QuestionPro × GMO-Z.com Research Study Highlights Limited Awareness in Japan of Australia-Related Trade and Business Activities

2026/01/30

Japan and Australia have long maintained cross-border economic ties through trade, investment, and business cooperation. In order to address how consumers recognize these connections and how they relate to everyday life, QuestionPro and GMO-Z.com Research conducted a joint quantitative study in October 2025, providing insights into market education and cross-border business communication.

The findings reveal a clear awareness gap between Japanese and Australian consumers, with Japan trailing Australia by 30 points in the share of people expressing interest in bilateral economic activities. This article focuses on the Japan-side results and explores what Japanese consumers know—and don’t know—about Australia-related trade and business activities.

Methodology

Target: Adults aged 18+ in Japan and Australia

Method: Online survey

Survey Duration : October 7‒22, 2025

Sample sizes: Japan n=1,196 ; Australia n=1,118

Survey Platform: QuestionPro (Enterprise Survey Platform)

Online Panel: GMO-Z.com Research

Key Findings: Japanese Consumer Awareness Remains Limited, but Not Negative

Low interest, limited active engagement

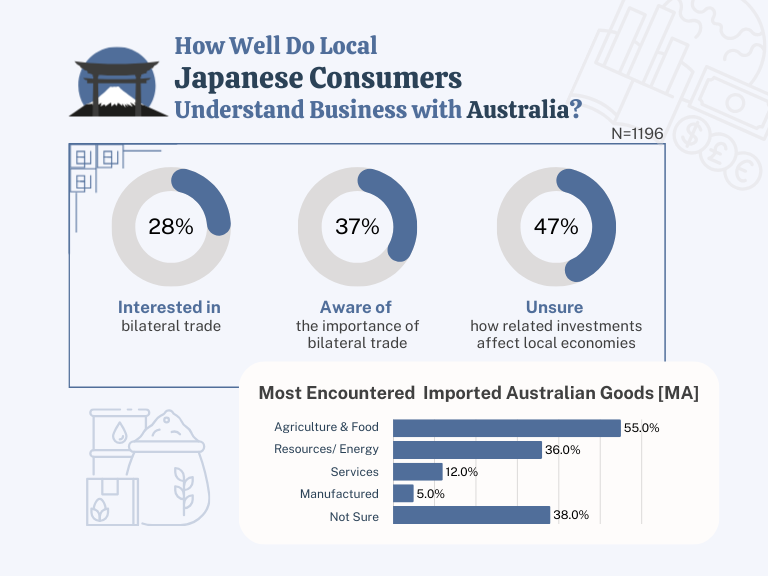

Interest in Japan–Australia business interactions remains modest among Japanese consumers. Only 28% reported interest in bilateral economic activities, and just 6% said they are “very interested,” indicating that engagement is still largely passive at this stage.

Trade awareness remains unclear for many

A similar pattern appears in trade awareness. While 37% of respondents said they understand Japan–Australia trade relations, 63% answered that they “don’t know,” reinforcing a broad consumer-level knowledge gap.

Investment impact is uncertain, with little negativity

Perceptions of investment show the same dynamic. 47% of Japanese respondents were unsure how investment flows affect local economies and employment. Meanwhile, positive responses totaled 43%, and virtually no negative impact was reported, indicating that sentiment is still forming rather than unfavorable.

Australia image led by food exports

When asked what Australia mainly exports to Japan, consumers most strongly associated Australia with food-related exports (55%), followed by energy (36%), while 38% were not sure. This suggests awareness is concentrated on familiar everyday categories, with broader economic areas remaining less visible.

Implications for Consumer-Friendly Communication in Japan

The Japan-side findings suggest that consumer understanding of Australia-related trade and business activities is still developing, with “don’t know” responses appearing frequently across key topics. This points to an information accessibility challenge, where cross-border economic activity is not being communicated in relatable, everyday terms.

Qualitative feedback also indicates that Japanese consumers value stability and practical relevance, often linking cross-border economic activity to everyday essentials and long-term confidence. This highlights the importance of clear, consumer-friendly messaging grounded in tangible examples.

Based on these findings, key communication opportunities in Japan may include:

- Start with tangible categories consumers already recognize, such as food-related products, then gradually broaden the narrative to include energy, resources, and sustainability-related business activities.

- Emphasize everyday relevance and stability, linking cross-border activity to practical benefits such as supply reliability, quality, and daily life impact, instead of relying on abstract terms or formal labels.

- Increase exposure through targeted market education, especially among audiences with limited prior awareness, using clear examples and simple language to build understanding over time.

By using practical, everyday storytelling, businesses and organizations involved in Australia-related activities may improve consumer understanding in Japan. Ongoing listening to consumer feedback can also help refine communication over time and support more effective two-way engagement as Japan–Australia trade and business activities continue to develop.

About QuestionPro and GMO-Z.com Research

QuestionPro is a global survey platform that supports everyone from beginners to advanced researchers, offering end-to-end capabilities for survey creation, distribution, and analysis. The platform features over 50 question types and advanced branching logic to ensure precise data collection. With robust multilingual support and real-time analytics, QuestionPro enables organizations to conduct seamless international research and transform data into actionable insights.

GMO-Z.com Research

GMO-Z.com Research has operated an extensive online research panel in the Asia-Pacific region for over 20 years, reaching more than 65 million panelists across 14 markets. The company specializes in Japan, China, and South Korea, offering access to both general consumer audiences and specialized segments, including healthcare, B2B, automotive, gaming, and other industries. This enables robust quantitative and qualitative data collection tailored to diverse research needs.