Trump's Reciprocal Tariffs: How Businesses Are Responding in China and South Korea

2025/05/28

The New Tariff Landscape: Impact on Global Supply Chains

At the onset of reciprocal tariffs in the latest convention in the Trump administration, global markets have been sent into a state of flux, with trade relations with China and South Korea being affected the most. The tariffs on Chinese imports have since been raised up to 145%, while China defended itself by slapping tariffs of 125% on American goods. South Korea has stuck to a baseline tariff of 10% for virtually every product category, setting rates of 25% for targeted categories such as automotive, auto parts, and steel.

GMO Research & AI’s survey on this topic took place in China and South Korea reveals how businesses in these countries are responding, and the specific strategies these businesses are employing to lessen the impact. American businesses with overseas operations or supplying dependencies would do well to take into consideration how these policies are affecting their Asian counterparts, as this would give them some insight into the kinds of disruptions and price increases that may be occurring in their own operations.

Survey Specifications

-

Survey Date: 18-30 April 2025

Target Group: Management-level executives in China and South Korea

Sample Size: 185ss from China and 145ss from South Korea

Method: Online survey

*Remarks: In mid-May 2025, the U.S. and China agreed to a 90-day tariff reduction period. Tariffs on Chinese imports to the U.S. were lowered to 30%, while tariffs on U.S. exports to China were reduced to 10%. This survey was conducted prior to the mutual agreement; therefore, responses from China reflect the context of the 145% tariff level in place at the time.

Impact Assessment: How American Tariffs Are Affecting Asian Businesses

High Awareness of U.S. Tariff Policy Among Asian Firms

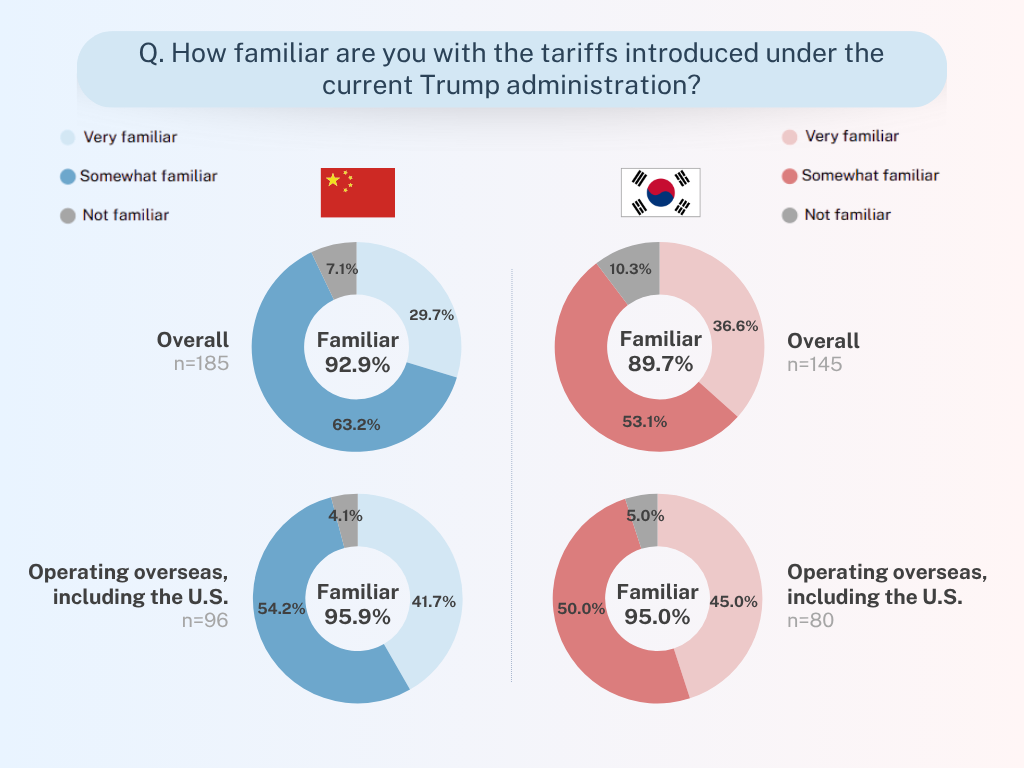

The respondents in the survey reveal nearly unanimous knowledge of the tariff policies implemented by the Trump administration among the Chinese and South Korean businesses. Nearly 93% of Chinese and 90% of South Korean respondents stated that they were familiar with or somewhat familiar with the tariffs. Among companies with U.S. operations, familiarity rises to a staggering 95% in both countries.

*Click on the image to expand

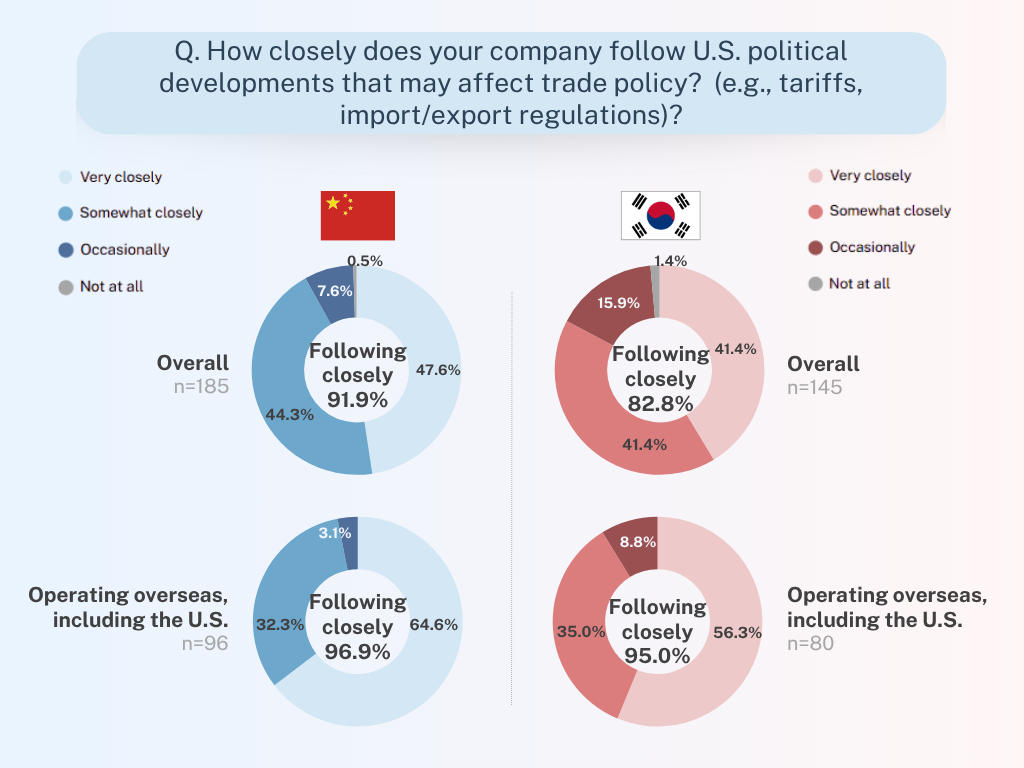

Equally revealing is how closely these businesses view developments in U.S. trade policy. Around 92% of Chinese and 83% of South Korean companies respond that both very closely and somewhat closely monitor U.S. political developments that might affect trade policy. Among companies with operations in the U.S., over half of the respondents indicated that they are monitoring U.S. politics “very closely”, which is 64.6% in China and 56.3% in South Korea.

Areas of Concern and Financial Impact Due to Reciprocal Tariffs

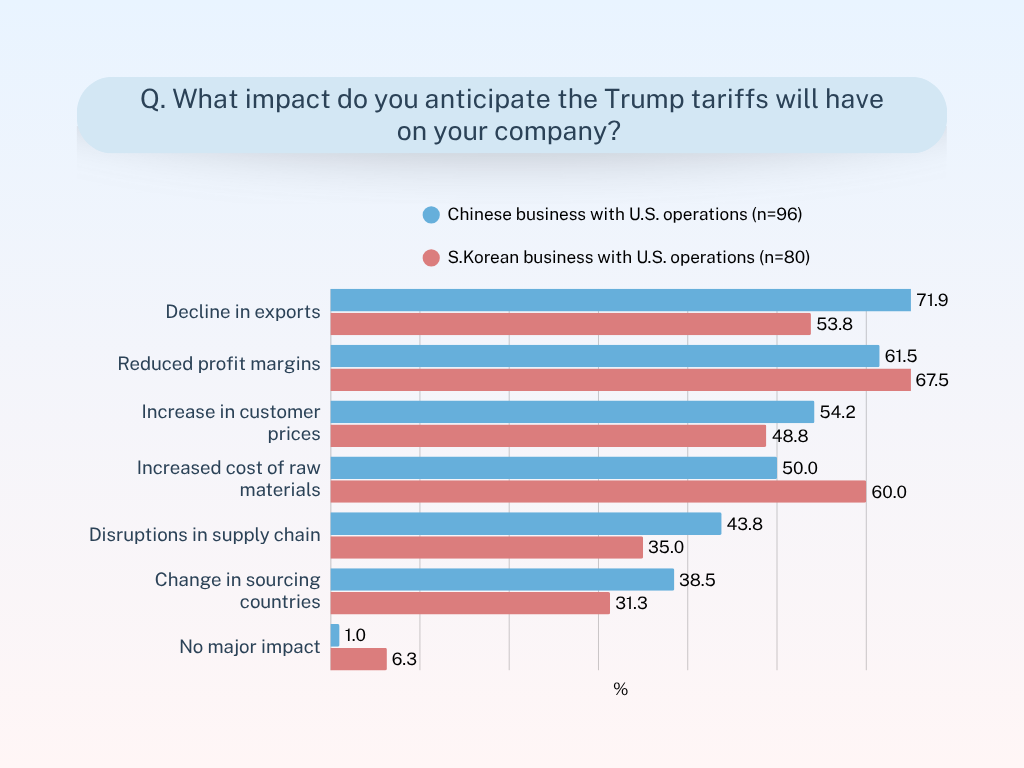

Both Chinese and South Korean businesses are anticipating significant negative impacts, as the U.S. is a key export destination for both countries. In 2024, exports from China to the U.S. accounted for 14.7% of total exports, ranking first among all destinations. For South Korea, exports to the U.S. made up 18.8% of its total export, slightly below China which held the top position.

- ・Reduced profit margins - Cited by 61.5% of Chinese and 67.5% of South Korean businesses with U.S. operations

- ・Increasing raw material costs - A particular concern to South Korean firms (60%)

- ・Decline in exports - More pronounced among Chinese companies with U.S. operations (71.9%)

- ・Price increases to customers - 54.2% of Chinese businesses with U.S. operations expect to raise prices

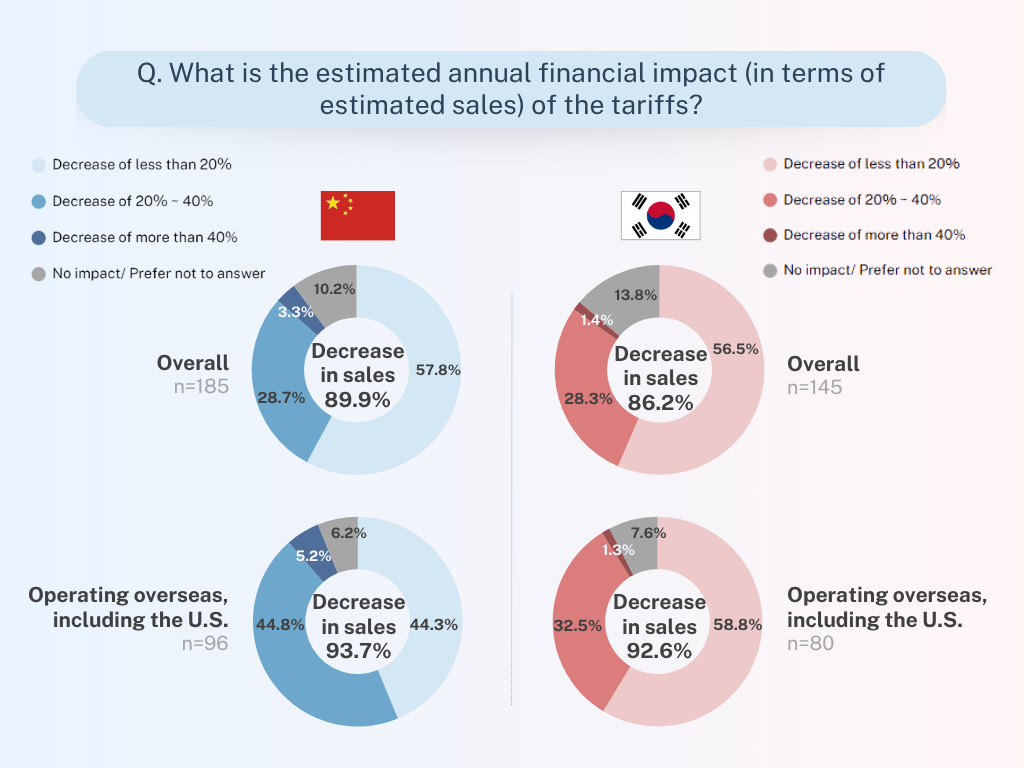

They foresee tariff impacts to be very serious. Roughly just 10% of companies in both countries estimate there won't be an economic impact on them from the tariffs. Of those companies with U.S. operations, 44.8% of Chinese companies and 32.5% of South Korean companies expect a 20-40% reduction in sales.

Strategic Responses to the Trade War: How Asian Businesses Are Adapting to American Tariffs

Immediate Tactical Responses

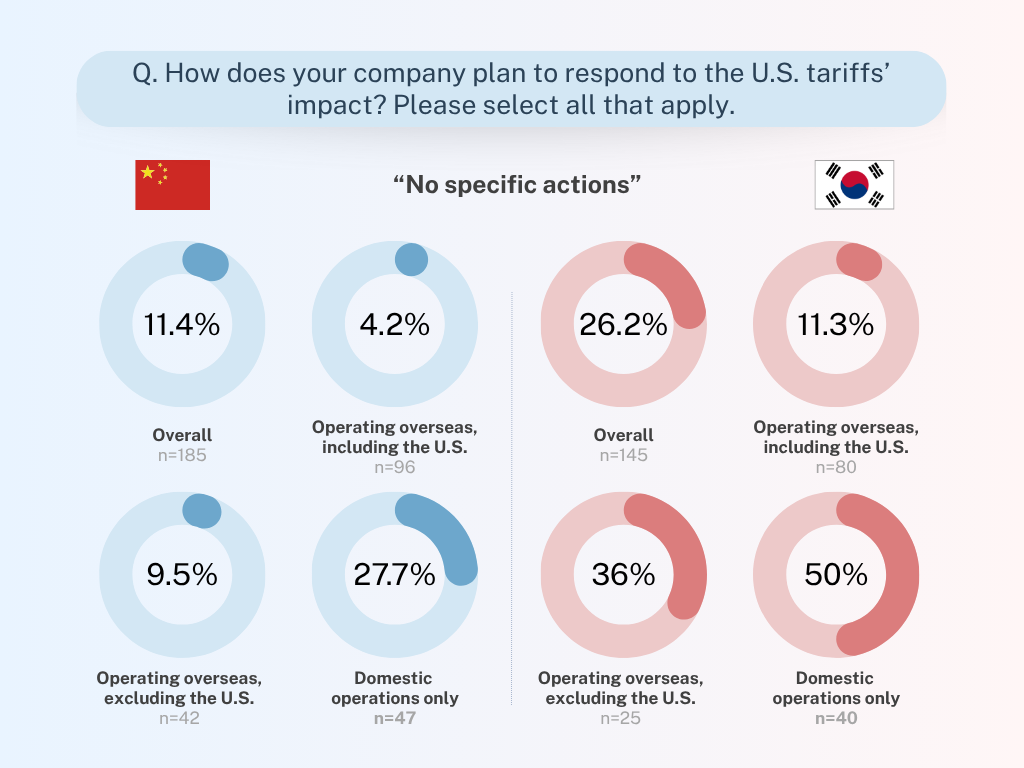

Chinese companies seem to be much more aggressive in response to the tariffs than South Korean companies. In fact, 26.2% of South Korean companies said that they had taken no specific action, compared with 11.4% of Chinese companies. This becomes even more obvious when emphasizing respondents with domestic-only operations, where 50% of South Korean companies took no action, as opposed to 27.7% of their Chinese counterparts.

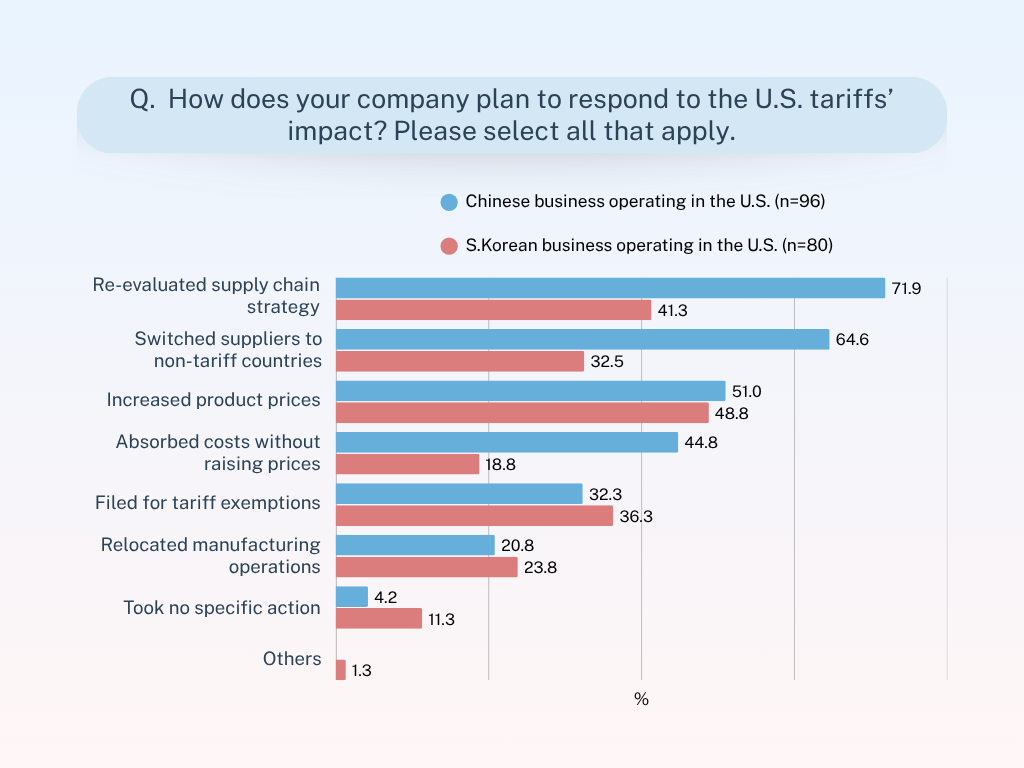

- The top strategies for Chinese companies with U.S. operations include:

・Re-evaluating supply chain strategy (71.9%)

・Switching suppliers to non-tariff countries (64.6%)

・Increasing product prices (51%)

South Korean companies with U.S. operations focus mainly on:

・Increasing product prices (48.8%)

・Re-evaluating supply chain strategy (41.3%)

・Filing for tariff exemptions (36.3%)

Long-term Strategic Adjustments

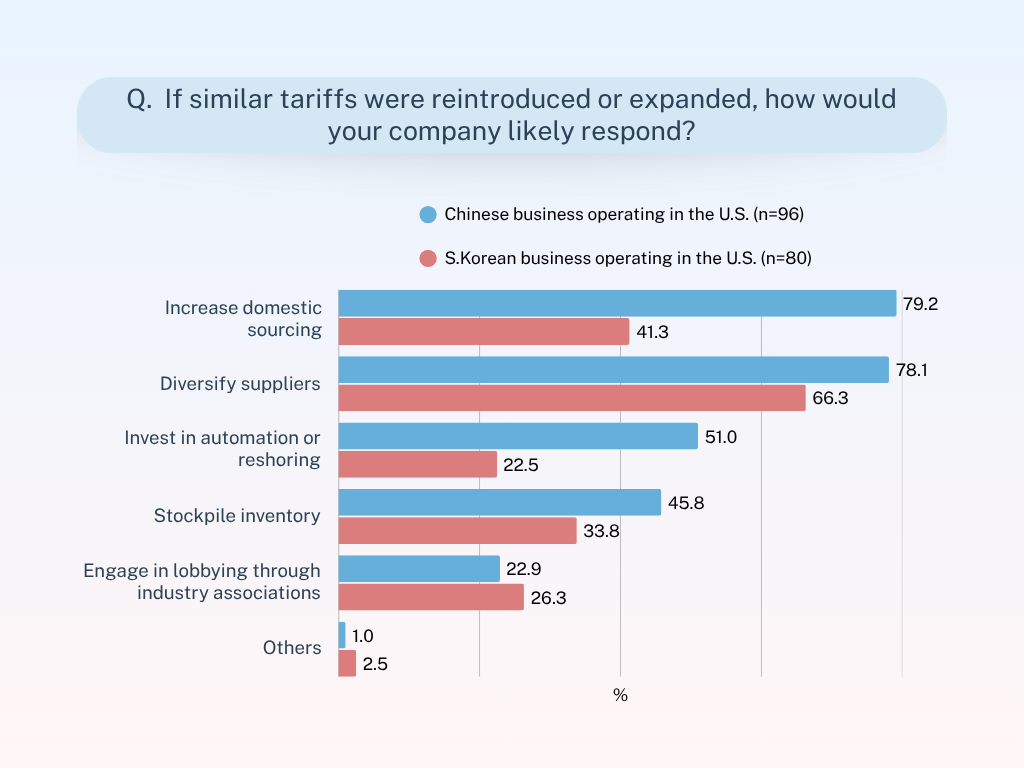

Both Chinese and South Korean businesses are preparing to implement similar long-term strategies should the tariffs be reinstated or expanded.

・Increase domestic sourcing (79.2%)

・Diversify suppliers (78.1%)

・Invest in automation or reshoring (51%)

・Diversifying suppliers (66.3%)

・Increasing domestic sourcing (41.3%)

・Stockpiling inventory (33.8%)

In open-ended responses, Chinese executives emphasized technological innovation and efficiency improvements. One respondent noted plans to "reduce production costs, carry out technological reform and innovation, invest in automated production, and apply for government policy support." Another mentioned introducing "intelligent robots" to reduce costs.

Many Chinese businesses also mentioned expanding into alternative markets: "Change sales channel strategy, expand into Southeast Asia and countries not affected by tariffs," and "Establish the domestic market, explore the ASEAN and African markets" were common themes. This aligns with China's "dual circulation" economic strategy, emphasizing developing domestic markets while maintaining international trade relationships.

South Korean businesses appear more focused on supply chain adjustments and market diversification. Several responses indicated plans to "find more export routes outside the U.S." and "pursue a strategy of price adjustment and supply chain diversification through negotiations with buyers." Some South Korean manufacturers are considering relocating production facilities, with reports that major electronics companies are evaluating moving production to the United States.

Significant challenges in planning due to policy uncertainty are also noted among South Korean respondents: "Waiting for tariff confirmation and supply chain decision on whether to operate overseas factories" and "Increased uncertainty makes it difficult to determine future response measures" reflect the cautious stance many are taking.

Implications of Tariff Impact for American Businesses: Preparing for a Different Trade Landscape

These accounting results have profound implications for American companies that have their supply chain dependent on China and South Korea. More than half the businesses in both China and South Korea plan on increasing prices and adjusting their supply chain, so importers into the United States should expect cost increases and potential disruptions.

The move toward domestic sourcing and supplier diversification in both China and South Korea could mean that certain products and components become scarce to American buyers. Also, the shift toward automation and efficiency gains, especially in China, could alter the competitive dynamics in the medium term.

Time now for American companies highly dependent on suppliers in China/South Korea to:

| ・Assess their supply chain risks and options for alternative sourcing |

| ・Prepare for price increases from existing suppliers |

| ・Keep an eye on policy developments, for the tariff situation is anything but stable |

| ・Consider stockpiling essential components if shortages are anticipated |

This survey shows that Chinese and South Korean businesses are treating these tariffs as a long-term strategic issue, not a short-term disruption. American companies would do well to do the same, developing solid strategic frameworks within which to operate in this novel and quickly evolving trade environment. With sufficient planning and foresight, disruptions can be minimized, and competitive advantage maintained even in a period of wholesale realignment in global supply chains.

GMO Research & AI will continue monitoring developments in U.S. tariff policies and their impacts on businesses across various countries. Subscribe to our newsletter to stay updated!

Subscribe to receive latest APAC insights!

Inquiries about the survey results:

GMO Research, Inc. / GMO Z.com-Research USA

Gus Peña – Business Development, North America

rfq_us@gmo-research.ai

Customize your online research in APAC