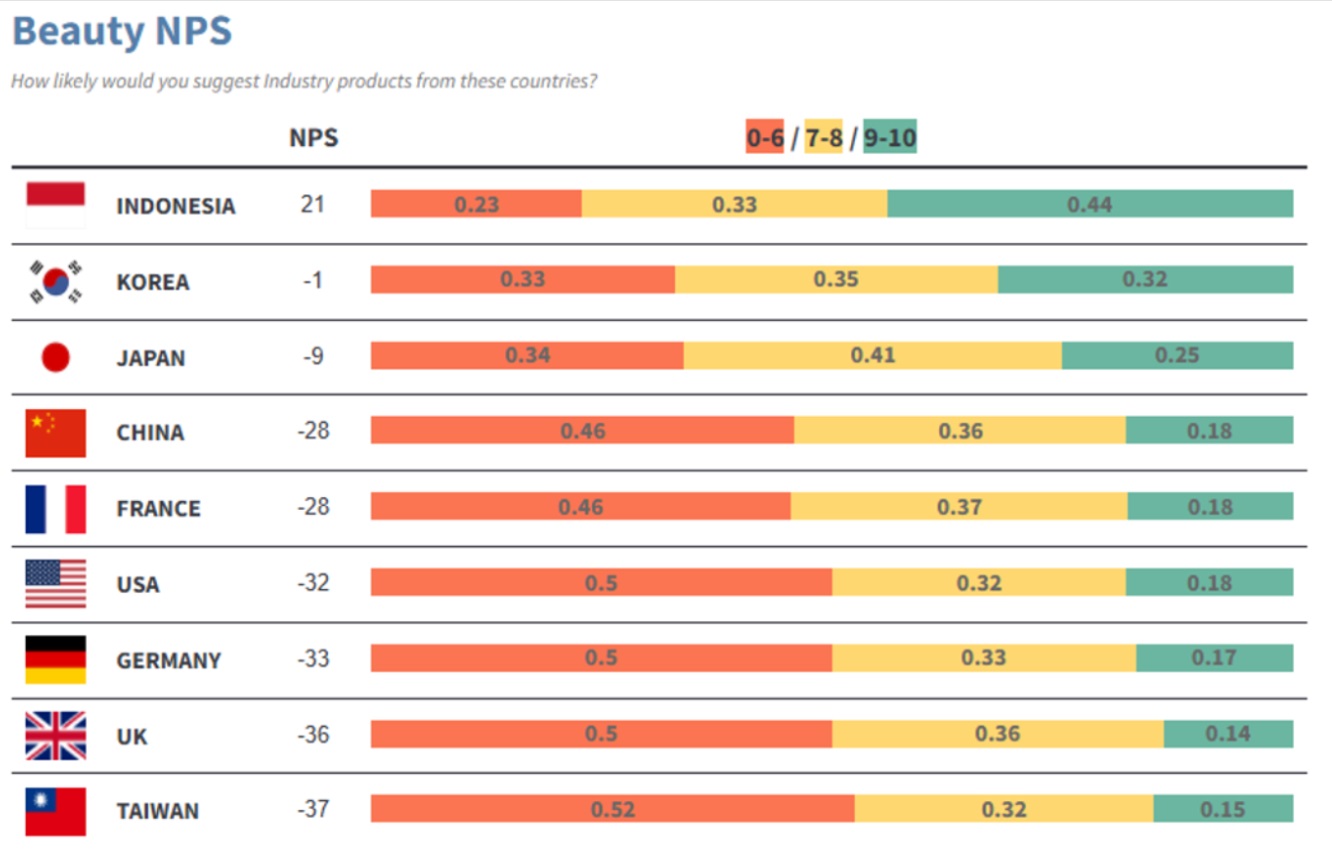

Local brands lead in recommendations, while Western brands lag behind

According to the Net Promoter Score:

●Local Indonesian brands scored +21

●South Korean brands: -1

●Japanese brands: -9

While Asian brands still hold some appeal, Western brands lag significantly:

●USA: -32

●Germany: -33

●UK: -36

This suggests that local brands resonate most with Indonesian consumers, and neighboring Asian countries still enjoy some trust, while Western brands face a colder reception.

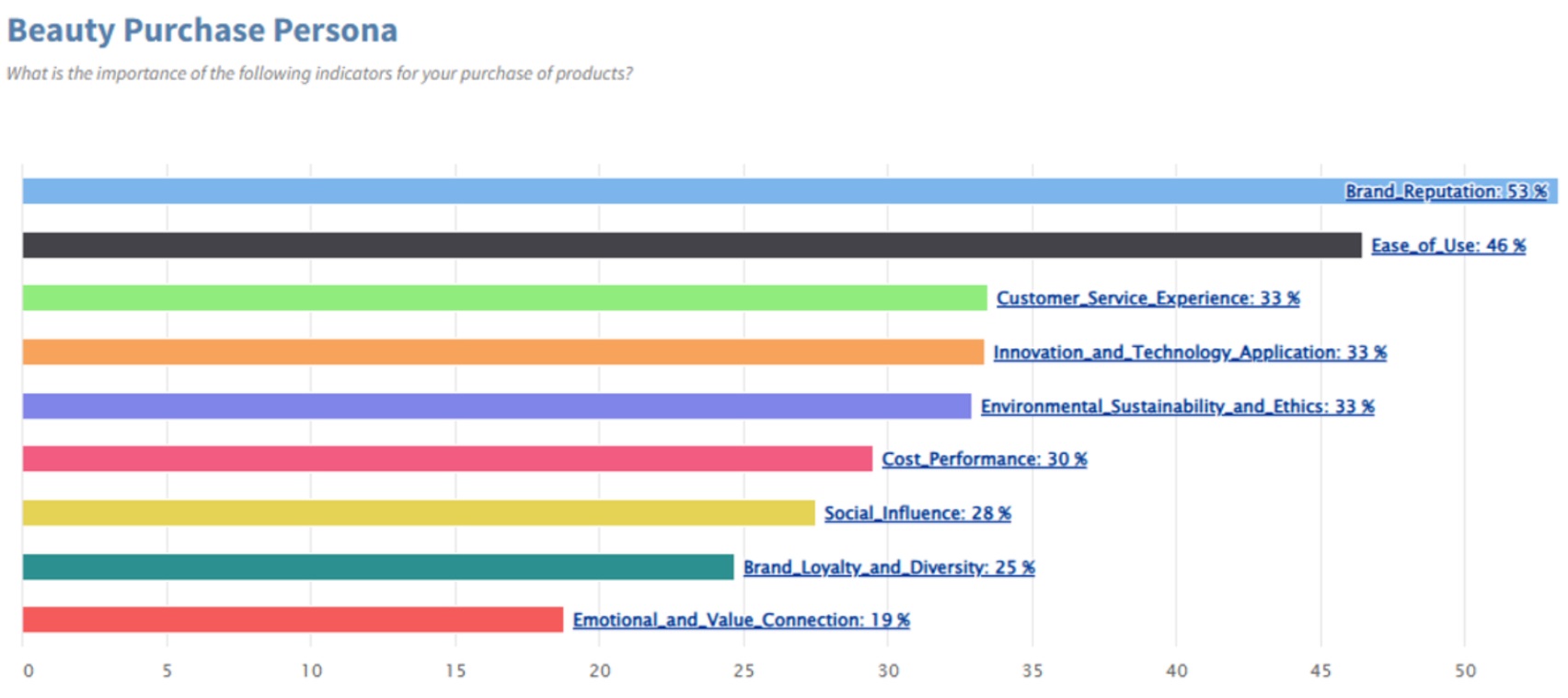

Key purchase drivers: Brand reputation leads, but convenience and values matter too

When choosing beauty products, consumers prioritize:

●Brand reputation (53%)

●Ease of use (46%)

●Customer service (33%)

●Innovative technology (33%)

●Sustainability and ethics (33%)

Beyond trust, consumers also value innovation, experience, and ethical standards in their purchase decisions.

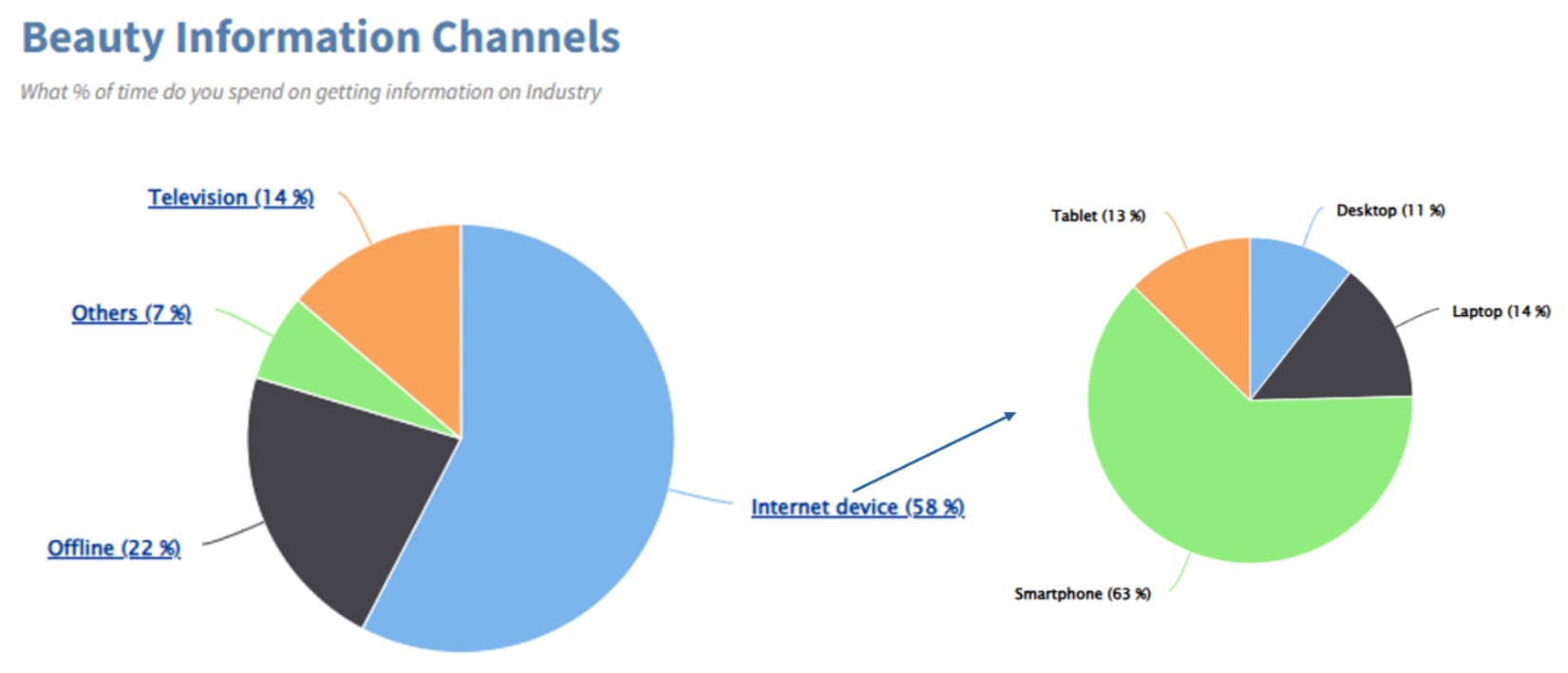

Mobile is the main gateway for beauty information

According to the Information Source Survey:

●58% of information comes from digital devices, with 63% of that via mobile

●Physical stores: 22%

●TV: 14%

This highlights mobile as the dominant information channel for Indonesian consumers and makes digital presence a vital competitive arena for brands.

Clear growth momentum: brands must embrace innovation and localization

The findings confirm strong growth potential in Indonesia’s beauty industry. Consumers are hopeful yet demand reform. To stand out, brands must differentiate in brand trust, user experience, and values, while leveraging mobile and digital platforms to build closer relationships with consumers.

GMO Research & AI and Z.com Engagement Lab will continue monitoring Indonesian consumers’ beauty-related behaviors and update the findings regularly to stay in tune with market trends and evolving consumer needs.

Survey Specifications

-

Research by|GMO Research & AI, Z.com Engagement Lab

Survey Date|2025-06-10 to 2025-06-16

Methodology|Online survey

Target Group|Indonesia internet users aged 16-60

Sample Size|913

Editor|Z.com Engagement Lab / ShareParty Insights

Review by|Tatt Chen

* Contents in this report were drafted with input from generative.ai