Online Banking Usage and Habits Among Taiwanese Consumers

2025/03/31

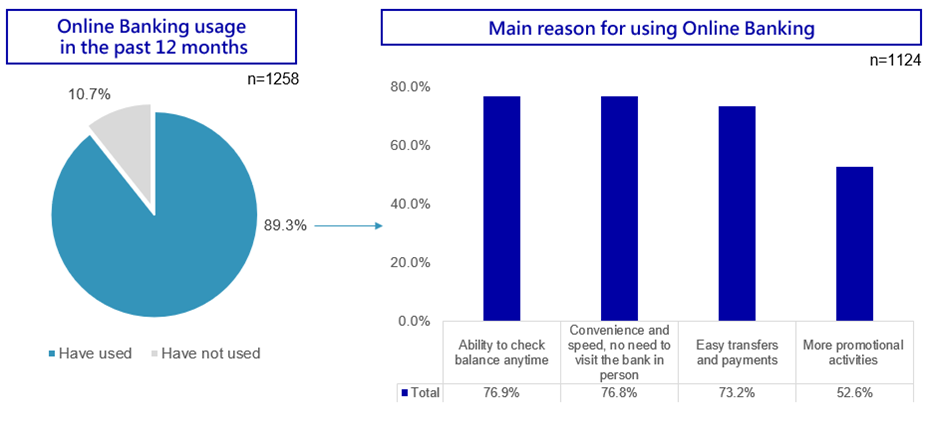

This report is conducted by GMO Research & AI and Z.com Engagement Lab. With the rise of digital finance, online banking has become an essential financial tool in modern life. According to survey results, 89.3% of respondents have used online banking in the past 12 months, while only 10.7% have not yet engaged with these services, indicating that online banking has become an integral part of everyday financial activities in Taiwan.

Main Reasons for Using Online Banking

For those who choose online banking, the key factors include:

● Convenience of checking balances anytime (76.9%)

● Time-saving and no need to visit a physical bank (76.8%)

● Easier transfers and payments (73.2%)

● More promotional offers (52.6%)

It is clear that consumers prioritize convenience and efficiency. Reducing the need for in-person banking transactions is a major driver for the widespread adoption of online banking.

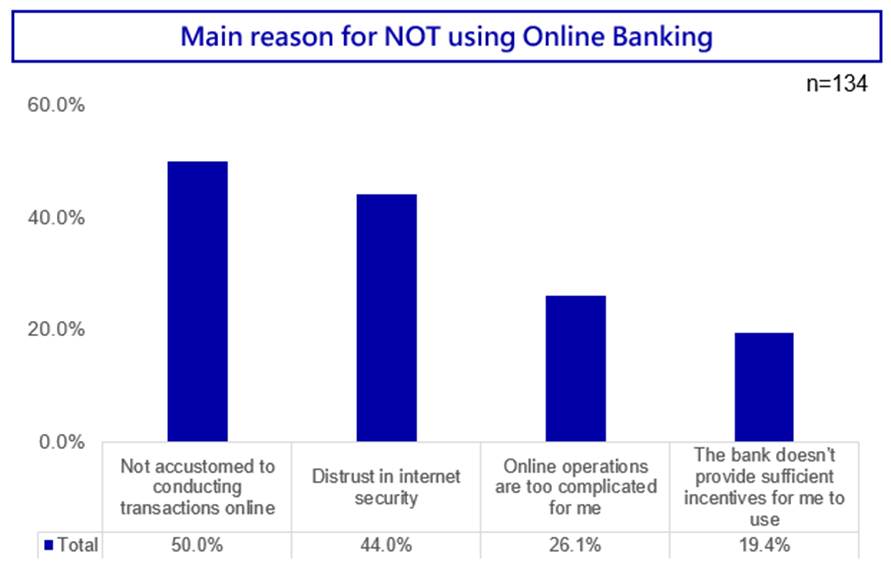

Reasons for Not Using Online Banking

However, some consumers remain hesitant about online banking. Their main concerns include:

● Not accustomed to conducting transactions online (50.0%)

● Concerns about internet security (44.0%)

● Complicated user interfaces (26.1%)

● Lack of attractive banking incentives (19.4%)

Beyond habit, data security concerns play a major role in preventing certain consumers from using online banking. Strengthening security measures and simplifying banking processes could encourage more users to adopt these services.

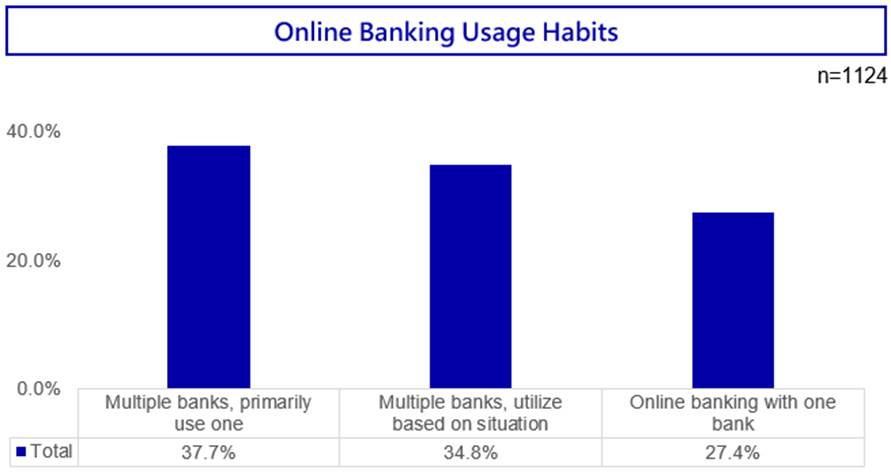

Online Banking Usage Habits

Interestingly, most Taiwanese consumers do not rely on just one bank but instead use multiple banks for different purposes so Banking service providers needs to amplify it’s points of differentiation vs competitors to win-over users:

● 37.7% primarily use one bank but also have accounts with multiple banks

● 34.8% choose banks based on different situations

● Only 27.4% rely solely on one bank

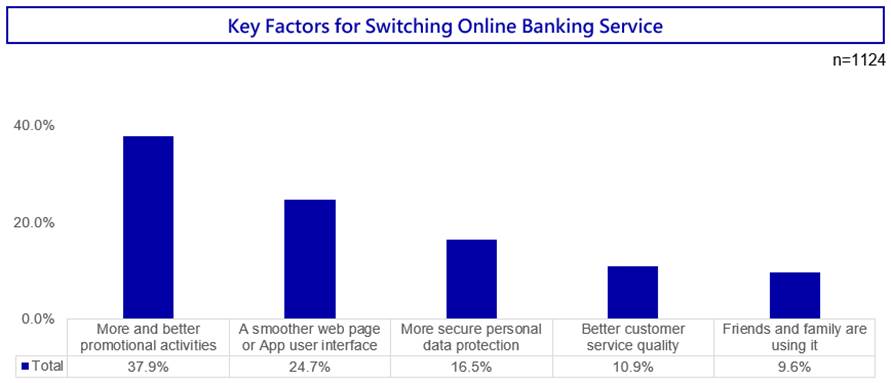

Factors Influencing Consumers to Switch Online Banking Providers

Even among existing users, promotional offers can be strong triggers to switch banks. The main factors influencing bank switching include:

● More and better promotional offers (37.9%)

● A smoother web or app interface (24.7%)

● Stronger personal data protection (16.5%)

● Better customer service quality (10.9%)

● Friends or family recommendations (9.6%)

Besides promotions, and user experience play crucial roles in determining consumer loyalty.

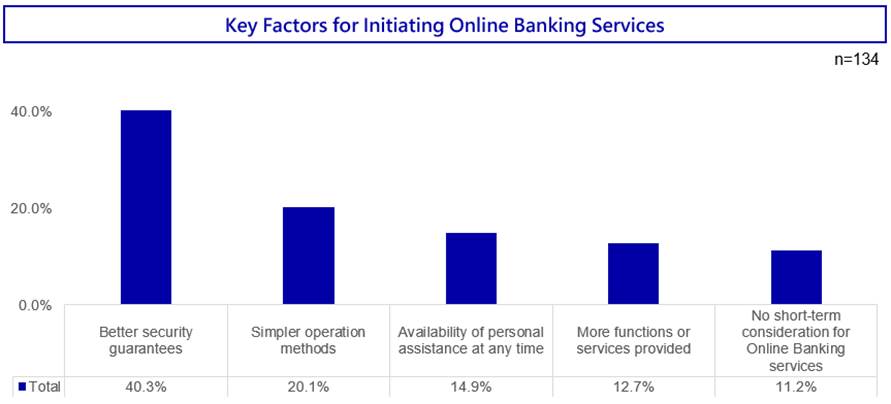

Expectations of Non-Users Toward Online Banking

For consumers who have yet to use online banking, the most crucial factors that might encourage them to start include:

● Stronger security guarantees (40.3%)

● Simpler operation methods (20.1%)

● Availability of personal assistance anytime (14.9%)

● Additional financial services (12.7%)

● No short-term plans to use online banking (11.2%)

This indicates that many consumers still have concerns about security and ease of use, highlighting key areas where banks should improve.

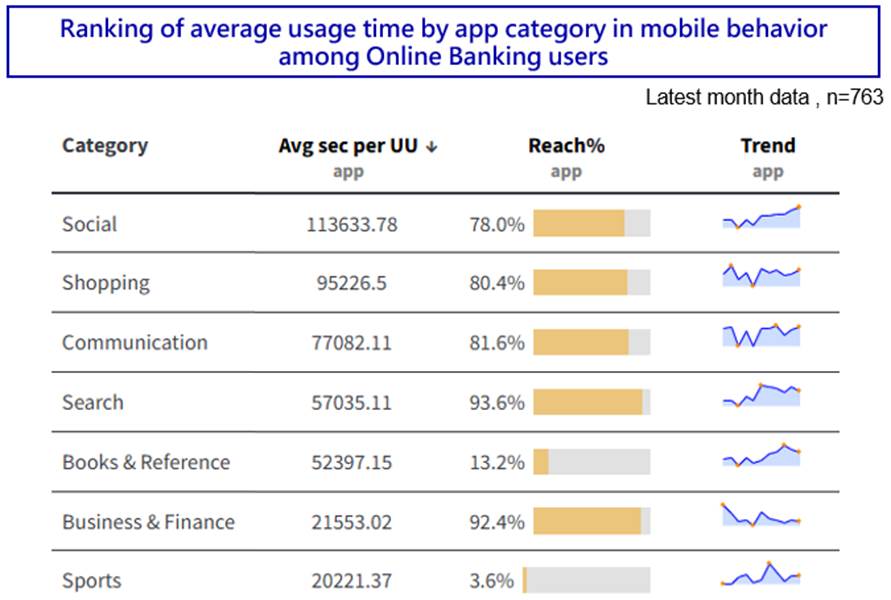

Mobile Behavior Among Online Banking Users

According to data from ShareParty Insight Behavior Database, users who engaged in online banking over the past month also exhibited distinct mobile app usage patterns.

Among this group, the most commonly used app categories include:

- Social Media (Average usage: 113,633.78 seconds, reach: 78.0%)

- Shopping (95,226.5 seconds, reach: 80.4%)

- Communication (77,082.11 seconds, reach: 81.6%)

- Search Engines (57,035.11 seconds, reach: 93.6%)

- Books & References (52,397.15 seconds, reach: 13.2%)

- Business & Finance (21,553.02 seconds, reach: 92.4%)

- Sports (20,221.37 seconds, reach: 3.6%)

This data indicates that online banking users are also highly engaged with social media and e-commerce platforms, suggesting that they are not only digitally savvy but also frequent online consumers.

-

What are the most used apps of Taiwan's online banking users?

-

Find out more from the article below!

Balancing Convenience and Security: The Key to Digital Banking Success

Overall, Taiwanese consumers have widely adopted online banking, but concerns about security and user habits still deter some individuals. For banks, achieving the right balance between convenience and security, while offering attractive promotions and a seamless digital experience, will be critical in retaining and expanding their user base.

Moreover, given the strong correlation between online banking users and social media or e-commerce engagement, banks can leverage these channels to enhance their marketing strategies and increase service penetration.

GMO Research & AI and Z.com Engagement Lab will continue to track the Taiwan Consumer Survey of the Online Banking public and update survey data, monitoring market trends and changes in consumer demand.

Survey Specifications

-

Research by|GMO Research & AI, Z.com Engagement Lab, ShareParty

Survey Date|2025-01-13 to 2025-01-19

Methodology|Online survey

Target Group|Taiwan internet users aged 16-60

Sample Size|1,258

Editor|TNL Research

Review by|Tatt Chen

* Contents in this report were drafted with input from generative.ai

Reach Your Ideal Audience

|

GMO Research & AI operates an online panel of 65 million individuals across 14 markets in Asia-Pacific with a diverse profile. Find more details of the respondents from the panel book! |