Metaverse Adoption Trends in Southeast Asia: A Comprehensive Market Analysis of Indonesia, Philippines, Malaysia, and Thailand

2025/06/23

Table of Contents

- Background Fueling Metaverse Adoption in Southeast Asia

- Current Metaverse Experience Rates in 4 Southeast Asian Regions

- Metaverse Trend and Marketing Insights for 4 Southeast Asian Regions

- Conclusion and Strategic Recommendations

- Get FREE Report on Metaverse Brand Engagement in China, Taiwan and South Korea!

In Southeast Asia, the metaverse market is expected to grow at a compound annual growth rate (CAGR) of 40% between 2025 and 2033, presenting significant investment opportunities for brands that want to stay ahead.

As global brands aim to expand their presence into virtual spaces, it becomes crucial to understand how adoption unfolds at the regional level to break into their markets successfully. GMO Research & AI conducted a survey of Internet users in four Southeast Asian countries regarding their experiences with the metaverse and their areas of interest. This comprehensive analysis examines the adoption trends of the metaverse across four key Southeast Asian markets: Indonesia, the Philippines, Malaysia, and Thailand, drawing on the latest consumer research conducted in May 2025.

Survey Specifications

-

Survey Date: May 2025

Target Group: Internet users aged above 15

Target Country: Indonesia, the Philippines, Malaysia, and Thailand

Sample Size: Indonesia 6359ss, the Philippines 1200ss , Malaysia 2850ss, Thailand 742ss

Method: Online survey

Digital Foundation Fueling Metaverse Adoption in Southeast Asia

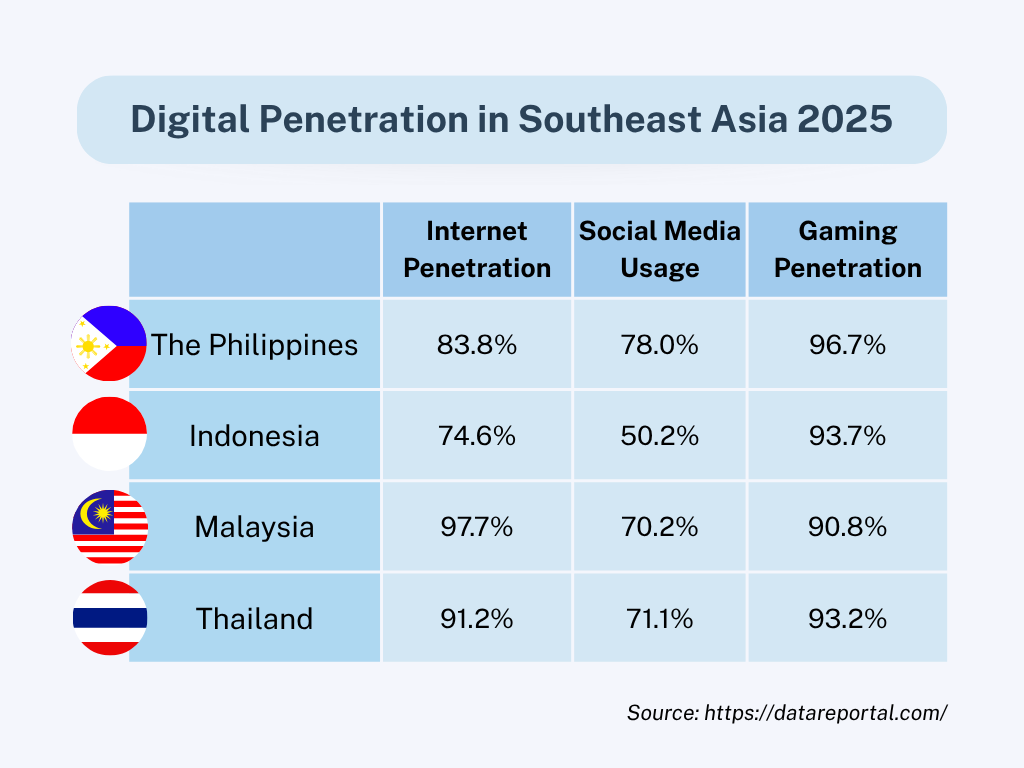

As one of the digital transformations, this has laid a strong foundation for the emergence of the metaverse in Southeast Asia. Internet penetration has increased drastically from 34% in 2013 to above 73% in 2024, paving the way for a massive digital user base ready to engage in virtual experiences.

Gaming penetration rates in the four countries are above 90%, while social media usage rates are 50.2% in Indonesia and 78% in the Philippines. Such engagement levels facilitate an easy transition towards adopting the metaverse, as users are pretty comfortable with virtual interactions and owning digital assets.

*Click on the image to expand

The success stories of early adopters point to enormous market potential. Lazada, a top e-commerce platform in Southeast Asia, has developed a virtual marketplace where users interact with products within 3D environments and participate in virtual events. This initiative saw a 50% increase in engagement on the platform and a 20% increase in the average transaction value, underscoring the economic legitimacy of metaverse ventures in the region.

Current Metaverse Experience Rates: A Market in Development

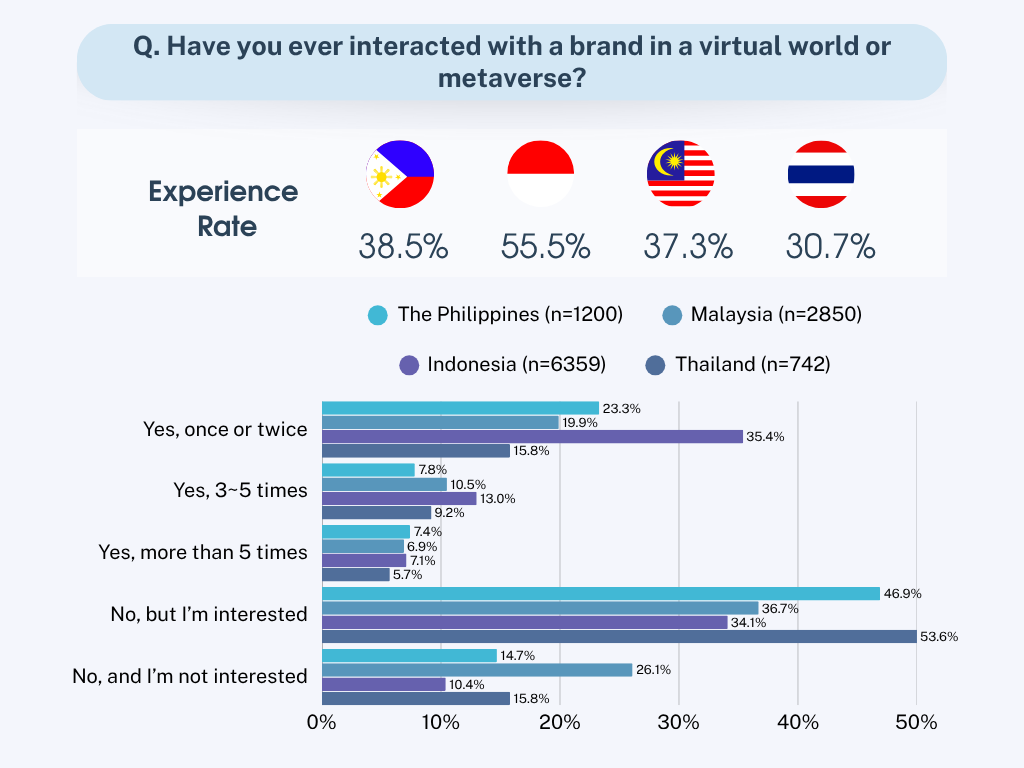

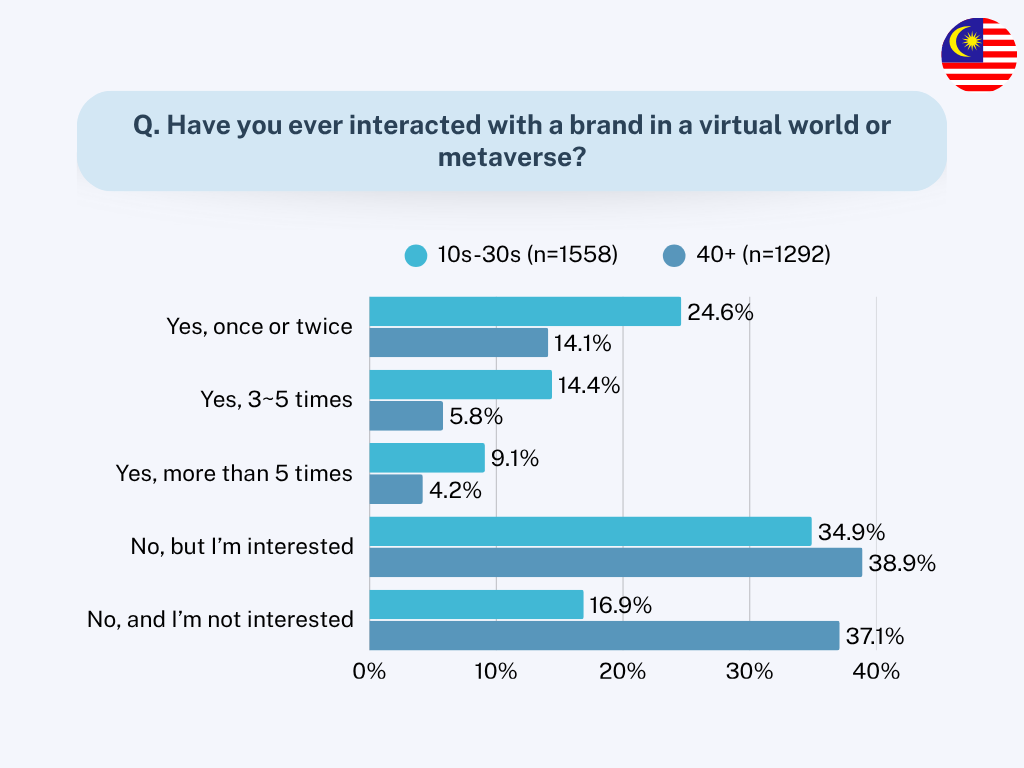

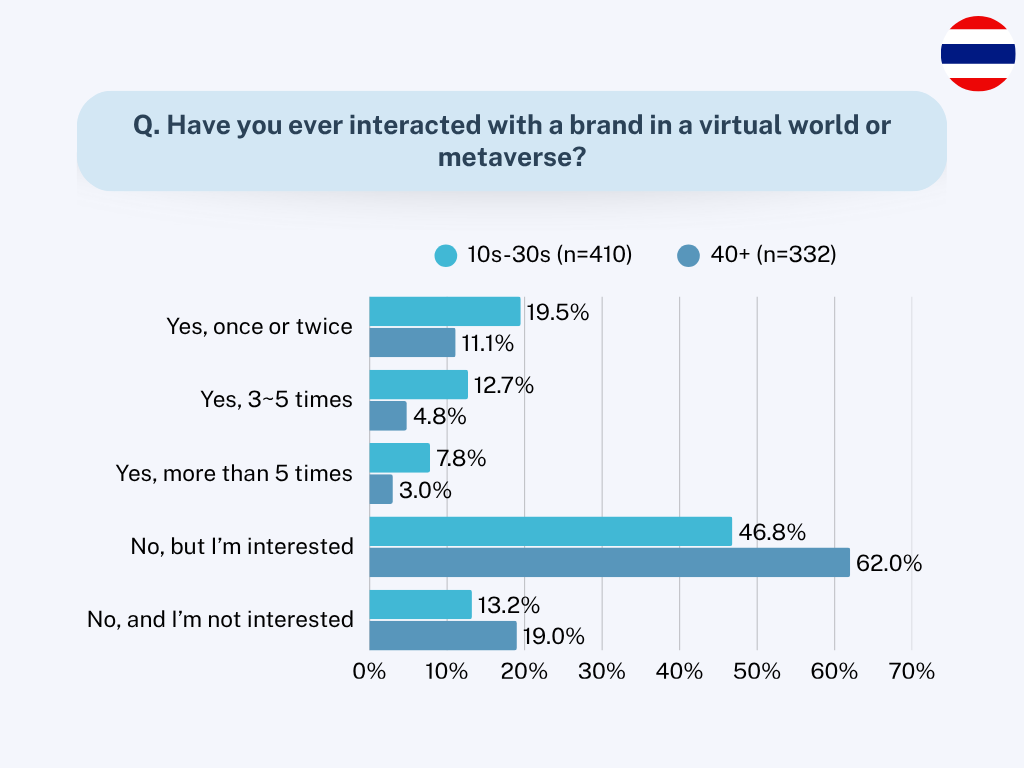

As of May 2025, the adoption of the metaverse across the four surveyed countries presents several contrasting patterns of promise. Indonesia leads with an experience rate of 55.5%, followed by the Philippines at 38.5%, Malaysia at 37.3%, and Thailand at 30.7%. Despite the relatively modest range of experience rates, the interest shown by non-actors is conspicuous across all markets.

The data reveal an interesting fact: at least 70% of respondents in each country have either experienced metaverse brand interactions or expressed interest in doing so. This means a significant opportunity for brands to gain early market share in emerging technologies.

Indonesian leadership in metaverse adoption stems from a vast digital-native base and deep-rooted gaming culture. Its digitally inclined consumers are more accepting of virtual experiences than the rest of the region, making it an ideal landscape for trialing new metaverse initiatives.

Thailand, on the other hand, shows the least current adoption but the most interest from potential users, with 53.6% of respondents expressing curiosity about metaverse experiences. This equates to a market that, after reducing accessibility and awareness barriers, should expand.

Metaverse Experience Rates by Age Group

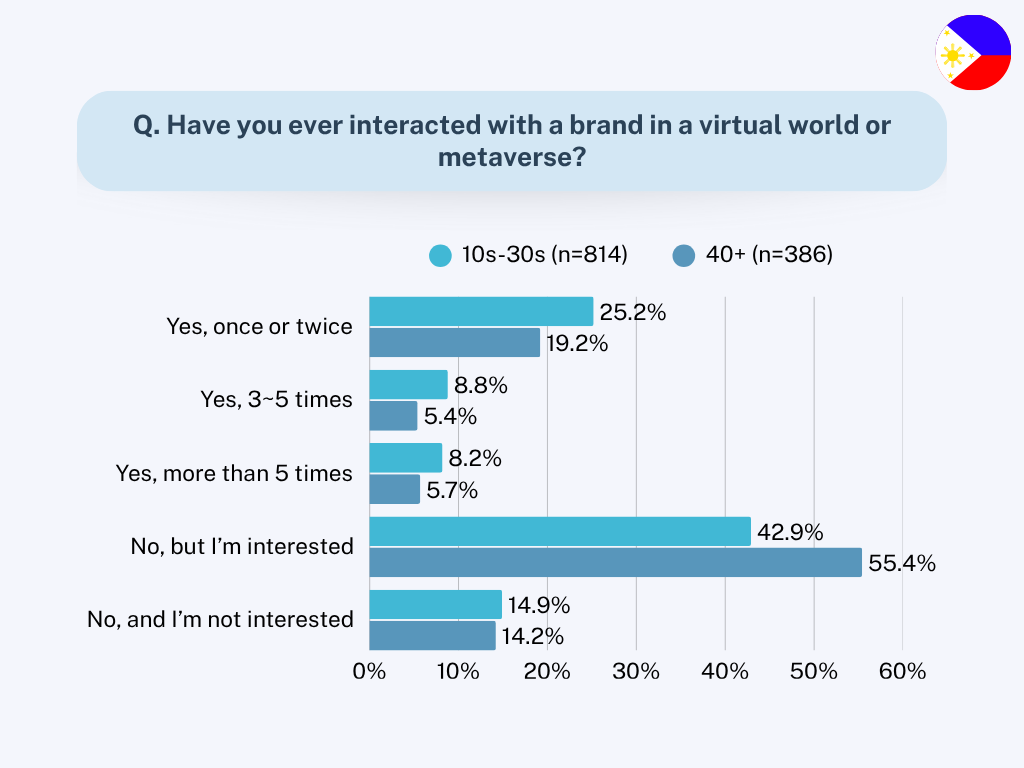

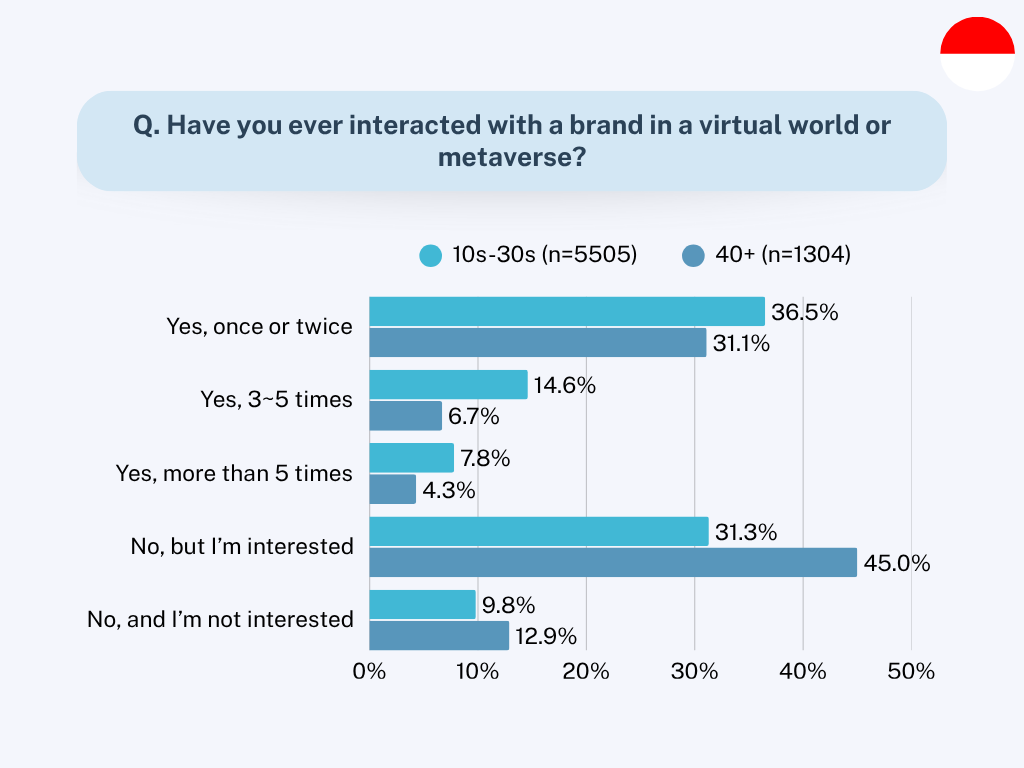

Age demographics influence adoption trends and patterns. Across all four countries, the 10-30 age group displays the most significant levels of experience, with digital natives naturally gravitating toward virtual environments. However, the 40+ demographic, while showing lower experience levels, retains considerable interest, particularly in those relating to more practical use cases, such as virtual shopping and product demonstrations.

*Click on the image to expand

|

The Philippines |

Indonesia |

|

Malaysia |

Thailand |

Metaverse Trend and Marketing Insights in Particular Countries in Southeast Asia

Philippines: Fashion-Oriented Virtual Experiences

In the case of Filipino consumers, strong gender-differentiated preferences are shown for metaverse experiences. Women seem especially keen on Virtual Try-Ons & AR Shopping, which ties in with the vibrant fashion and beauty culture of the country. The trend also cuts across age groups, with the senior population showing a stronger inclination toward virtual shopping experiences than the younger users.

Male consumers in the younger group mostly favor gaming-type experiences, with Brand-Sponsored Games ranking at the top of their preferences. Above 40, there is a shift in preference among male consumers toward more pragmatic applications, including Virtual Product Demos and Workshops, which clearly call for age-differentiated content strategies.

In a nutshell, the country tops the charts when it comes to interest in NFTs and digital collectibles among the four countries, particularly among young males, providing obvious avenues for brands in the digital assets space.

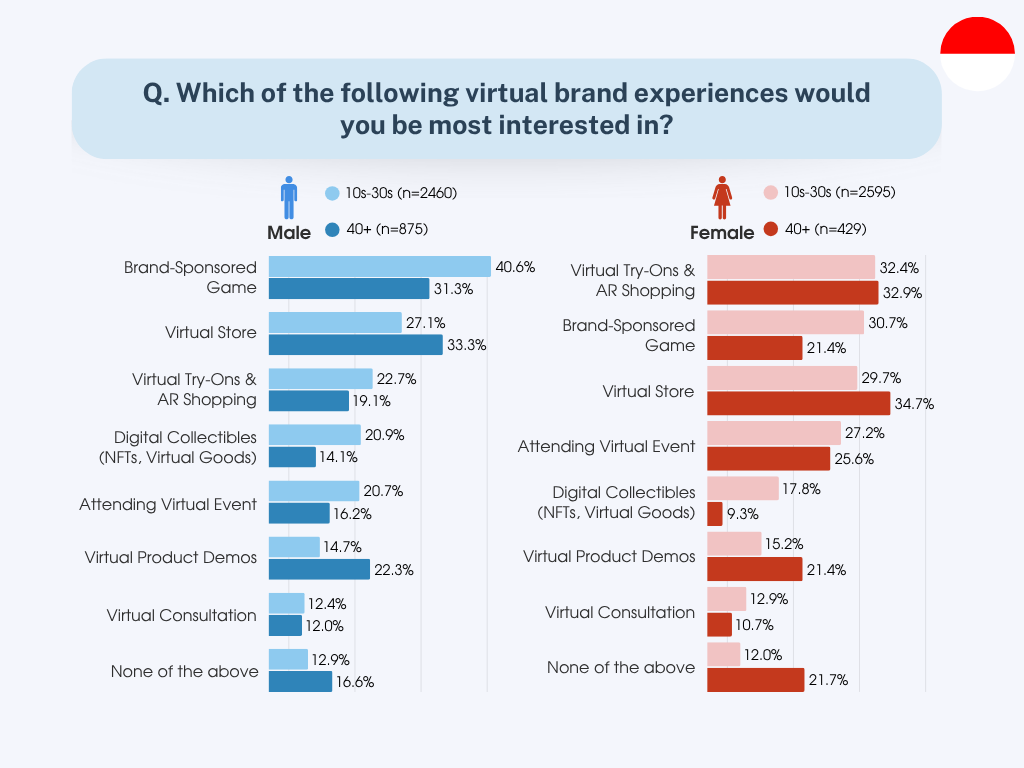

Indonesia: Half-Gaming, Half-AR Shopping

Indonesian consumers exhibit slightly more balanced preferences across metaverse experiences, where gaming and shopping applications coexist. Male consumers between 10 and 30 years of age show an interest in brand-sponsored gaming experiences of up to 40 percent, which falls to 30 percent for older demographics.

Female consumers across age groups maintain consistent levels of interest in Virtual Try-Ons and AR Shopping, whereas 40-plus virtual store experiences tend to peak for consumers of both genders, with a clear resonance in the actual application of shopping among mature consumers.

The high overall adoption rate suggests that consumers in Indonesia are embracing metaverse formats with enthusiasm, making it gratifying for brands to have an experience strategy that resonates across the country.

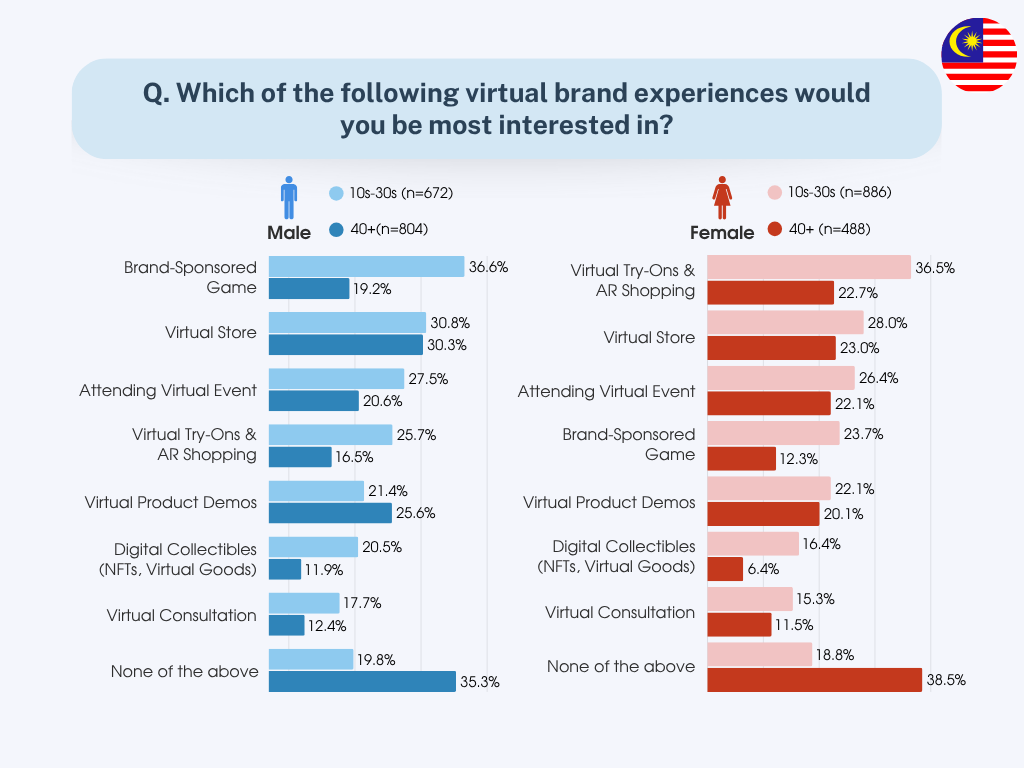

Malaysia: Digital Divide and Polarized Preferences

Malaysia presents an interesting case, with distinct polarization between consumer segments that are interested and those that are not. Uninterest rates, compared to those in other countries, rise significantly among the 40+ demographic, clearly amplifying the generational divide in metaverse adoption.

Young women aged 10-30 show the strongest interest in Virtual Try-Ons and AR Shopping, while young men tend to lean toward Brand-Sponsored Games. Virtual Store experiences maintain a broad appeal across demographics, suggesting that this format could become a gateway experience for hesitant consumers.

The polarized nature of Malaysian consumer preferences necessitates targeted segmentation strategies; experiential approaches should be favored for younger demographics, while older consumers tend to lean toward more traditional marketing channels.

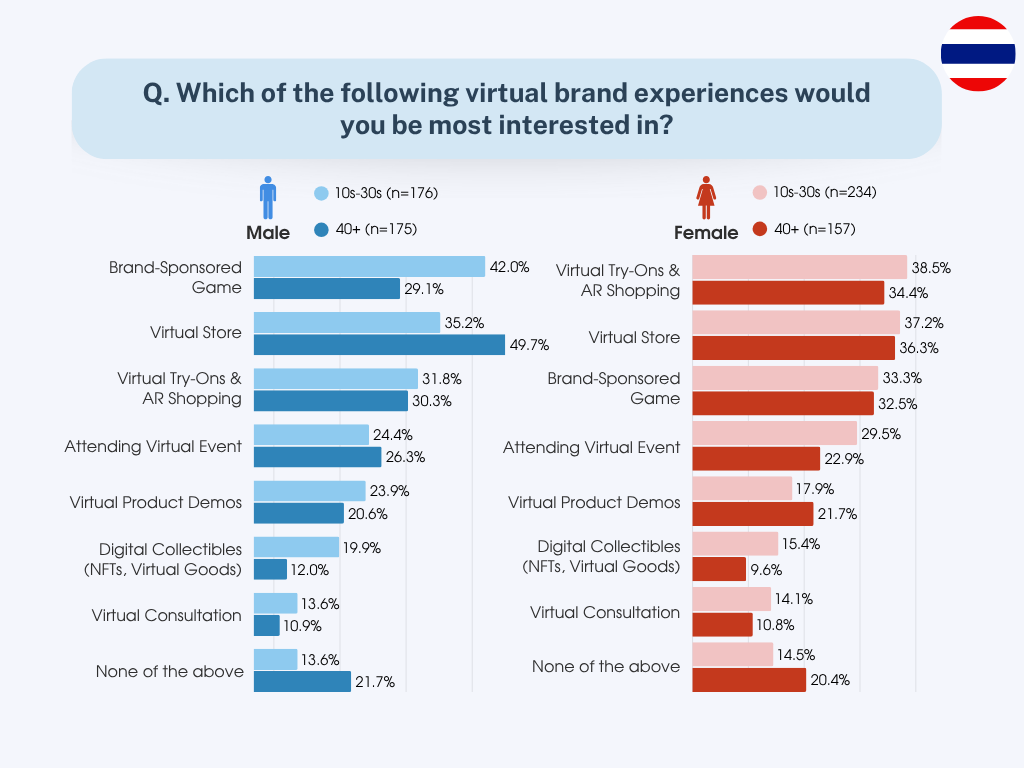

Thailand: Universal Gaming Appeal and AR Shopping Focus

The market in Thailand reflects the interest of gamers, unlike the other countries where gaming has been strongly skewed towards males, thus expanding the horizon for brands through gamified experiences.

Virtual shopping experiences, encompassing both AR Try-Ons and Virtual Stores, stand out across all demographics. Notably, males aged 40 and above have the highest interest in Virtual Store experiences (circa 50%), indicating that mature consumers appreciate practical shopping applications.

>Among non-users, the high interest level suggests a relatively unexplored potential that can be, in all probability, due to sparse access to metaverse experiences rather than a low level of consumer interest.

FREE Report Download

Eager to explore the metaverse trends in East Asia as well? Download our FREE report for the latest data from the link below!

Strategic Recommendations for Metaverse Marketing in Southeast Asia

The study highlights several critical lessons for brands seeking metaverse strategies in Southeast Asia.

Generational segmentation holds great importance in actualizing its successful implementation. Young consumers prefer gamified and entertainment-oriented experiences, while older consumers would rather use more practical applications that can either ease their shopping or learning experiences. Hence, brands could very likely develop parallel experience tracks that cater to both segments.

Virtual stores are appealing to a wide range of age groups and countries, making them an essential starting point for a brand looking to make a stride into the metaverse. However, these experiences must be backed up by excellent online customer assistance to aid inexperienced users and the older generation.

With the limited and growing interest in NFTs and digital collectibles, brands need to be cautious when proposing such offerings, potentially tying digital assets to physical products to provide tangible value propositions.

Lastly, the great interest expressed among non-users in all markets shows that awareness and accessibility constitute the significant barriers rather than an outright consumer resistance attitude. Brands that can scale their middleware, educate consumers, and enable easy access will be well-positioned to capture a significant chunk of the emerging metaverse economy in Southeast Asia.

The metaverse epitomizes emerging opportunities in Southeast Asia for deeper brand-customer engagement and relationship-building through immersive experiences. Metaverse success will depend on understanding and adapting to local tastes and preferences while simultaneously maintaining the technological edge that makes these virtual experiences compelling.

Customize your online research in APAC