Indonesia Online Shopping Trends: Convenience Drives Near-Universal Adoption, Price Remains the Key Battlefield

2025/05/27

This report is conducted by GMO Research & AI and Z.com Engagement Lab. Reveals that a striking 96.1% of Indonesian online consumers have engaged in online shopping in the past 12 months, indicating that it has become an integral part of everyday life. The high penetration rate is mainly driven by convenience (67.4%), attractive promotions and discounts (67.4%), and better prices compared to physical stores (63.9%). Indonesian shoppers value speed, affordability, and variety, suggesting e-commerce platforms still have room to grow through continuous innovation in product offering and pricing strategies.

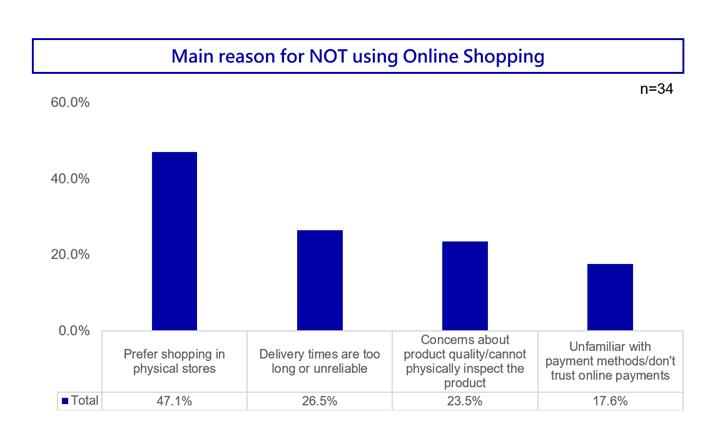

Voices of Non-Users: Preference for Physical Stores and Delivery Concerns

While the vast majority have embraced online shopping, 3.9% have not. Among them, the top reasons include a preference for shopping in physical stores (47.1%), delivery times that are too long or unreliable (26.5%), and concerns about product quality due to the inability to physically inspect items (23.5%). In addition, 17.6% feel unfamiliar with payment methods or do not trust online payments, highlighting opportunities to improve logistics and build confidence in digital payment systems.

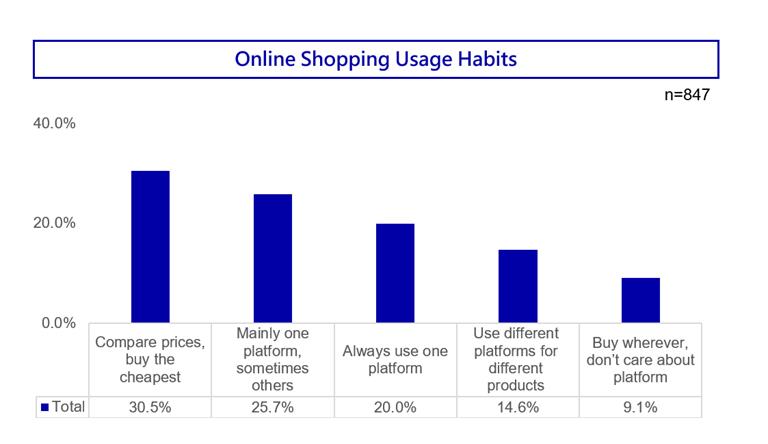

Usage Habits: Price Comparison Leads, but Platform Loyalty Still Exists

Among online shoppers, comparing prices and buying the cheapest option (30.5%) is the most common behavior, followed by mainly using one platform, with occasional use of others (25.7%), and always using one platform (20%). This shows that while price sensitivity is high, there is still potential for platforms to cultivate loyalty through differentiated services.

Reasons for Switching Platforms: Price is King, Followed by Delivery and Payment

When it comes to switching online shopping platforms, product prices and discounts (45.8%) overwhelmingly top the list, followed by delivery speed and convenience (16.3%) and payment method options and security (15.6%). Price remains the main battleground, but improvements in delivery and payment experience may also persuade users to shift platforms.

Potential Growth: Secure Payment and Faster Delivery as Incentives

For non-users, the most compelling reason to consider online shopping is the availability of safer payment methods (e.g., cash on delivery) (41.2%). However, 38.2% say they will not consider using online shopping services in the near future, under any circumstances. This indicates a need not only for improved trust mechanisms but also for education and experience-driven onboarding. Additional incentives include same-day or next-day delivery (8.8%) and better product guarantees and after-sales services (8.8%).

Mobile Usage Insights of Online Shoppers: High Overlap Between TikTok and Mobile Legends Users

Based on mobile behavior data from ShareParty Insight, among online shopping users, TikTok (33.37 average hours per user per month) and Mobile Legends: Bang Bang (31.51 average hours per user per month) rank highest in average usage time, indicating their dominance as entertainment apps and their potential for e-commerce promotion. WhatsApp Messenger, with an impressive 953.29 average visits per user per month, also highlights the importance of instant messaging as a tool for communication and customer service.

Price Sensitivity + Seamless Logistics and Payment Experience = Winning Formula

Indonesia's online shopping ecosystem is mature, yet user behavior reveals a strong sensitivity to price and reliance on convenience. Concerns around payment security and delivery reliability remain barriers for some. E-commerce platforms that focus on secure payment, efficient logistics, and tap into high-engagement apps such as social media and games will be best positioned to retain current users and convert new ones.

-

What are the most used apps of Indonesia's online shoppers?

-

Find out more from the article below!

- Top Apps Usage Revealed! App Category Rankings Among Indonesia’s Online Shoppers

GMO Research & AI and Z.com Engagement Lab will continue to track the Indonesia consumer survey of the online shopping public and update survey data, monitoring market trends and changes in consumer demand.

Survey Specifications

-

Research by|GMO Research & AI, Z.com Engagement Lab, ShareParty

Survey Date|9 ~ 15 April 2025

Methodology|Online survey

Target Group|Internet users aged 16-60 in Indonesia

Sample Size|881ss

Editor|TNL Research

Review by|Tatt Chen

* Contents in this report were drafted with input from generative.ai

Reach Your Ideal Audience

|

GMO Research & AI operates an online panel of 65 million individuals across 14 markets in Asia-Pacific with a diverse profile. Find more details of the respondents from the panel book! |