Reciprocal Tariffs Impact: Japanese Businesses Reshape Global Supply Chains Amid U.S.-Japan Trade Tensions

2025/05/16

Introduction

In April 2025, the Trump administration introduced a 10% baseline tariff on imports from nearly all countries and a 24% reciprocal tariff on most Japanese goods. While the reciprocal tariffs are under a 90-day suspension, which is set to expire in early July, the baseline duty remains in effect (as of mid-May 2025). Given that exports to the U.S. constitute over 20% of Japan's total exports, the economic impact on affected industries could be significant.

GMO Research & AI conducted a survey among Japanese executives to gain deeper insights on recent U.S. trade policies. The results reveal widespread concern over Trump's reciprocal tariffs and their adverse effect on Japanese firms, particularly those with an American connection. This article explores the strategies Japanese firms employ in response to the American tariffs, which, in turn, affect business relations and geopolitics between the U.S. and Japan, as well as on the resilience of the world supply chain.

Survey Specifications

-

Survey Date: 18-25 April 2025

Target Group: Management-level professionals in Japan

Company Size: 50+ employees, annual revenue of over 500 million yen

Sample Size: 180ss

Method: Online survey

Wider concern and the financial consequences that tariffs bring to Japanese companies

High Awareness of U.S. Tariff Policy Among Japanese Firms

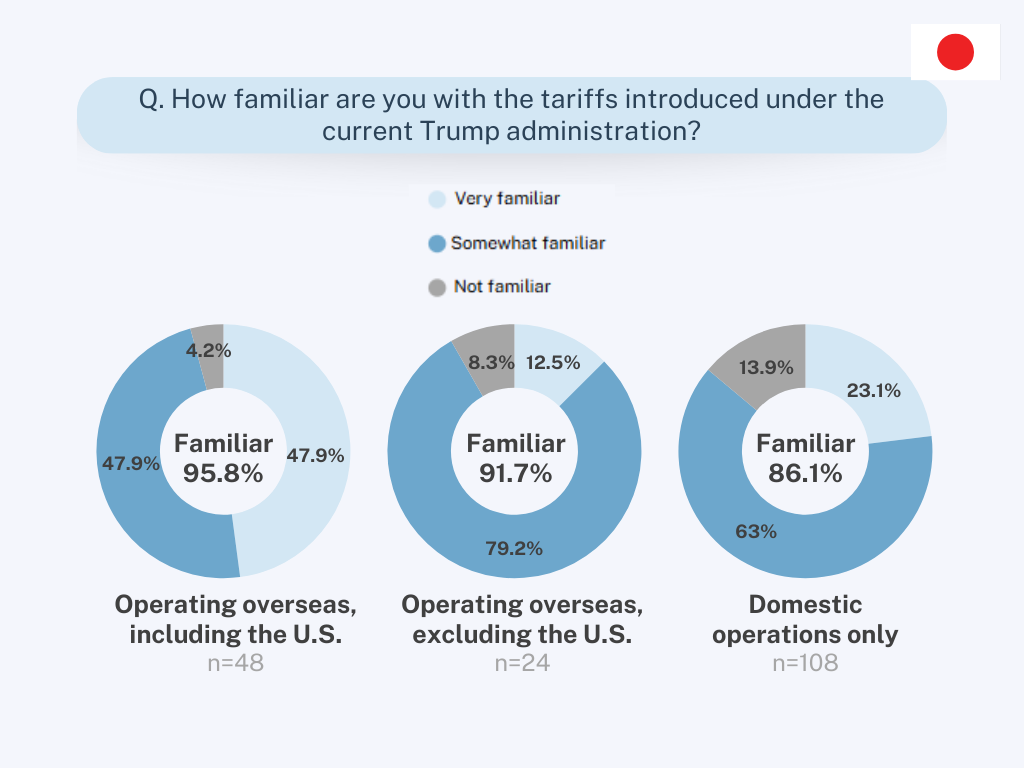

With the answers provided in this survey, it may be clear that among Japanese businesspersons, awareness of American tariff policies is indeed very high. Almost all respondents with U.S. operations were aware of reciprocal tariffs (95.8%), with 47.9% stating the level as 'very high.' It is worth noting here that this concern was also logged by the companies that operate only within Japan (86.1% familiarity), thus revealing that the economy of Japan has grown to consider tariffs on its exports as a concern.

*Click on the image to expand

Strong Expectation of Negative Business Outcomes

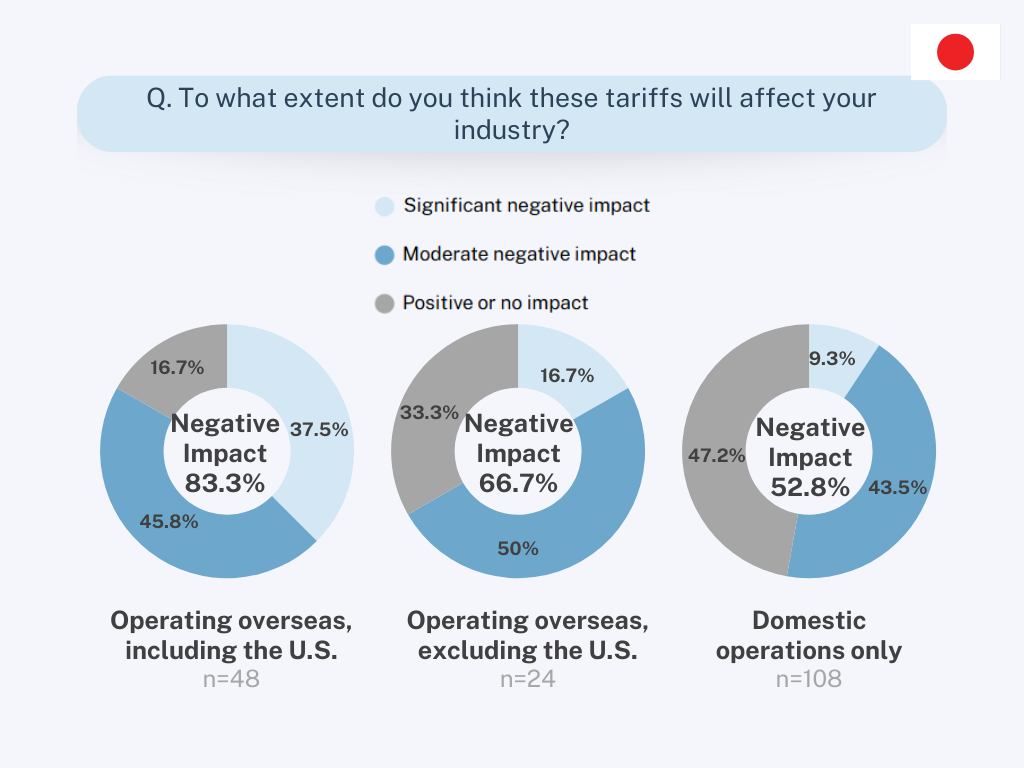

It is directly proportional when they anticipate adverse outcomes. Among the businesses that include operations in the U.S., 83.3% expect negative consequences: 37.5% of them say 'significant' and 45.8% say "moderate-negative impact." While 52.8% of companies with domestic-only sales also expect some degree of negative impacts, further organization of the American tariff policy has far-reaching ramifications on the global supply chain.

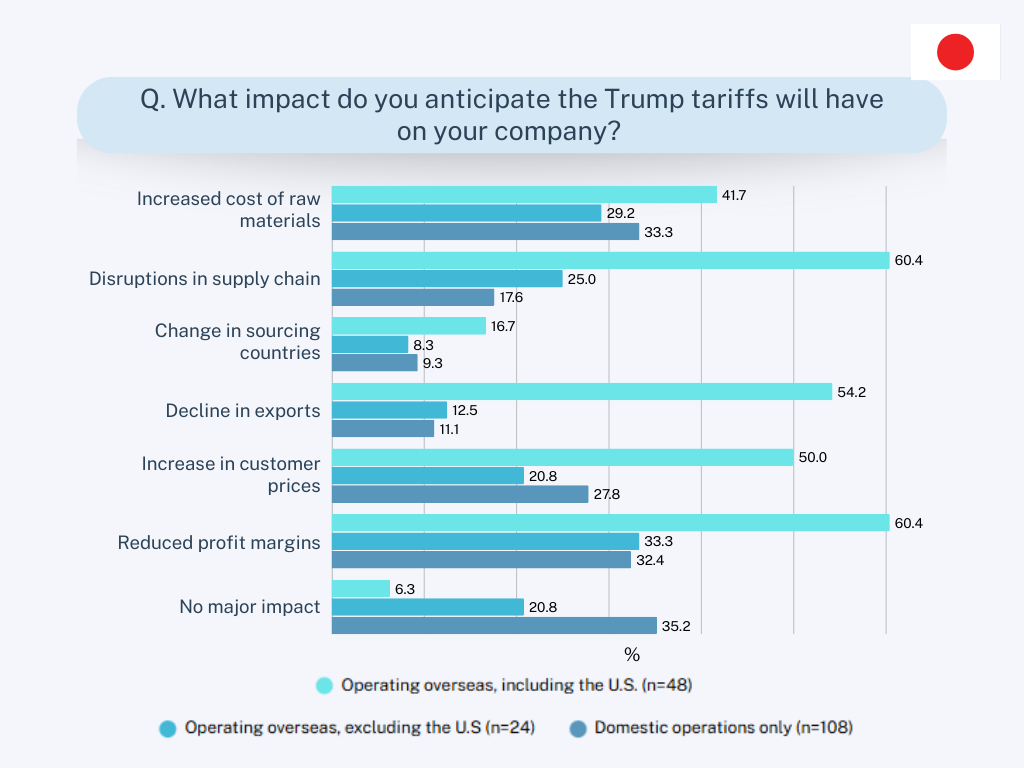

When it comes to specific issues, companies with operations in the United States cited a few key areas:

| ・Reduced profit margins (60.4%) |

| ・Disruptions in the supply chain (60.4%) |

| ・Decline in exports (54.2%) |

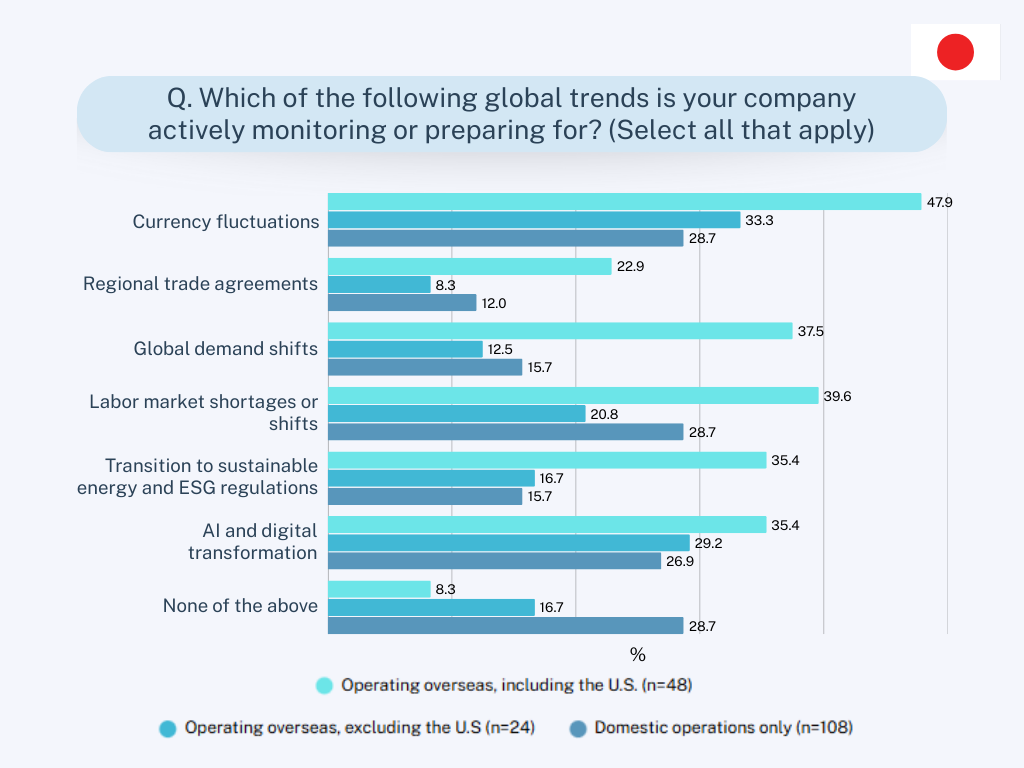

These concerns appear compounded by broader economic factors, with nearly half (47.9%) of U.S.-operating businesses actively monitoring currency fluctuations between the USD, JPY, and other currencies. In fact, the weakening of the dollar work against Japanese exporters whose reciprocal tariffs have hit, as it makes their goods more expensive in dollar terms.

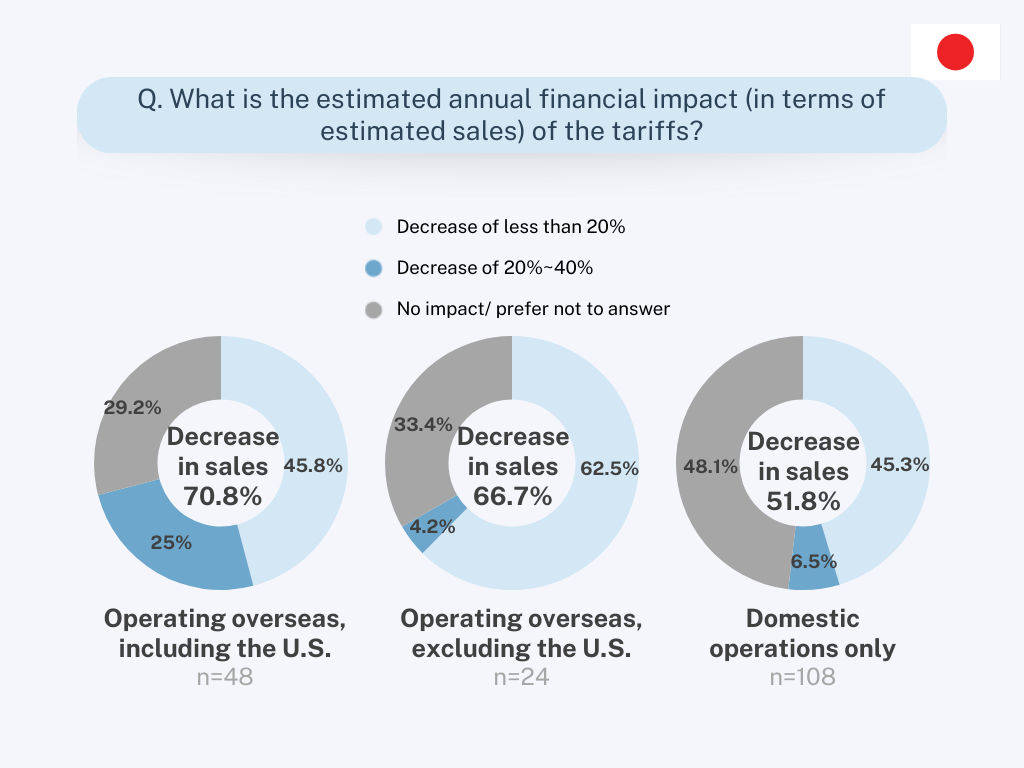

The anticipated impact of financial tariffs varies significantly according to company size and international exposure. Among businesses with U.S. operations, 45.8% anticipate sales decreases of less than 20%, and 25% project decreases between 20-40%.

Mid-sized companies (annual revenue 50-500 billion yen) with U.S. operations appear particularly vulnerable to tariffs on Japanese products, with 26% expecting sales decreases of 20-40%, while smaller companies (5-50 billion yen) report less expected impact.

Japanese Strategic Responses to American Tariff Policies: Reshaping the Global Supply Chain

Immediate Measures: Supply Chain Shifts and Price Revisions

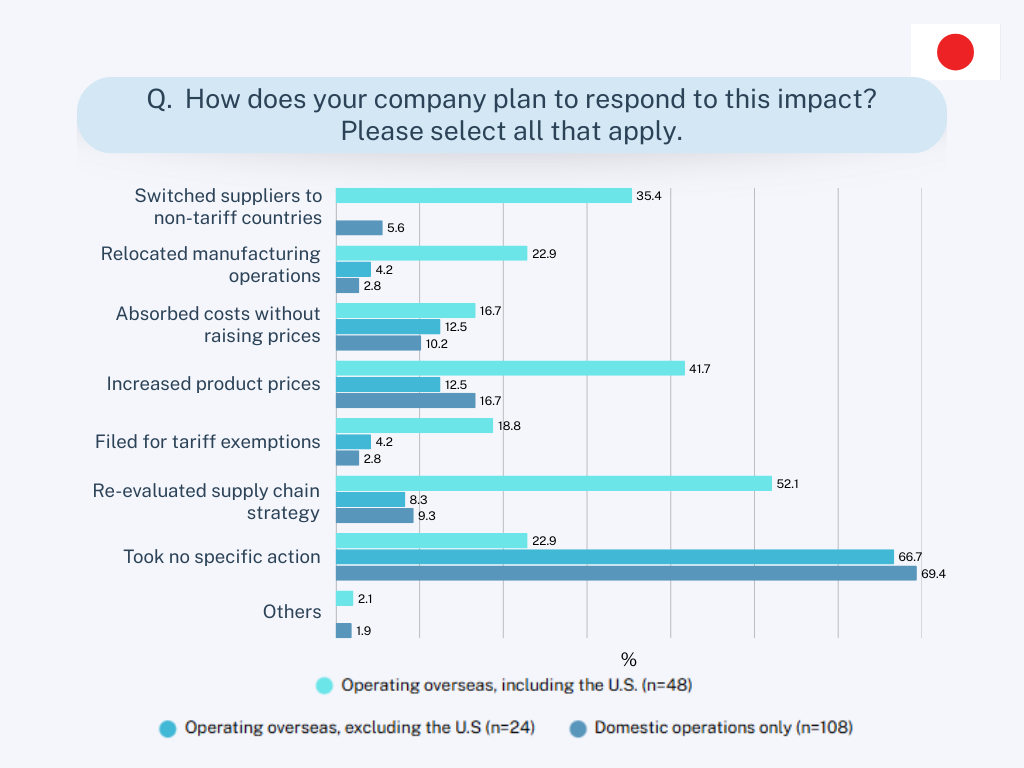

Japanese companies are actively strategizing in the immediate and long term to tackle the issue of reciprocal tariffs. Only 22.9% of companies with U.S. operations state that they do not take any specific action, compared to 66.7% of companies with overseas operations excluding the U.S., and 69.4% of domestic-only operations that keep their existing approach.

Immediate responses to tariffs on Japanese exports, from those exposed to the U.S. markets, are mainly as follows:

|

・Re-evaluating global supply chain strategy (52.1%)

|

|

・Increasing product prices (41.7%)

|

|

・Switching suppliers to non-tariff countries (35.4%)

|

The increasing prices as a strategy is significant for American companies purchasing from Japan. More than 40 percent of Japanese suppliers may either start increasing prices or threaten to do so; hence, American firms are already facing higher procurement costs, which will then be adopted in their global supply chains to the detriment of price competitiveness in the domestic market and customer relations.

The survey reveals interesting variations in response to reciprocal tariffs by company size. Larger enterprises (over 500 billion yen) with U.S. operations show a mixed approach—35.9% are re-evaluating global supply chains, 35.9% increasing prices, while another 35.9% are maintaining their current approach. By contrast, 70% of smaller companies (5-50 billion yen) with U.S. operations reported taking no specific action, suggesting limited options or a wait-and-see approach to the Japan-US tariff situation.

Long-Term Strategies: Structural Shifts in Supply Chain Planning

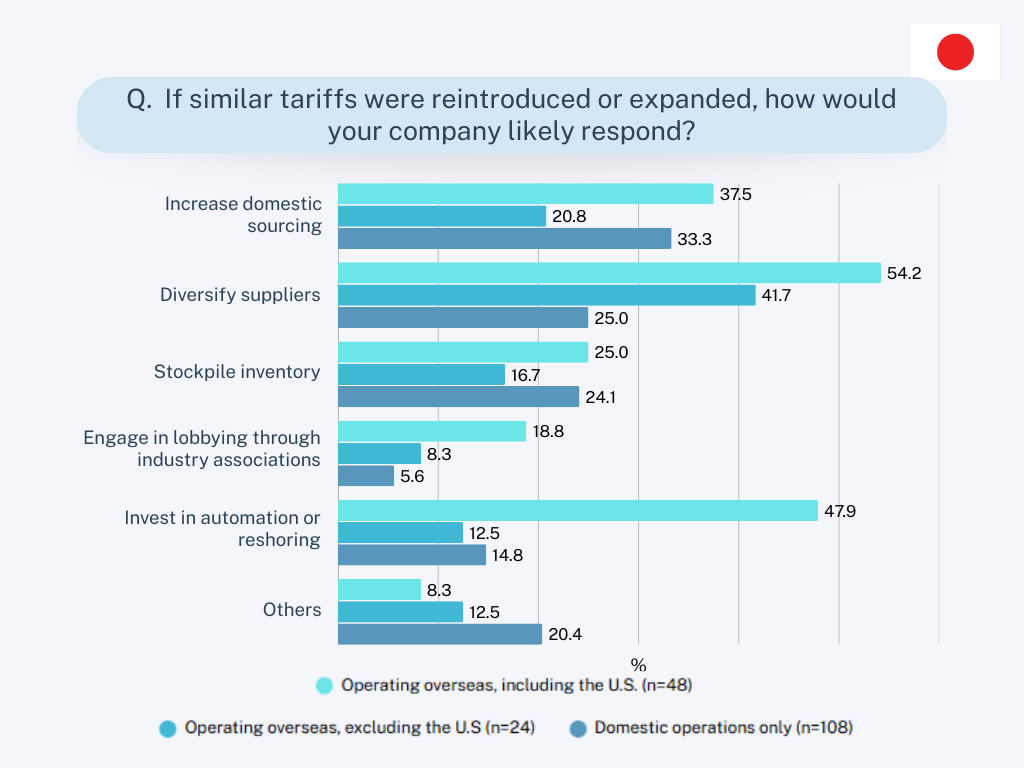

Looking at longer-term strategies, if American tariff policies targeting Japanese goods are expanded or prolonged, Japanese businesses with U.S. operations are planning more structural changes to their global supply chain:

| ・Diversifying suppliers (54.2%) |

| ・Investing in automation or reshoring (47.9%) |

| ・Increasing domestic sourcing (37.5%) |

The emphasis on automation and reshoring is particularly pronounced among larger companies facing reciprocal tariffs. For businesses with U.S. operations, 43.5% of mid-sized companies and 38.5% of large enterprises are considering these investments, compared to just 10% of smaller companies. This trend appears influenced not only by tariffs on Japanese imports but also by pre-existing challenges of U.S.-operating businesses citing labor market shortages (39.6%) , and a tendency of focusing on AI and digital transformation opportunities (35.4%).

Japanese Business Perspectives on U.S. Politics and Global Supply Chain Resilience

High Awareness of U.S. Politics and Anticipated Shifts in Tariff Policy

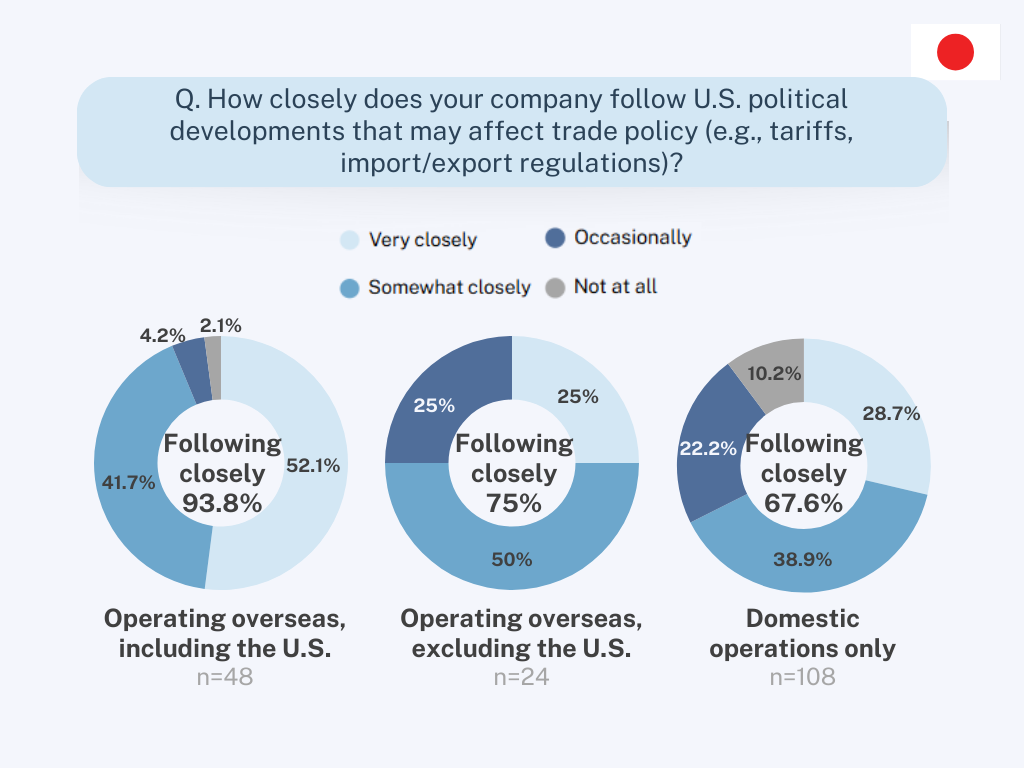

Japanese businesses demonstrate extraordinary engagement with U.S. political developments that could affect American tariff policies. Among companies with U.S. operations, an overwhelming 93.8% follow American political developments either "very closely" (52.1%) or "somewhat closely" (41.7%). This political attention extends beyond those with direct U.S. exposure—even among domestic-only businesses, 67.6% maintain close monitoring of U.S. politics, with only 10.2% reporting no interest.

When asked about expectations for the 2026 U.S. midterm elections, 62.5% of businesses with U.S. operations expressed some degree of hope for changes in the Japan-U.S. tariff relationship, with 27.1% "very hopeful" and 35.4% "somewhat hopeful." This cautious optimism suggests many Japanese businesses view the current tariff situation as temporary, though they are still preparing various global supply chain adjustments.

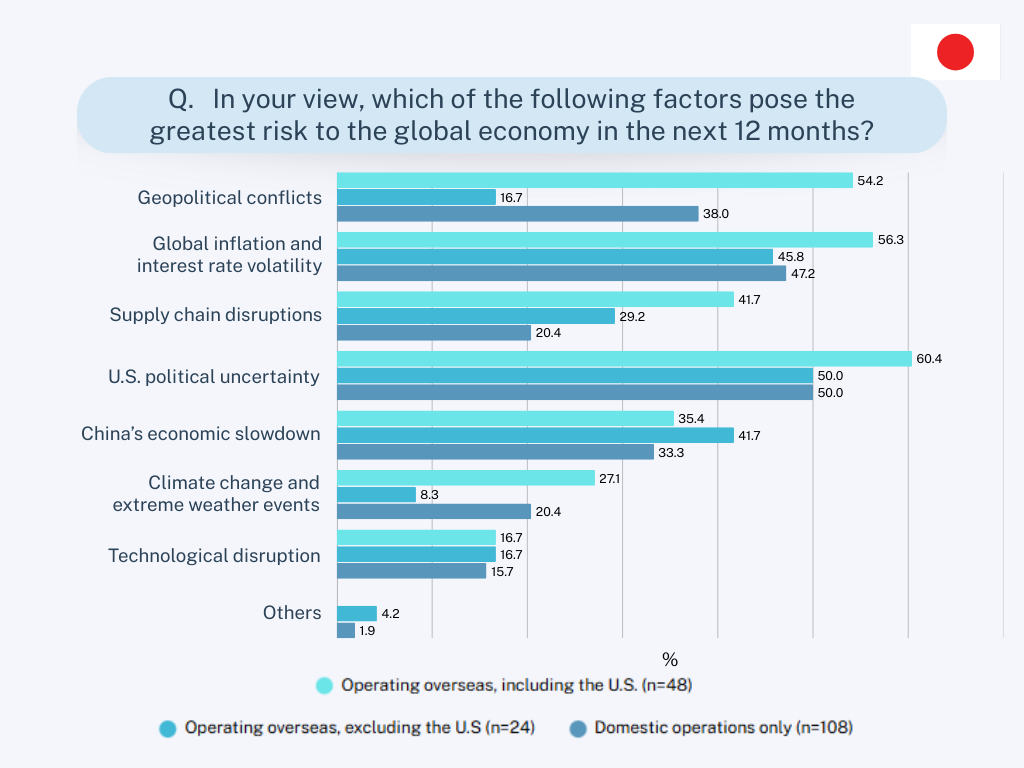

Geopolitical and Political Uncertainty as Key Business Risks

When identifying the most significant risks to the global economy in the next 12 months, Japanese businesses cited geopolitical conflicts and U.S. political uncertainty as their key concerns. This focus on political factors underscores how deeply intertwined Japanese businesses perceive economic conditions and global supply chain stability with political developments, particularly those affecting decisions about tariffs on Japanese goods.

Conclusion: Reciprocal Tariffs and the Future of U.S.-Japan Global Supply Chains

The survey indicates that Japanese businesses, especially those operating in the U.S., are highly concerned about reciprocal tariffs and are taking both tactical and strategic measures in response. Their immediate actions—such as raising prices and absorbing costs—will likely directly impact their American business partners in the short term as the Japan-U.S. trade relationship adjusts to the new tariff realities.

More concerning for long-term U.S.-Japan business relationships is the emerging trend toward global supply chain diversification, reshoring, and increased domestic sourcing—strategies designed to reduce exposure to American tariff uncertainties. With over half of Japanese companies with U.S. operations planning supplier diversification and nearly half considering automation or reshoring investments, these moves could potentially reduce business opportunities between American and Japanese companies and fundamentally alter established global supply chains in various industries.

The Japanese closely watch geopolitical tensions in the U.S., which sometimes impose reciprocal tariffs on their exports. Any American firm dealing with Japanese suppliers or partners should seriously consider the shifting strategies. The push to reduce U.S. dependency in the global supply chain might create some long-term changes, irrespective of whether Japan-U.S. tariff policies are altered in the future. This is a rare opportunity for American companies to start assessing their supply chain resiliency and key partnerships in a world trade environment more complicated by reciprocal tariffs.

Inquiries about the survey results:

GMO Research, Inc. / GMO Z.com-Research USA

Gus Peña – Business Development, North America

rfq_us@gmo-research.ai

Customize your online research in APAC