Singapore E-Hailing Behavior Insight Report: Behind the High Adoption—Choices and Concerns

2025/09/03

This report by GMO Research & AI, Z.com Engagement Lab explores how E-Hailing services have seamlessly integrated into urban life in Singapore. From daily commutes to spontaneous trips, the convenience of ride-hailing apps has won over many residents. Based on recent findings, this report provides a comprehensive view into motivations for usage, barriers, platform-switching behavior, and possible areas of improvement.

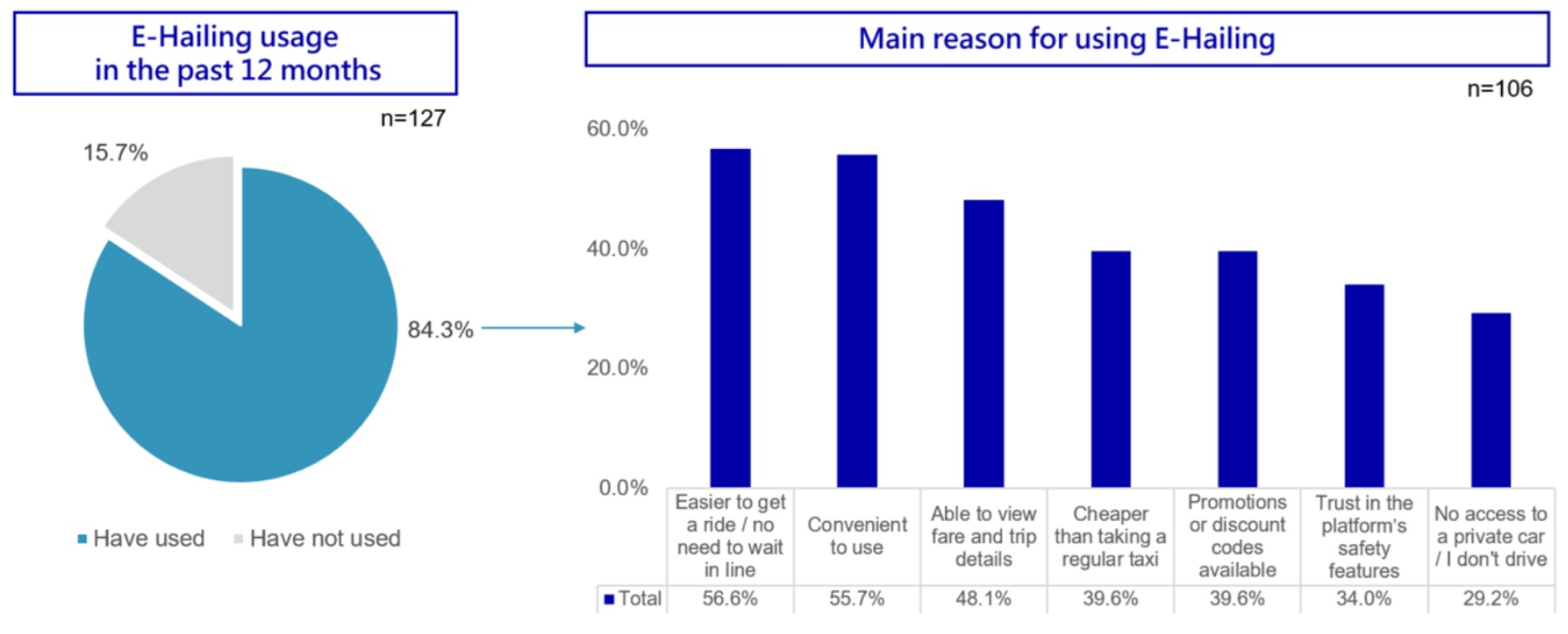

Over 80% have used E-Hailing: Convenience and efficiency lead the way

84.3% of respondents reported having used E-Hailing in the past 12 months. Among them, the top reasons include:

●Easier to get a ride / no need to wait in line (56.6%)

●Convenient to use (55.7%)

●Able to view fare and trip details (48.1%)

-

In addition, Cheaper than taking a regular taxi (39.6%) and Promotions or discount codes available (39.6%) also emerged as key factors.

-

These results point to user preference for convenience, transparency, and affordability. Platform safety features and the lack of private transport options also played notable roles (34.0% and 29.2% respectively).

-

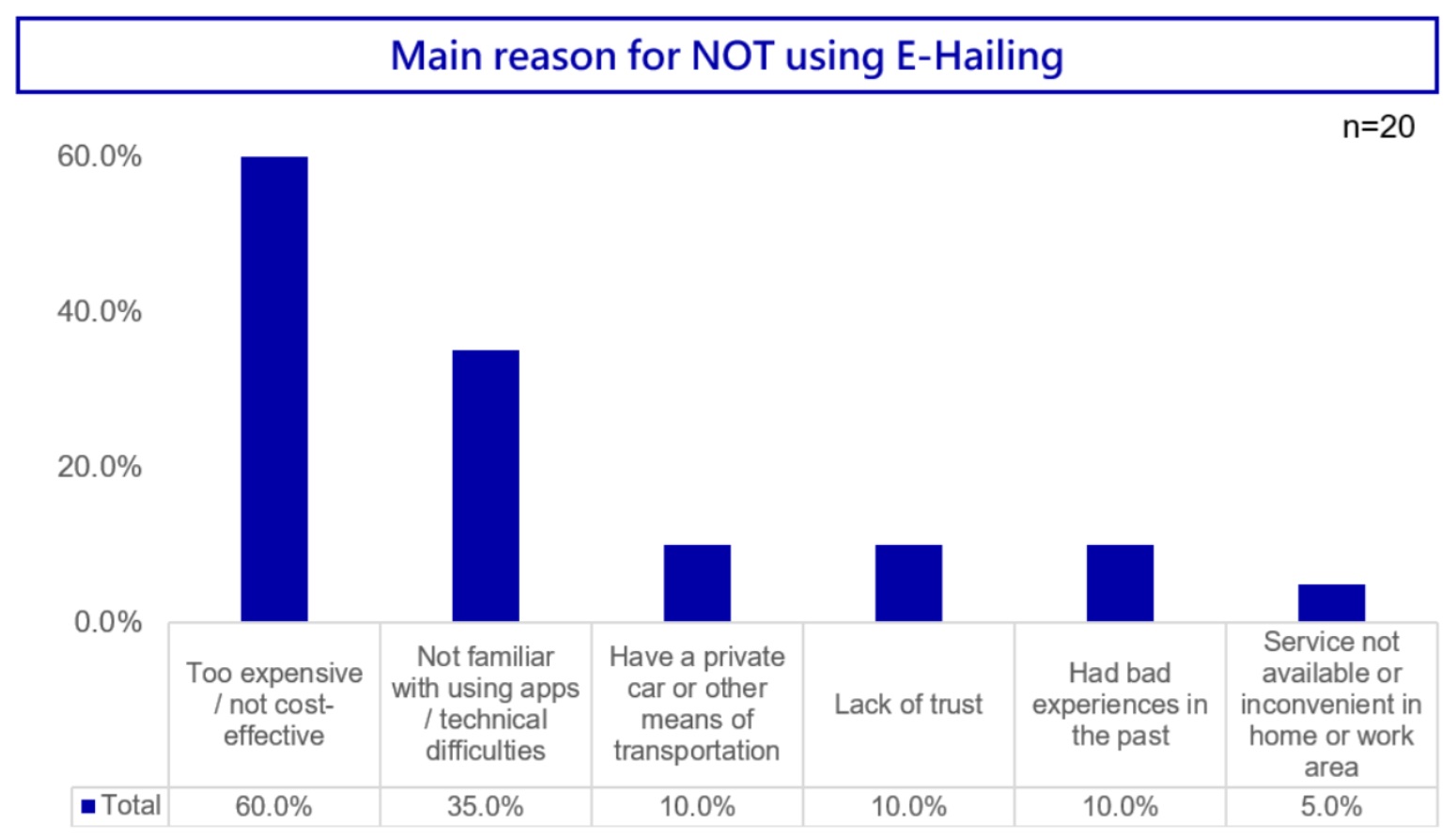

Why not use it? Price and tech barriers dominate

Despite high adoption, 15.7% said they hadn’t used E-Hailing in the past year. Among these 20 respondents:

●Too expensive / not cost-effective was the leading reason (60.0%)

●Followed by Not familiar with using apps / technical difficulties (35.0%)

Other reasons included owning a private car (10.0%), lack of trust or previous bad experiences (both 10.0%), and unavailability in residential or work areas (5.0%).

Even in a digitally advanced city, cost perception and digital literacy remain key obstacles.

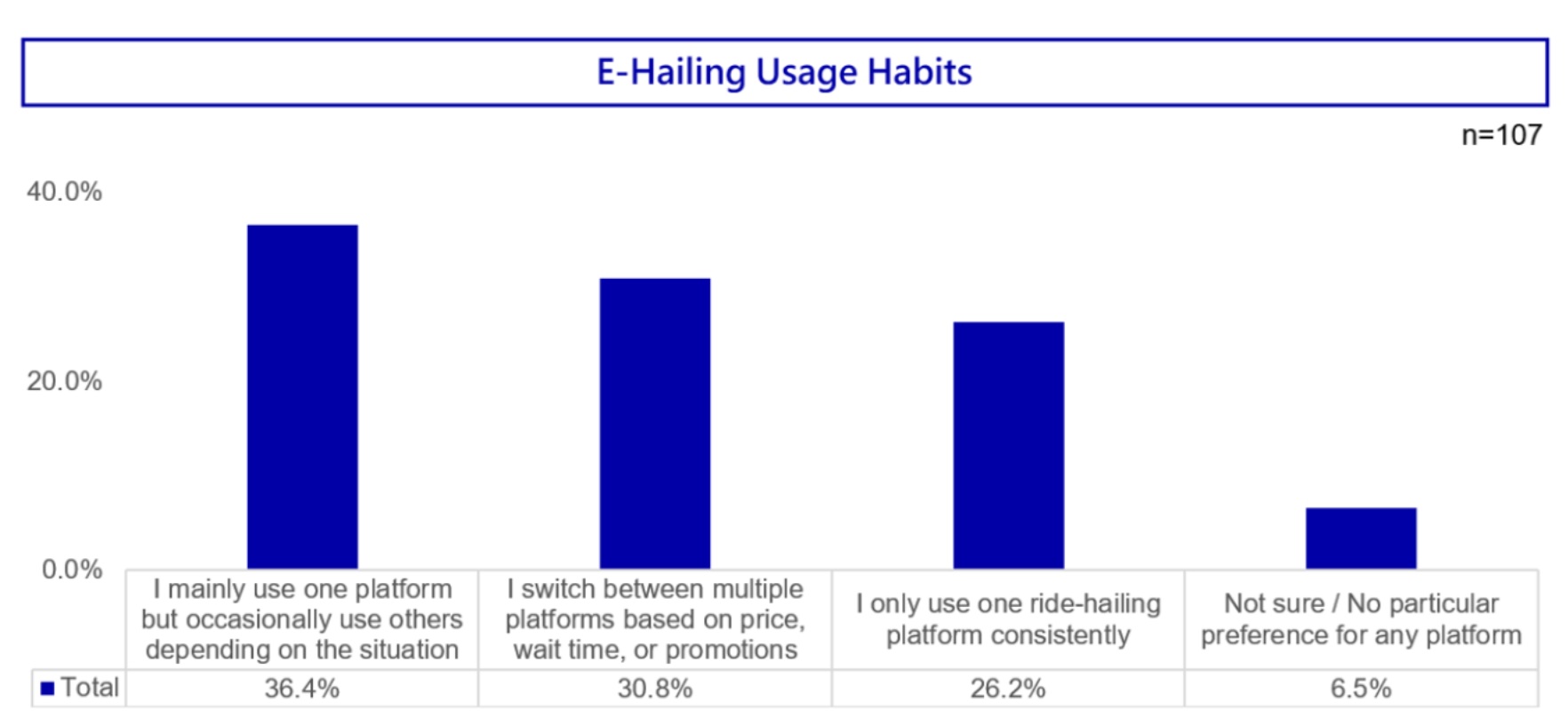

Low platform loyalty: Most users switch depending on situation

Only 26.2% said they stick with a single ride-hailing platform. A larger share (36.4%) reported using one as their primary app but switch based on the situation, while 30.8% actively switch based on price, wait time, or promotions.

This reflects a highly competitive market with users showing limited brand loyalty and favoring flexibility.

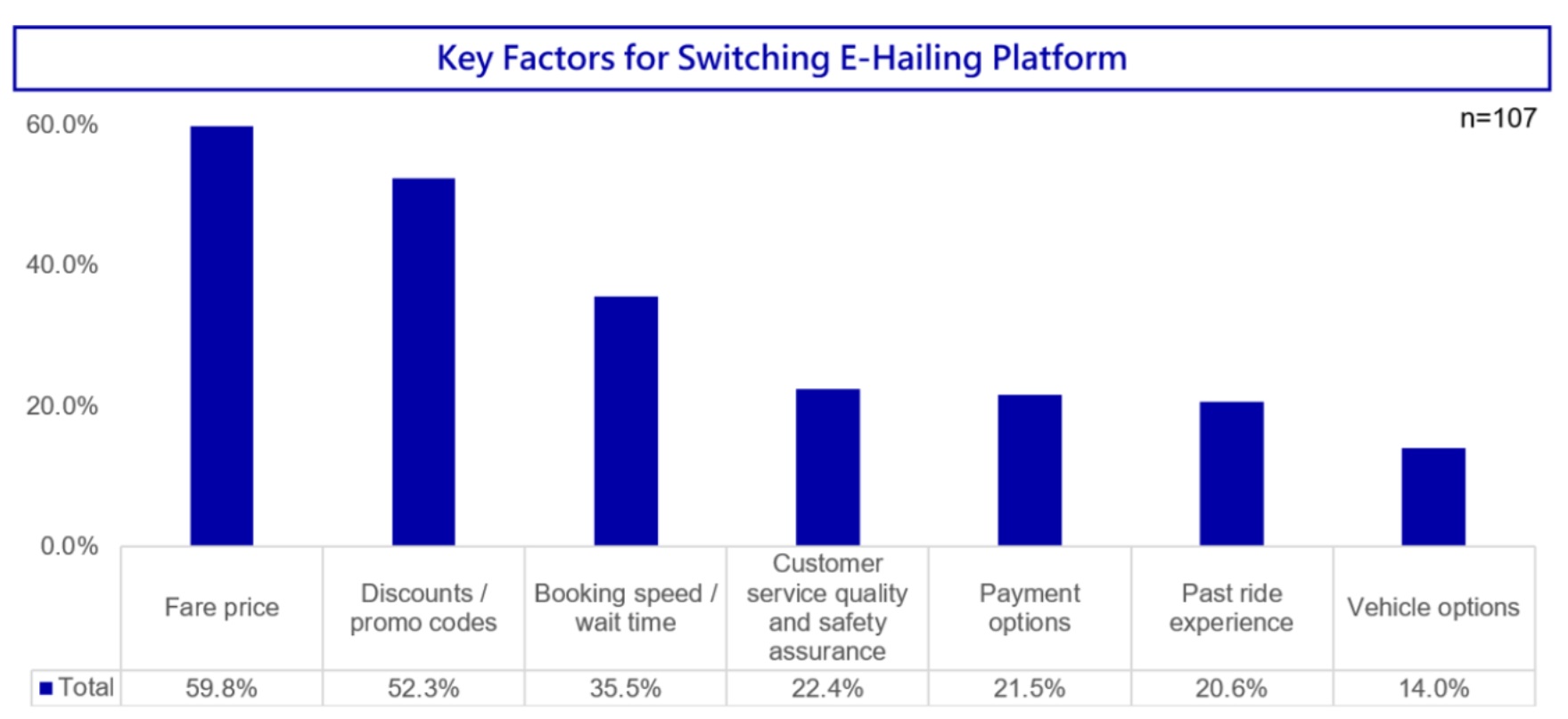

Price and discounts drive platform switching

When asked what factors lead them to switch platforms:

●Fare price (59.8%) and Discounts / promo codes (52.3%) top the list

●Booking speed / wait time (35.5%) also plays a significant role

Other influential factors include customer service and safety (22.4%), payment options (21.5%), past ride experience (20.6%), and vehicle options (14.0%).

This indicates that pricing remains the primary trigger, followed by service and experience factors.

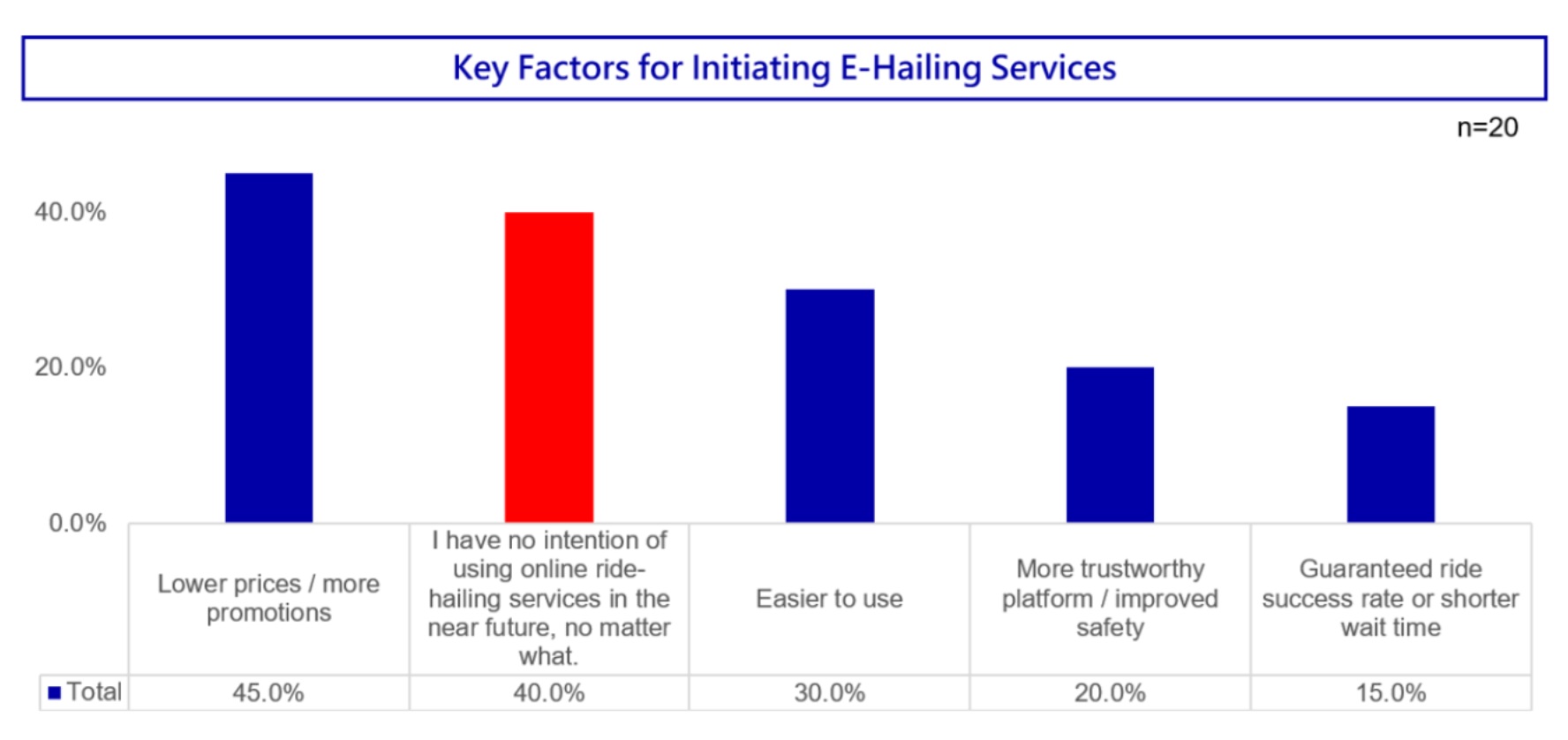

How to attract non-users? Price, usability, and trust are key

For those who may consider using E-Hailing in the future, the most persuasive conditions are:

●Lower prices / more promotions (45%)

●Easier to use (30%)

●More trustworthy platform / improved safety (20%)

However, 40% expressed no intention of using E-Hailing anytime soon—showing a portion of the market remains firmly resistant.

Amid fierce competition, brands must focus on pricing, experience, and trust

Although E-Hailing has become widespread in Singapore, brand loyalty is low and user decisions are driven by pricing, promotions, and experience. To win over more users and increase retention, platforms must optimize price flexibility, interface friendliness, and trust-building strategies—lowering barriers to entry while standing out in a crowded market.

GMO Research & AI and Z.com Engagement Lab will continue to monitor Singapore’s E-Hailing usage trends and update consumer insights to track market shifts and evolving needs.

Survey Specifications

-

Research by|Z. com Engagement Lab powered by GMO Research & AI

Survey Date|2025-07-03 to 2025-07-09

Methodology|Online survey

Target Group|Singapore internet users aged 16-60

Sample Size|127

Editor|Z.com Engagement Lab / ShareParty Insights

Review by|Tatt Chen

* Contents in this report were drafted with input from generative.ai