Reciprocal Tariffs Impact on Japan and South Korea: A Strategic Guide for American Businesses in the Trade War Era

2025/08/01

Author: GMO Research & AI

Table of Contents

1. Executive Summary: Understanding Reciprocal Tariffs in Today's Global Supply Chain

Reciprocal tariffs have truly altered trade flows with the United States and major Asian partners under the Trump administration. This comprehensive analysis, based on a July 2025 survey of management-level executives in Japan and South Korea, reveals how American tariff policies are forcing companies to reconfigure their global supply chain strategies and what it means for American businesses with operations or partnerships in these markets.

Survey Specifications

*Note: This survey was conducted in early July 2025, when companies were preparing for a proposed 25% American tariff scheduled to take effect on August 1st. Following the July 23rd US-Japan and July 30th US-Korea agreement that reduced the reciprocal tariffs rate to 15%, the findings offer critical insights into corporate strategies during high-tariff scenarios amid the ongoing trade war.

2. High Awareness of American Tariff Impact: Asian Companies Brace for Trade War Effects

Widespread Recognition of the Reciprocal Tariffs

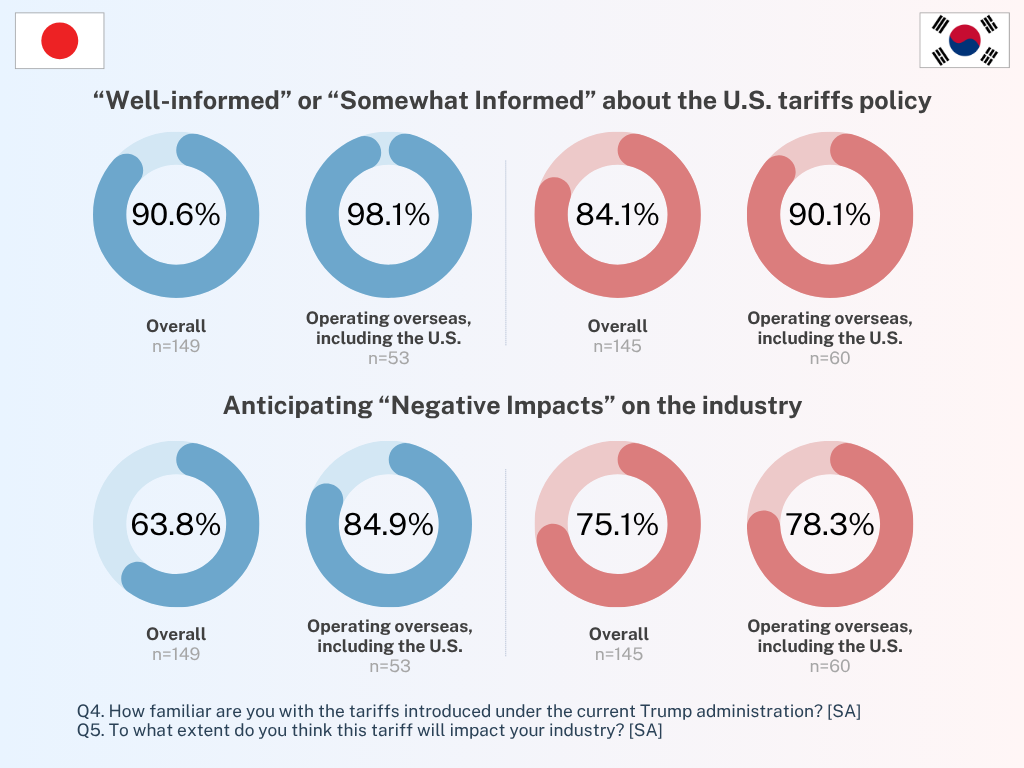

Both Japanese and South Korean management teams demonstrate remarkably high awareness of American tariff policies and their tariffs impact on business operations. According to our survey data, approximately 90% of Japanese executives and over 80% of South Korean executives report being "well-informed" or "somewhat informed" about the reciprocal tariffs policies. This awareness spans across companies regardless of their international business involvement, indicating the broad perceived significance of the ongoing trade war.

Anticipated Negative Tariffs Impact Across Industries

The sentiment toward American tariff policies remains overwhelmingly negative across both countries. Among companies with US operations:

- Tariff Japan impact: 85% of executives anticipate adverse effects from reciprocal tariffs

- Tariff South Korea impact: 78% expect adverse effects on their industries and global supply chain operations

This pessimistic outlook has remained consistent since previous surveys, suggesting that negative perceptions of American tariff policies have become entrenched among Asian business leaders navigating the trade war landscape.

3. Real Business Impact: Global Supply Chain Relations Under Tariff Pressure

Declining US Trade Volumes Due to Reciprocal Tariffs

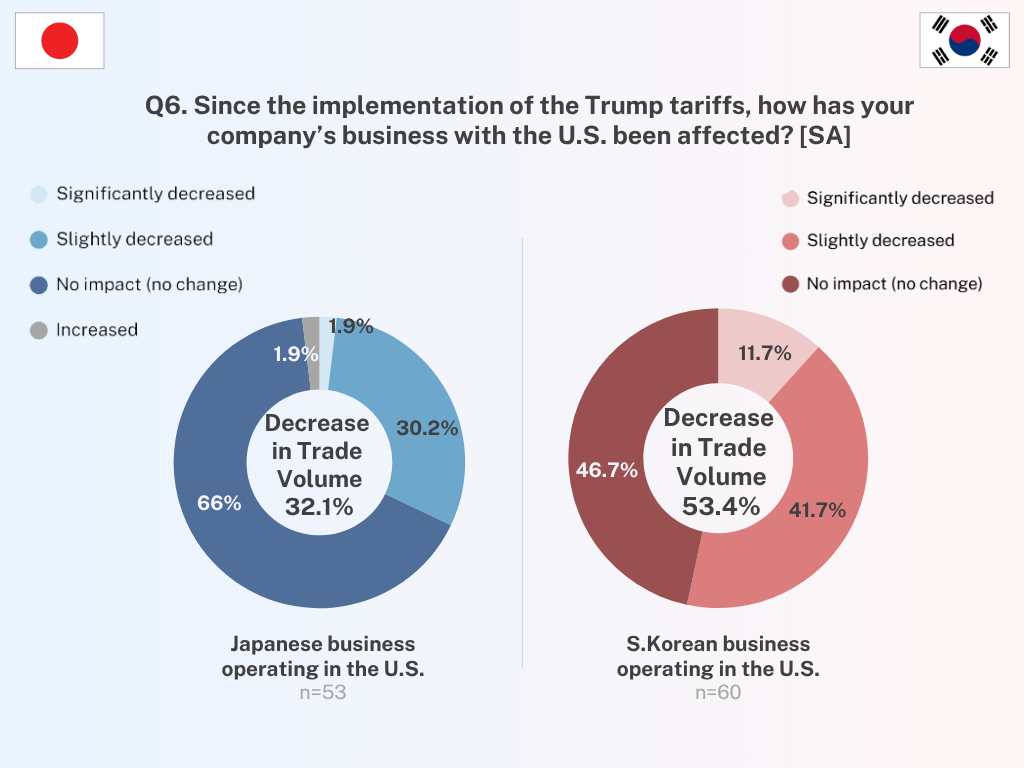

The survey reveals concerning trends in the tariffs impact on US-Asia trade relationships and global supply chain dynamics:

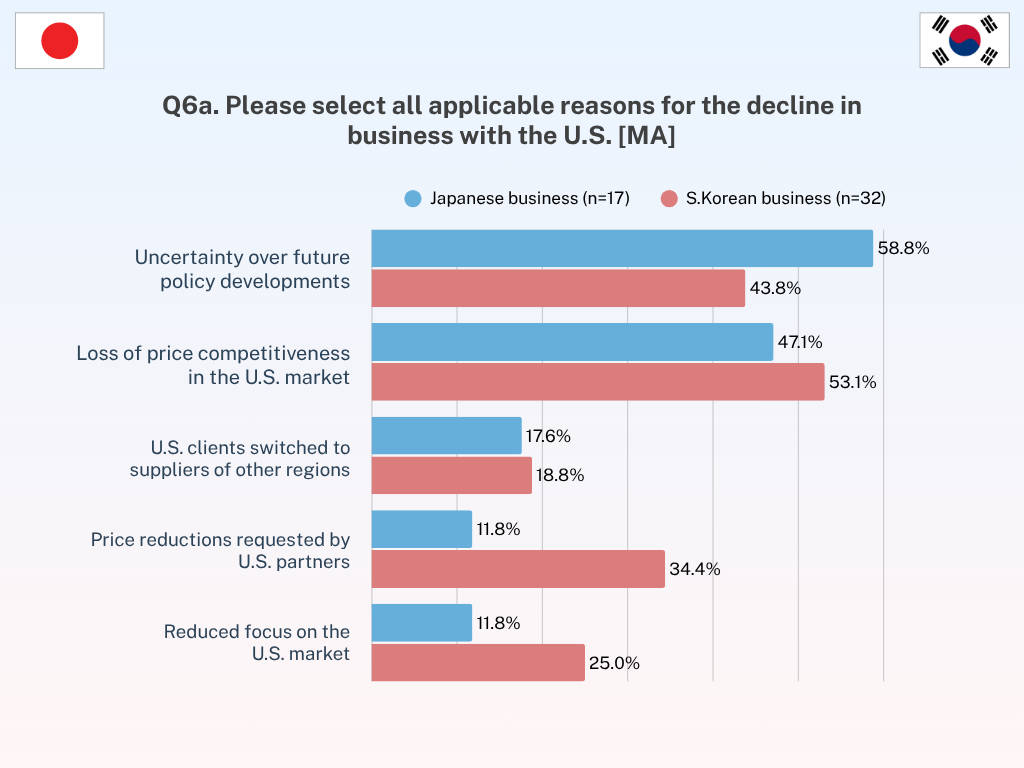

Japanese Companies: Roughly 32% of companies with US operations note a decrease in trade volumes with American partners due to American tariff policies. Primary causes given include:

- Policy uncertainty in the trade war environment (58.8% of respondents)

- Direct reciprocal tariffs burden impact (47.1%)

- Cautious "wait-and-see" approach to new transactions amid tariff uncertainty

South Korean Companies: A more substantial 53% report reduced US trade due to tariffs impact, with factors including:

- Direct American tariff burden (53.1%)

- Trade war policy uncertainty (43.8%)

- Price negotiation pressure from US partners affected by reciprocal tariffs (34.4%)

*Click on the image to expand

Such figures are in line with the lens of trade statistics during that time. Japanese export shipments dropped 11.4% year over year in yen terms. On the other hand, the South Korean shipments bound for the United States declined by 14.6% during the first 20 days of May 2025, thus marking the abysmal specter of tariff imposts over global supply chain flows.

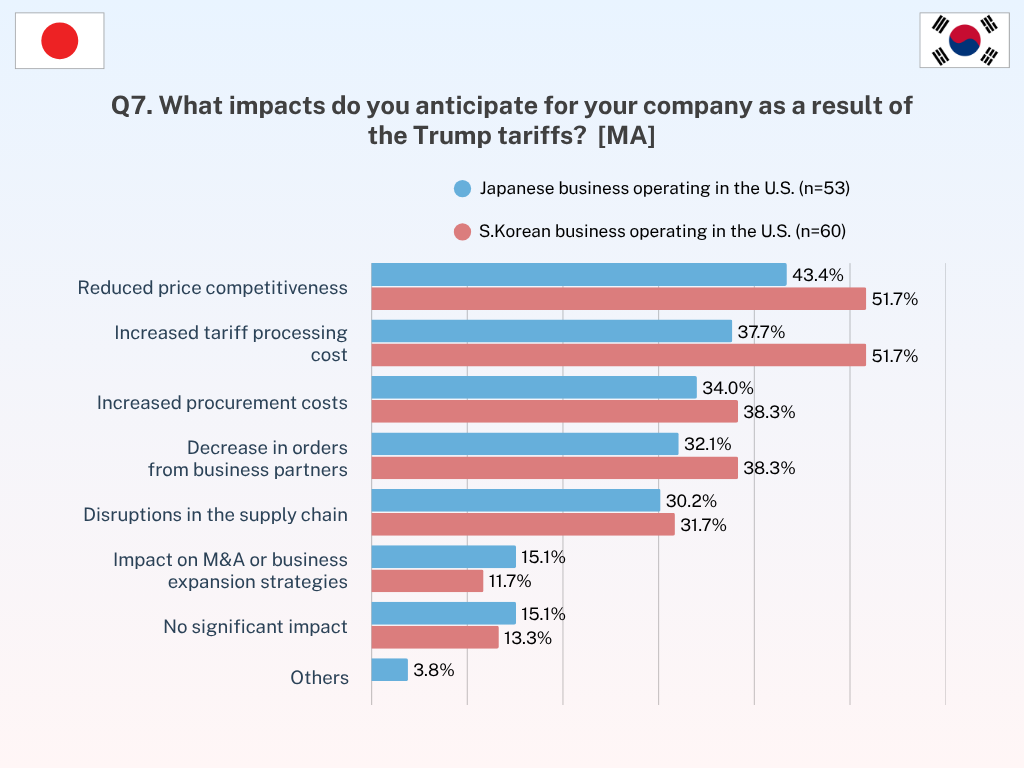

Core Business Challenges from American Tariff Policies

Companies in both countries identify three primary areas where reciprocal tariffs are disrupting their global supply chain operations:

- Reduced Price Competitiveness: 43.4% of Japanese and 51.7% of South Korean companies cite American tariff-related pricing pressure as a significant challenge.

- Increased Tariff Processing Costs: 37.7% of Japanese and 51.7% of South Korean companies anticipate an increase in the administrative burden due to reciprocal tariffs compliance.

- Increased Procurement Costs: 34% of Japanese and 38.3% of South Korean companies are concerned about rising raw material and component cost.

- Declining Orders from Trading Partners: 38.3% of South Korean companies are expecting a decrease in demand due to the impact of tariffs on U.S. customers.

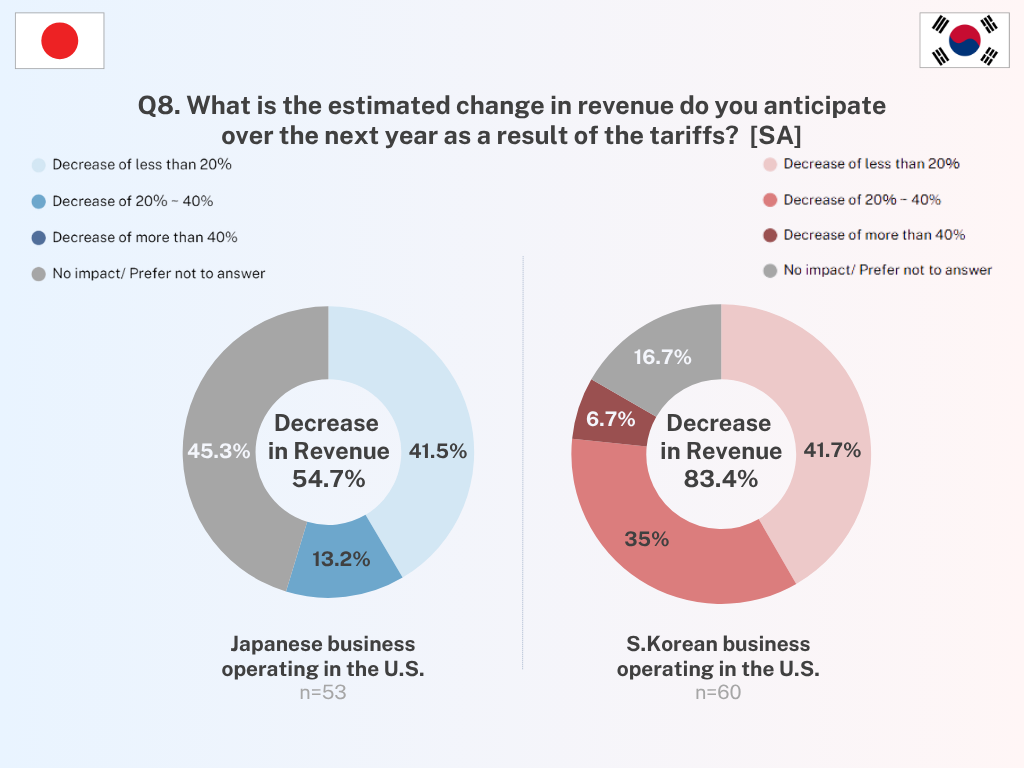

4. Financial Projections: Significant Revenue Decline Due to Trade Policies

Looking ahead to the next 12 months, companies project a substantial financial impact from reciprocal tariffs:

Tariff Japan Impact: Approximately 50% of companies with US operations anticipate revenue decreases due to American tariff policies, with about 30% expressing uncertainty about the extent of trade war impact—likely reflecting the evolving nature of US-Japan negotiations at the time of the survey.

Tariff South Korea Impact: Nearly 80% of companies predict revenue declines from reciprocal tariffs, with significantly fewer (only 2.8%) expressing uncertainty about outcomes. This suggests South Korean companies had developed more concrete assessments of the American tariff impact on their global supply chain operations.

The disparity in uncertainty levels between the two countries may reflect different stages in their respective government negotiations with the US during the ongoing trade war.

5. Strategic Responses to Reciprocal Tariffs: Cautious Japan vs. Proactive South Korea

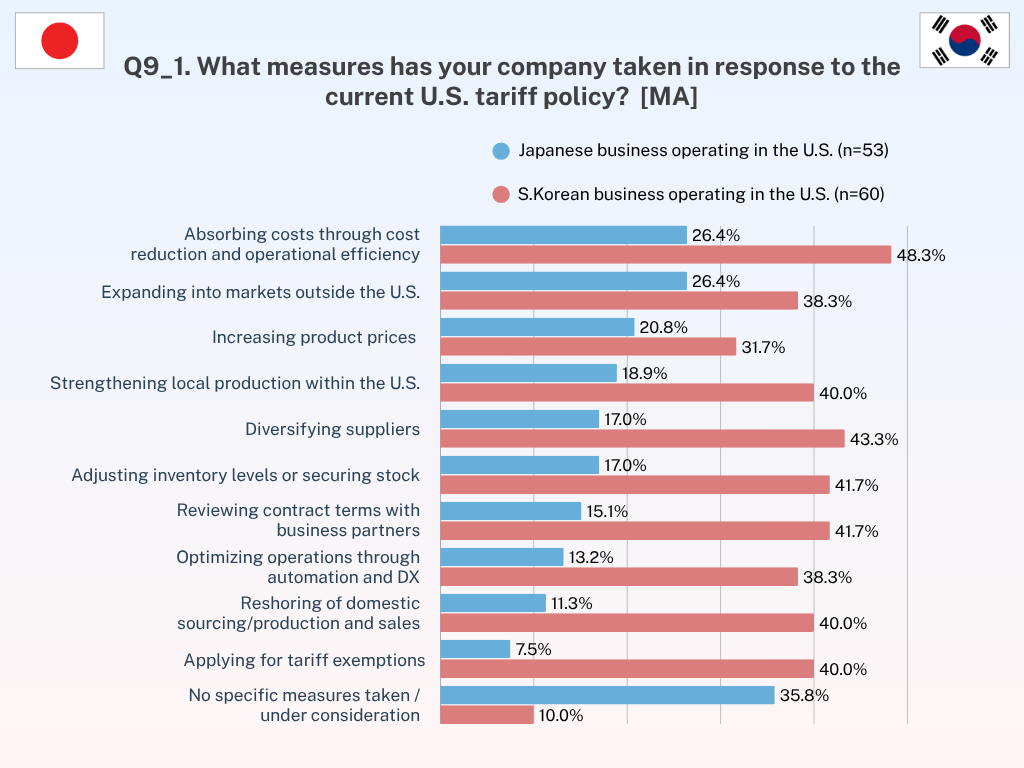

Current Global Supply Chain Adaptation Strategies

The survey reveals markedly different approaches to American tariff challenges and trade war pressures.

Japanese Companies demonstrate a cautious, wait-and-see approach to reciprocal tariffs:

- 35.8% are taking no specific measures or remain in planning phases regarding the tariffs impact

- Top active strategies include global supply chain diversification beyond the US (26.4%) and cost reduction/operational efficiency improvements (26.4%) to offset American tariff costs

One Japanese automotive executive noted: "The automotive industry faces a significant American tariff impact. We want to respond based on short-term and long-term strategies to minimize reciprocal tariffs risks while timing our actions appropriately. Although government negotiations in this trade war remain unclear, we hope for a successful agreement."

South Korean Companies are responding swiftly to American tariff policies:

- Only 10% are taking no specific measures against reciprocal tariffs impact

- Leading strategies include reducing costs to cover American tariff expenses (48.3%), diversifying suppliers to lessen the impact of reciprocal tariffs (43.3%), and adjusting inventory while securing supplies in advance (41.7%)

A South Korean semiconductor executive explained their approach to managing tariffs impact: "We're negotiating unit prices with customers and increasing production efficiency to maximize production at the lowest cost while managing American tariff pressures."

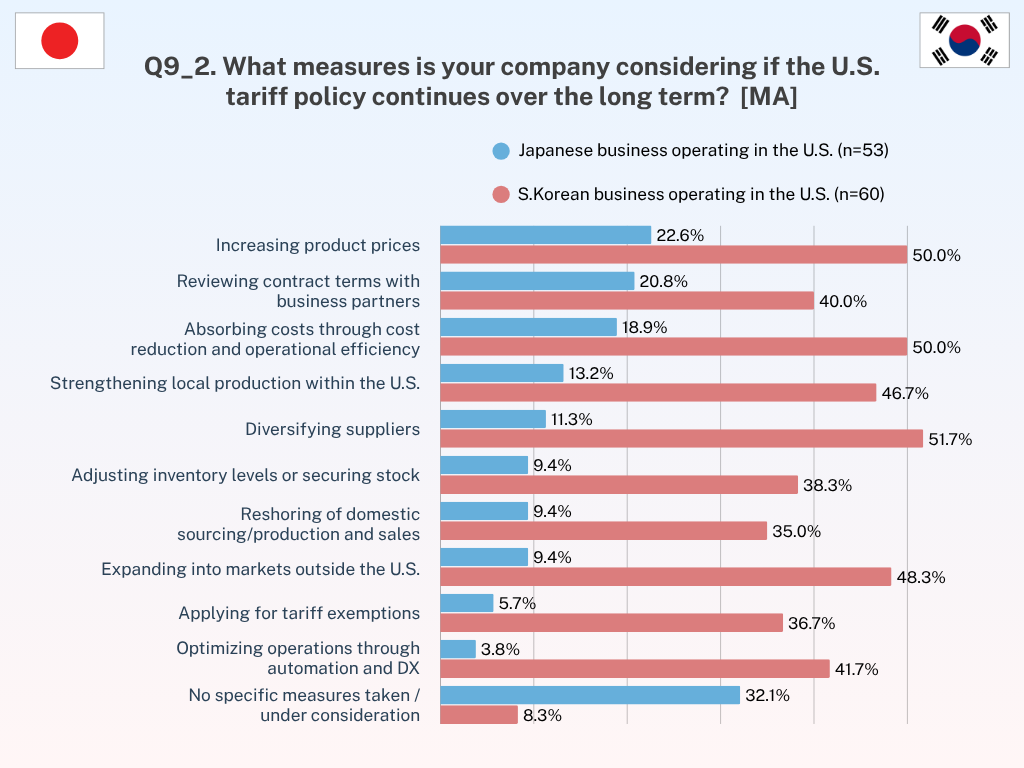

Long-term Strategic Planning for Sustained Trade War

For sustained American tariff scenarios, the strategic divergence becomes even more pronounced:

Japan: 32.1% continues to avoid specific actions for long-term reciprocal tariffs impact, maintaining its cautious stance in the trade war

South Korea: Only 8.3% of businesses have no long-term plans for adapting to the U.S. tariffs. More than 50% are considering strategies such as diversifying suppliers, absorbing costs through cost reductions and operational efficiencies, and raising product prices

6. Japan and South Korea Negotiates Lower Reciprocal Tariffs Through Strategic Investment

On July 23, the landmark agreement between the United States and Japan that completely altered the American tariff landscape. According to the new arrangement, Japan agreed to invest $550 billion in the US economy in exchange for a reduced tariff rate of 15% reciprocal, as compared to the original ask, which was 25%. The agreement also includes Japan's commitment to open its markets to American automobiles, trucks, rice, and specific agricultural products.

South Korea, meanwhile, reached an agreement with the United States on July 30, under which tariffs on imported South Korean goods—including key products such as automobiles and semiconductors—will be reduced to 15%. The deal also includes South Korea’s commitment to a $350 billion investment in the U.S.

7. Looking Ahead: Monitoring Market Changes and Ongoing American Tariff Challenges in Japan and South Korea

While the two agreements represent a substantial improvement from the originally proposed 25%, the revised 15% tariff still exceeds pre-trade war levels. Added with factors such as currency fluctuations, US companies can expect continued cost pressures and adjustments to their global supply chains from Japanese and South Korean partners. Monitoring how these partners adapt to the new tariff structure will be essential for effective strategic planning. Below are some anticipated developments:

Emerging Strategic Shifts Among Japanese Companies

The survey findings indicate that a significant portion of companies remained in a wait-and-see phase prior to the agreement. As the baseline 15% tariff takes effect, more concrete strategic responses are likely to emerge. Many may begin implementing measures to alleviate cost burdens—such as reducing reliance on the U.S. market, diversifying trade partners, or strengthening domestic operations.

While the market opening offers new business opportunities for U.S. companies, it may also intensify competition for Japanese manufacturers in their domestic market. This could lead to challenges like higher procurement costs and more complex negotiations with Japanese partners.

Sustained Agility in South Korea’s Strategic Tariff Response

South Korean companies appear to be responding more swiftly than their Japanese counterparts, with only 10% taking no specific measures versus 35.8% in Japan three months after the initial tariff announcement. Their agility suggests continued adaptation in the months ahead.

Notably, 40% has already started strengthening their local production within the U.S. If the current tariff framework stabilizes, this strategy may continue or expand—potentially opening doors to American companies for deeper collaboration in areas such as product development and localized manufacturing. In fact, Samsung Electronics is reportedly planning to shift part of its production to the United States.

Conclusion: Data-Driven Insights for American Businesses

The survey reveals a clear divergence in how Japanese and South Korean companies respond to American tariff policies. Japanese companies show cautious, wait-and-see approaches, while South Korean companies implement speedy adaptation strategies. This difference in response styles provides American businesses with concrete data on what to expect from their Asian partners, suggesting that partnership strategies should account for these distinct cultural and strategic approaches to managing the impact of reciprocal tariffs.

Understanding these data-driven insights about partner behavior patterns will be essential for American companies navigating relationships with Japanese and South Korean businesses in the current tariff environment. GMO Research & AI will continue to monitor the impact of tariffs and corporate responses, and remain committed to providing up-to-date insights.

Feel free to download the raw data of this survey for more insights!

Inquiries about the survey results:

GMO Research, Inc. / GMO Z.com-Research USA

Gus Peña – Business Development, North America

rfq_us@gmo-research.ai

Customize your online research in APAC